“What An Absolute Clown Show”

No point in even trying to interpret Charlie McElligott’s stream of consciousness this morning so here it is, straight from the horse’s mouth (full note available to pro subs in the usual place):

ENTROPY

SUMMARY:

Quick take—idiosyncratic fiscal largesse in midst of an already unstable monpol tightening creates a market accident which leads to an asymmetrically WILD policy response from the BoE…which creates more instability.

Just a massive change here in the past few hours on a STUNNING policy move from the BoE to arrest the Gilt / Sterling Vol by an announcement of long-end GILT BUYING mkt operations, coming at a time where they are supposed to be tightening policy and shrinking the balance sheet to fight inflation—but tactically, is causing an enormous short-cover in markets which is lifting all assets off earlier panic lows.

And that’s because the BoE action today was a forced UK Pension Fund BAILOUT, full-stop, on account of the “death spiral” caused by the Gilt / Sterling move which spun-out into forced liquidations of all assets, in order to meet margin calls on deriv / leveraged repo positions.

Bigger picture: now the BoE has opened this “Pandora’s Box” in order to control their admittedly far more idiosyncratic market episode caused by the new government’s fiscal stupidity—are we now finally proving that Central Banks are trapped into a BoJ-like “forever state” of balance sheet expansion, as they are once again forced to “bend the knee” to market forces?

Accordingly at the bottom of today’s email, I trot out the tried-and-true Jerome Powell pre- “Taper Tantrum” 2013 quotes from the ex post facto released Fed Minutes, where he acknowledges this very “trap”—i.e. that Central Bank QT / balance-sheet unwind is a 100 delta spot-on “unloading our short volatility position” into a market which was emboldened by the moral hazard of central bank intervention in the first place, with massive accumulation of risk and leverage during a period of artificial calm….which has then built this latest “Minsky Moment,” as those “stability” –built imbalances then creates the conditions for future (now) “instability.”

What an absolute clown-show.

BULLETS:

- The velocity of the Rates and FX moves are breaking-stuff, real-time—so bad that it has forced an absolutely stunner from the BoE, where they have announced shocking “temporary buys of long-dated UK Bonds” via Gilt open-market opps in order to “restore orderly market conditions” (https://www.bankofengland.co.uk/news/2022/september/bank-of-england-announces-gilt-market-operation), creating a massive global Bond and Equities impulse rally initially, coming off the earlier cross-market breakdown levels pre- the BoE headlines

- *BANK OF ENGLAND ANNOUNCES GILT MARKET OPERATION

- *BOE TO CARRY OUT TEMPORARY BUYS OF LONG-DATED UK BONDS

- *BOE TO CARRY OUT TEMPORARY PURCHASES FROM SEPT. 28

- *BANK OF ENGLAND: IN LIGHT OF CURRENT MARKET CONDITIONS, THE BANK’S EXECUTIVE HAS POSTPONED THE BEGINNING OF GILT SALE OPERATIONS THAT WERE DUE TO COMMENCE NEXT WEEK

- *BANK OF ENGLAND: THE MPC WILL NOT HESITATE TO CHANGE INTEREST RATES BY AS MUCH AS NEEDED TO RETURN INFLATION TO THE 2% TARGET SUSTAINABLY IN THE MEDIUM TERM, IN LINE WITH ITS REMIT

- *BOE BOND BUYING TO BE FINANCED WITH NEW RESERVES: SPOKESPERSON

- UK curves saw a shocking impulse downshift, with yields dropping anywhere from 30-70bps at the extremes—which has obviously pulled G10 fixed-income “better” with it, reversing earlier extension of the ugly selloff and now, BULL-steepening

- And that final bullet above is WILD—you’re gonna fund these purchases with NEW RESERVES, with a currency already being melted due to the insanity of un-funded fiscal stimulus into an inflation overshoot?

- And mind you, the GBP still has massive structural headwinds where this changes NOTHING (h/t Jordan Rochester):

- Trade balance deteriorating (Nordstream pipeline explosion not helping sentiment), terms of trade falling

- Growth slowing with European factories curtailing production in face of high energy costs (this will lead to a second round effect of importing more basic materials from China/US)

- Hiking into a recession: UK households stepping back from consumption with higher mortgage rates,

- And the key problem in the past week – Inflation being added to by fiscal policy.

- The currency should be getting DESTROYED after the initial kneejerk “better”…and thankfully, IS…proving there is still some sanity left in the world

Source: Bloomberg

- CRITICALLY, the BoE is stating that these unlimited purchases in long-end Gilts are “strictly time limited” and will later be unwound, which keeps the door open to these operations being “faded” by markets:

- “They are intended to tackle a specific problem in the long-dated government bond market. Auctions will take place from today until 14 October. The purchases will be unwound in a smooth and orderly fashion once risks to market functioning are judged to have subsided.”

- Why were they forced into this, and at a time where they are seemingly so keen on tightening monpol? Well…we began to hit “death spiral”—e.g. UK LDI’s / defined-benefit pension plans, who are rationally being forced to liquidate assets (selling govt bond holdings, equities, credit) in order to meet ratcheted-up margin calls on their derivatives and leveraged repo positions, due to the quantum of the collapse in Gilts and Sterling

- Accordingly, today’s action from the BoE is pure and simple a PENSION FUND BAILOUT from said margin-call liquidation spiral….period, end of story, full-stop

- Despite the local stabilization from the above BoE actions, we are now entering the period of this “Macro Vol” impulse where similar “un-economic” selling is a next wave, “systemic” concern for markets—i.e. not just the “pension margin call spiral,” but too, hypotheticals in the form of year-end / tax-loss selling risk >>> spiraling redemptions at mutual funds adding pressure to the already deep selloff in assets

- And as these types of “second-order” unwinds begin to ripple-out into the market, the spiral of forced-selling to make cash-calls is further evidence that widespread deployment of leverage across strategies from the halcyon days of QE and the Central Bank “Vol Supression” era is no more, and that systemic de-leveraging is now at an acceleration point, particularly as “risk free” assets used as collateral turn to “meme-stocks”

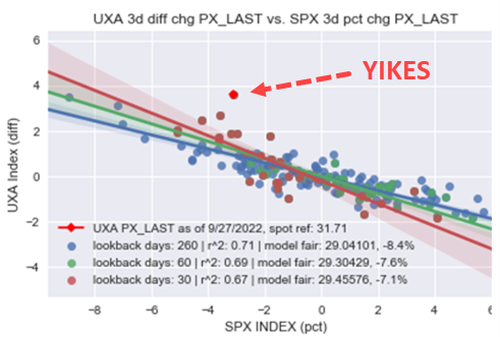

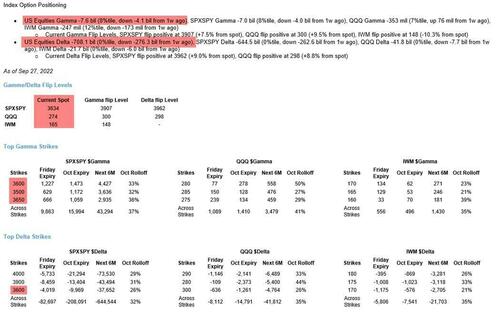

- From a cross-asset Vol perspective, all of this is occuring at massively important and dangerous inflection, as we are seeing Rate Vol Dealer positioning having now “flipped” in recent days, with Dealers now seemingly getting SHORTER VEGA into sell-offs

- The scary thing now is that within the Equities Vol space, it “feels” like we are seeing something similar brewing—where for the longest time, Dealer “long Vega” has helped keep Vol contained despite the pervasive state of Dealer “Short Gamma vs Spot” positioning felt over much of the year

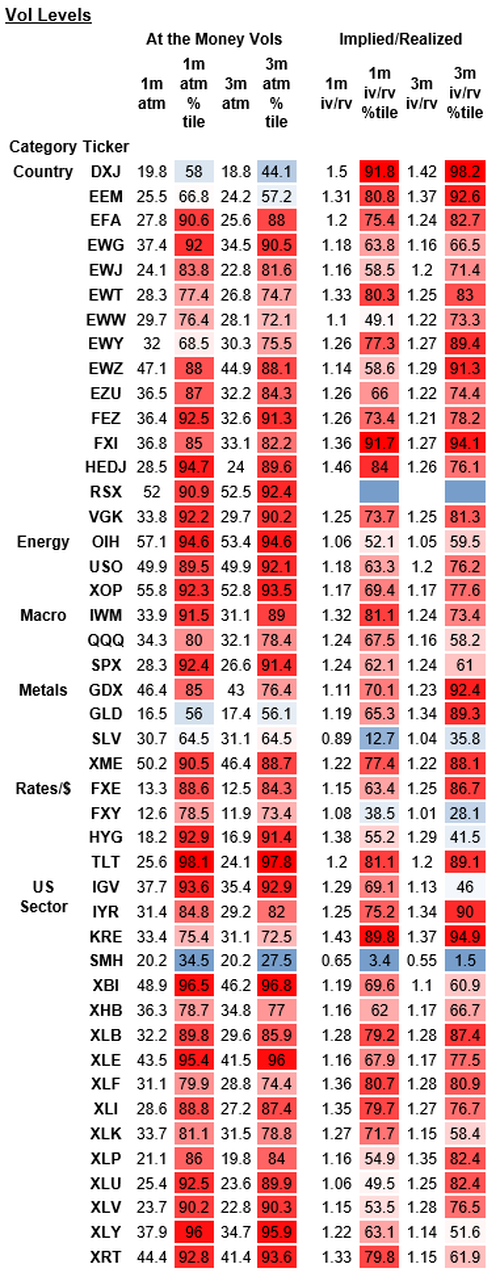

- But where over the past 3 days, US Equities Vols / Skew / Crash is really beginning to firm and squeeze, as the “left-tail fattens” with Macro Rates / FX calamity increasing the likelihood of both market- and economic- “accidents” (which the BoE actions of today are deliberately now having to reverse!)

Source: Nomura

BROAD U.S. EQUITIES VOLS GOING CRAZY BID:

Source: Nomura

- Over the past 3 days, US Equities Vol is aggressively outperforming after months of doing the exact opposite, and certainly at least a partial function of all of Client-side VIX Upside Call buying seen recently, which has the Dealer(s) aggressively buying short-dated SPX “Crash” as the hedge for their “Short” in said VIX Upside Calls

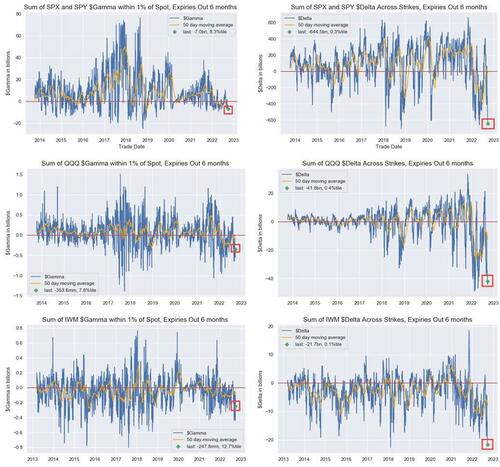

- And all this while Dealers remain “Short Gamma” with EXTREME “Negative $Delta”—just massive tension and “accelerant flows” forcing dangerous overshoots and range expansions

Source: Nomura

- The higher-level ABSOLUTE FARCE of it all is this: Despite today’s BoE actions being “idiosyncratic” in light of the inane fiscal policy decisions of the new government, the fact is that QT has already broken markets—and as of today, the Bank of England became the first Central Bank to “bend the knee” back to markets and FCI, forced to EXPAND THEIR BALANCE SHEET at a time they’re supposed to be trying to tighten monpol and lean into inflation…

- My long-time readers know I trot these Jerome Powell quotes (first published on Zero Hedge) out from the Fed meetings before the “taper tantrum” kicked-off in 2013…but we were discussing them on the desk just YESTERDAY, and are so apropos today:

“I have concerns about more purchases. As others have pointed out, the dealer community is now assuming close to a $4 trillion balance sheet and purchases through the first quarter of 2014. I admit that is a much stronger reaction than I anticipated, and I am uncomfortable with it for a couple of reasons….

[W]hen it is time for us to sell, or even to stop buying, the response could be quite strong; there is every reason to expect a strong response. So there are a couple of ways to look at it. It is about $1.2 trillion in sales; you take 60 months, you get about $20 billion a month. That is a very doable thing, it sounds like, in a market where the norm by the middle of next year is $80 billion a month. Another way to look at it, though, is that it’s not so much the sale, the duration; it’s also unloading our short volatility position.

When you turn and say to the market, I’ve got $1.2 trillion of these things, it’s not just $20 billion a month it’s the sight of the whole thing coming. And I think there is a pretty good chance that you could have quite a dynamic response in the market.

I think we are actually at a point of encouraging risk-taking, and that should give us pause. Investors really do understand now that we will be there to prevent serious losses. It is not that it is easy for them to make money but that they have every incentive to take more risk, and they are doing so. Meanwhile, we look like we are blowing a fixed-income duration bubble right across the credit spectrum that will result in big losses when rates come up down the road. You can almost say that that is our strategy.”

Tyler Durden

Wed, 09/28/2022 – 10:48

via ZeroHedge News https://ift.tt/D5RqMY2 Tyler Durden