“Doom Cycle Of Default, Fraud, And Contagion” Could Give Way To Crypto Spring

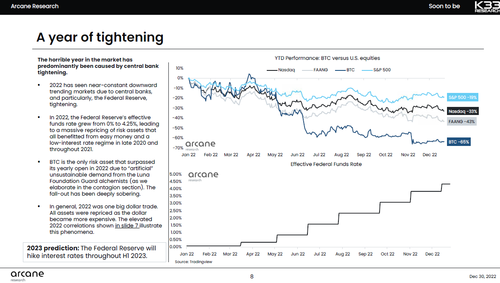

Crypto endured a major hangover year in 2022 after a 2020-21 boom during the central banks’ Covid liquidity party. The emerging blockchain space was battered by central banks removing the punch bowl, harsh macroeconomic environment, bankruptcies, exchange blowups, stablecoin implosions, and even criminal charges against top crypto executives.

“Consistent interest rate hikes and quantitative tightening in 2022 granted us a devastating hangover. Fortune did not favor the brave, and we entered a consistent doom cycle of default, fraud, and contagion. A financial crisis with seemingly no end that still ravages our industry. In 2022, the naked swimmers were exposed and bad apples got eliminated. This is promising through long-term lenses, while ever so painful in the short term,” Vetle Lunde, research analyst at Arcane, wrote.

Lunde wrote if 2022 had one key lesson for the crypto industry, it would be the following: “your funds in someone else’s custody is someone else’s liability, and their intentions could be harmful. While there are good arguments for storing funds at exchanges, traders should strive to avoid concentrating risks on one venue.”

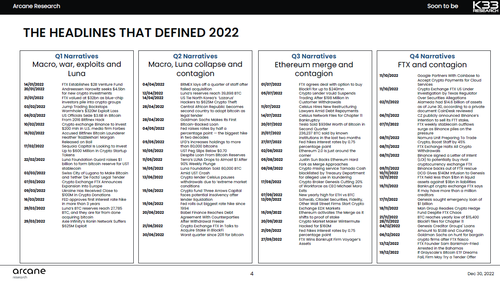

Arcane’s analyst put together the top headlines that defined the crypto industry in 2022 — much of the headlines were doom and gloom.

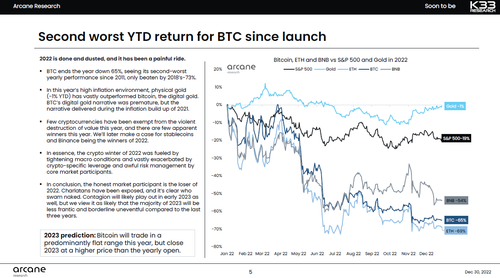

Lunde pointed out Bitcoin recorded the second worst year-to-date returns in existence. He called the down move in crypto “a painful ride.”

Lunde continued with an outlook for 2023, expecting a calmer market due to declining volatility.

We expect the market to calm down in 2023, with declining volumes and falling volatility. Overall, we expect interest and headlines related to crypto to be fewer and the market to be less hectic in general. This will be a year to accumulate and build exposure. It will be a year for the patient, and we do not anticipate prices nearing former all-time highs in 2023. We believe BTC and ETH will increase their relative strength in the market and that altcoin returns will be subdued for most of the year.

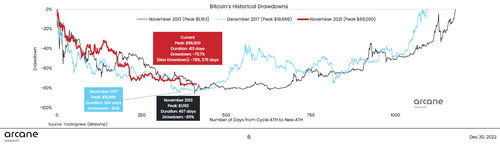

And he revealed further the current drawdown in Bitcoin appears to follow similar bear market patterns in previous cycles.

The 2018 bear market saw a 364-day long duration from peak to through, while the 2014-15 bear market lasted for 407 days. For now, BTC has bottomed 376 days after peaking, right in between the duration of earlier cycle peak to through periods. If a new bottom is reached in 2023, this will be the longest-lasting BTC drawdown ever.

And one silver lining the analyst said about the FTX debacle is that it might increase “more rapid progress with regulations, and we view both positive signals related to U.S. spot BTC ETF launches and more coherent classifications of tokens as a plausible outcome by the end of the year, with exchange tokens being particularly exposed for potential security classifications.”

Here is Lunde’s core 2023 forecast for crypto:

While the tightening macro landscape and BTC’s correlated relationship to macro complicate analogies to previous bear markets, we firmly believe that this is an excellent area to build gradual BTC exposure. However, we expect low activity to be the key trend throughout most of 2023, with diminishing trading volumes and volatility in a significantly more boring market than the previous three years. As we advance into the next year, patience and long-term positioning will be key.

Much of the crypto down cycle has come since the Federal Reserve embarked on its most aggressive tightening scheme in decades.

And rate traders are already pricing in the possibility the Fed might have to begin cutting late in the second half of 2023.

He also noted Bitcoin liquidity is drying up as the coins are being pulled off the markets.

This has direct implications for BTC liquidity and, in particular, experienced BTC scarcity. With fewer BTC available to trade, the impact of the net buyer or net seller will be more significant, and we believe the market is slowly headed towards a scenario where the net buyer will once again make a difference.

The backward-looking review and forward outlook might suggest crypto winter has peaked, while others, such as David Marcus, CEO and founder of Lightspark, recently warned crypto will need until at least 2024 to “recover from the abuse of unscrupulous players.”

Tyler Durden

Sun, 01/01/2023 – 12:45

via ZeroHedge News https://ift.tt/YO2csVg Tyler Durden