Is It Too Late To Buy Oil Stocks?

Submitted by Kailash Concepts

We get asked this question. A lot. Investors, scorched by multiple expansion in speculative stocks, are understandably concerned about the movement of prices in oil and gas. We believe the reason to invest in oil stocks stems from a fundamental backdrop for the sector, unlike anything we have seen in our careers.

We are going to generalize. No offense intended. We see three primary groups of equity investors today:

-

Index Fund Investors: since we first wrote up energy over 18 months ago, the sector’s weight in the S&P 500 has doubled to 4.8%, so this group has “decided” to put less than a nickel of every dollar into some of the cheapest, most well-run and disciplined group of capital allocators in the market (we thank them for making what we believe is a catastrophic error)

-

Active Managers: hewing to explicit or implicit environmental mandates that have deemed the producers of energy to be “bad” – this is a very large group of a shrinking pool of active managers who are willfully omitting energy and embracing “Clean Tech” stocks that often lack fundamental merit

-

Active Managers who deviate from what we believe are flawed index funds and seek out firms with robust fundamentals that are often shunned by the crowds. These investors favor assets that provide a significant margin of safety based on a view that “risk” is defined as the permanent impairment of capital.

Fortunately, that third group has never been smaller from what we can tell. The capital discipline, commitment to healthy balance sheets, and exploding free cash flow that characterizes oil and gas stocks seem to count for little. This indexing age has created market inefficiencies so large and so slow to resolve themselves that it is almost hard to believe.

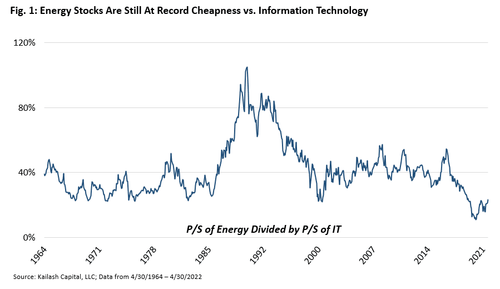

Figure 1 suggests this is the early innings for energy. Oversimplified? Yes. Compelling? Yes. Complicated? No.

When to Buy Oil Stocks

Nobody at KCR relishes the pain high energy prices are inflicting on the world. And we certainly do not write this piece with any illusions that things cannot go wrong for oil and energy stocks. Here are some examples:

-

An outbreak of a nasty new Covid strain

-

Persistent inflation

-

Sudden deflation

-

A central banker induced recession

-

Something we have yet to contemplate [our money is on this one if something should go wrong]

We think many oil stocks’ valuations already factor in lower commodity prices despite structural supply shortages. Considering the hostile financial (ESG), regulatory and political backdrop (discussed below) do you believe any material supply is coming online? Possibly of more importance: if any of the above scenarios hit energy prices, won’t bloated growth stocks trading at 50x earnings and speculative loss-making stocks get hit much harder?

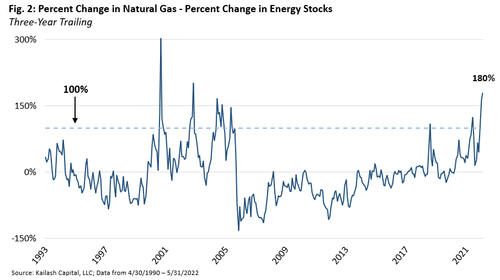

Our team believes the disparity between the change in the commodity prices vs. the stocks is a compelling sign of just how little credit investors are giving the energy sector. The chart below does the following:

-

Takes the 3-year change in natural gas prices minus the 3-year change in the price of energy stocks[i]

-

When the line is above zero, it tells us that natural gas has gone up much faster than energy stocks

-

When the line is below zero, it tells us that the stock prices have gone up much faster than the gas prices

Over the last three years, natural gas prices are up 232%, while the Energy Sector’s stock prices have only risen 52%. Said differently, natural gas prices have risen 180% more than energy stocks since April 2019. The last time the commodity ran this far ahead of the stocks was in November of 2000. That date would prove to be the start of a seven-year bull market for energy stocks, which would destroy the S&P500.

In the dot.com bubble, investors went crazy for novel tech stocks. Energy stocks, which make the basic input for modern life, were deemed obsolete. That lack of investment led to a serious supply shortage. The cycle repeats today.

Fig. 2: Percent Change in Natural Gas – Percent Change in Energy Stocks

Today’s situation “rhymes” but strikes us as significantly more constructive for the energy sector. We do not recall AOL, Akamai, Cisco, or other internet darlings talking about how oil was obsolete. The sector was just forgotten and left behind during the dot.com mania.

In this cycle, we had promotional shills proclaiming the end of energy. The novel story stocks were, and are, often companies that suggest they solve the energy crisis despite considerable evidence to the contrary. We believe the divergence between narrative and truth has rarely been wider than it is today.

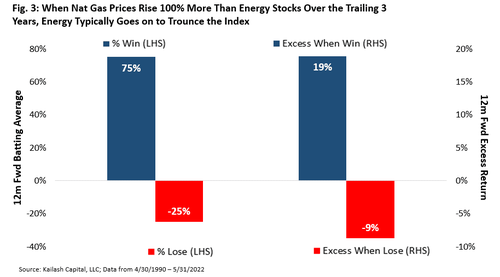

The chart below shows how investors did in prior periods when natural gas outperformed the energy sector by 100% or more (light blue line in Fig. 2). Intuitively, when the stocks do not follow the commodity, that means investors doubt the durability of physical market prices for energy. Rarely has that doubt been more pronounced than it is today. Figure 3 shows that in 3-year periods when natural gas rises 100% more than Energy stocks:

-

Energy stocks outperform the index 75% of the time by an average of 19% over the following year

-

Energy stocks underperform the index 25% of the time by an average of -9% over the following year

-

Conclusion: History suggests this is a fantastic time to buy Energy Stocks

Fig. 3: When Nat Gas Prices Rise 100% More Than Energy Stocks Over the Trailing 3 Years, Energy Typically Goes on to Trounce the Index

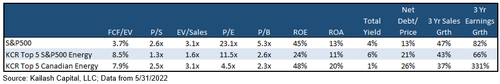

The table below shows the fundamentals of the S&P500 vs. the KCR top 5 ranked U.S. and Canadian energy stocks today. We think the data speaks for itself. We provide the lists for the two KCR energy groups in the exhibit at the end of this piece.

Below, we take a moment to address some fears around energy prices and energy stocks.

Buy Oil Stocks When Others Won’t

People fret about the “sustainability” of the commodity rally. The oil market’s recent surge is deemed, by many, as being too high. Today people blame the invasion of Ukraine as the cause of what many view to be a transitory problem. We agree that current oil prices may be transitory.

Yet we believe the data suggests prices may be too low.

There is no doubt the tragedy in Ukraine has sent oil and natural gas higher. But the IEA did a remarkable job outlining the bull case for oil in early 2021, long before the war. We summarized the IEA’s bullish findings on oil shortly after its publication. To summarize our summary: they explained that halting the growth in energy use would require the wholesale change of human behavior globally.

We saw no sign of any such changes. Starstruck by celebrity CEOs and Fund Managers shilling impossible narratives, people chased story-stocks to obscene levels. Published in May of 2021, our piece on Oil Producing Assets noted that Tesla’s market cap was equivalent to all the stocks in the energy sector combined.

Faced with the choice of making difficult changes in lifestyle or getting a government subsidy to buy an electric sports car, the sports car won out. Unfortunately, investors and consumers seemed almost willfully blind to the unforgiving data around EVs. Goehring & Rozencwajg’s research was quick to highlight the brutal shortfalls, and still no one listened. Lucas White of GMO recently penned a clear and quick summary of the problems with the EV narrative.

While BEVs of dubious environmental merit were drowning in capital, the energy sector starved. Our lead-in chart in Crude Investing: Energy Stocks & ESG highlighted that capital expenditures in the energy sector hit lows last seen at the peak of the dot.com bubble. When we make an industry a pariah, starve them of capital, choose to believe storytellers over fact, and then see spending on production collapse, we should expect higher commodity prices. Let’s use recent history to put current prices in context.

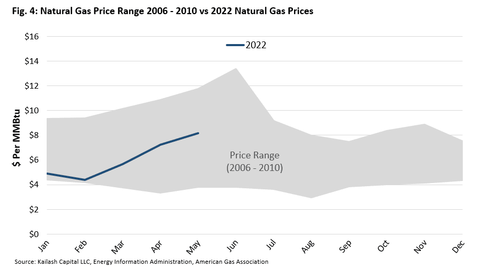

The shaded area shows the range of observed natural gas prices between 2006 – 2010 by month. Revisit our chart on energy sector capital expenditures. The US was spending nearly 4x as much on energy capex as we are today. The line you see is natural gas prices so far in 2022. Does it still look expensive?

Fig. 4: Natural Gas Price Range 2006 – 2010 vs 2022 Natural Gas Prices

For further perspective, we ask you to consider the following. Current energy prices are where they are despite coordinated releases of oil from the US and other countries’ strategic reserves working to hold prices down. The US SPR is now below 538ml barrels. The lowest level since 1987.

We think that adds a built-in “bid” to energy. If governments stop selling, prices may rise. Also, it is worth noting that the US economy is five times larger today than in 1987 and experiencing a reshoring boom. Seems unwise to have our strategic reserves back to 1987 levels. At some point, we will need to rebuild our strategic reserve. Exploration and Production: An Unfortunate Tailwind

There is a lot of noise about the conduct of the energy companies. They are accused of profiteering from the war. People clamor for windfall profit taxes.

We believe the vast majority of people in America have much more in common than the media would have us believe. With that said – the media has never been more powerful in polarizing us.

In the interest of encouraging a middle ground, let us take a quick tour of energy companies’ recent experiences.

In the Covid crash, oil prices went negative. British Petroleum’s 2020 Energy Outlook and many other major energy experts came out and declared peak demand had arrived. In one piece, we cited this article about brand new rigs with 30 year operating lives being scrapped. Famous people were calling for $12 oil based on EVs. Even today, stories come out suggesting “Peak Oil is Coming” warning about stranded oil assets.

So, which is it? Are these companies profiteering? Or are they at risk of ending up stranding investors’ assets?

Energy investing is a capital-intensive business that requires long-term thinking. In 2016, 142 oil and gas companies went bankrupt. Another 100 followed them into insolvency in 2020. So, they’ve had a good year and a half and now we want both more production at lower costs but are going to increase their costs via punitive taxes?

This is sheer madness. Energy and fertilizer shortages will grow worse. Soaring incidence of famine will merely get worse. Egged on by the most promotional CEOs and money managers we have ever seen, the world has and continues to shower capital on speculative clean tech stocks of dubious to negative value.

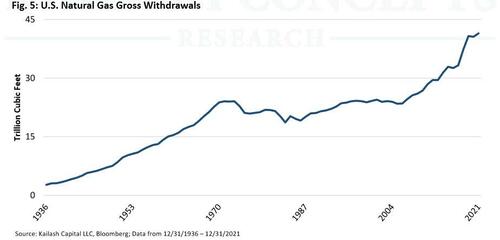

Regardless of your opinion, the chart below doesn’t lie. That’s the EIA’s most comprehensive measure of US natural gas production. This is an industry that shattered production records in 2021. Not bad, considering the catastrophic 2020 Covid year and the calls by many pontificators for their inevitable decline. To each their own.

Fig. 5: U.S. Natural Gas Gross Withdrawals

Tyler Durden

Sat, 06/04/2022 – 10:30

via ZeroHedge News https://ift.tt/UQqSPin Tyler Durden