JPMorgan Says “We Go Higher” But Morgan Stanley Counters “Sell Rallies”, This Is A “Classic Bear Market”

One day after even traditionally bullish Goldman flow trader Scott Rubner said that “sell the rally trading mode is still in place” (although a capitulation, especially if coupled with CNBC’s “market in turmoil” would spark a fierce rally), we get a reminder that nobody knows anything when the Fed throws market for a loop and pulls the Fed Put.

Case in point, two market notes this morning, one from JPMorgan’s trading desk, another from Morgan Stanley’s chief equity strategist, Michael Wilson, which look at the exactly same data and reach two diametrically opposing conclusions.

First, as we noted earlier, in his morning intelligence note, JPMorgan’s desk trader Andrew Tyler recapped last week’s action, repeating what we said, namely that “Friday’s moves were primarily related to month-end rebalancing which tends to occur about 3 days before month-end” and asked rhetorically, “where do we go from here?“

His answer: “near-term, higher” explaining that “we’ll continue to see earnings support from MegaCap Tech and the chatter surrounding Citrix being bought may also help form a near-term bottom.” In terms of his Trading View, he urges clients to “stay long the “barbell trade” being long MegaCap Tech, Energy, Metals/Miners, Consumer Recovery stocks, and Transports… hedged using a market-neutral approach, with a combination of SPX, IG Credit (LQD), and Staples.”

That said, over the longer-term, the JPM trader thinks “investors will need to see Liftoff, at a minimum, before feeling comfort in being maximally deployed. Keep an eye on VIX, as it will likely need to fall to/below 20 in order to have a sustainable move higher.”

So if the March FOMC meeting is the bigger catalyst, when do investors position for the March meeting? According to JPM, “it could be as soon as mid-Feb. A situation to monitor is the so-called “Stealth Omicron” variant which could slow the decline in case counts.”

But while JPMorgan is bullish tactically, if still cautious until we get some more Fed clarity, for their colleagues at Morgan Stanley, there is no confusion, and the only question is how fast to sell. As Morgan Stanley’s chief equity strategist strategist Michael Wilson writes this morning, “the safety net of forward guidance from the Fed is gone just as earnings revisions and PMIs appear set to decelerate—an unattractive risk/reward set up. We remain sellers of rallies and of the view that S&P 500 fair value remains closer to 4,000 tactically. Stick with Defensives under the hood.”

This is how Wilson explains his descent into the most bearish circle of advisory hell (where being a bull is usually a career-truncating, if not ending, move): “while last week’s FOMC meeting met consensus’s expectations on multiple fronts—that the FOMC will likely begin raising rates in March while tapering is scheduled to conclude in mid-March—it also reinforced the notion that we are heading into a period of greater uncertainty from a forward guidance standpoint. Every meeting is a “live” one from a rate hike standpoint, and while our economists don’t see a 50 bp hike coming in March, it is a possibility at later meetings. Chair Powell’s commitment to fighting inflation is evident, and it’s unlikely that anything labor market related changes that view in the coming months. Furthermore, despite recent risk asset volatility, financial conditions remain accommodative and we’d likely need to see a much larger selloff to force the Fed to pivot in the near term.”

While expected, Wilson notes that “Powell’s hawkish tilt likely contributed to elevated equity volatility last week. That uncertainty was assuaged to some extent by several strong earnings reports that helped convince investors that demand pull forward fears may now be over-priced, particularly in Software. Nevertheless, the S&P 500 continued to struggle with its 200-day moving average while other major averages closed well below this key technical resistance even after Friday’s strong rally.”

At the same time, defensives hung in maintaining their outperformance over Secular Growth, Cyclicals and Value since the sell-off started almost a month ago.

Wilson’s bottom line: “we remain uninspired by last week’s price action at the index level despite strong earnings prints and resilient retail participation. We remain sellers of rallies and of the belief that the volatility and intra-day swings we are seeing are classic bear market action. Fair value remains closer to 4,000 at the S&P 500 level—we detail our view here in today’s note, leveraging our equity risk premium framework.“

* * *

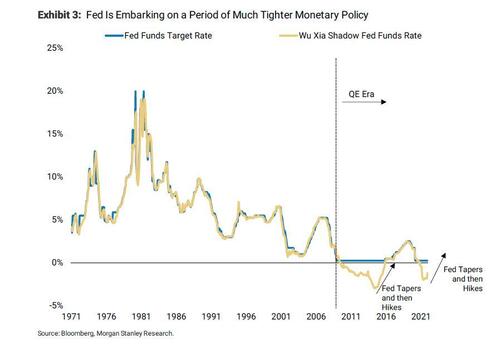

The rest of Wilson’s note is more or less a recap of what he has said previously, starting with his take on the upcoming Fed tightening path which he views as an aggressive one.

Specifically, he shows that “tighter Fed policy brings lower returns and greater uncertainty for equities. On this front, Exhibit 4 shows that during tightening cycles, average equity returns are less than a quarter of what they are in easing cycles.”

Additionally, he also observes that the monthly positive return hit rate during tightening cycles is close to 50%: “that means greater uncertainty for stocks and higher volatility” which in turn prompts Wilson to predict that “returns are likely to be even lower during this tightening cycle (i.e., negative) because the Fed is going to be tightening into a macro and earnings growth slowdown that’s about more than just omicron.”

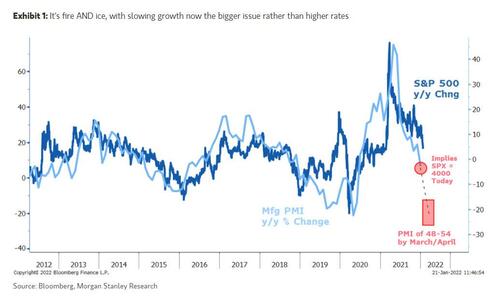

As Wilson showed just last week, as PMIs decelerate more sharply (as earnings revisions breadth falls toward zero, or Wilson’s “ice thesis”), the drivers are not so much Omicron as a payback in demand from overconsumption in 2021, coupled with cost pressures (especially on the labor side) that remain persistent through 1H ’22.

The MS strategist thinks that “the market has yet to fully process these dynamics, which should prove to be the drivers of the next leg to 4,000 at the index level.” Why? Because a Fed that’s focused on inflation and certainly not as much on the path of earnings revisions or higher frequency macro data/surveys “increases the likelihood that we see aggressive tightening directly into this growth slowdown—a further negative for equity prices even if the economy remains on solid footing overall.”

Here the bank’s clients push back, and ask Wilson what evidence he has that PMIs will slow, to which he responds as follows:

“Exhibit 5 shows that the spread between ISM manufacturing orders vs. inventories is pointing to a significant slowdown in the headline PMI. Further, Exhibit 6 illustrates that the Industrials sector’s relative forward P/E multiple is pointing to a similar dynamic. An average of manufacturing surveys that have advanced January readings also confirms this trend (Exhibit 7). Finally, our economists’ MS Business Conditions Index also weakened in January (Exhibit 8).”

But why should anyone care about PMIs? Here Wilson also has a ready answer, replying that they represent are a meaningful input into his top down forecasting approach: “In our 2022 outlook, we refined our approach to forecasting forward price/earnings multiples. After an extensive analysis looking at the correlation of various macro and fundamental indicators versus equity risk premium (ERP), we found the ISM PMI to be the most consistent explainer of ERP over time.” There are three specific reasons why Wilson likes PMIs:

- it has extensive history;

- it’s a mean reverting indicator so we can make more confident assumptions of its path when it’s at extremes (like today); and

- as noted above, there are leading indicators that point to direction of travel for PMIs going forward.

These long term relationships can be leveraged to project out ERP estimates based on different PMI levels. Coupling those ERP estimates Treasury yield forecasts allows Wilson to make more “informed assumptions” around the path of the market multiple.

That leads Wilson to a couple of questions: Where is fair value today? Where would fair value be if PMIs fell? How about if rates rose further?

To answer these questions, the chief equity strategist has put together a sensitivity analysis of how multiple and price level would look under various PMI and bond yield assumptions. As the yellow shaded cells in Exhibit 9 show, assuming current levels on the ISM composite PMI and the 10-year yield, the Morgan Stanley model projects a fair value multiple of ~19.5x and a price level of ~4,400, almost exactly where we are trading today.

So on this score, as things stand today, the market is fairly priced. That said, Wilson sees downside to the mid 50s in the PMI in the next 1-2 months. If rates stay static, that implies a forward multiple of 17.5-18x, and a price level of ~4,000.

Assuming Wilson is wrong on the level of the PMI, and it remains close to 60 (the 89th percentile of historical levels), but rates move higher toward the MS strategists’ 1Q target of 2%, one is still looking at 18x and ~4,000. Naturally, the bank’s high conviction PMI call could be wrong as could the rates strategists’ high conviction 10-year yield call, but even if one is correct, the bearish model still implies downside at the index level. If both are wrong, there’s likely modest upside in price, but as things stand now, Wilson concludes that “it’s an unattractive risk/ reward set up, in our view.”

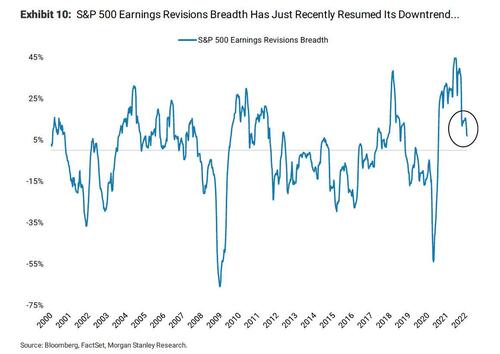

One final point made by Wilson in his Monday note is that the other key indicator he is watching for signs that his “ice” thesis, is playing out is earnings revisions breadth, which appears to have resumed its downward trajectory as shown in the charts below.

As Exhibit 11 shows, cyclical industries are showing relative weakness from an earnings revisions standpoint and appear to be driving this recent downtrend. Defensives generally are showing signs of relative strength and notably Software has seen its relative earnings revisions breadth stabilize this week amid strong earnings.

Overall, Wilson thinks that these dynamics are supportive of his relative preference for Defensives (and financials) over Cyclicals (and unprofitable grwoth). And while the bearish strategist is encouraged by the recent relative strength shown by Software revisions, unlike other banks he doesn’t recommend adding to the group broadly given the banks’ view that this rate move higher in yields is not finished.

In summary, while JPM is urging clients to buy now and sell once markets have bounced modestly before selling again ahead of an even bigger drop, Morgan Stanley is bearish throughout and is sticking with its relative preference for Defensives and Financials over broad Cyclicals and Unprofitable Growth, and waiting for a more attractive entry point at the index level that will likely come as we get closer to 4,000.

Tyler Durden

Mon, 01/31/2022 – 13:25

via ZeroHedge News https://ift.tt/CK8mHtPrG Tyler Durden