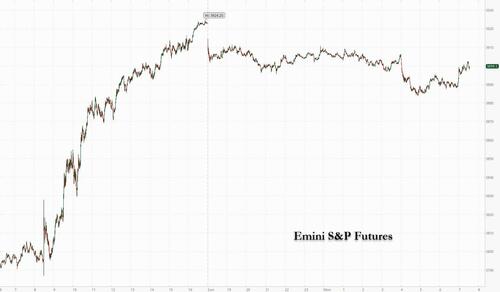

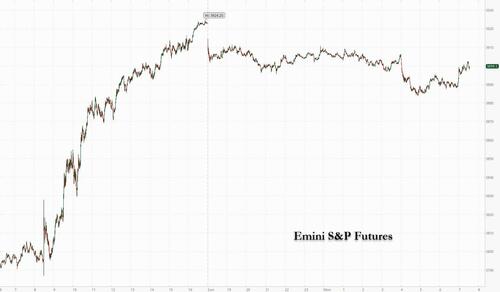

US futures were mixed at the start of another busy week of earnings and key central bank decisions, after posting their best two-week rally since November 2020, with investors bracing for the Federal Reserve’s meeting and another busy earnings week. S&P 500 futures were down 0.4 as of 7:30 a.m. in New York, having dipped as much as 0.7% earlier, after the index closed 2.4% higher on Friday, while Nasdaq 100 futures fell 0.7%. Both gauges are set to pare gains for October, which has been the best month since July. The market drop was led by chipmakers and Chinese stocks. The 10-year Treasury yield hovered around 4.04% after surging by nine basis points on Friday, but has receded from about 4.25% in the past week; yields on UK gilts were steady ahead of what could be the Bank of England’s biggest interest-rate hike in more than 30 years. The dollar rose as the yen and pounds reversed much of last week’s gains. Crypto unexpectedly spiked.

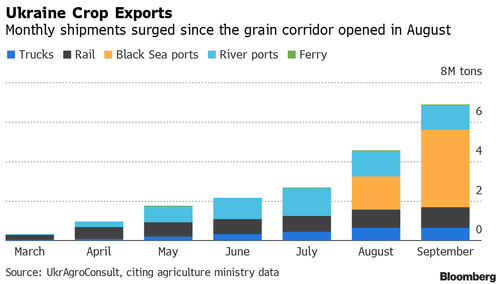

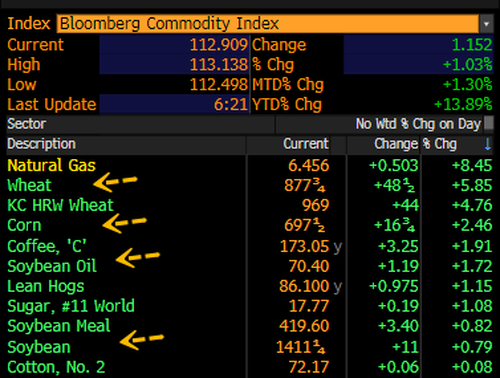

Wheat soared after Russia pulled out of a grain-export deal even as vessels continued to depart from Ukraine.

Brazilian assets are set to weaken on Monday after Luiz Inacio Lula da Silva won the presidential election. The extent of the market drop will depend on whether President Jair Bolsonaro will concede as a contested election would likely trigger larger losses.

In premarket trading, U.S-listed shares of Brazilian oil firm Petrobras tumbled as much as 11% after Luiz Inacio Lula da Silva won the presidential election, amid concerns about how the left-wing politician will impact the firm. In other premarket moves, Chinese stocks listed in the US declined after Covid cases spiked across the country while factory and services activity weakened more than expected. US chipmakers fell after Foxconn Technology Group, the world’s largest maker of iPhones, said it may boost capacity at alternative sites to mitigate potential disruption at its main Covid-stricken plant in China. Other notable premarket movers:

- Y-mAbs Therapeutics (YMAB US) shares slumped as much as 38% in US premarket trading, as the stock was downgraded by Kempen and JPMorgan analysts after the drug developer’s cancer drug omburtamab failed to win a nod from an FDA panel, with Kempen not expecting the treatment to win FDA approval and Cowen calling the vote outcome “unfortunate.”

- Chinese stocks listed in the US decline in premarket trading after Covid cases spiked across the country while factory and services activity weakened more than expected.

- Alibaba (BABA US) falls 1.9%, Baidu (BIDU US) -2.8%, Pinduoduo (PDD US) -1.5%, Li Auto (LI US) -4.2%, Nio (NIO US) -1.4%

- Selina Hospitality (SLNA US) rises 36% in US premarket trading. Shares have been volatile since they debuted on Thursday following merger with BOA Acquisition Corp. Stock closed down 63% on Friday after a first session ended with the stock rising 348% from the price BOA closed at.

- Hanesbrands (HBI US) falls 3.6% in premarket trading after Wells Fargo double- downgrades to underweight based on rising risks from the macro outlook and the company’s balance sheet.

- Keep an eye on Ceridian (CDAY US) as Barclays raised the recommendation on the stock to equal-weight from underweight, citing the company’s international expansion strategy, shift to more cloud and product investments.

- Watch Gilead Sciences (GILD US) stock as it was raised to equal-weight from underweight at Barclays, which sees strong commercial execution justifying higher estimates. Meanwhile, the brokerage cut its rating on Amgen (AMGN US) to underweight from equal-weight.

Sparking debate about another split between fundamentals and technicals, US stocks ended last week with sizeable gains despite very disappointing earnings from tech giants including Meta, Amazon and Microsoft. That said, overall earnings season has been quite positive (thanks to sharp estimate cuts in recent weeks), with a majority of companies beating estimates, although fewer than in the past few seasons. Meanwhile, some economic data, including plunging home sales, indicated the Federal Reserve’s fight against inflation is working, fueling hopes of a sooner than expected pivot in rate policy.

“The market is pricing in by next spring a 5% Fed fund rate — this is a massive tightening cycle, one of the fastest in history, and I think essentially, it’s in the price right now,” said Yves Bonzon, Julius Baer Group CIO on Bloomberg TV, warning that even if the Fed pauses, the quantitative tightening actually continues.

Hopes for a Fed pivot rose after a lower-than-expected rate hike from the Bank of Canada last week and a perceived change of tone from the European Central Bank. Tweets from Nick Timiraos last Friday also sparked a dovish sentiment reversal. The WSJ’s Fed mouthpiece sought to reverse some of the euphoria over the weekend, however, as we discussed here.

“This week’s Fed meeting is critical for the rally to continue, pause or even end completely,” Morgan Stanley strategists led by Michael Wilson wrote in a note on Monday, noting macro-economic indicators “support a Fed pivot sooner rather than later.”

In Europe, the Stoxx 600 was little changed, with travel and financials outperforming, while consumer and commodities sectors fell. In Asia, stocks advanced, boosted by Hong Kong technology shares, with gains also seen from Japan to Australia.

Fed Chairman Jerome Powell “should be a bit less hawkish”at his press conference on Wednesday compared to after the last meeting, according to Yardeni Research. With the expectation that another 75 basis points is penciled in this week, “Powell will have to acknowledge that the federal funds rate is now further into restrictive territory and will be even more so come the FOMC’s December meeting,” it said in a note.

In Europe, the Stoxx 600 was little changed, with travel and financials outperforming, while consumer and commodities sectors fell. Mining and energy stocks underperformed in Europe, where the benchmark fluctuated.Here are some of the biggest European movers:

- International Distributions Services rises as much as 8.7%, the most intraday in almost a year, after the UK government said it won’t take any further action under a national security law in relation to a potential stake increase by Czech billionaire Daniel Kretinsky’s Vesa Equity Investment.

- Credit Suisse shares climb as much as 5% after it announced expected terms for its capital increase and after the Saudi National Bank ruled out raising its stake further for the time being.

- UK bank stocks including NatWest and Lloyds rise after the Sunday Times reported that the UK government is unlikely to seek more windfall taxes on bank profits.

- Know IT gains as much as 7.8%, extending gains into a third day, after Swedish business daily Dagens Industri labeled the IT consultancy’s shares a “bargain,” saying the company will benefit greatly from “megatrends” such as the shift to digitalization.

- Loomis falls as much as 6.7%, before paring the drop, after Carnegie cut its recommendation for the Swedish cash handling firm to hold from buy after strong year-to-date performance, saying the shares are approaching fair value.

- Pandora falls as much as 2.7% after the Danish jeweler on Oct. 30 said a fire has affected its European distribution center in Hamburg, Germany.

- Exmar shares drop as much as 11%, erasing a post-earnings gain on Friday, after an analyst at ING writes that the total potential book gain on a divestment by the gas transporter may be lower than expected.

- Verbund falls as much as 5.3% after Credit Suisse says it expects the power firm to be negatively impacted by rising interest rates, as well as the risk of adverse political intervention and falling power prices.

- Fresenius SE gains as much as 4.6% after the German health care company published a better-than-feared quarterly figure.

- EMS-Chemie fell as much as 4.8% after Berenberg cut the stock to hold from buy, saying the chemicals firm’s valuation is “too expensive.”

Euro-area inflation surged to a fresh all-time high, while the bloc’s economy lost momentum — reinforcing fears that a recession is now all-but unavoidable. That’s after a core gauge of US inflation accelerated in September, bolstering the case for more tightening.

In Asia, stocks advanced, boosted by Hong Kong technology shares, with gains also seen from Japan to Australia, as optimism on corporate earnings and a lift from Apple offset disappointment with Chinese economic data. The MSCI Asia Pacific Index climbed as much as 1.1% before halving the advance in afternoon trading. Tech-heavy markets of South Korea and Taiwan saw indexes rise more than 1%, while key gauges in China and Hong Kong extended last week’s rout. Samsung, TSMC and other Apple suppliers in Asia staged a rally after the iPhone maker jumped nearly 8% Friday, fueling gains on Wall Street. Apple’s results were seen as positive in contrast with disappointing recent announcements from other tech giants.

“Asian countries, especially Taiwan and South Korea, have a high portion of companies that supply to Apple so Asia can’t be left out of the Apple-led rally in the US,” said Lee Jae-Mahn, a strategist at Hana Financial Investment. Investors have already priced in a likely 75 basis point rate hike by the Federal Reserve this week, he added. Equities in mainland China and Hong Kong ended down after seeing big swings Monday, with the Hang Seng China Enterprises Index closing at its lowest since late 2005. Sentiment slumped as factory and services activity in Asia’s largest economy contracted in October amid tight Covid rules and an ongoing property slump, while China continued to impose lockdowns. Even with Monday’s gain, the key MSCI Asian stock gauge is poised for a loss of nearly 2% in October, its third-straight monthly decline. The index is trading near its lowest level since April 2020

The dollar rose and the yen fell as traders positioned for another large interest-rate hike by the Federal Reserve this week, widening the policy divergence with the Bank of Japan. The euro and the pound also declined

In rates, US Treasuries fell, pushing the two-year yield 6 basis points higher although off worst levels of the day leading into the US session; yields remain cheaper from front-end out to intermediates, flattening the curve. US 10-year yields cheaper by 3.5bp on the day at around 4.03% with bunds underperforming by additional basis point over early European session; losses have been pared into early US session after 10-year peaked at 4.075%. Long-end outperforms, flattening 5s30s by 4.2bp on the day with 30-year yields little changed from Friday’s close. Wider losses seen across the German curve while gilts outperform. The Dollar issuance slate empty so far; this week’s estimates are for $15b to $20b, front-loaded before Wednesday’s Fed rate decision. German bunds fell, lifting the 10-year bund yield 3.9 basis points higher and steepening the yield curve. UK gilts were mixed.

In FX, the Bloomberg Dollar Spot Index rose as much as 0.5%, extending gains from late last week as speculation cools that the Fed may signal a slower pace of monetary tightening. Such speculation earlier in October had prompted selling in the greenback, putting the index on track for its first month of decline since May.

Commodities are under pressure as the USD picks up and following weak Chinese PMIs and ongoing COVID concerns. WTI and Brent are lower by just shy of 1% amid the above factors and as focus increasingly turns to next week’s US midterms and remarks from US officials, including President Biden. US President Biden said that oil companies who complain he is picking on them ‘ain’t seen nothing yet’, according to Reuters. QatarEnergy CEO said discussions are ongoing with several Asian buyers as value-added partners on the North Field expansion and that western international oil company partners have all been announced, while the CEO said several supply agreements are being discussed related to the expansion and announcement will be made in due course, according to Reuters. US Energy Envoy Hochstein says the US has called on oil producers to increase output, speaking at ADIPEC; need more investment in the oil and gas sector right now and tomorrow. Both precious and base metals are lower given the USD’s upside and softer China trade

European natural gas fell after two days of gains as unseasonably warm weather reduces demand and eases concerns about shortages for the winter and oil edged lower as weak economic data from China fanned concerns about energy demand, but it was still set for the first monthly advance since May on OPEC+’s planned supply cuts.

Bitcoin is pressured on the session but resides within a narrow range circa. USD 400 above the USD 20k handle and as such is well within recent parameters.

It’s a quiet start to the week, with just the October Chicago PMI, and Dallas Fed manufacturing activity on the calendar. Central bank speakers include ECB’s Visco and Lane speak with the Fed still in blackout period ahead of Wednesday’s FOMC. We get earnings from Stryker, NXP Semiconductors

Market Snapshot

- S&P 500 futures down 0.7% to 3,885.50

- STOXX Europe 600 down 0.2% to 410.02

- MXAP up 0.5% to 136.23

- MXAPJ up 0.1% to 433.17

- Nikkei up 1.8% to 27,587.46

- Topix up 1.6% to 1,929.43

- Hang Seng Index down 1.2% to 14,687.02

- Shanghai Composite down 0.8% to 2,893.48

- Sensex up 1.0% to 60,575.58

- Australia S&P/ASX 200 up 1.1% to 6,863.46

- Kospi up 1.1% to 2,293.61

- German 10Y yield up 1.7% to 2.14%

- Euro down 0.4% to $0.9924

- Brent Futures down 0.5% to $95.34/bbl

- Gold spot down 0.5% to $1,637.02

- U.S. Dollar Index up 0.40% to 111.20

Top Overnight News from Bloomberg

- Luiz Inacio Lula da Silva won Brazil’s presidential election in a dramatic comeback for the left-wing politician who was languishing in a jail cell for corruption just three years ago.

- Euro-area inflation surged to a fresh all-time high, while the bloc’s economy lost momentum — reinforcing fears that a recession is now all-but unavoidable.

- Wheat worries and weak China PMIs reminded Monday’s markets that not all is well. However, with Fed Chairman Powell likely to confirm hopes of a December step-down in the pace of rate hikes, the mood could be sanguine until the US jobs data on Friday.

- For months, investors have been eagerly awaiting a Federal Reserve policy pivot. But now, at least for some, it might come too soon.

- European stocks fluctuated and US equity futures fell at the start of another busy week of earnings and key central bank decisions.

- Asian stocks tracked Friday’s gains in the US amid optimism over corporate earnings in the region. The dollar climbed as traders positioned for another large interest rate hike by the Federal Reserve this week.

A more detailed look at global markets courtesy of Newsquawk

Asia-Pacific stocks traded mostly positive with momentum from last Friday’s rally on Wall St although some of the gains were capped by disappointing Chinese PMI data and lingering COVID-19 woes, while participants are also bracing for a week laden with risk events including the latest FOMC meeting and NFP jobs data. ASX 200 traded positively with advances led by outperformance in tech but with further upside limited by weakness in the commodity-related sectors and as participants await tomorrow’s RBA policy meeting. Nikkei 225 was boosted after Japan’s Cabinet formally approved a JPY 71.6tln economic stimulus package on Friday and with the index shrugging off mixed Industrial Production and Retail Sales data. Hang Seng and Shanghai Comp were mixed with the mainland pressured after Chinese PMI data showed surprise contractions in both factory and services activity, while Hong Kong was somewhat choppy amid a plethora of earnings releases including the big 4 banks and with casino names hit after Macau imposed three days of rapid COVID testing and locked down the MGM Cotai resort.

Top Asian News

- PBoC Governor Yi reiterated that China will continue with its prudent monetary policy to keep the value of the yuan stable and said that China has the conditions to maintain conventional monetary policy for as long as possible, while Yi also reaffirmed to step up support for the real economy, according to Caixin and Reuters.

- China’s State Council reiterated support for China’s digital economy and proposed an eight-pronged approach, according to SCMP.

- China named Chen Yixin, who is a long-time confidant of President Xi, as the new state security minister in the latest leadership shake-up, according to SCMP.

- US Secretary of State Blinken spoke with China’s Foreign Minister Wang Yi today and discussed the need to maintain open lines of communication and responsibly manage the US-China relationship, while Blinken raised the subject of Russia’s war in Ukraine and the threat it poses to global security and economic stability, according to the State Department.

- Shanghai Disney Resort suspended operations today due to COVID controls, according to Global Times.

- Macau required residents to undergo three days of rapid Covid tests and locked down MGM China’s (2282 HK) Cotai casino resort although it was also reported that residents from mainland China will be able to travel to Macau from November 1st via the smart visa process, according to Reuters.

- Macau is to commence mass COVID nucleic acid testing on November 1st, via Bloomberg.

- Foxconn’s (2354 TT) Zhengzhou plant may see up to 30% of the factory’s November shipments of Apple (AAPL) iPhones impacted by the COVID-19 situation and it is working to increase iPhone production at its Shenzhen factory, according to a source

- Japan is to establish a new joint command to manage operations of land, sea and air self-defence forces with the government aiming to establish the new self-defence forces joint command in 2024, according to Nikkei. It was also separately reported that Japan is mulling extending its high-speed missile range to defend the Senkaku/Diaoyu Islands, according to SCMP.

- At least 153 people died and 150 others were injured during a stampede after large crowds surged into a narrow street in Seoul’s Itaewon nightlife district, according to a fire official cited by YTN. South Korean President Yoon declared a national day of mourning and said he would come up with measures to prevent a recurrence of similar incidents, according to Yonhap.

- At least 132 people died and many are still missing after a suspension bridge collapsed in India’s Gujarat state, according to BBC.

- RBNZ said bank solvency stress test shows resilience to a stagflation scenario and although capital buffers would be reduced in a stagflation scenario, they would still remain above the regulatory minimum, according to Reuters.

European bourses began the week modestly firmer, though this proved shortlived and the complex has pivoted to being mixed overall in-fitting with the APAC handover amid PMIs, COVID, month-end and ahead of a busy week. Specifically, Euro Stoxx 50 +0.10% while sectors are similarly mixed and feature some outperformance in defensives while Energy & Basic Resources lag amid COVID concerns and pressure in Glencore. Stateside, futures are under more pressure, ES -0.5% as yields pickup a touch, NQ -0.7% lags slightly, ahead of Wednesday’s FOMC where a 75bp hike is expected and as corporate updates continue.

Top European News

- UK PM Sunak is reportedly considering freezing foreign aid for two additional years to help balance UK government finances, according to The Telegraph.

- UK government quashed suggestions that it is considering a windfall tax on banks as one of the measures to plug a hole in its finances at next month’s budget, according to The Sunday Times.

- UK Home Secretary Braverman is under increasing pressure regarding security breaches after it emerged she took several hours to alert the UK’s top civil servant of an “error of judgement” regarding sensitive documents, according to FT.

- UK housing developers warned that new rules and taxes will add GBP 4.5bln to annual costs, according to FT citing a report by the Home Builders Federation.

- UK rail companies and unions are to hold talks to prevent more strikes, according to FT.

- UK’s ONS has concluded the classification review of the Energy Price guarantee. Payments will be classified as subsidies on products, paid by gov’t to suppliers. Reduced energy unit prices will push inflation lower than if the scheme did not exist.

- Irish PM Martin said political deadlock in Northern Ireland which led London to announce that it will call fresh elections in Northern Ireland, demonstrates that the governance system for the system is not fit for purpose and should be reformed, according to FT.

- ECB’s Knot said the ECB is not done with normalising monetary policy and that the ECB will significantly increase rates again in December which could be by 75bps but noted the next interest step will probably be between 50bps-75bps. Knot added the following interest rate steps will probably be smaller from early 2023, while he added that the ECB is not even at half-time of its fight against inflation and that the prospect of a recession in the Eurozone has become increasingly likely, according to Reuters.

- EU officials have proposed a far-reaching ban on the sale of goods made with forced labor, the plan is in early days and could take years to come into force, WSJ reports.

FX

- USD is bolstered by the general risk tone, Yuan pressure post-PMIs and the latest piece from WSJ’s Timiraos; DXY to a 111.20+ peak, though it has eased slightly and holds just above the figure.

- USD/JPY lifted beyond 148.00 amid USD strength with little impetus from its own data inputs, though upside has seemingly been capped ahead of 148.50.

- EUR is pressured given the above action, though saw little reaction to hotter-than-expected EZ CPI for October, with market pricing steady at around a 90% chance of 50bp in December; single currency between 0.9915-0.9965.

- After the JPY, GBP has borne the brunt of the USD’s advances with EUR/GBP modestly bid as such with UK politics very much in focus as we count down to the BoE; currently, Cable holds around the session’s 1.1550 trough.

- Petro-FX dented on softer benchmark pricing while the antipodeans are sensitivity to APAC pressure particularly in China though the Kiwi is deriving some support from domestic stress tests.

- Brazil’s former President Lula has won the Brazilian presidential election run-off with 50.9% of votes vs Bolsonaro at 49.1% of votes, according to BBC.

Fixed Income

- Core benchmarks are pressured as we enter a week dominated by numerous Central Bank updates.

- USTs are lower by 13 ticks with the 10yr yield surpassing Friday’s 4.05% best and nearing Thursday’s 4.08 peak before 4.10%; action that occurs ahead of the Wednesday FOMC and following the latest WSJ piece.

- Bunds lag amid the above factors and following better-than-expected domestic retail data before another hot EZ CPI print, though reaction to the latter was limited after last week’s German release; currently, holding around 20 ticks above the 138.20 trough.

Commodities

- Commodities are under pressure as the USD picks up and following weak Chinese PMIs and ongoing COVID concerns.

- Specifically, WTI and Brent are lower by just shy of 1% amid the above factors and as focus increasingly turns to next week’s US midterms and remarks from US officials, including President Biden.

- US President Biden said that oil companies who complain he is picking on them ‘ain’t seen nothing yet’, according to Reuters.

- QatarEnergy CEO said discussions are ongoing with several Asian buyers as value-added partners on the North Field expansion and that western international oil company partners have all been announced, while the CEO said several supply agreements are being discussed related to the expansion and announcement will be made in due course, according to Reuters.

- US Energy Envoy Hochstein says the US has called on oil producers to increase output, speaking at ADIPEC; need more investment in the oil and gas sector right now and tomorrow.

- Both precious and base metals are lower given the USD’s upside and softer China trade; spot gold remains below the USD 1650/oz handle while LME copper has slipped beneath USD 7.5k/T.

Geopolitics

- Ukrainian official sources says three missiles fired from Belarus were shot down on the Volyn province, in the west of the country, via Al Jazeera.

- Russia announced it is suspending the UN-brokered grain agreement with Ukraine after accusing Ukraine of a massive drone attack on the Black Sea Fleet in Sevastopol, Crimea. Russia’s Defence Ministry stated that the drones used to attack Russia’s Black Sea Fleet were recovered and analysed, while it alleged that the drones used Canadian-made navigation modules and were launched by Ukraine near Odesa, according to Reuters.

- Ukrainian President Zelensky said Russia’s suspension of the grain export deal needs a strong international response from the UN and the G20, while he suggested that Russia doesn’t belong in the G20 as it is deliberately trying to provoke starvation. Furthermore, Zelensky separately commented that Ukrainian forces repelled a fierce offensive by Russian forces in the Donetsk region.

- Ukrainian President’s Chief of Staff accused Russia of blackmail and faking terror attacks on its own facilities in response to Russian accusations that Ukraine was behind explosions in Crimea on Saturday, according to Reuters.

- US President Biden said Russia’s decision to suspend participation in the grain deal is outrageous, according to Reuters.

- NATO called on Russia to reconsider its decision and renew the grain deal urgently, while it said that Russian President Putin must stop weaponising food and end the illegal war on Ukraine, according to Reuters.

- UN Secretary-General Guterres delayed his departure for the Arab League Summit in Algiers by a day to focus on the Black Sea grain deal and continues to engage in intense contacts aimed at ending Russia’s suspension of participation in the deal, according to a spokesperson cited by Reuters.

- UN said Ukrainian, Turkish and UN delegations agreed on Sunday for a movement plan for 16 vessels on October 31st under the Black Sea grain initiative and agreed for inspections to be provided on Monday to 40 outbound vessels, while the UN added that the Russian delegation has been informed of both plans, according to Reuters.

- Turkey’s Defence Minister is in talks with counterparts in Kyiv and Moscow to resume the grains deal and reminded the parties of the importance of continuing the grain deal for all humanity, while Turkey will continue to do its part for the restoration of peace in the region, according to the Defence Ministry cited by Reuters.

- Russian Foreign Minister Lavrov said the Russian leadership, including President Putin, remains ready to negotiate on Ukraine, according to Anadolu Agency.

- Russia will reportedly take into account the modernisation of US nuclear bombs in Europe in its military planning, according to RIA citing Deputy Foreign Minister Grushko.

- Russian Defence Ministry alleged that representatives of a UK navy unit blew up the Nord Stream gas pipelines although didn’t provide any evidence for its claims, while the UK Defence Ministry said that these were ‘false claims of an epic scale’ and that Russia is making false claims to detract from its disastrous handling of the illegal invasion of Ukraine. Furthermore, the French Foreign Ministry also stated that Russian accusations against Britain have no basis and are part of a strategy to turn attention away from Moscow’s sole responsibility for the war in Ukraine, according to Reuters.

- US government was urged to open an investigation regarding allegations of a hacking of former PM Truss’s phone while she was Foreign Secretary, while The Mail on Sunday reported that agents suspected of working for Russia were responsible for the alleged hacking, citing unnamed sources.

US Event Calendar

- 09:45: Oct. MNI Chicago PMI, est. 47.0, prior 45.7

- 10:30: Oct. Dallas Fed Manf. Activity, est. -18.5, prior -17.2

DB’s Jim Reid concludes the overnight wrap

The most unoriginal intro I can use this morning given today’s date is to speculate as to whether the Fed will offers tricks or treats this week. Indeed a week with the latest FOMC and payrolls is unlikely to be dull, and could “spook” the market, especially after a 10-day period that was mostly made of up dovish pivot talks. However this momentum stalled a bit after runaway European inflation on Friday tempered some of the enthusiasm for the trade. So all to play for. We also have a BoE meeting (Thursday) that although less pivotal than it could have been a few weeks back is still something that can influence global markets. Remember that the following week sees US mid-terms (Tuesday) and CPI (Thursday). So quite a run of big events coming up as we hit the last day of the month.

Other key data releases include the ISM indices in the US (tomorrow and Thursday). Industrial activity and labour market indicators will be also released in Europe. Corporate earnings will feature Saudi Aramco, BP, Pfizer, Starbucks, Toyota and Qualcomm after last week’s disappointing results from Big Tech firms.

Over the weekend, Russia announced that it is exiting from the internationally brokered arrangement that allowed grain ships to leave Ukrainian Black Sea ports, in response to what it called a major Ukrainian drone attack near the port of Sevastopol in Crimea. The abrupt move by Russia has caused international outcry as the decision undermines efforts to ease a global food crisis. Moscow has requested a meeting with the UN’s security council today to discuss the issue. Grain markets have reacted to this development with Chicago wheat futures rising +5.47% to $8.75 a bushel after hitting a high of $8.93 a bushel in early trade. Additionally, Corn (+2.2%) and soybeans (+0.75%) have also moved higher. So one to watch.

Moving on to political news, Brazilian left wing leader Lula narrowly defeated the far-right incumbent Bolsonaro in an extremely tight election to become the next president with 50.9% of votes against 49.1% for Bolsonaro. Lula will be sworn in on 1 January 2023.

Back to this coming week and with regards to the Fed, a fourth successive 75bps has long been pretty much nailed on but the subsequent path of hikes is now up for grabs and will be the key focus from this week’s meeting. It feels inconceivable to us, given how spectacularly forward guidance has broken down across the global markets over the last 12 months, that Powell will try to guide too aggressively for December, especially with two payrolls (one this week) and two CPIs to come before they meet again. Our economists currently believe that 75bps is still likely in December (see “Denying the Fed its December downshift”), but that January could mark a downshift whilst still seeing upside risks to their terminal rate expectation of 5% given the recent inflation data and evidence that r-star has risen (see “(R-)Star gazing: Macro drivers suggest real neutral rate may have risen”). Even WSJ Timiraos tweeted at the weekend “Consumers have a big cushion of savings. Corporations have lowered their debt-service costs. For the Fed, a more resilient private sector means that when it comes to rate rises, the peak or “terminal” policy rate may be higher than expected.” To be fair in his WSJ article that went viral 10 days ago he did mention that 2023 Fed forecasts could be upgraded. However the market mostly focused on the near-term downshift possibilities.

The downshift debate will still carry on right up to the meeting though with a few bits of important data for the Fed to throw into the mix prior to their final statement and subsequent tone in the press conference. The Chicago PMI (47.6 forecast vs. 45.7 previously) today will tweak estimates for tomorrow’s manufacturing ISM (DB at 49.8 vs. 50.9 last). The latter could drop below 50 for the first time since May 2020. Our economists note that the employment series of both will be important, especially in payrolls week. Last month the employment component of the Chicago PMI plunged 14.4 points to 40.2 – the largest month-over-month decline on record, while the equivalent in the manufacturing ISM fell by 5.5 points to 48.7 last month. Staying with jobs, tomorrow’s JOLTS is always a key indicator of the tightness of the labour market, albeit a month behind other releases. After the FOMC, the services ISM (DB at 55.3 vs. 56.7 last) could also tweak payrolls estimates. The employment component bounced from 50.2 to 53 last month but the flash services PMI indicates that the risks to the employment outlook are to the downside.

In terms of payrolls, the headline consensus is at +190k (DB at +225k vs. +263k previously) with private at +195k (DB at +225k vs. +288k previously). DB expect the unemployment rate to stay at 3.5% but the consensus expects it to tick up to 3.6%. Average hourly earnings is expected by the street to dip from 5% to 4.7% (DB at 4.6%)

Back here in Europe, the BoE’s decision on Thursday will be in the spotlight after a tumultuous month since its latest rate hike on September 22. Our UK economists preview the meeting here and expect the central bank to hike by +75bps, taking the Bank Rate to 3%. Beyond Thursday’s meeting, the team sees a terminal rate of 4.5% amidst growing fiscal consolidation. Their expected sequence of hikes beyond Thursday has +50bps in December and February and +25bps in March and May. For the ECB Lagarde speaks twice (Thursday and Friday) and she can firm up or row back on the slightly more dovish meeting last week than expected. Will she be influenced by Friday’s shocking European inflation numbers that saw German inflation at 11.6% YoY against 10.9% expectations, Italy at 12.8% vs. 9.9% expected and France 7.1% vs. 6.5% expected? Italy’s PPI was at 53.0% YoY vs. 50.5% expected. It wasn’t just energy related and core estimates for the full EA reading will likely have been upgraded given Friday’s numbers. Chief Economist Lane speaks today as well.

Turning to earnings now, with 255 of S&P 500 members now reported and after Big Tech’s disappointing releases, this week’s busy line-up of results include key numbers from key oil & gas, healthcare and consumer firms. It’s been an interesting season so far as our equity strategists reviewed over the weekend here. They comment that the breadth and size of Q3 earnings beats are near historical averages but these are off estimates that have continued to be cut. The blended estimate for Q3 earnings (combining actuals plus consensus for those yet to report) as a result has barely ticked higher and is significantly below the typical upward trajectory at this stage of the earnings season. In addition, consensus estimates for Q4 have fallen over -2% since the beginning of this earnings season, much larger than the typical -1%, and follow cuts of -6% in the prior three months. 2023 estimates have fallen by -2% this earnings season bringing the cuts since April to -7%. 2023 EPS consensus is now at $234, still significantly higher than our team’s forecast of $195 which incorporates a recession forecast next year. The consensus forecast on the other hand looks to embody a soft landing.

In terms of this week, for oil and gas, we will hear from Saudi Aramco and BP tomorrow, followed by ConocoPhillips, Cheniere, Enel and EOG on Thursday. In healthcare, results will be due from Eli Lilly, Pfizer (tomorrow), Novo Nordisk (Wednesday) and Moderna (Thursday), among others. After some strong performance from staples this week, earnings from Mondelez (tomorrow) and Starbucks (Thursday) will be in focus. Automakers outside the US will announce too, including Toyota (tomorrow), Ferrari (Wednesday) and BMW (Thursday). Tech firms reporting will include AMD, Sony and Uber tomorrow, Qualcomm and eBay on Wednesday and PayPal on Thursday. Other notable earnings releases will include Booking, Maersk (Wednesday) and Marriott (Thursday). See the full day by day week ahead at the end for all the key data and earnings releases.

Asian equity markets are trading mostly higher this morning extending Friday’s rally on Wall Street. Across the region, the Nikkei (+1.67%) is leading gains with the KOSPI (+1.10%) and the Hang Seng (+0.89%) also creeping higher. Elsewhere, stocks in mainland China are trading in negative territory with the CSI (-0.15%) and the Shanghai Composite (-0.27%) both edging lower following the release of weak PMI data (more below). In overnight trading, US equity futures are indicating a slightly negative start with contracts on the S&P 500 (-0.14%) and NASDAQ 100 (-0.20%) slightly lower ahead of the final day of October. Meanwhile, yields on 10yr USTs (+1.65 bps) are slightly higher, trading at 4.03% as I type.

Early morning data showed that China’s official manufacturing PMI fell to 49.2 in October from 50.1 in September, as softening global demand and strict domestic COVID-19 curbs hit the world’s second biggest economy. Separately, the non-manufacturing PMI unexpectedly contracted to 48.7 from 50.6 in September. Moving on to Japan, we have seen mixed data with the September industrial production (-1.6% m/m) falling for the first time in four months (v/s +3.4% in August, -0.8% market consensus). In contrast, retail sales extended its gain for the seventh consecutive month after it advanced +1.1% m/m in September (v/s +0.8% expected) raising expectations for a sustainable boost in consumption as the increase in tourist activity coincided with the relaxing of Covid-19-related restrictions. It followed August’s downwardly revised increase of +1.3%.

Looking back to last week now. 10yr Treasury and Bund yields fell -20.4bps (+9.4bp Friday) and -31.4bps (+14.1bps Friday) over the week, as markets seized on hopes for a coordinated central bank pivot. Friday’s inflation data out of Europe discussed above and the fact that US core PCE still above 5% on a YoY basis, and thus not enabling a true pivot, took some steam out of the rally. We’ll see what the Fed’s comms this week do to it. 10yr yields in the UK (-57.6bps, +7.5bps Friday) and Italy (-57.2bps, +16.7bps Friday) outperformed. The former can be attributed to the appointment of Rishi Sunak as Prime Minister, which not only resolves some political risk, but marks someone with markets experience who warned about the impact of former Prime Minister Truss’s economic plan which drove such a large selloff. Italy outperformed following less progress on QT discussions out of the ECB meeting than was anticipated, leading to a rollout farther in the future.

Risk assets enjoyed a boost from the perceived policy pivot, with the S&P 500 (+3.95%, +2.46% Friday) and STOXX 600 (+3.65%, +0.14% Friday), both gaining. The S&P 500 also saw strong earnings results from a number of bellwethers including Coca Cola, General Motors, Universal Health, Hess, Visa, Caterpillar, Honeywell, McDonald’s, and UPS beat estimates. However, big tech earnings were not nearly as strong, with even the companies beating estimates for the quarter gone revising guidance lower for the quarter ahead. That saw the FANG+ index severely underperform, falling -4.12% (+1.25% Friday), marking the largest weekly outperformance of the S&P 500 above the FANG+ index since Bloomberg started publishing data on the latter in late 2014.