Here Comes The Pivot: JPM Sees Sharp Slowdown In US Economy, “No Further Hawish Developments From The Fed”

For much of the past month we have been warning that as the broader investing public has been fascinated by the mounting speculation that the Fed will hike 4 times (or even “six or seven” times, thank you Jamie Dimon) and commence shrinking its balance sheet, the US economy had quietly hit a major air pocket and – whether due to Omicron or because the vast majority of US consumers are once again tapped out (see more below) – US GDP growth is now rapidly collapsing and may turn negative as soon as this or next quarter as the US economy contracts for the first time since the covid shutdowns in Q1/Q2 2020.

10Y yield LOD 1.82128% as market realizes that Fed is hiking “six or seven times” into a deep slowdown

— zerohedge (@zerohedge) January 20, 2022

Throw in the lack of a new Biden stimulus (BBB is dead as a doornail, courtesy of Manchin), and soaring gas prices (Goldman, Morgan Stanley and Bank of America all see Brent hitting triple digits in the near term, while a Russia-Ukraine war would send oil to $150 and crash the global economy), and we are willing to go on the record that a recession before the November midterms is virtually assured.

But while this is obviously a wildly contrarian view for now, especially with the labor market still supposedly helplessly backlogged with a near record number of job openings coupled with still soaring inflation, others are starting to notice…

Tightening into a slowdown… Déjà vu? pic.twitter.com/pczXzMVSxb

— Julien Bittel, CFA (@BittelJulien) January 22, 2022

… and so is the bond market, which traditionally is the first to sniff out major market inflection points, and which after surging to multi-year highs earlier this week, yields have suddenly slumped.

Nowhere is it clearer what is coming than in the ongoing collapse in the yield curve which at the fulcrum 5s30s, is just 30bps away from where the Fed was when it ended its tightening cycle in 2018.

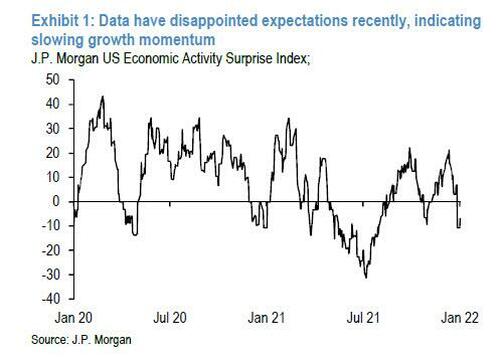

So it was with some surprise that we were reading the latest big bank weekly reports where precisely this slowdown is being increasingly flagged. Consider the following from JPMorgan’s latest Fixed Income Strategy note by Jay Barry (available to professional subs), who writes that JPMorgan’s Economic Activity Surprise Index (EASI) “has swung sharply into negative territory in recent weeks, indicating data have underperformed relative to consensus expectations.”

This was punctuated by the December retail sales data, as the important control group fell 3.1% over the month (consensus: 0.0%).

The weakness in data, JPM explains for the benefit of the Fed which in hopes of recovering its “credibility” after destroying it in 2021 when it said inflation was transitory and is now scrambling to fix its error is now willing to crash the market just to reduce aggregate demand, “indicates consumption should moderate in 1Q22.” And since consumption accounts for 70% of US GDP, guess what that does to overall US growth?

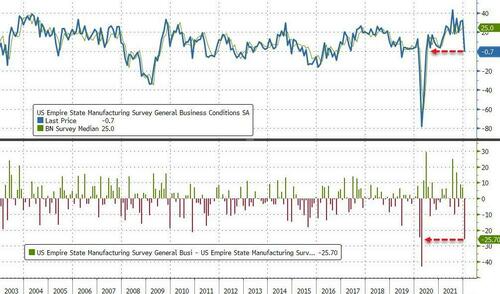

Or don’t guess and read what JPM now expects: “we forecast growth decelerated from a 7.0% q/q saar in 4Q21 to a trend like 1.5% in 1Q22.” It’s not just retail sales, however, or that recent Empire Fed Manufacturing Survey, which just suffered its 3rd biggest monthly drop in history (with only March and April 2020 worse)…

… more locally, initial claims surged 55k to 286k in the week ending January 15, their third straight increase and the highest weekly reading since October.

And while the seasonal volatility in claims around the new year could be amplifying the rise, this was the survey week for the January employment report and presages a much weaker payroll growth this month. In fact, as we discussed in our December jobs report commentary, it is now likely that January payrolls will be negative.

Of course, one can blame the Omicron spike in December for much of this slowdown, and many do – especially those who confused the surge in inflation in 2021 as a “transitory” phenomenon – and are now using covid as a smokescreen to argue that the current slowdown is transitory, but the reality is that there is much more to the current sharp slowdown, and Bank of America’s Michael Hartnett put it best on Friday when he said that the “End of Pandemic = US Consumer Recession” (more here).

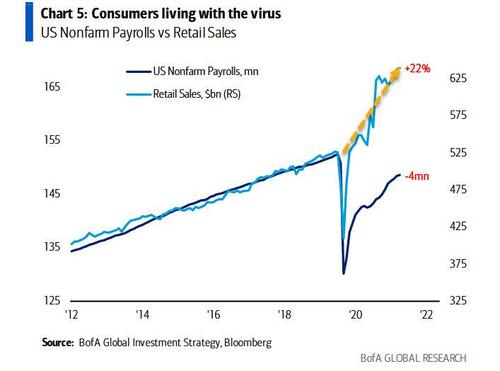

Here is the punchline of what the BofA CIO said: “retail sales 22% above pre-COVID levels…

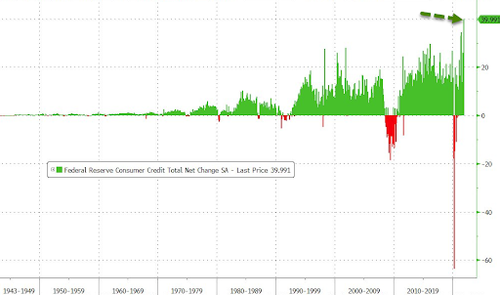

…payrolls up 18mn from lows, inflation annualizing 9%, real earnings falling a recessionary 2.4%, stimulus payments to US households evaporating from $2.8tn in 21 to $660bn in 2022, with no buffer from excess US savings (savings rate = 6.9%, lower than 7.7% in 2019 & and the rich hoard the savings), and record $40bn MoM jump in borrowing in Nov’21…

… “shows US consumer now starting to feel the pinch.”

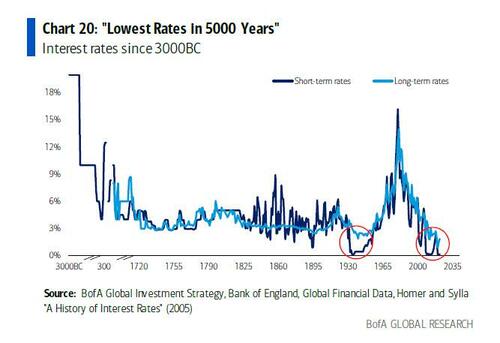

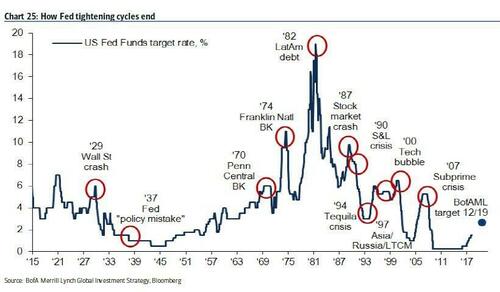

Alongside the realization that an exit from covid means the US is entering a consumer recession, comes Hartnett’s admission that any Fed hiking cycle will be short (it not sweet) and will be followed by easing as soon as 2023!. Indeed, according to Hartnett, while the broader economy certainly needs more hikes to contain inflation, it will take far fewer rate hikes to crash markets, because “when stocks, credit & housing markets have been conditioned for indefinite continuation of “Lowest Rates in 5000 Years” might only take a couple of rate hikes to cause an event (own volatility)”.

And since Wall Street always leads Main Street (sorry peasants), it is Hartnett’s view that the current “rates shock” is grounds for an imminent “recession fear”, and as noted above, the Fed hiking into a slowdown guarantees not only an economic a recession but also a market crisis.

The only question at this point is when will the Fed realize that it can’t possibly hike rates enough to offset the surge in inflation which incidentally is not demand driven, but is due to continued supply constraints, over which the Fed has no power!

Which is why JPMorgan’s economists go on a limb and perhaps seeking to assure markets, write that “next week’s FOMC meeting will not present the case for further hawkish developments”…. and “is only likely to ratify expectations next week and not surprise market participants with another hawkish pivot.”

Putting it all together is Goldman Sachs, which agrees with JPMorgan that there will be no hawkish surprises from the Fed, and wrote on Friday that if anything, the Fed will be more dovish than expected, and as such Goldman sees “the conditions in place for a large cover rally into and around the FED next week and when month-end new capital comes back into the equity markets, with corporates dry powder.”

Of course, there is always the risk that Joe Biden, now beyond dazed and confused and terrified of the upcoming Democratic implosion after the Nov midterms…

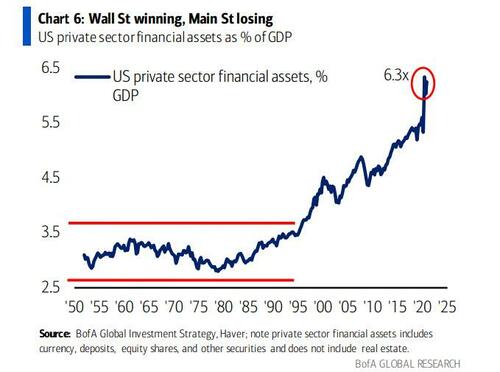

… does not realize how devastating a market crash will be for the US economy where financial assets are now 6.3x greater than GDP…

… and will order Powell to keep hiking and tightening just to break inflation’s back (as discussed above, and as Blackrock also noted recently, the Fed is completely powerless to halt supply-driven inflation), even if it means the destruction of the entire wealth effect that the Fed spent the past 13 years trying to create. In that case, all bets are off.

Tyler Durden

Sat, 01/22/2022 – 17:00

via ZeroHedge News https://ift.tt/3qQfRoq Tyler Durden