Even One Of The Biggest Bears Expects The S&P To Dead-Cat Bounce To 4,100

It’s almost as if just like Wall Street bulls live in an echo chambered world, where nobody dares to take a breath out of step over fears of toppling the collective construct of stupidity and laziness where everyone is wrong but at least everyone agrees to be wrong at the same time, so the bears have some odd convergence of views, including the market inflection points. How else can one explain that a little over a week after Wall Street’s biggest bull, Michael Hartnett, actually demonstrated glimmers of bullishness in “At SPX 3600 Nibble, At 3300 Bite, At 3000 Gorge“, today the 2nd biggest Wall Street bear, Morgan Stanley’s Michael Wilson, also joined the bear market rally bandwagon and in his latest Weekly Warm Up Note (available to professional subs) writes that even though the market’s fair value will eventually head (far) lower (which in itself is remarkable since Wilson is calling for much lower risk markets over time even though his economists still don’t have the guts to make a recession their base case, leaving the bearish strategist to drift alone in the bearish void), for now “US equity markets can rally further.”

Specifically, in addition to the lower rates and oil prices helping support the belief in a soft landing, Wilson notes that “there is still some equity demand from Pension funds that need to rebalance at the end of the month/quarter this week” similar to what we previewed last week, and here Morgan Stanley agrees with Goldman’s estimates, writing that the bank’s QDS team “estimates about $25-$30B of equity demand globally with approximately $15-$20B for the US” in terms of quarter-end pension demand. That according to Wilson is “a substantial amount of excess demand and if retail joins in like last week, that could carry equity prices higher before 2Q earnings season begins and the revisions arrive.” Furthermore, it is unlikely to see a slew of pre- announcements ahead of earnings as most companies have already managed 2Q results and likely want to wait a few more weeks for more data before providing guidance for 3Q and the rest of the year in some cases.

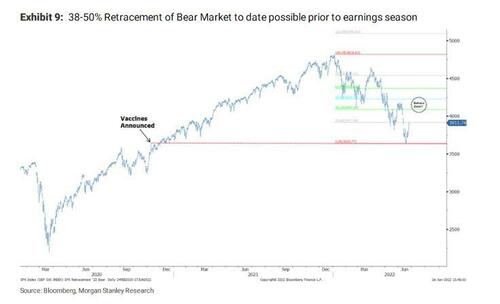

Finally, the MS strategist calculates that a Fib retracement of 38-50% of the entire decline would not be unnatural or out of line with prior bear market rallies, particularly ones associated with a recession at the end which is yet to come: “In S&P 500 terms that would translate into 4100-4200 or approximately 5-7% upside from Friday’s close.”

Let’s start at the top.

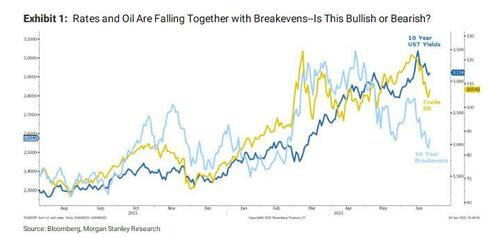

Walking us through last week’s events, Wilson writes that with talk of recession increasing sharply over the past few weeks and culminating with Fed Chair Powell’s 2-day Congressional testimony, markets decided enough bad news had been priced. Furthermore, the MS strategist also thinks the sharp decline in both oil and interest rates helped ease some of the concerns on inflation which still remains elevated and public enemy (certainly Biden approval rating enemy) number one.

In Wilson’s view, both the fall in oil and rates are being driven more by the fears of an economic slowdown, or worse, rather than a real peak in inflation and, therefore, peak Fed hawkishness. However, with markets so oversold and bearishness so pervasive, “equity investors have taken the bullish view and re-rated stocks higher via both the interest rate and Equity Risk Premium (ERP) channels.”

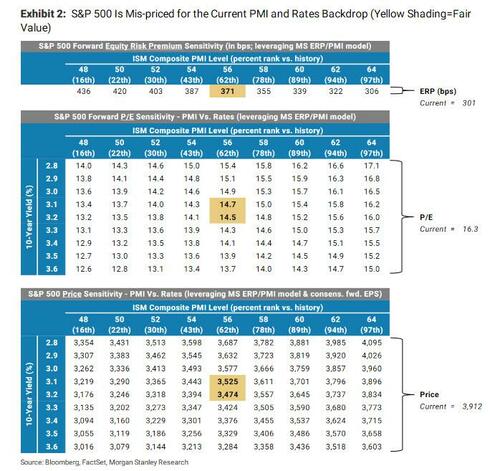

Next, some math: based on Friday’s close, the S&P 500 is trading back at 16.3x or 1 turn higher than where it was at the prior week’s lows. In other words, Wilson cautions that “all of the move last week was due to valuations moving higher which seems unusual given the growing concern about earnings. In fact, even taking into account the fall in 10-year yields, the Equity Risk Premium is back to 300bps.” That to the MS strategist “makes little sense in the context of the likely negative earnings revisions coming in 2Q and still rising risk of recession over the next 6-12 months. As our fair value valuation framework (Exhibit 2) shows, the S&P 500 is now meaningfully mis-priced again for the current PMI and rates backdrop (even with the recent fall in bond yields).”

Like we said: it’s a little awkward being one of the most vocal Wall Street bears without your economists even daring to make a recession their base case. It sure must lead to a lot of confused client calls… But we digress.

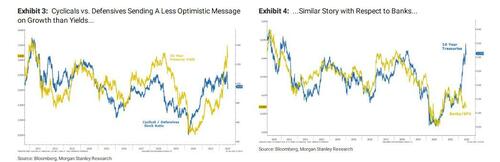

As Wilson adds, another way to think about this set up is that the internals of the equity market (as least some of them as shown in the charts below) are much further along in terms of thinking about the risk of recession than bonds, a point even Goldman made over the weekend.

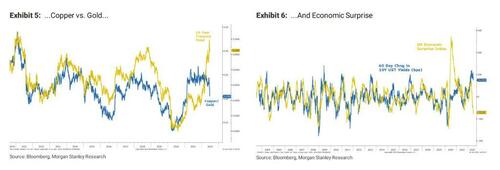

Meanwhile, economic signals like the copper versus gold ratio and the economic surprise index are also saying the same thing.

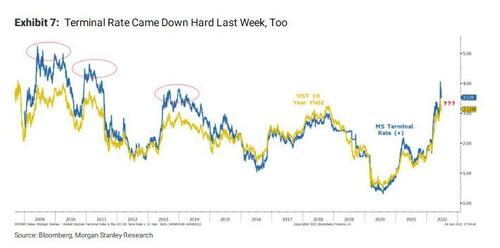

Furthermore, echoing a point we have repeatedly made in recent weeks, Wilson points out that “the Treasury market appears potentially ready to accept the risks to growth and the possibility that the Fed may not be able to complete the amount of tightening that is now priced into the bond market” Perhaps the best measure of this change is the terminal rate which started to fall last week, too.

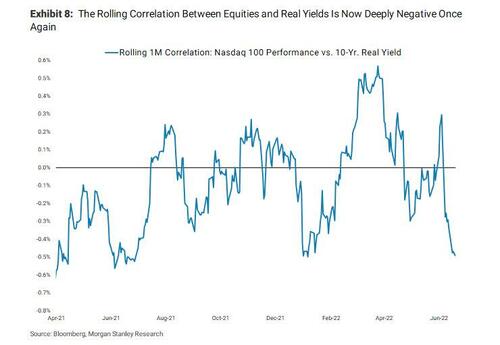

And so, with short-term rolling correlations between equities and real yields now deeply negative once again, this recent decline in bond yields has been perceived as positive for equities…

… which however Wilson views is “ultimately a misread”, because as he explains, “for this read (falling yields=positive for equities) to continue to hold, we’d likely need to see a continuation of falling yields in the context of cresting inflation pressures, an associated less hawkish Fed policy path, more durable economic growth than we expect and a re-acceleration in earnings revisions.” The combination of those factors (i.e., one iteration of the soft landing) is feasible, but is not likely, in Wilson’s view.

All of which is to say that the strategist sees the recent rebound in equities as just another bear market rally on the path to fair value price levels of 3400-3500 (his tactical base case, even though he still can’t claim a recession as his base case). Of course, if and when he does – as we noted last week – a recession would likely bring tactical price lows closer to ~3000 (as Wilson published in his mid-year outlook in May where he hedged his bets, a recession is embedded in his bear case). Additionally, the June 2023 point in time price target associated with that bear case is 3350, which implies a temporary overshoot to the downside (~3000) of that target before working back toward that price level next May.

In short, Wilson is still a bear – just as Hartnett is – and does not see the bear market ending any time soon, although as he adds, “it may feel like it over the next few weeks as markets take the lower rates as a sign the Fed can orchestrate a soft landing and prevent a meaningful revision to earnings forecasts.”

* * *

Which then brings us to his latest hedge (so that he can say he was right in either case, whether stocks surge from here or tumble), and also brings us to the topic of his latest note. In the context of last week’s (bear market) rally (which Goldman thinks has the makings of an entirely new ramp higher), Wilson thinks US equity markets can rally further. Here’s how much:

In addition to the lower rates and oil prices helping support the belief in a soft landing, there is still some equity demand from Pension funds that need to rebalance at the end of the month/quarter this week. Our QDS team estimates about $25-$30B of equity demand globally with approximately $15-$20B for the US. That’s a substantial amount of excess demand and if retail joins in like last week, that could carry equity prices higher before 2Q earnings season begins and the revisions arrive. We think it’s unlikely to see a slew of pre-announcements ahead of earnings as most companies have already managed 2Q results and likely want to wait a few more weeks for more data before providing guidance for 3Q and the rest of the year in some cases. Finally, a retracement of 38-50% of the entire decline would not be unnatural or out of line with prior bear market rallies, particularly ones associated with a recession at the end which is yet to come.

In S&P 500 terms that would translate into 4100-4200 or approximately 5-7% upside from Friday’s close, which Wilson thinks is the possible upside from here; and if such a rally were to continue, it would likely be led by the longer duration / interest rate sensitive stocks–i.e. Nasdaq.

That said, Wilson is quick to hedge that “in no way are we suggesting the bear market is over or that earnings estimates won’t have to come down. Instead, we are simply being realistic about the viciousness of bear markets and their ability to confound all market participants at times, even the bears.“

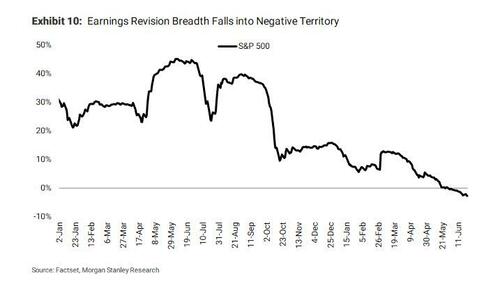

What is behind Wilson’s persistent bearishness? Because as the strategist points out next when he turns back to the fundamentals, there is continuing weakness as earnings revisions breadth remains in negative territory

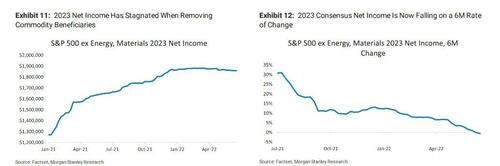

And while this can often be a slow moving measure, it continues to decelerate in negative territory, which is “usually a precursor to a consolidation in forward EPS.” On that score, Wilson finds it interesting that “2023 net income ex-commodity sectors has actually been stagnant for several months. This points to the notion that the continued grind higher in forward earnings of the overall market has largely been driven by commodity sectors.” Of course, given that commodities are a cost for most of the market, “this is not ultimately a healthy development.”

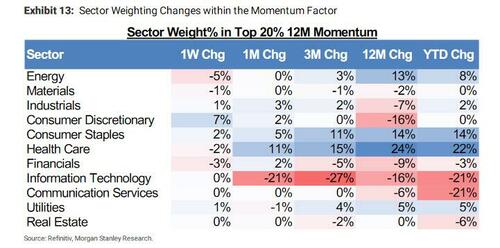

Finally, in response to client inquiries around the changing composition of the momentum factor, Wilson took a look at how the sector weights within momentum have evolved over the last week, month, 3 months, 1 year and YTD. Unsurprisingly, given recent price action, Energy has seen its weight decline over the last week, while Discretionary’s weight has jumped higher amid the market’s squeeze higher. Completing the factor picture, healthcare’s weight has jumped significantly in recent months, while Tech’s weight has fallen materially

Tyler Durden

Mon, 06/27/2022 – 20:15

via ZeroHedge News https://ift.tt/3ISzhq5 Tyler Durden