Bonds, Stocks, & Bitcoin Battered As “Rage-Hike” Fears Grow

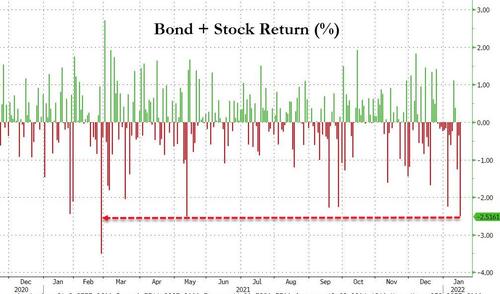

Today saw both bonds and stocks battered, creating the biggest daily aggregate loss (10Y TSY Px plus S&P 500) since March 2021…

Source: Bloomberg

In fact, a combined equity/bond portfolio has lost money on 13 of the last 15 days.

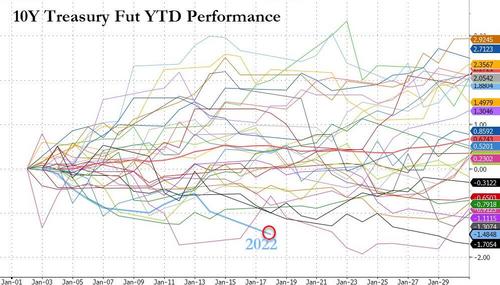

10Y Treasuries are having their worst start to a year in at least 30 years…

Source: Bloomberg

And stocks are having their worst start to a year since 2016 (and 3rd worst in at least 30 years).

“It sure is a hell of a lot easier to just be first… sell it all today…”

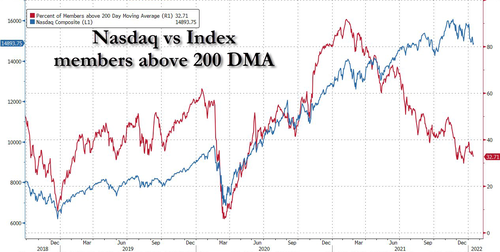

Breadth continues to stink…

Source: Bloomberg

With the average stock is now trading 38% off their 52-week highs.

Today was ugly for stonks with Small Caps (down over 3%) and Nasdaq underperforming (down 2.5%). The S&P was also ugly and The Dow was weighed down by GS (-171pts), MSFT (-46pts) and JPM (-42pts)…

NOTE that futures got hit at the Asia open, the EU open and the US open… and the US close.

Nasdaq went back into correction today- its biggest drawdown since March 2021…

Source: Bloomberg

Significant technical levels came into play today with the S&P bouncing off its 100DMA (then falling back to it), Dow bouncing off its 100DMA (then falling back below it), but Nasdaq unable to get back above its 100DMA…

Goldman was monkeyhammered after earnings is now down 8.5% YTD (while Wells Fargo remains up 18% YTD)…

Source: Bloomberg

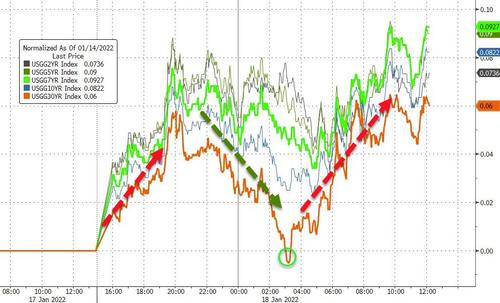

Yields surged again today with the belly underperforming (5Y-10Y +8-9bps, 2Y & 30Y +6bps)…

Source: Bloomberg

10Y Yields are back at pre-COVID-lockdown levels (as are 5Y yields) and 30Y is back at its highest since June 2021 (topping the Oct 2021 levels)…

Source: Bloomberg

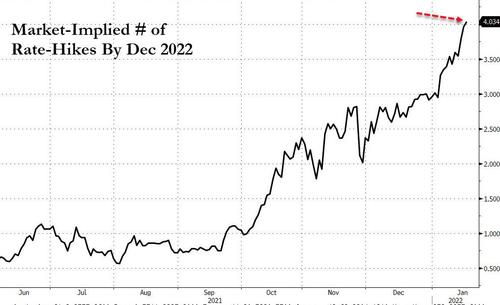

At the very short-end, the market is now pricing in more than 4 rate-hikes by year-end…

Source: Bloomberg

…and is starting to price in a so-called “rage-hike” of 50bps for March…

Source: Bloomberg

Echoing Nomura’s thoughts, Deutsche Bank economists argued in a note to clients today that The Fed could raise interest rates faster than expected to get ahead of inflation and even potentially hike by 50 bps at some stage.

“The most likely scenario is that the Fed begins to raise rates at each meeting this year beginning at the March meeting,” write authors Peter Hooper, global head of economic research, and Matthew Luzzetti, chief U.S. economist.

“In addition, the Fed could decide to announce an earlier rundown of its bill portfolio, possibly beginning as early as the March meeting, and begin QT in the second quarter.”

Before we leave bond-land, we note that 30Y Real Yields are getting very close to turning positive once again…

Source: Bloomberg

This leave bonds at their cheapest to stocks since May 2019…TINA is dead

Source: Bloomberg

The dollar extended its recent ramp, but once it got back to unchanged on the year, the trend reversed…

Source: Bloomberg

Crypto was weaker from Friday’s close with Bitcoin slipping back below $41500 as the ‘death cross’ is triggered (which marked the lows the last time it was hit)…

Source: Bloomberg

Oil prices rallied today, with WTI chopping around before jumping back above $85, taking out October’s highs, back to its highest since October 2014…

Gold ended marginally lower (from Friday’s close) on a choppy day…

Finally, in case you were wondering, the market is not just worried about a “rage-hike” liftoff and the trajectory of The Fed, but is now starting to price in the possibility of a rate-cut between 2024 and 2025…

Source: Bloomberg

Not exactly what ‘recovery’ is supposed to look like.

Tyler Durden

Tue, 01/18/2022 – 16:00

via ZeroHedge News https://ift.tt/3FzsRTC Tyler Durden