Yellen Warns US Will Hit Debt Limit Next Thursday, Will Take Extraordinary Measures To Avoid Default

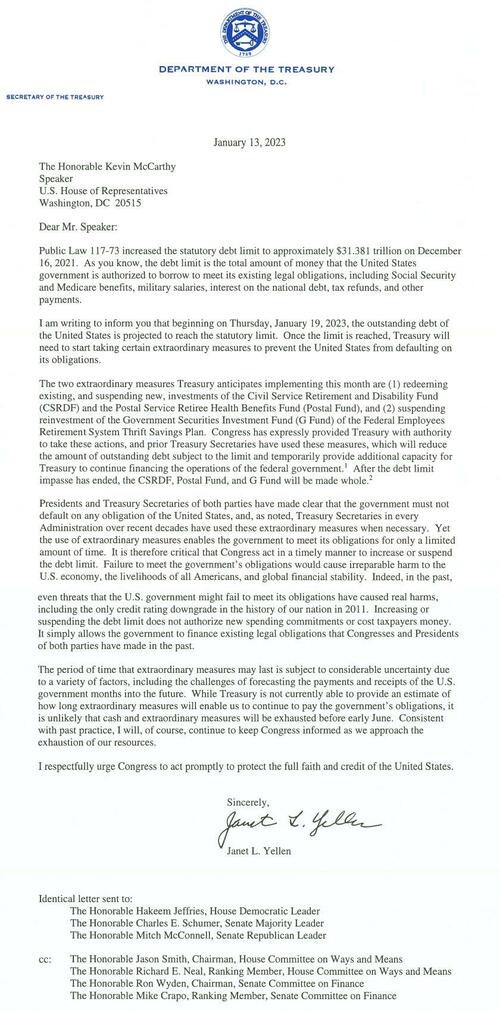

Exactly as we warned here, Treasury Secretary Janet Yellen just wrote a letter calling on Congress to raise the debt ceiling as soon as possible, stating that the US will reach its limit next Thursday, Jan. 19.

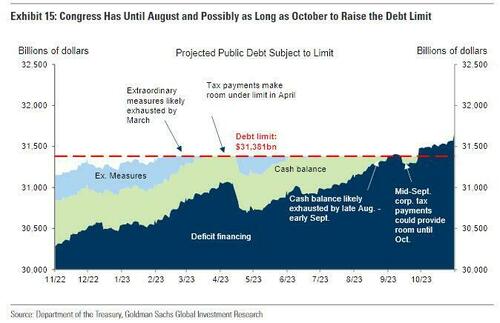

Then, she says, “extraordinary measures” will be used to keep paying bills, which she expects to continue until “early June”…

“While Treasury is not currently able to provide an estimate of how long extraordinary measures will enable us to continue to pay the government’s obligations, it is unlikely that cash and extraordinary measures will be exhausted before early June,” Ms. Yellen wrote to Congressional leaders.

Honoring US debt is “a sacred obligation,” and Congress will have to deal with it “without conditions, without games and without putting our economy at risk, ” White House economic adviser Brian Deese says on Bloomberg TV, seemingly foregetting Democrats’ historic gamesmanship with Trump over the debt ceiling.

“The last thing that we can afford is to violate the Hippocratic oath by having a self-inflicted wound on the economy,” he added.

As we detailed previously, Goldman’s chief economist Jan Hatzius said:

“The debt limit likely poses the greatest political risk next year, and we expect it to rival the 2011 episode in its disruption to financial markets and the economy. That said, we do not expect Congress to enact major fiscal changes. Republicans might press for spending cuts in a debt limit deal, but we do not expect substantial cuts next year. The White House might press for increased fiscal support, but this also looks unlikely as we believe a soft landing is more likely and a divided Congress would have difficulty responding to a recession even if one occurs.”

Goldman believes the government is not actually at risk of defaulting until the second half of 2023 because of the extraordinary measures the Treasury usually uses to avoid exceeding the cap, including using up the existing Treasury cash balance and funding from tax payments.

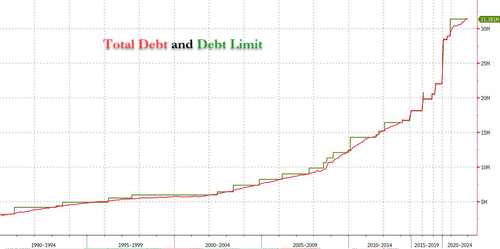

And so, the question is not if and when the US will breach the debt ceiling and cross the infamous D-Day, but how will broken Congress reach a solution. As we explained one week ago in “Investors Are Already Dreading The Debt Ceiling Chaos In 2023”, not even the always cheerful Wall Street expects a smooth and drama-free resolution to a process that will be nothing short of absolutely chaotic and expose the full Congressional dysfunction for the entire world to see.

Stifel Financial’s chief Washington policy strategist Brian Gardner says in a note: “Investors should be on guard as the summer approaches as to the possibility that the brinksmanship over the debt ceiling could lead to market volatility and a risk-off trade.”

* * *

Read Yellen’s full letter below:

Tyler Durden

Fri, 01/13/2023 – 12:34

via ZeroHedge News https://ift.tt/SmZzOg8 Tyler Durden