Government Handling Of COVID Has Been “A Crime”, Expect More Selloffs: Trader

Submitted by QTR’s Fringe Finance

This is Part 1 of an exclusive interview with Rosemont Seneca, a U.S. based professional trader focused on event-driven and distressed situations. Rosemont spent their career on the buy-side working as a financials analyst and their investing/trading style is inspired in equal parts by Icahn and Druckenmiller.

Like me, Rosemont is not an RIA and does not hold licenses. Market commentary and opinion expressed in this interview are personal views, not investment advice or solicitation for business.

QTR’s Note: The point of this blog is to bring to the reader information and perspectives they, or the mainstream media, may not otherwise find on their own. The cool thing about FinTwit is that you get to meet people based on their ideas and investing acumen and not their identities. I have been following Rosemont on Twitter for years and love their perspective and takes on the market – their takes often stand at odds with my own and they have helped me broaden my horizon and be less bearish on markets, while still maintaining my skepticism about monetary policy. They have chosen to remain completely anonymous with me, which I respect, and I have never personally met or otherwise know anything about the identity of Rosemont. That doesn’t matter, however, because I like their ideas and their commentary. You can follow Rosemont on Twitter here.

Part 2 of this interview can be found here.

Q: Hi Rosemont. Thanks for agreeing to an interview for my readers despite wanting to stay anonymous. Right off the bat: why do you use Bernard Baruch for your Twitter profile photo?

Baruch is one of the most fascinating Wall Street characters of 20th Century. He has tremendous intuition and gut instinct for the markets, macro economics and politics and he reminds us that the three are intertwined at all times

That’s a great segue to my next question: you recently got very bullish on gold when you hadn’t been in the past – what caused that shift in attitude?

We saw a global risk contagion event in capital markets today (11/26); Bitcoin lost over 8.0% of its value, the S&P dropped -2.2% and gold ended the session flat on the day after a mostly positive session. We expect more days like this in 2022.

This is the first time since the post-GFC period in 2009 that we’ve purchased or held gold instruments in our portfolios. At present we own an 8.0% position in the GLD ETF and periodically traffic in Barrick Gold and Newmont equities. Recall that during the Q4 2018 ‘Taper Tantrum’ and most acute phase of the COVID dislocation in Q1-Q2 2020, gold futures, ETFs, and gold miner equities protected your wealth from severe capital market drawdowns.

Gold is an umbrella we hope will keep us dry if it rains very hard next year.

Holding gold in a portfolio today is a pragmatic ‘TINA’ bet borne of healthy caution in the wake of a multi-year equity bubble that has begun to run amok.

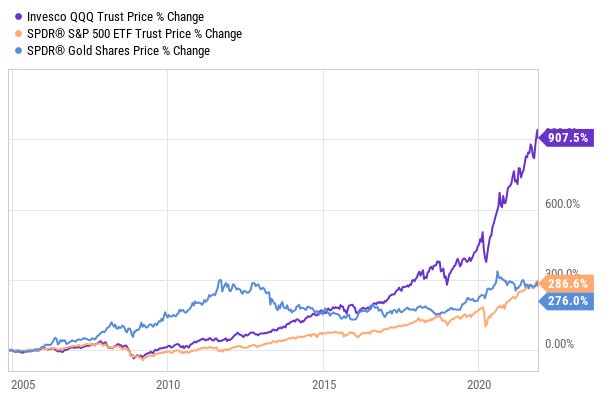

The reality is gold is not an optimal investment for compounding wealth in the long-run; owning the GLD ETF since inception in 2004 has returned a roughly 8.0% CAGR which is adequate for a pension fund or retiree but relatively mediocre vs. the alternatives.

Investors are better off owning Walmart, Costco, McDonald’s or Starbucks and grow our capital tax-efficiently with high-ROE/RoIC ‘compounders’ that pay dividends. The gold ‘streamers’ such as Wheaton and Franco-Nevada however happen to be very interesting investments with compelling business models that have generated compounder-like returns for Shareholders over the last two to three decades.

We’ve come a long way from the market depths of March 2020 and perhaps it’s time to take a more cautious stance going into year-end. We are currently operating on the premise that the Nasdaq and S&P could see negative returns in 2022. If the indices see a drawdown of 10-20% (or greater) we expect gold to appreciate or hold its value in real terms next year. There are labor and supply chain shortages globally that will definitely impact the gold mining industry. If CPI hits escape velocity and reaches 8-10% higher next year, we’ll be content with a 10% allocation in gold as we expect institutional and speculator capital flows to put a firm bid behind the yellow metal.

You’re one of the very few out there calling the entire crypto space a bubble. What’s the key argument in differentiating crypto from other assets? Is crypto worth zero or is there a value and, if there is, where does the value come from?

In the last few years market participants have adopted a pseudo-religious attitude towards Bitcoin, Ethereum, and a whole host of crypto currencies. People have come to either ‘believe’ or ‘not believe’ in the asset class and its prospects.

What we can definitely say today is that there are over 14,850 different crypto currencies trading on over 430 venues with a combined ‘market capitalization’ of roughly $2.5 trillion dollars. To our best knowledge these assets produce zero cash flow or dividends, exhibit very high volatility, remain subject to boom-bust sequences, and are used as an apparatus for elaborate criminal hacking schemes.

The average daily volume of these 14,000+ crypto currencies is roughly $150 billion per day. We estimate that approximately 90% of this turnover is driven by purely speculative or gambling capital flows from small retail traders. If we assume that roughly 2-3% of average daily volume consists of bona fide commercial transactions (including portfolio investment), this leaves almost $10 billion of daily volume that derives from money laundering, fraud and other illicit schemes etc.

Some governments have rushed to legalize, adopt or allow for crypto currencies to proliferate in their economy for fear of stymieing or not supporting innovation. Others have taken a hardline stance and begun to outlaw the usage of crypto in their banking and financial system. We are of the view that Bitcoin-like protocols present a clear & present danger to many emerging market countries’ ability to issue currency and sovereign debt over the next decade. As the true nature of these crypto assets become more evident, we’ll see more and more countries outright ban and prosecute their usage in their economies.

Bitcoin and Ethereum (combined 60% of total crypto market capitalization) may very well survive and find a way to thrive due to ‘fiat-by-consensus’ adoption. Under that scenario they clearly will not trade to zero. But that doesn’t negate the presence of a current bubble where 99% of cryptos are of near-zero ultimate value. Promoters have come to euphemize cryptocurrencies as ‘projects’ but most cryptocurrencies are outright frauds.

We think it’s time for crypto investors and regulators to have a more honest, empirical framework for discussing the intrinsic value and risks of these crypto assets. If we can handicap real estate on cap rates and LTV ratios and equites on P/E ratios and cashflow yields, we should adopt a framework for Bitcoin and Ethereum etc (Dogecoin?) that doesn’t border on the pseudo-religion.

I wrote an entire article based off your assumption that we are once again in a 1999-2000 style crash setup. What were the signs that helped you recognize this?

In the wake of the COVID crisis and ensuing Monetary/Fiscal stimulus, too many people with very little financial literacy or professional training took up day-trading of equities, options and crypto currencies as a hobby and eventual vocation. The prudent, cautious amongst us (Warren Buffett included) were seemingly left behind in the speculative frenzy that ensued in the summer of 2020.

We’re often reminded to not confuse investing/trading luck with skill. Regardless, many very young people made a lot of money in a very short period and thought that this process was somehow normal or even sustainable. To be perfectly clear: there was nothing normal about the Meme Stock frenzy, SPAC mania, or crypto and NFT bubble that erupted.

When we witnessed trillion-dollar market caps such as Tesla and Nvidia trading like biotechs in the frenzy of Q4 of 2021, we decided we’d seen enough of this equity market mania. It was eerily reminiscent of Cisco, Lucent, Intel in 1999. The equity market today feels bloated and reckless; it’s probably a good time to start taking chips off the table and leave the party while people are still having fun.

November 2021 was a harsh reminder that valuations and capital structures eventually do matter; people will learn the hard way.

What are the most likely catalysts to set the market off moving lower?

Nobody rings the bell at a market top, but negative catalysts include:

– inability to eradicate COVID in Europe & Asia will keep global trade and travel routes shut for another year

– cascade of lingering supply chain woes = potentially very recessionary

– debilitating energy price spikes in 2022-2023 = looming stagflation

– margin loan balances are at historically very high levels

– continuation of the Tech selloff we witnessed in Q4 2021

– fraud & accounting malpractice (always prevalent in manias)

– Fed signaling significantly higher interest rates in the aftermath of inflation

– Geopolitics: a potential Kamala Harris Presidency would see Russia and China turn belligerent overnight

What’s your take on how we’re handling Covid? You’ve mentioned what happened to our economy over the last 18 months was “economic terrorism”. Will we learn – either through people revolting or negative consequences – or will we continue down this Orwellian path?

It’s very disappointing to see how politicized the pandemic became in the United States. It obviously didn’t help that COVID struck in an Election year, but there will be plenty of blame to go around the table when a proper post-mortem analysis is conducted years from now. We hope that Bethany McLean (Enron: The Smartest Guys in the Room) will eventually write a thoroughly unbiased expose on the timeline of policy decisions in 2020. We’re of the firm belief that our Leaders in Washington D.C. did more harm than good in the early months of this pandemic.

We can safely conclude the 2020 COVID shutdowns are the direct cause for the supply chain dislocations and hyperinflation that Americans are about to suffer. The shutdowns that we witnessed in the United States were a flawed policy decision akin to willful pilot error or ‘economic terrorism;’ Federal and State Governments suffocated millions of livelihoods and permanently destroyed hundreds of thousands of perfectly viable small & medium family-owned businesses. The larger, better capitalized multinational corporations capable of accessing capital markets and Government Stimulus Programs not only survived, they eventually thrived.

What happened can only be described as a crime.

Part 2 of this interview, where we discuss inflation, the Biden administration, why China banned crypto and more, can be found here.

—

DISCLAIMER:

It should be assumed I or Rosemont Seneca has positions in any security or commodity mentioned in this article. None of this is a solicitation to buy or sell securities. Neither I nor RS hold licenses or are investing professional. None of this is financial advice. Positions can always change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I get shit wrong a lot.

Tyler Durden

Tue, 11/30/2021 – 15:30

via ZeroHedge News https://ift.tt/3o7AtqQ Tyler Durden