Watch Live: Fed Chair Powell Sees Terminal Rate “Somewhat Higher”, Needs “Substantially More Evidence” On Inflation

Watch Powell speak live at The Brookings Institute here: (due to start at 1330ET):

“It will take substantially more evidence to give comfort that inflation is actually declining. By any standard, inflation remains much too high.”

Highlights from Powell’s prepared remarks:

Dovish:

- *POWELL: TIME FOR MODERATING HIKE PACE MAY COME AS SOON AS DEC.

Hawkish:

-

*POWELL SAYS FED WILL NEED RESTRICTIVE POLICY FOR `SOME TIME’

-

*POWELL: RATE PEAK LIKELY `SOMEWHAT HIGHER’ THAN SEPT. FORECASTS

-

*POWELL: CONSIDERABLE UNCERTAINTY OVER WHERE RATES WILL PEAK

-

*POWELL: WILL REQUIRE SUSTAINED PERIOD OF SLOWER DEMAND GROWTH

-

*POWELL: NEED `SUBSTANTIALLY MORE EVIDENCE’ OF INFLATION FALLING

-

*POWELL: HISTORY CAUTIONS AGAINST PREMATURELY LOOSENING POLICY

Full Remarks below:

Today I will offer a progress report on the Federal Open Market Committee’s (FOMC) efforts to restore price stability to the U.S. economy for the benefit of the American people. The report must begin by acknowledging the reality that inflation remains far too high. My colleagues and I are acutely aware that high inflation is imposing significant hardship, straining budgets and shrinking what paychecks will buy. This is especially painful for those least able to meet the higher costs of essentials like food, housing, and transportation. Price stability is the responsibility of the Federal Reserve and serves as the bedrock of our economy. Without price stability, the economy does not work for anyone. In particular, without price stability, we will not achieve a sustained period of strong labor market conditions that benefit all.

We currently estimate that 12-month personal consumption expenditures (PCE) inflation through October ran at 6.0 percent (figure 1).1 While October inflation data received so far showed a welcome surprise to the downside, these are a single month’s data, which followed upside surprises over the previous two months. As figure 1 makes clear, down months in the data have often been followed by renewed increases. It will take substantially more evidence to give comfort that inflation is actually declining. By any standard, inflation remains much too high.

For purposes of this discussion, I will focus my comments on core PCE inflation, which omits the food and energy inflation components, which have been lower recently but are quite volatile. Our inflation goal is for total inflation, of course, as food and energy prices matter a great deal for household budgets. But core inflation often gives a more accurate indicator of where overall inflation is headed. Twelve-month core PCE inflation stands at 5.0 percent in our October estimate, approximately where it stood last December when policy tightening was in its early stages. Over 2022, core inflation rose a few tenths above 5 percent and fell a few tenths below, but it mainly moved sideways. So when will inflation come down?

I could answer this question by pointing to the inflation forecasts of private-sector forecasters or of FOMC participants, which broadly show a significant decline over the next year. But forecasts have been predicting just such a decline for more than a year, while inflation has moved stubbornly sideways. The truth is that the path ahead for inflation remains highly uncertain. For now, let’s put aside the forecasts and look instead to the macroeconomic conditions we think we need to see to bring inflation down to 2 percent over time.

For starters, we need to raise interest rates to a level that is sufficiently restrictive to return inflation to 2 percent. There is considerable uncertainty about what rate will be sufficient, although there is no doubt that we have made substantial progress, raising our target range for the federal funds rate by 3.75 percentage points since March. As our last postmeeting statement indicates, we anticipate that ongoing increases will be appropriate. It seems to me likely that the ultimate level of rates will need to be somewhat higher than thought at the time of the September meeting and Summary of Economic Projections. I will return to policy at the end of my comments, but for now, I will simply say that we have more ground to cover.

We are tightening the stance of policy in order to slow growth in aggregate demand. Slowing demand growth should allow supply to catch up with demand and restore the balance that will yield stable prices over time. Restoring that balance is likely to require a sustained period of below-trend growth.

Last year, the ongoing reopening of the economy boosted real gross domestic product (GDP) growth to a very strong 5.7 percent. This year, GDP was roughly flat through the first three quarters, and indicators point to modest growth this quarter, which seems likely to bring the year in with very modest growth overall. Several factors contributed to this slowing growth, including the waning effects of reopening and of pandemic fiscal support, the global implications of Russia’s war against Ukraine, and our policy actions, which tightened financial conditions and are affecting economic activity, particularly in interest-sensitive sectors such as housing. We can say that demand growth has slowed, and we expect that this growth will need to remain at a slower pace for a sustained period.

Despite the tighter policy and slower growth over the past year, we have not seen clear progress on slowing inflation. To assess what it will take to get inflation down, it is useful to break core inflation into three component categories: core goods inflation, housing services inflation, and inflation in core services other than housing (figure 2).

Core goods inflation has moved down from very high levels over the course of 2022, while housing services inflation has risen rapidly. Inflation in core services ex housing has fluctuated but shown no clear trend. I will discuss each of these items in turn.

Early in the pandemic, goods prices began rising rapidly, as abnormally strong demand was met by pandemic-hampered supply. Reports from businesses and many indicators suggest that supply chain issues are now easing. Both fuel and nonfuel import prices have fallen in recent months, and indicators of prices paid by manufacturers have moved down. While 12-month core goods inflation remains elevated at 4.6 percent, it has fallen nearly 3 percentage points from earlier in the year. It is far too early to declare goods inflation vanquished, but if current trends continue, goods prices should begin to exert downward pressure on overall inflation in coming months.

Housing services inflation measures the rise in the price of all rents and the rise in the rental-equivalent cost of owner-occupied housing. Unlike goods inflation, housing services inflation has continued to rise and now stands at 7.1 percent over the past 12 months. Housing inflation tends to lag other prices around inflation turning points, however, because of the slow rate at which the stock of rental leases turns over.2 The market rate on new leases is a timelier indicator of where overall housing inflation will go over the next year or so. Measures of 12-month inflation in new leases rose to nearly 20 percent during the pandemic but have been falling sharply since about midyear (figure 3).

As figure 3 shows, however, overall housing services inflation has continued to rise as existing leases turn over and jump in price to catch up with the higher level of rents for new leases. This is likely to continue well into next year. But as long as new lease inflation keeps falling, we would expect housing services inflation to begin falling sometime next year. Indeed, a decline in this inflation underlies most forecasts of declining inflation.

Finally, we come to core services other than housing. This spending category covers a wide range of services from health care and education to haircuts and hospitality. This is the largest of our three categories, constituting more than half of the core PCE index. Thus, this may be the most important category for understanding the future evolution of core inflation. Because wages make up the largest cost in delivering these services, the labor market holds the key to understanding inflation in this category.

In the labor market, demand for workers far exceeds the supply of available workers, and nominal wages have been growing at a pace well above what would be consistent with 2 percent inflation over time.3 Thus, another condition we are looking for is the restoration of balance between supply and demand in the labor market.

Signs of elevated labor market tightness emerged suddenly in mid-2021. The unemployment rate at the time was much higher than the 3.5 percent that had prevailed without major signs of tightness before the pandemic. Employment was still millions below its level on the eve of the pandemic. Looking back, we can see that a significant and persistent labor supply shortfall opened up during the pandemic—a shortfall that appears unlikely to fully close anytime soon.

Comparing the current labor force with the Congressional Budget Office’s pre-pandemic forecast of labor force growth reveals a current labor force shortfall of roughly 3-1/2 million people (figure 4, left panel).4 This shortfall reflects both lower-than-expected population growth and a lower labor force participation rate (figure 4, right panel). Participation dropped sharply at the onset of the pandemic because of many factors, including sickness, caregiving, and fear of infection. Many forecasters expected that participation would move back up fairly quickly as the pandemic faded. And for workers in their prime working years, it mostly has. Overall participation, however, remains well below pre-pandemic trends.

Some of the participation gap reflects workers who are still out of the labor force because they are sick with COVID-19 or continue to suffer lingering symptoms from previous COVID infections (“long COVID”).5 But recent research by Fed economists finds that the participation gap is now mostly due to excess retirements—that is, retirements in excess of what would have been expected from population aging alone.6 These excess retirements might now account for more than 2 million of the 3‑1/2 million shortfall in the labor force.7

What explains these excess retirements? Health issues have surely played a role, as COVID has posed a particularly large threat to the lives and health of the elderly.8 In addition, many older workers lost their jobs in the early stages of the pandemic, when layoffs were historically high. The cost of finding new employment may have appeared particularly large for these workers, given pandemic-related disruptions to the work environment and health concerns.9 Also, gains in the stock market and rising house prices in the first two years of the pandemic contributed to an increase in wealth that likely facilitated early retirement for some people.

The data so far do not suggest that excess retirements are likely to unwind because of retirees returning to the labor force. Older workers are still retiring at higher rates, and retirees do not appear to be returning to the labor force in sufficient numbers to meaningfully reduce the total number of excess retirees.10

The second factor contributing to the labor supply shortfall is slower growth in the working-age population. The combination of a plunge in net immigration and a surge in deaths during the pandemic probably accounts for about 1-1/2 million missing workers.11

Policies to support labor supply are not the domain of the Fed: Our tools work principally on demand. Without advocating any particular policy, however, I will say that policies to support labor force participation could, over time, bring benefits to the workers who join the labor force and support overall economic growth. Such policies would take time to implement and have their effects, however. For the near term, a moderation of labor demand growth will be required to restore balance to the labor market.

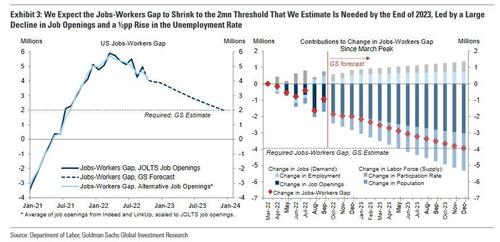

Currently, the unemployment rate is at 3.7 percent, near 50-year lows, and job openings exceed available workers by about 4 million—that is about 1.7 job openings for every person looking for work (figure 5). So far, we have seen only tentative signs of moderation of labor demand. With slower GDP growth this year, job gains have stepped down from more than 450,000 per month over the first seven months of the year to about 290,000 per month over the past three months. But this job growth remains far in excess of the pace needed to accommodate population growth over time—about 100,000 per month by many estimates. Job openings have fallen by about 1.5 million this year but remain higher than at any time before the pandemic.

Wage growth, too, shows only tentative signs of returning to balance. Some measures of wage growth have ticked down recently (figure 6). But the declines are very modest so far relative to earlier increases and still leave wage growth well above levels consistent with 2 percent inflation over time. To be clear, strong wage growth is a good thing. But for wage growth to be sustainable, it needs to be consistent with 2 percent inflation.

Let’s sum up this review of economic conditions that we think we need to see to bring inflation down to 2 percent. Growth in economic activity has slowed to well below its longer-run trend, and this needs to be sustained. Bottlenecks in goods production are easing and goods price inflation appears to be easing as well, and this, too, must continue. Housing services inflation will probably keep rising well into next year, but if inflation on new leases continues to fall, we will likely see housing services inflation begin to fall later next year. Finally, the labor market, which is especially important for inflation in core services ex housing, shows only tentative signs of rebalancing, and wage growth remains well above levels that would be consistent with 2 percent inflation over time. Despite some promising developments, we have a long way to go in restoring price stability.

Returning to monetary policy, my FOMC colleagues and I are strongly committed to restoring price stability. After our November meeting, we noted that we anticipated that ongoing rate increases will be appropriate in order to attain a policy stance that is sufficiently restrictive to move inflation down to 2 percent over time.

Monetary policy affects the economy and inflation with uncertain lags, and the full effects of our rapid tightening so far are yet to be felt. Thus, it makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down. The time for moderating the pace of rate increases may come as soon as the December meeting. Given our progress in tightening policy, the timing of that moderation is far less significant than the questions of how much further we will need to raise rates to control inflation, and the length of time it will be necessary to hold policy at a restrictive level. It is likely that restoring price stability will require holding policy at a restrictive level for some time. History cautions strongly against prematurely loosening policy. We will stay the course until the job is done.

1. Throughout this discussion, PCE data for October are estimates based on the October consumer price index and producer price index data. Return to text

2. Rental lease data are also the main input into the measurement of owner-occupied housing prices. Return to text

3. The pace of wage inflation affects all sectors of the economy, but wages are a particularly large share of costs in core services ex housing and, thus, particularly important for inflation in this category. Return to text

4. See Congressional Budget Office (2020). To account for the effect of population controls on the level of the labor force, the shortfall is calculated by appending the Congressional Budget Office’s January 2020 projected labor force growth over the years 2020–22 onto the level of the labor force in 2019:Q4 that is adjusted for population controls. Return to text

5. Recent research suggests that long COVID may be keeping 280,000 to 680,000 individuals aged 16 to 64 out of the labor force (Sheiner and Salwati, 2022), and long COVID may explain why the percentage of those aged 18 to 64 not in the labor force due to a disability has stalled over the past two years rather than continuing its pre-pandemic decline (see also Price, 2022). Return to text

6. See Montes, Smith, and Dajon (2022). Return to text

7. This analysis adjusts for population controls to the Current Population Survey. This adjustment is important, because while the unadjusted data show a marked decline in the retired share in January 2022, this drop is entirely an artifact of new population controls introduced in January. A proper assessment of the effects of retirements since the start of the pandemic needs to adjust the historical data for the effects of these population controls. See Montes, Smith, and Dajon (2022). Return to text

8. For example, see Goda and Soltas (2022). Return to text

9. Displaced workers aged 65 and over had markedly lower reemployment rates and markedly higher rates of labor force exit than did similarly aged displaced workers in the years just before the pandemic. See Bureau of Labor Statistics (2022). Return to text

10. Among those 55 and over, transitions into retirement are currently well above the average rate in the three years before the pandemic (after adjusting for population controls). At the same time, retirees are returning to the labor force at a rate similar to that before the pandemic. Return to text

11. First, due primarily to COVID, mortality over the past few years has far exceeded what had been expected before the pandemic. This channel accounts for about 400,000 of the labor force shortfall. Total deaths due to COVID are much larger—about 1 million people. However, the effect on the labor force is smaller than this because COVID deaths have mostly been among older people, who participate in the labor force at lower rates than younger people.

Second, due, at least in part, to pandemic-related restrictions on entry into the United States, total immigration has slowed substantially since the start of the pandemic, lowering the labor force by about 1 million people relative to pre-pandemic trends. While lawful, nonpermanent immigration (for example, H-1B and H-2B visa holders) has bounced back considerably since earlier in the pandemic, these categories of immigration are generally still below 2019 levels. Meanwhile, lawful permanent immigration (that is, new green card holders) is also somewhat lower than in 2019 and well below levels that prevailed earlier in the 2010s. Regarding undocumented immigration, while migrant encounters at the U.S.–Mexico border have been high lately, some estimates suggest the number of undocumented immigrants in the United States is not much different than in 2019. (For data on legal immigration, see U.S. Department of Homeland Security, 2022; for data on border encounters, see U.S. Customs and Border Protection, 2022; for estimates of the number of undocumented immigrants, see Camarota and Zeigler, 2022.). Return to text

* * *

When we previewed Jay Powell’s speech yesterday, we explained both why the market has been so nervous heading into (PTSD from his Jackson Hole market mauling) as well as why the blackout period that follows Powell’s speech and lasts through the middle of December will be far more important for the market over the next two weeks.

Looking at today’s jitteryness, the market is clearly still on edge, so below we share two Powell previews as of this morning, one from Goldman bankers, the other from JPMorgan.

We start with JPMorgan trader Andrew Tyler who has a neutral view of what to expect from the Fed chair today:

While Equities saw a lift on Weds following Fed Minutes, this week have multiple Fed speakers, none more important that Powell’s speech Weds at 1.30pm. Should the market be bracing for a repeat of Jackson Hole? When Powell gave his Jackson Hole speech Fed Funds were 2.25% – 2.50% and now they are 3.75% – 4.00%; but financial conditions have loosened considerably following the tightening that we experienced in Sept and Oct, though the financial conditions index is tighter (higher) now than in August. While mortgage rates have come off their highs, the 6.78% rate compares to 5.89% during Jackson Hole.

Given that background, it is unclear what more Powell could say that we have not heard from recent Fed speakers:

(i) terminal rate 4.75% – 5.25% seems to be an acceptable place to pause;

(ii) once at that ~5% level, data will determine the next moves. Currently, the market is pricing in a 5% terminal rate, and it feels unlikely that the bond market would have a material repricing ahead of Friday’s NFP, the Dec 12 CPI print, and Dec 13 Fed announcement. For reference, the Monday of Powell’s Jackson Hole speech, the terminal rate expectation was 3.74% and the Monday following, the terminal rate moved to 3.84%; and the 10Y yield moved from 3.01% to 3.10% over the same period. The SPX fell 3.4% the day of the speech, NDX was -4.1%, RTY was -3.3%. The market feels less offsides now with a higher-for-longer view becoming consensus, so moves of that magnitude do not appear to be very likely.

Our tactical view is that Equity market moves are likely lower from here given the number of clients who want to sell stock around the 4,000 level in the SPX; many clients feel the 3700 – 3900 range is appropriate absent a material change in the data (e.g., NFP under 100k or CPI falls another 50bps, or more). While a Fed pivot is currently off the table, investors looking for a pause are unlikely to find that support from Powell this week.

So while JPM notes that its clients are generally bearish, there is nothing in what Powell will say that could precipitate a selloff. Not surprisingly, Goldman agrees, and as Goldman’s Michael Nocerino notes the market has “somewhat de-risked heading into the event after Fed Speakers this week dropped the hawkish tone on the market”

-

James Bullard said markets are underestimating the chances that the FOMC will need to be more aggressive next year, adding tightening may go into 2024;

-

John Williams said “there’s still more work to do” to get inflation down;

-

Loretta Mester told the FT that the central bank isn’t near a pause.

Here is some additional color from Goldman trader Mike Cahill, who says that Powell’s speech is important for two reasons. :

-

First, the focus on the labor market is critical for assessing the how Powell views the Committee’s task ahead. Does he think it is likely the Fed can cool the labor market without a significant rise in the unemployment rate? And why did the September projections show such a sharp fall in inflation with only a modest rise in unemployment?

-

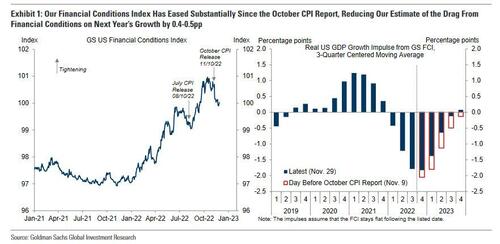

Second, this is a chance for Powell to comment on the substantial easing in financial conditions since the CPI print. Lower inflation is a better fundamental reason for the market to price less tightening, but our FCI has unwound half the tightening since Powell’s JH speech and is now essentially flat since June. Is he ok with this? Vast majority of FCI tightening has been pre June versus 80% of rate hikes. But we think FCI is how policy translates to the economy (the change and not the level). The easing in FCI now means that the FCI drag to growth peaks this quarter and is now roughly flat as of middle of the year – see 2nd chart below. Overall we think that FC will need to act as a restraint to the economy throughout 2023 to achieve a soft landing.

Finally, here is an extended preview excepted from Jan Hatzius at Goldman’s research desk (full note available to pro subscribers in the usual place).

At 1:30pm ET today, Chair Powell will deliver prepared remarks on “then economic outlook, inflation, and the labor market.” Since the October CPI print, our financial conditions index (FCI) has eased substantially, which has reduced our estimate of the drag from financial conditions on next year’s growth by 0.4-0.5pp.

The key question for markets is therefore to what degree he will try to push back against the recent FCI easing by striking a hawkish tone.

Powell is likely to hint that the FOMC will slow the pace of rate hikes at then December meeting but push back against the recent easing in financial conditions with two hawkish counterpoints.

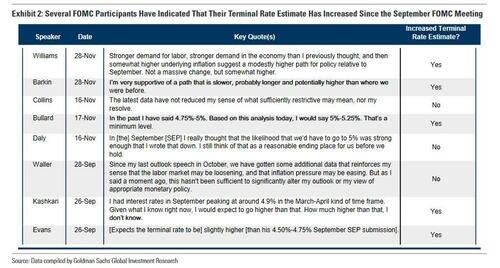

- First, Powell is likely to suggest that the FOMC will need to raise the funds rate to a higher peak than it projected at the September meeting, echoing his remarks at the November press conference and following similar comments from several other FOMC members over the last few weeks.

- Second, he is likely to reiterate that inflation remains too high and the labor market remains extremely tight. At the November press conference, he acknowledged that job growth had slowed and that job openings had started to decline, but stressed that the labor market remained “out of balance” and noted that the participation rate had been “little changed since the beginning of the year.” That said, the fact that financial conditions are meaningfully tighter today than when he pushed back against easing financial conditions in his Jackson Hole speech should reduce the impetus for an overly hawkish message in today’s speech

While Powell will likely try to avoid a further counterproductive easing in financial conditions by signaling that the FOMC will keep hiking well into 2023, recent data have shown encouraging signs that labor-market rebalancing is underway, and the reasons to expect lower future inflation have continued to strengthen. Our jobs-workers gap has closed 45% of the distance between its March peak and the level we think is necessary to restore balance to the labor market, recent indicators of wage growth have softened on net, and alternative web-based measures of rent growth for new tenants have decelerated substantially.

The recent news on inflation has also been encouraging. Core CPI inflation slowed in October and we expect core PCE inflation to decelerate to 0.25% (m/m) in Thursday’s release (vs. 0.45% in September). In addition, the reasons to expect lower future inflation have strengthened further.

First, leading indicators of core goods prices — especially the supplier deliveries and prices paid components of the ISM as well as used car auction prices—have declined sharply. Second, asking rents on new leases slowed further in October, and data from Apartment List indicate that asking rents declined 0.2% in November. While Powell endorsed the official CPI/PCE rental components as the best measures of housing inflation for monetary policy purposes, he did note that the committee is “considering that we also know that at some point you’ll see rents coming down” because of the signal from the alternative measures.

We continue to expect the FOMC to slow the pace of rate hikes to 50bp inn December and to 25bp in February, March, and May, raising the funds rate to a peak of 5-5.25%.

More in the full reports available to pro subs.

Tyler Durden

Wed, 11/30/2022 – 13:20

via ZeroHedge News https://ift.tt/Eq7ktAz Tyler Durden