Solid 5Y Auction Sees First Drop In Yield Since December

After a solid 2Y auction which saw the first sequential drop in high yield since mid-2021, moments ago the US Treasury sold $48BN in 5Y paper exactly one hour before today’s FOMC minutes release. And while traditionally such events lead to heightened volatility, today’s session has been relatively tame, with yields modestly higher reversing some of yesterday’s plunge, which is perhaps why the 5Y auction came off without any fireworks.

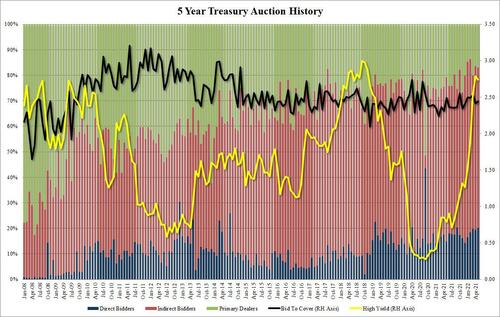

Pricing at a high yield of 2.736%, the auction saw – just like yesterday’s 2y – the first sequential drop in the high yield, down from 2.785% in April, and tailing the When Issued 2.732% by 0.4bps.

The bid to cover rose from 2.41 in April to 2.44, which was right on top of the recent six-auction average.

The internals were also solid: Indirects took down 62.9%, a drop from last month’s 64.0% and just below the recent average of 63.9%. And with Directs awarded 20.0%, or above the recent average of 17.4%, Dealers were left holding 17.0%, again one of the lowest Dealers awards on record, if somwhat higher from last month’s 16.5%.

Overall, another very solid auction, with the tail only indicative of the recent sharp drop in yields across the curve and little else. After all, yields have already peaked and we are currently in the pre-recessionary slump which ends with “Powell throwing in the towel” on his hiking plans.

Tyler Durden

Wed, 05/25/2022 – 13:19

via ZeroHedge News https://ift.tt/mY39HJt Tyler Durden