Foreign Holdings Of US Treasuries Hit A Record High In November

After October’s ugliness, and before the carnage began in December, November saw US Treasury yields oscillate with the last week seeing rates plunge on Omicron anxiety.

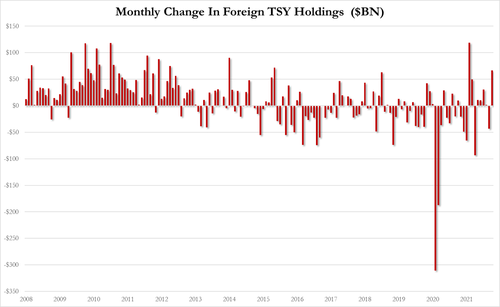

So, the big question is – did global central banks continue to dump bonds into this late-rally or did they flip-flop back to buyers of the world’s most liquid reserve asset?

The answer is – they were back to big buyers…

Today’s (latest) TIC data (for November) shows that foreign holdings of US government debt rose to a new record $7.75 trillion.

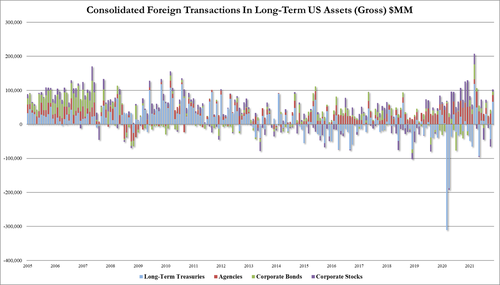

Foreign purchases of corporate stock +$7.2BN, biggest monthly increase since August, and follows sales of $11BN in Sept and $21.8BN in Oct

Foreign Purchases of corporate bonds +9.8BN, 4th month of purchases in a row

Foreign purchases of agencies $19.6BN, 56th consecutive month of foreign purchases of Agencies

Official buying of Long-Term Treasuries rose by $66.3BN in Nov, biggest increase since March 2021 when bonds got crushed on the Japanese pension selling

November saw the biggest private-buying of USTs ever…

China added to its Treasury holdings for the 3rd straight month in November (+15.4bn to $1.08 trillion)…

But Japan remains the biggest holder of USTs and added for the second straight month in November (+$20.2bn to $1.3 trillion)…

On a 6-month-rolling-basis, enthusiasm for US stocks is fading…

Overall, while private TIC flows surged, official flows saw capital exit in November…

Finally, we note that the trend towards gold reserves (and away from USTs) continues (according to IMF and Fed Custody data)…

Net gold buying by central banks globally reached 393 tons at the end of Q3 (latest data from WGC). Central banks have already bought more gold this year than they did in the entirety of 2020 (255 tons) with one quarter left to go. The World Gold Council says net gold purchases are “poised to reach a significant total in 2021.”

Tyler Durden

Tue, 01/18/2022 – 16:17

via ZeroHedge News https://ift.tt/3tBoftV Tyler Durden