Markets On A Precipice As Speculation Runs Rampant

Authored by Simon White, Bloomberg macro strategist,

A rapid rise in speculative behavior driven by FOMO and a growing belief in a soft landing contains the seeds of its own destruction. Lower equity prices, significantly higher equity volatility and much wider credit spreads lie ahead.

If you thought that one of the steepest rate-hiking cycles would be enough to tame the most egregious of speculative behavior, think again. Equities have so far managed to navigate a narrow channel that presupposes recession and persistent inflation will be avoided.

Macro funds and CTAs are getting longer, suggesting they are chasing the move, while speculators remain net short, implying there is more buying capacity available.

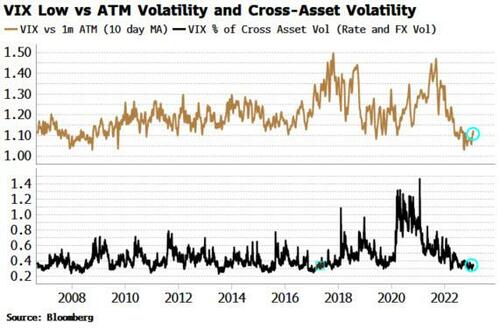

But once again, speculation is overreaching and leaving the market on increasingly unstable ground. As we saw in 2018, ever-declining volatility is not a good sign. The more it is repressed, the more likely it will spring back violently. The VIX recently hit lows not seen since the beginning of the bear market last January.

Why? One probable driver is the explosive rise in so-called 0DTE option trading. This has not only been a factor in lowering the VIX, it also increases crash risk for the market.

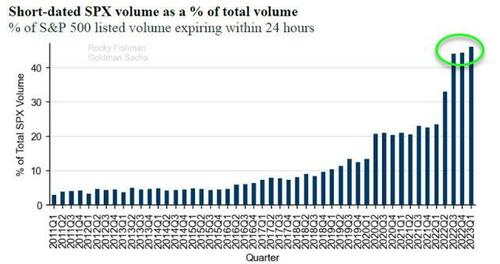

0DTE options are those with zero days to expiry. Their big advantage is they do not require margin to be posted as they are not held overnight. They have risen from 10%-20% of total S&P option volume in 2018-2021 to well over 40% in the last year. That’s a lot of implicit leverage that’s been added to the market.

Source: Goldman Sachs

S&P options now expire Monday to Friday, meaning people can trade 0DTE every day. Generally they are sold as the time decay is very steep on the last day. 0DTE strategies can be lucrative if you get them right.

The VIX is made up of options with ~30-day maturity so 0DTE does not directly impact it. Nonetheless, if more trading is done very close to expiry, and less in options with longer to run, this would be a factor in why the VIX has stubbornly moved lower despite the worst bear market in many years.

But as more people trade and hedge on the day of expiry, the market becomes increasingly exposed to sudden moves.

A large overnight move could be catastrophic, as it would lead to a big follow-through move when the market opens due to those who are not hedged properly – with any move exacerbated by the prevailing low liquidity in markets.

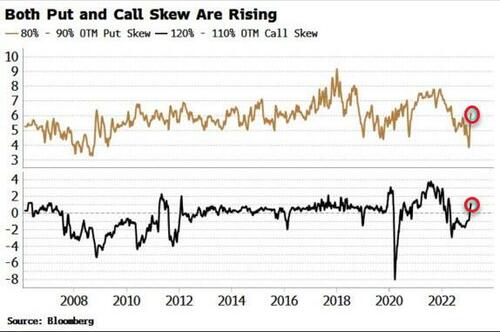

The VIX has also been depressed by falling demand for crash insurance, reflected in a drop in S&P put skew. This has led to the VIX being historically very cheap versus at-the-money implied volatility. Other assets’ volatility has not experienced the same downward pressure, with the VIX historically low compared to cross-asset volatility.

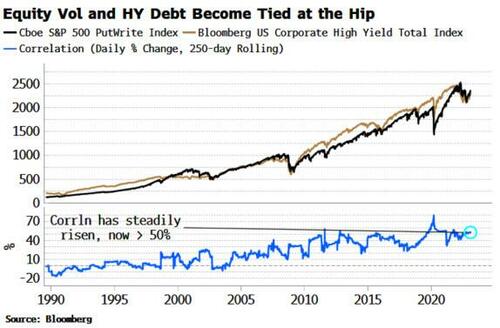

A preternaturally low VIX is also a factor causing credit spreads to tighten.

The two move closely together, one key reason being that equity volatility is used to estimate company default risk (via the Merton model), and hence model where the firm’s credit spread should trade. (The equity of a firm is taken to be a perpetual call option on the solvency of the firm, and the observable equity volatility is used to help estimate the firm’s probability of default via Black-Scholes).

The rising linkage between credit spreads and equity volatility can be seen by considering that buying HY debt in a company is functionally similar to selling a put. But that similarity has become increasingly closer over the last few decades, with the correlation between HY debt and an S&P put-writing strategy steadily rising.

That’s all good and well but it means that speculative behavior in equity markets can lower equity volatility, which can mechanically make default risk look better, even though the company’s fundamentals may not have changed.

The flipside is that a jump in equity volatility would lead to wider credit spreads – which already look biased much higher due to the credit cycle showing signs of nearing its end.

We are drawing closer to the denouement of this latest market saga. Both put and call skew are rising as upside is chased through call buying and cheap downside hedges are available, leading to upward pressure in the VIX in recent days.

Fevered speculation has led to inherent market instability which sets up equity and credit markets for a potentially fierce repricing. Rising equity volatility is the canary in the coal mine that should be watched very closely.

Tyler Durden

Tue, 02/07/2023 – 10:05

via ZeroHedge News https://ift.tt/PJ02Ryg Tyler Durden