Nomura: When Does The Fed “Blink”?

The velocity of “things breaking” around the world (Yen, Yuan, Euro, Sterling, SONIA, Gilts, MBS, Lev Loan deals, the entirety of the UK LDI / Pension complex) is obviously a “neon swan” telling us that we are clearly now in the “market accident” stage from the tightening surge.

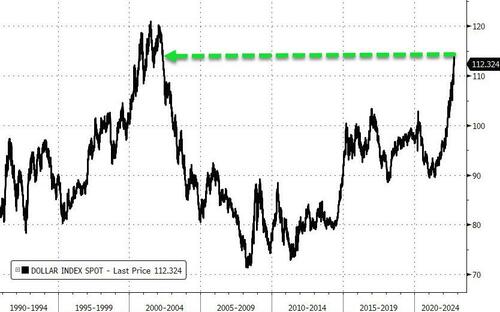

And, as Nomura’s Charlie McElligott notes, let’s be fair…all of these things are happening for completely rational reasons, particularly for the USD vs lack of viable global alternatives, as the US economy remains the “cleanest dirty shirt” by-far, while rest of world is running increasingly “incongruent” monetary vs fiscal policy on structural issues.

Again, looking at the below generic UK / Europe type set-up, McElligott points out a laundry-list of messy inputs (h/t Jordan Rochester):

-

Collapsing terms of trade / trade-deficits largely due to energy imports

-

Manu / Industrial growth slowing due to high energy / input costs

-

“Hiking into recession” with slower consumer being negatively impact by broad inflation (energy bills, food costs) AND shock-resets on mortgage rates

-

“Demand CONSTRUCTION” policies which feed actually FEED consumption and inflation (energy caps, subsidies, fiscal stim / tax cuts)

And again, all while those central banks are trying to “rage tighten” monetary policy with hot inflation – but against collapsing currencies thanks to the “USD Wrecking Ball”.

And so, authorities are starting to agitate against growing market and economic calamity being caused by the impulse tightening of FCI and the USD Wrecking Ball – which is making the “macro trend trades” which have dictated all thematic performance in 2022 now increasingly open to reversal.

So what will make the Fed “blink”?

The Nomura strategist writes that, outside of trying to project outrageously unpredictable Inflation data, there are two scenarios:

-

Job losses / Negative NFPs – currently, labor mkt tightness and wage growth at all-time highs gives Fed room to hit the economy HARDER, bc a hot jobs mkt gives you room to crunch it—so the Fed will keep hiking into postive NFP prints; but my view has continued to be that the first time you print a negative NFP, the market will immediately interpret it as a counter-intuitive “constructive” signal for Equities, because this allows for a Fed pivot back towards “dual mandate” (from current solo focus on inflation) which means they can “move the goalposts” – ESPECIALLY as “job losses” then becomes a political feature / issue

-

Credit Market “freeze,” as Corp access to Capital Markets dries-up (note: this is NOT necessarily then about some absolute Spread level of say HY)—if FCI tightening and / or market Vol hits such an extent that BBBs can’t do debt deals…then the Fed will make a move; watching Lev Loans- and / or CLO- markets as most reasonable spots for an “issue” due to floating-rate nature of the products.

Are we starting to see any signs of this anticipation of a Fed Pivot?

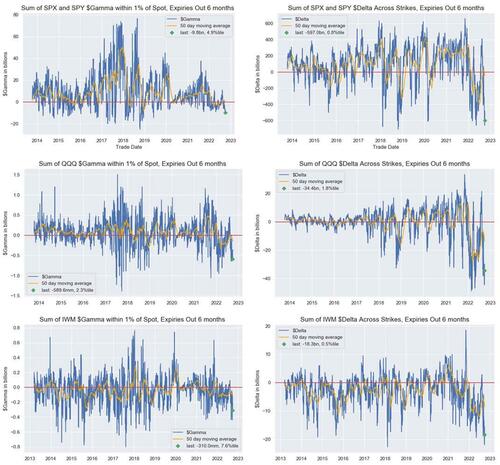

Turning to tactical Equities / Vol – yesterday was the first day in four where we saw some normalization in the recent blast of Vol / Skew / Crash outperformance vs Spot Index,despite the seemingly big “down day”—with a resumption of fairly aggressive “monetization of downside” flows in Equities index / ETF options.

And this segues nicely into today’s quarterly rebalance of the large client SPX Put Spread Collar, which tends to exhibit tremendous market impact on hype alone…but for many of the past year and a half’s rebal cycles, has indeed marked local market inflection points. Per the desk Put Spread Collar update:

“The SPX Sept 30th 3020/3580/4005 Put Spread Collar (cust long the Sep 30th PM 3580/3020 Put Spreads vs. short the Sep 30th PM 4005 Calls) is expected to be rolled at some point today. The gamma on the SPX Sep 30th PM 3580 Put was ~$2.3B as of last night’s close, so dealers/market makers are broadly welcoming this morning’s de minimis move in futures. Based on last night’s closing level, the expectation is that the investor will roll into something like a a new SPX Dec 30th 2910/3460/3800 Put Spread Collar ~46,000x, which will create ~$16.8M of vega supply in that Dec 30th bucket (along with a fair amount of downside skew via that Dec 30th 2910 Put). The structure has ~$7B of net delta to sell as it currently stands on the MOC, though in the past we have seen this structure trade with a 1-day option (would sell a Sep 30th ITM call for example) so that the delta impact comes on the close as opposed to intra-day”

McElligott’s point is that with the recent “bid” to Vol / Skew that it is looking “rich” again (as an entry point then for it to fade from) – and yes, with a likelihood that the end of day Equities MOC imbalance could be a disasterously huge “$7B FOR SALE” print that frightens the mkt….i actually kinda think it sets up for a potential relief trade thereafter next week or even into / around Oct Op-Ex, because Dealers are getting a BUNCH of Vega and Gamma back, as well as picking up some big downside Skew…IF WE CAN AVOID A MELTDOWN TO THE 3580 STRIKE FIRST.

I think all of this sets-up for a short-term tactical dynamic where Equities implied Vol could come off the recent squeeze higher and begin fading again next week, which then along with the reduced “Short Gamma” dynamic, but against so much “Negative $Delta”…could allow for Equities “relief” as iVol softens further with Dealers in a much “cleaner” place from an Options market perspective.

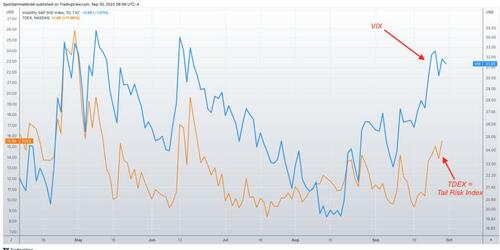

Interestingly, the team at SpotGamma note a similar tactical dynamic as today’s put expiration is enough to give equities a bump, and that could lead to a rapid decline in implied volatility. So, we have puts deltas coming off due to expiration, but also vanna. Shown below is the VIX which has hit recent highs – but note too the movement of the TDEX “Tail Risk” index. There was a sharp move in this metric over the last week which tells us that traders were buying deep out of the money puts.

On a rally this stuff could get smoked, and could help generate a ~5% equity rally rather quickly.

But SpotGamma warns, the macro risks in this environment are massive, an its the perfect environment for something to snap and lead to limit down style moves. This is why we favor playing rallies in call positions with fixed risk. Second, this view of a rally is based on positional analysis, nothing fundamental.

Because we are in a put-heavy environment with high volatility rallies should be treated as very unstable and subject to rapid reversal. Think CPI crash, or even yesterdays reversal from 3940 Wed closing to 3910 Thursday lows. Those were 3-5% rallies which retraced in hours.

Tyler Durden

Fri, 09/30/2022 – 14:15

via ZeroHedge News https://ift.tt/J23lEMt Tyler Durden