“The Crack Of Dawn For Chinese ADRs”: Didi Soars Over 50% With China Set To End Probe With A Penalty, Restore App

After a miserable year for China’s version of Uber, which saw the stock of Didi Global crater following a crackdown by China which also destroyed the company’s US listing as DIDI stock plunged from the mid-teens last summer to a record low $1.37 one month ago, DIDI longs finally had a reason to rejoice this morning as Didi Global’s stock exploded more than 50% higher after the Wall Street Journal reported that Chinese regulators are preparing to wrap up their investigation into Didi Global Inc. and restore the ride-hailing giant’s main apps to mobile stores as soon as this week.

Regulators are also finishing up their probes into data security at two other firms, Full Truck Alliance Co. and online recruitment platform Kanzhun Ltd., the Journal said, citing unidentified people familiar with the discussion. Agencies including the Cyberspace Administration of China told executives from the three companies of their plan during meetings last week, the Journal added.

While the three companies are expected to face financial penalties, including a relatively large fine for Didi, the outcome is far more benign than the worst-case scenario that had been floating for months, including a terminal hobbling of the ride hailing giant. All three will also offer to transfer 1% of their shares to the state, giving officials greater say in running the business, the Journal reported.

Commenting on the report, Chen Da, an executive director at HHSC Assets, said that China’s action could trigger a valuation recovery of around 50% in tech shares; he noted that the company’s case is symbolic and may have played a part in triggering harsh crackdowns.

“The news comes like the crack of dawn for ADRs and tech stocks. The probe into Didi was an important incident last year, which started the downward spiral for Hong Kong tech shares and ADRs – – so a conclusion of this is necessary to end the troubles,” Chen told Bloomberg by phone.

Because Didi’s transgressions were perceived as quite severe, the company was symbolic of a “disorderly expansion of capital” and the regulations got really tough. As such, a fine would be seen as letting the company off lightly, if business was allowed to resume. After all, Didi is still a key platform for the flexible employment that China is promoting.

Should the probe be nearing conclusion, as the report suggests, it may trigger a relief rebound mirroring last year’s rout, with valuations recovering by about 50%.

“This would be the most concrete measure of support from authorities after so many meetings that suggested regulatory headwinds.”

Indeed, while a surprise, the outcome was not exactly a shock: after more than a year of regulatory scrutiny on big tech firms, Chinese policy makers repeatedly promised to soften their stance in recent months as the economy slumped and over a trillion-dollar in market value for the sector evaporated. While a lack of follow-through initially sowed doubts on policy determination, analysts say Monday’s report shows the regulatory environment is improving and will provide impetus for a market turnaround. Here is what analysts had to say following the report on Didi.

Beijing Gelei Asset Management Center LP (Du Kejun)

- “Looking back at this moment in a few months, this is likely to be the inflection point”

- Action speaks louder than words after authorities repeatedly promised to allow platform companies to develop in a healthy and orderly manner

- Allowing Didi’s app back into stores is an “ultimate demonstration” that healthy development is welcome. In the future we would like to see more developments in resumption of ADR IPOs

Straits Investment Management (Manish Bhargava)

- It is definitely positive news and further sign that the regulators are done tightening their grip on homegrown technology firms

- “The path of least resistance is, most likely, upward from here”

- Bloomberg Intelligence (Marvin Chen)

- “It is a sign that regulators are following through on their pledge to end the crackdown on tech platforms, which will likely continue to improve sentiment on the sector”

- “As policymakers continue to deliver on support pledges, the worst is likely behind us. We are seeing the beginning of a recovery into the second half of the year as the growth outlook bottoms out.”

CEB International Investment Corp. (Banny Lam)

- The worst is over for those technology companies. Didi news reflects that the peak of regulatory crackdown could be behind

- “Looking forward, when companies in the sector develop new businesses, they should know much better about how to avoid regulatory risks. So the unexpected regulatory shocks could be minimized going forward.”

- Also, despite their earnings forecasts having been adjusted down so much, it has also been reflected in share prices. Now is the time to take a “deep dive” into the sector and see which ones are in a better position to grow their market share in the competitive environment

Forsyth Barr Asia Ltd (Willer Chen)

- The report is marginally positive for sentiment. But there’s still no conclusion on what really happened with Didi, at least according to the report

- If the investigation on Didi can be concluded and there’s some solid debriefing (like what really happened and what the penalty is), that could clear the sky and let both Internet companies and investors get a better understanding of the regulatory approach

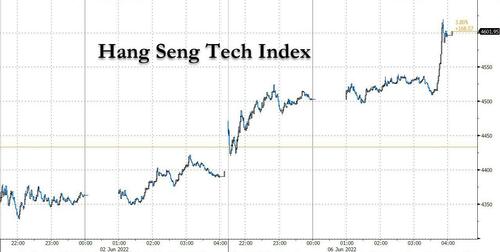

In kneejerk Didi surged about 50% in pre-market trading in New York, while Full Truck and Kanzhun both climbed more than 20%. The Hang Seng Tech Index gained 4.6% in Hong Kong. Investors have been awaiting the outcome of the probe into Didi, launched in July after the ride-hailing firm proceeded with its $4.4 billion US IPO despite Beijing’s objections.

The news, which came just minutes before the Hong Kong’s Hang Seng Tech Index closed for the day, sent the index sharply higher, rising as 5.1% in afternoon trading and closing just off session highs.

d

Tyler Durden

Mon, 06/06/2022 – 06:58

via ZeroHedge News https://ift.tt/CWFNtkI Tyler Durden