Citi And Barclays Capitulate On Bearish Crude Views, Raise Oil Price Forecasts

By Julianne Geiger of Oilprice.com

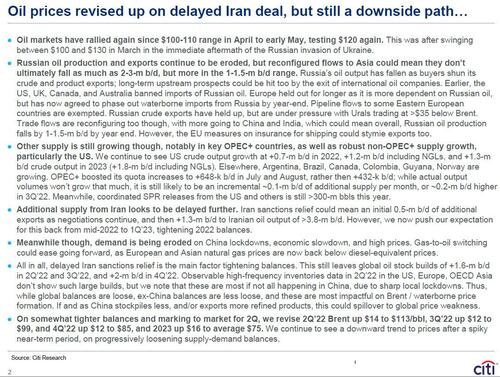

Two banks and big oil bears – Citi and Barclays – raised their oil price forecasts over the weekend, citing the effects of Russian crude oil sanctions and delays in the renewal of the Iran nuclear deal – without which there will be no meaningful increase in crude oil exported from Iran.

Citi Research, which was one of the biggest bears on oil with bank strategist predicting $70 oil as recently as last week, raised its oil price forecast due to heavy delays in securing another Iranian nuclear deal, which will contribute to the tight market conditions for crude oil.

Citi now sees sanction relief for Iran coming in the first quarter of 2023, adding 500,000 bpd in the first half and 1.3 million bpd over the second half. This is in contrast to its previous forecast, which assumed Iranian sanctions relief—and therefore additional crude oil—would come sometime mid-2022. Now that we are already in mid-June and the talks appear to have stalled, Citi’s previous scenario looks highly unlikely.

Citi’s second-quarter 2022 Brent forecast is now seen at $113 per barrel—up from $99 per barrel in its previous forecast. Citi also raised its Q3 and Q4 forecast to $99 and $85 per barrel, respectively. For 2023, Citi lifted its Brent price forecast to $75—up $16 per barrel.

Barclay’s also lifted its price forecast citing crude oil sanctions on Russia by the EU. Barclays now sees Brent prices averaging $111 this year and next—an increase of $11 for this year and $23 for next year. Barclay sees WTI at $108 for both years.

Barclay’s estimate assumes Russia’s crude oil production will decrease by 1.5 million bpd by the end of the year, after European Union ambassadors approved last Thursday the plan to ban Russian seaborne imports of crude in six months and refined products in eight months. The sanctions package also includes a ban on tanker insurance for Russian shipments to third countries, to take effect six months after the package is formally adopted.

Tyler Durden

Mon, 06/06/2022 – 15:06

via ZeroHedge News https://ift.tt/HbeWQUI Tyler Durden