A Record Number Of Americans Expect Stocks To Tumble Over Next Six Months

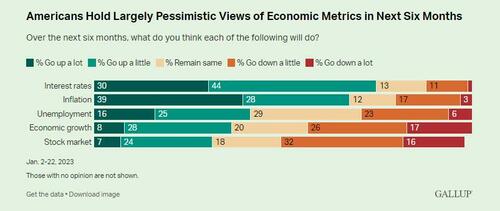

In a glowing testament to the disaster that is the administration of Biden’s handlers, Americans now predict negative rather than positive outcomes for five key aspects of the U.S. economy over the next six months. Higher inflation, unemployment and interest rates, as well as reduced economic growth and stock market values, are all expected. Furthermore, a record 48% of Americans expect the stock market to fall over the next 6 months, while just 18% think the market will stay the same in the next six months, and 31% think it will go up, according to Gallup.

Here are the details from the latest Gallup poll.

A majority of U.S. adults (67%) expect inflation to rise, although more (79%) predicted that it would last year. At the same time, the public’s outlook for unemployment and the stock market have become more pessimistic and are now negative on balance. Expectations for economic growth and the stock market are the most pessimistic in Gallup’s periodic trend.

Gallup first asked Americans in October 2001 what they expected would happen with these five aspects of the economy and updated them monthly until 2006. Since then, Gallup has asked about them eight times, though not during the late 2007-early 2009 Great Recession. The latest results are from the Jan. 2-22 Mood of the Nation poll, which also found that Americans’ confidence in the economy remains low, mentions of inflation as the nation’s most important problem are still elevated and perceptions of the job market are positive but weakened compared with a year ago.

The public’s gloomy outlook for the economy was similarly predicted in a November-December Gallup poll that found eight in 10 Americans thought 2023 would be a year of economic difficulty. Majorities expected that inflation and unemployment would rise and the stock market would fall.

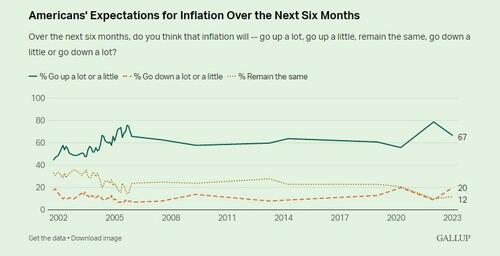

Rise in Inflation Expected by Smaller Majority Than in 2022

While Gallup has typically found U.S. adults predicting inflation will rise, last year’s 79% was the highest percentage on record. In 2021, the U.S. inflation rate began to climb to levels last seen more than 40 years earlier, and 55% of Americans said in late 2022 that inflation had created hardship for them. After peaking in June 2022, the inflation rate has been slowly declining.

The 67% of U.S. adults who now expect inflation will rise in the coming months, though down 12 percentage points from 2022, far outpaces the 20% who think it will decline and the 12% who say it will remain the same. The current figure is similar to readings in late 2004 and 2005, although high inflation did not materialize at that time.

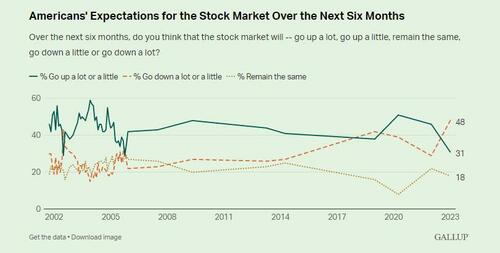

Record-High Percentage Predict Stock Market Decline

Americans are likely factoring the stock market’s recent poor performance into their outlook for 2023, after just ending its worst year since the Great Recession. A record-high 48% plurality of U.S. adults now predict the market will fall in the first half of 2023; 18% expect that it will remain the same, while 31% say it will go up.

It is possible Americans would have been even more pessimistic than now about the stock market during the Great Recession and financial crisis, when stocks lost much more value than they did in 2022. Gallup didn’t ask this question during that period but did find in April 2008 that 62%, near the record high, thought it was a bad time to invest in the stock market.

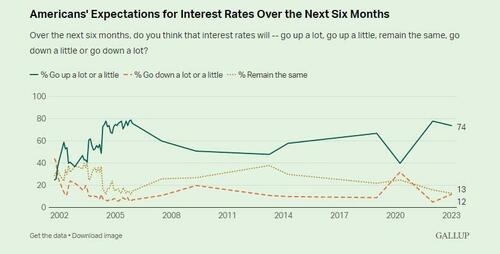

Broad Majority Continue to Say Interest Rates Will Rise

In most years since 2001, Americans have been far more likely to say interest rates would go up rather than go down or remain the same. In response to high inflation, the Federal Reserve raised interest rates seven times in 2022, and 74% of Americans predict that interest rates will increase over the next six months. (The January poll was completed before the Fed’s Feb. 1 announcement of the latest rate increase.) Equal percentages think rates will go down (12%) or remain the same (13%).

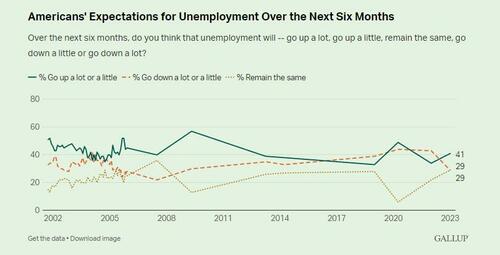

Unemployment Increase Expected in Coming Months

Although the U.S. unemployment rate was relatively low and steady throughout 2022, Americans’ expectation that it will increase in the first half of 2023 rose seven points over the past year, to 41%.

Last year, more U.S. adults thought the unemployment rate would decrease rather than remain the same or increase — but this year, belief that the jobs situation will worsen outpaces optimism by 12 points. While 41% say unemployment will rise, 29% say it will go down and the same proportion think it will remain the same. This change may stem from the recent highly publicized layoffs in the technology sector and concerns by some economists that the interest rate hikes may lead to an economic recession. The poll was completed before the January U.S. unemployment data were released. These data show an unexpected improvement in the labor market, resulting in the lowest unemployment rate since 1969.

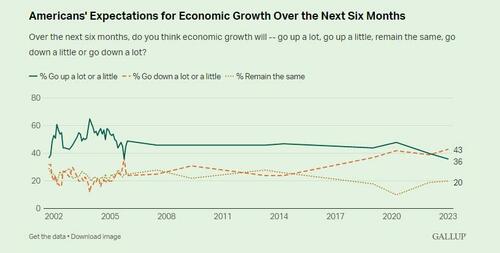

Views of Economic Growth Have Worsened Slightly Since 2022

The U.S. economy grew in the last two quarters of 2022, but Americans are skeptical about gross domestic product continuing on that path in 2023. More U.S. adults now say they expect GDP will go down (43%) than think it will go up (36%) or stay the same as it is now (20%).

Last year, the public was evenly divided between predicting an increase and a decrease in the economy. This is the first time Gallup has seen more Americans believing it will decrease rather than increase, though it is likely that would have been the case during the Great Recession.

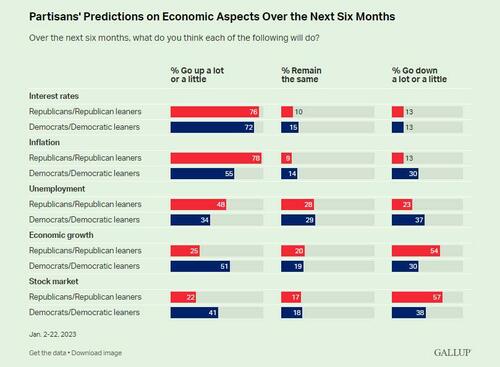

Republicans More Pessimistic Than Democrats on Most Economic Aspects

Republicans’ expectation that inflation will rise is 23 points higher than Democrats’, and Republicans are more likely to predict the stock market and GDP will go down. The only metric that doesn’t garner a majority of Republicans holding negative views is unemployment, yet nearly half think it will rise in the coming months, while the others are divided over whether it will decrease or remain steady.

Nearly equal majorities of Republicans and Republican-leaning independents (76%) and Democrats and Democratic-leaning independents (72%) think interest rates will rise over the first six months of 2023, but Republicans are much more pessimistic than Democrats about the other four aspects.

Democrats are most positive about GDP, with just over half saying they think it will increase. They are nearly evenly divided in their predictions for the stock market and unemployment.

Bottom Line

High inflation, interest rate hikes, a rough end to 2022 for the stock market and recent big tech layoffs are all likely contributing to Americans’ pessimistic views of key U.S. economic conditions for the first half of 2023. Despite the stock market’s strong start to the year, indications that inflation may be easing, better-than-expected economic growth in late 2022 and continued low unemployment, the public is bracing for a 2023 marked by worsening economic conditions.

Tyler Durden

Tue, 02/07/2023 – 11:05

via ZeroHedge News https://ift.tt/93UsLNQ Tyler Durden