Boise, Idaho Becomes The Canary In The National Housing Market Coal Mine

One of the key housing markets that tore higher during the pandemic boom is now finally starting to cool off – likely a microcosm of what is already happening all of the U.S. as several key industries fall into recession.

It may have been tough to guess that Boise, Id. would be the harbinger of the state of the U.S. housing market, but a new Wall Street Journal article makes the argument that this could actually be the case.

The city saw a huge spike in population during the pandemic due to remote workers, but the boom has since cooled. 61% of listings in the area have seen a price cut, according to the report. This marks the highest rate of 97 metro areas surveyed. Just last year, home builders couldn’t keep up with demand, the report says.

People were flocking to the area because of its affordability and its fewer pandemic restrictions, the report says. Now, with prices higher and the rest of the country finally coming to its senses about restrictions, its allure has worn off.

Shauna Pendleton, a Boise real-estate agent for Redfin, commented that rising rates made it as if “somebody just turned the lights off” in the city. “The buyers just disappeared off the face of the earth,” Pendleton said.

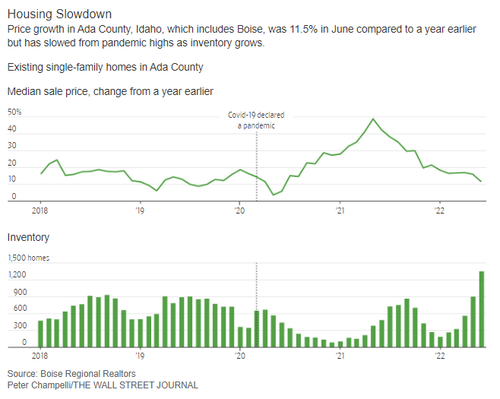

The article noted stunning inventory hitting the market in Boise, stating that “inventory of existing single-family homes for sale in Ada County, which includes Boise, surged 179% in June from a year earlier, according to Boise Regional Realtors.”

Nancy Vanden Houten, lead U.S. economist at Oxford Economics, commented: “Too many buyers cannot afford housing in this market. Some markets have become much more overheated than others, and I don’t think we can rule out price declines in some of those areas.”

In June, Boise was the “most overvalued housing market in the U.S.” according to an FAU analysis. Home values were 69% above where they should be relative to long-term trends, the study found.

David Turnbull, who ran a building company, said he shut down for 8 months during the pandemic and when he re-opened, demand was through the roof. “When we opened them back up, we were just swamped. Anything you listed for sale sold within days. You had bidding wars. Boise had never seen that. I mean, this is California stuff.”

The demand drove median single family home prices up 79% from three years prior and 44% above the national average at the time.

Meanwhile, sales of U.S. homes are lower for five straight months as consumers worry about rising rates at a time where stimulus money has run out and they are officially “tapped” out of cash to spend.

The expectation is that Boise-area homes will fall “at least” 10% from their peak. Corey Barton, president of CBH Homes, the region’s biggest home builder, concluded: “It did go way too far. It’s slowly going back to the old Boise.”

You can read the WSJ’s full report on Boise here.

Tyler Durden

Sun, 07/31/2022 – 13:00

via ZeroHedge News https://ift.tt/5NThmpd Tyler Durden