Stocks & Bonds Drop, Commodities & Cryptos Pop As ‘Hard Landing’ Looms

As the FedSpeak blackout period begins (and corporate share buyback blackouts accelerate), the markets dealt with a huge options expiration today with notable event risks right ahead in the FOMC with stocks and bond yields surging to end a volatile (holiday-shortened) week.

On the week, rate-trajectory expectations ended marginally lower (dovish) but the last two days have seen Fed jawboning lift the terminal rate and lower rate-cut outlooks…

Source: Bloomberg

US Macro Surprise Index tumbled significantly this week, crushing the ‘soft landing’ narrative…

Source: Bloomberg

On the week, financial conditions ‘tightened’ but remain around as ‘loose’ as they were in June when Fed Funds were 275bps lower…

Source: Bloomberg

With the largest non-quarterly OpEx today, we had a feeling something big was going to happen and stocks screamed higher from the moment the cash markets opened. Nasdaq rallied over 2% today…

Despite today’s surge, stocks ended the week lower (with The Dow back in the red YTD) with Nasdaq the prettiest horse in the glue factory (managing to ramp all the way into the green for the week today) and The Dow dumped over 3% on the week despite today’s melt-up…

After 7 straight days of short-squeeze, ‘most shorted’ stocks reversed on Wednesday and Thursday this week (only to see Friday bring the squeeze back) which left them down modestly on the week…

Source: Bloomberg

Technical levels dominated price action this week with the S&P breaking below its 200DMA and then trading around its 50DMA. Today saw the S&P rally all the way up to its 200DMA perfectly tagging it before stalling…

And Nasdaq flip-flopped between its 50- and 100-DMAs…

The big banks are very mixed since their earnings were announced with Goldman the biggest loser and Morgan Stanley leading the pack…

Source: Bloomberg

Treasuries were dumped for the last two days, erasing the gains from the start of the week and dragging 30Y Yields higher on the week (as the short-end outperformed)

Source: Bloomberg

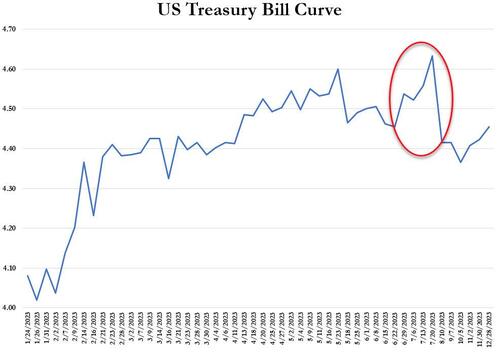

At the shortest-end of the curve, the T-Bill curve is starting to ‘kink’ around the June/July period in anticipation of the debt-ceiling debacle…

The Dollar ended the week very modestly higher after some noise midweek shifted the greenback out of its narrow range…

Source: Bloomberg

Cryptos rallied this week with Ethereum outperforming Bitcoin (and Solana leading them all)…

Source: Bloomberg

Bitcoin is up for the 16th day of the last 17 days, closing above $22,000, at its highest since September 2022 (above the November pre-FTX-plunge highs)…

Source: Bloomberg

Commodities were broadly higher on the week with Oil, Gold, and Copper all higher while NatGas ended lower after a very noisy week…

Source: Bloomberg

Gold closed the week at its highest since April 2022, finding support at $1900 numerous times…

Oil prices closed the week at their highest since November with WTI above $81…

Source: Bloomberg

Which means brace yourselves for gas prices at the pump to soar again soon

Source: Bloomberg

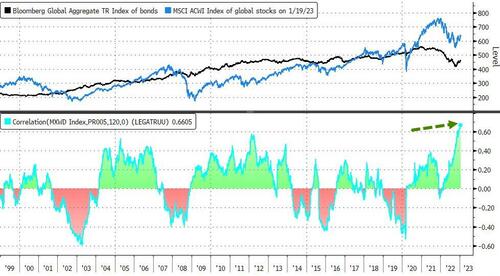

Finally, we note that global stocks and bonds are moving in sync like never before, thanks to expectations for a Federal Reserve pivot as well as a Chinese economic rebound.

Source: Bloomberg

As Bloomberg notes, the 120-day rolling correlation between the MSCI ACWI Index for world equities and the Bloomberg flagship gauge for bonds has reached the highest in data going back to 1998. The unusual level suggests the correlation could start to wind down, meaning the two asset classes are likely to start moving in opposite directions.

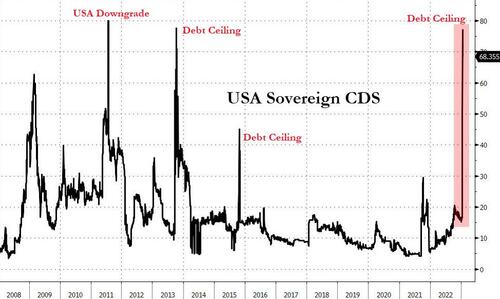

The market appears to be starting to worry about the debt-ceiling debacle as US sovereign credit risk is soaring…

Source: Bloomberg

…and there’s nothing The Fed can (or will) do about that.

Tyler Durden

Fri, 01/20/2023 – 16:00

via ZeroHedge News https://ift.tt/TNZ7EVi Tyler Durden