WTI Extends Losses Despite Bigger Than Expected Crude Draw

Crude prices extended yesterday’s losses this morning with WTI trading back below $90 briefly as recession fears combined with lower anxiety over Iraq disruptions were exacerbated by a collapse in liquidity in the futures market.

“Crude oil’s bounce from a six-month low has faded fast following Friday’s hawkish message from Jerome Powell, the Federal Reserve Chairman, which once again raised concerns that the central banks aggressive stance towards combatting runaway inflation would mean lower growth and with that lower demand for crude oil and fuel products,” Ole Hansen, head of commodity strategy at Saxo Bank, said in a note.

Slowing demand in China, the world’s largest importer, is also adding to expectations for weaker demand, as the country imposed fresh Covid-19 lockdowns in the cities of Dalian and Shenzhen, while factory orders fell in August.

Also adding to the drop, OPEC’s technical committee, reporting ahead of the OPEC+ monthly meeting on Sept.5, raised its estimate for the surplus of supply in the global market to 0.9-million barrels day, up from its July report estimating a surplus of 0.8-million bpd, according to reports.

The API-reported crude build also piled on some additional selling pressure at the margin.

All algo’s eyes will be on the official data to confirm that build.

API

-

Crude +593k (-1.9mm exp)

-

Cushing -599k

-

Gasoline -3.414mm (-1.3mm exp)

-

Distillates -1.726mm (-1.2mm exp)

DOE

-

Crude -3.326mm (-1.9mm exp)

-

Cushing -523k

-

Gasoline -1.172mm (-1.3mm exp)

-

Distillates +112k (-1.2mm exp)

Shunning API’s reported build, the official data showed US crude stocks drew-down for the 3rd straight week. Cushing stocks drew down for the firs time in 9 weeks. Distillates inventories rose while gasoline stocks fell once again…

Source: Bloomberg

US gasoline demand remained below 2020 levels last week…

Source: Bloomberg

Drilling activity is stalling out for the first time since it began to recover in September 2020. Over the past two years, the rig count has marched forward at a consistent clip of about five new rigs a week — until this month, that is.

Source: Bloomberg

WTI was hovering around $90.50 ahead of the official data and slipped a little lower after…

BI’s Valle: “Significant economic slowdowns in China, India and Brazil could have dire consequences for oil prices in the short term. But we still see a lack of supply as the most pressing force over the next two-to-three years.”

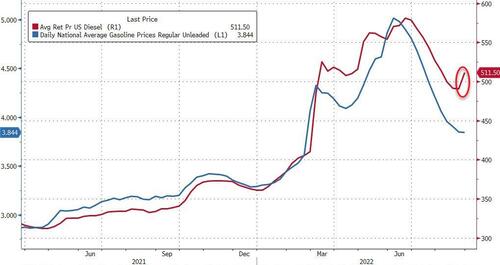

Finally, we note that Diesel prices rose this week for the first time in over two months and given oil and gasoline’s recent moves, we suspect gas-pump prices will be turning higher again soon…

And with that, Biden’s approval bounce will be over.

Tyler Durden

Wed, 08/31/2022 – 10:35

via ZeroHedge News https://ift.tt/VX27uKt Tyler Durden