US index futures jumped after suffering their worst weekly drop of 2023, as traders looked for fresh opportunities to buy stocks while assessing the outlook for growth. S&P 500 futures rose 0.5%, rising just shy of 4,000 by 7:45 a.m. ET after the underlying benchmark fell 1.1% in the last trading session. Nasdaq 100 futures rose by about 0.6% after the tech-heavy gauge tumbled 1.7% at the end of last week. European and Asian stocks also rose; the Bloomberg Dollar Spot Index turned red after retreating from the day’s highs, lifting most Group-of-10 currencies. Treasuries edged lower, mirroring moves in global bond markets. Gold was little changed, oil fell and bitcoin resumed losses after gains overnight

In premarket trading, cancer drugmaker Seagen soared after the Wall Street Journal reported that Pfizer is in early-stage talks to acquire the cancer therapy developer worth around $30BN. Pfizer shares slipped. Here are some other notable premarket movers:

- Best Buy (BBY) shares drop 1.8% after Telsey downgraded the electronics retailer, saying the company’s business is likely to experience a further decline in the near term.

- Fisker (FSR) climbs 7.8% after the carmaker posted 4Q results and forecast 8% to 12% annual gross margin and potentially positive Ebitda for 2023.

- FuboTV (FUBO) rises 8.2% after posting 4Q revenue that beat the average analyst estimate.

- Focus Financial Partners (FOCS) shares are halted after the company agreed to be acquired by affiliates of CD&R for $53 per share.

- Enphase Energy Inc. (ENPH) shares are up 1.9% after Janney Montgomery upgraded the company to buy, citing attractive valuation.

- Li-Cycle shares (LICY) rise 8% after the firm announced that one of its US subsidiaries had been granted a $375 million loan offer from the Biden administration.

- Lucira Health (LHDX) shares surge 240% after the FDA issued an emergency use authorization for the company’s Covid-19 and flu test.

- Payoneer Global (PAYO) gains 5% after Jefferies initiated coverage with a buy recommendation, saying the payments firm suffered from a “complexity discount.”

- Pulmonx Corp. (LUNG) rises 3.8% as Wells Fargo upgrades to overweight, saying the company’s fourth-quarter results “represent a turning point for the company.”

- Range Resources (RRC) shares slump 7.5% after Pioneer Natural Resources said it was not “contemplating a significant business combination or other acquisition transaction” in a statement Friday evening.

- Seagen (SGEN) shares soar 14% after the Wall Street Journal reported that Pfizer is in early-stage talks to acquire the cancer therapy developer.

- Tegna (TGNA) shares slump 22% after the Federal Communications Commission shelved Standard General’s proposed $5.4 billion buyout of the broadcaster.

- Union Pacific (UNP) shares climb 10% after the rail freight company said it was looking for a new CEO following pressure from a hedge fund.

- Universal Insurance Holdings (UVE) rises 1.8% after Piper Sandler upgraded the insurer to overweight, anticipating strong earnings in 2023 on higher prices and potential tort reform via a bill that seeks to reduce unnecessary litigation

- XPeng (XPEV) shares gain 5% after the Chinese electric-vehicle maker is included in the Hang Seng China Enterprises Index

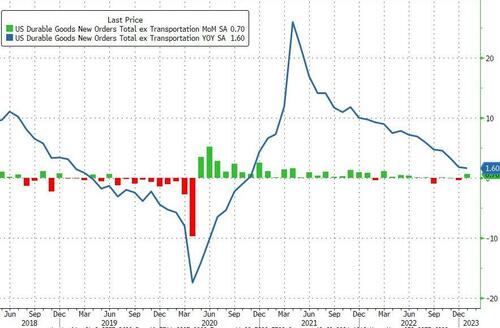

The S&P 500 has fallen over the past three weeks amid concerns that renewed price pressures will prompt more (and bigger) rate hikes from the US central bank. An unexpected acceleration in the personal consumption expenditures price index boosted expectations for policy tightening, while solid income and spending growth data further allayed fears of an imminent recession. Traders await durable goods data due later on Monday.

Monday’s advance may signal traders are looking “towards the end of the potential bearish correction brought by last week’s decreased appetite for riskier assets, after investors digested the prospect of longer hawkish monetary stances from central banks,” said Pierre Veyret, a technical analyst at ActivTrades.

Others – such as MS permabear Mike Wilson – remained bearish: Wilson said March will see stronger bear-market headwinds for stocks in a note on Monday. Fresh earnings downgrades will weigh on markets, with the S&P 500 potentially sliding as much as 24% to 3,000 points. Wilson also said that those treading into this market risk falling into a “bull trap”, a view echoed by Torsten Slok, chief economist at Apollo Global Management.

“A generation of investors has since 2008 been taught that they should buy on dips, but today is different because of high inflation, and credit markets and equity markets are underestimating the Fed’s commitment to getting inflation down to 2%,” Slok wrote in a note.

Stock markets that had mostly shrugged off forecasts for higher interest rates are finally giving way to a swift repricing of yields. Traders are now pricing US rates to peak at 5.4% this year, compared with about 5% just a month ago, as an acceleration in the Federal Reserve’s preferred inflation gauge dashes hopes for an imminent pause in policy tightening.

Meanwhile, JPMorgan strategists led by Mislav Matejka said last year’s strong outperformance in cheaper, so-called value stocks over growth peers is likely to reverse soon as the economic recovery slows. The next move for investors in the following month or two might be to go “outright underweight value versus growth,” they wrote in a note. Ironically, that comes as JPM initiated coverage of two big US online real estate firms, Zillow Group at overweight and Redfin at neutral, as it forecasts a recovery in the property market.

European stocks also rose as investors are tempted by lower prices following the largest weekly selloff since December. The Stoxx 600 is up 1.2% with tech, retail and consumer products the best-performing sectors. The bounce ignores the surge in German benchmark yields which hit 2.58%, the highest since 2011, on bets the European Central Bank will extend its tightening cycle beyond this year. Here are some of the biggest movers on Monday:

- Shell rises as much as 2.4% after Goldman Sachs upgrades the oil and gas company to buy from neutral, following a strong earnings season for oil majors

- Associated British Foods shares rise as much as 2.7% after the food processing and retailing company said it sees total sales for the first half more than 20% ahead of last year

- Michelin gains as much as 3.1% after Goldman Sachs upgraded the French tiremaker to buy from neutral, noting “underappreciated tailwinds” including lower raw material and logistics costs

- Hennes & Mauritz shares jump as much as 4.2% after Bank of America upgraded the clothing retailer to buy from underperform, citing prospects for a profit recovery this year

- Bunzl shares gain as much as 4.2%, hitting the highest intraday since August, after the distribution group’s results were marginally better than expected across the board, showing business model resilience

- Haleon shares rise as much as 1% after Bloomberg News reported the consumer health business, spun out of GSK last year, is exploring a divestiture of its ChapStick lip balm brand

- PostNL shares tumble as much as 12%, the most since October, after the Dutch delivery firm’s new FY23 Ebit guidance came in 43% below consensus

- Dechra Pharmaceuticals tumbles as much as 18% after the British animal health-care company posted a profit decline in the first half and forecast FY guidance that disappointed

Earlier in the session, Asian stocks declined as traders worry about the prospect of further interest rate increases by the Federal Reserve after an unexpected acceleration of US inflation. Investors were also cautious ahead of a key political meeting in China. The MSCI Asia Pacific Index dropped as much as 0.8%, led by technology and materials shares. Australia and South Korea were among the worst-performing markets, while Japan bucked the region’s trend following a pledge from the Bank of Japan governor nominee to maintain ultra-loose monetary policy. Chinese and Hong Kong benchmarks edged lower as investors eyed the National People’s Congress meeting starting this weekend. They are showing a preference for onshore stocks over Hong Kong peers amid expectations that more pro-growth policies will be announced.

A strong rally in Asian stocks has hit a wall this month amid renewed worries of US policy tightening and a lack of positive catalysts for Chinese shares. A hotter-than-expected set of data in the Fed’s preferred inflation gauge Friday spurred a hawkish recalibration of expectations for rate hikes, pressuring risk assets. Asian emerging markets will “certainly not be immune” from “spillover risks” of the rebound in US inflation, said Vishnu Varathan, Asia head of economics and strategy at Mizuho Bank. Prospects of tighter policy for a longer period “will hold feet to fire for valuations.”

Japanese equities closed mixed, as investors mulled the unexpected acceleration of US inflation data that suggested potential further interest rate hikes by the Federal Reserve. The Topix rose 0.2% to close at 1,992.78, while the Nikkei declined 0.1% to 27,423.96. The yen strengthened about 0.1% after tumbling 1.3% Friday to 136.48 per dollar. Fanuc contributed the most to the Topix gain, increasing 2.9% after it was upgraded at Nomura. Out of 2,160 stocks in the index, 1,478 rose and 591 fell, while 91 were unchanged. “Japanese equities were mainly influenced by the higher than expected US PCE data, and the rising US interest rates would make the environment tougher for growth stocks,” said Hirokazu Kabeya, chief global strategist at Daiwa Securities. “However, compared to US stocks, Japanese stocks are still supported by a weaker yen and this is likely to continue for some time.”

Australian stocks declined; the S&P/ASX 200 index fell 1.1% to close at 7,224.80, dragged by losses in mining shares. The materials sub-gauge dropped the most since Oct. 28, continuing a four-day losing streak, after iron ore slumped. In New Zealand, the S&P/NZX 50 index fell 0.9% to 11,793.33

In FX, the Bloomberg Dollar Spot Index was steady and the greenback traded mixed against its Group-of-10 peers. Sweden’s krona and the pound were the best performers while the New Zealand and Australian dollars were the worst.

- The euro was steady at $1.0550. Bund yields followed Treasury yields higher after an early drop. the 10-year yield rose to the highest since 2011 as traders are betting the ECB will extend its tightening cycle beyond this year, pushing back expectations for a peak in interest rates into 2024 for the first time. Focus is on speeches by policymakers

- The pound rose 0.2% against the dollar, snapping a three-day decline, to trade around 1.1966 amid speculation of an imminent deal on the Northern Ireland protocol. Gilts yields rose as bets on BOE rates pricing turned higher.

- The yen steadied near a two-month low as currency traders weighed remarks from BOJ governor nominee Kazuo Ueda at his second parliamentary hearing. Ueda said monetary easing should continue in support of the economy’s recovery, a comment that suggests he won’t seek an immediate change in policy if he is approved to helm the central bank

- The New Zealand dollar underperformed its G-10 peers. RBNZ chief economist Paul Conway said inflation is “far too high,” labor market is “incredibly tight”.

- The Australian dollar also tacked lower. RBA chief Philip Lowe’s expectation of further interest-rate rises prompted economists and money markets to narrow the odds of a recession

In rates, Treasury yields reversed a drop to inch up, led by the front end following a wider drop across German bonds, as traders wagered that the European Central Bank will extend its rate-hiking cycle further into 2024. US yields were cheaper by up to 1.7bp in front-end of the curve with 2s10s flatter by almost 1bp; 10-year yields around 3.95%, less than 1bp cheaper vs. Friday session close with Germany 10-year lagging by 3bp vs. Treasuries. Bund futures are lower as traders push back bets on when ECB rates will peak until 2024 for the first time. German 10-year yields are up 4bps.

In commodities, oil fell as concerns that the Fed will keep on raising rates eclipsed the latest disruption to supplies in Europe and optimism over a demand recovery in China; WTI hovered around $76.30. Spot gold is flat at around $1,810.

Bitcoin is modestly firmer on the session, +1.0%, but off initial best levels and well below 24k. RBI Governor Das said at the G20 that there is now wide recognition of major risk with crypto.

Looking at today’s calendar, we get the February Dallas Fed manufacturing activity, January durable goods orders, and pending home sales; elsewhere we also get Japan January retail sales, industrial production, Italy February manufacturing confidence, economic sentiment and consumer confidence index, Eurozone February services, industrial and economic confidence, January M3, Canada Q4 current account balance. Fed speaker slate includes Jefferson at 10:30am; Goolsbee, Kashkari, Waller, Logan, Bostic and Bowman are scheduled later this week. On the earnings front, Occidental Petroleum, Workday, and Zoom report.

Market Snapshot

- S&P 500 futures up 0.5% to 3,994.25

- STOXX Europe 600 up 1.0% to 462.49

- MXAP down 0.5% to 157.92

- MXAPJ down 0.8% to 511.47

- Nikkei down 0.1% to 27,423.96

- Topix up 0.2% to 1,992.78

- Hang Seng Index down 0.3% to 19,943.51

- Shanghai Composite down 0.3% to 3,258.03

- Sensex down 0.4% to 59,220.58

- Australia S&P/ASX 200 down 1.1% to 7,224.81

- Kospi down 0.9% to 2,402.64

- German 10Y yield little changed at 2.56%

- Euro little changed at $1.0555

- Brent Futures up 0.4% to $83.48/bbl

- Gold spot down 0.1% to $1,809.86

- U.S. Dollar Index little changed at 105.15

Top Overnight News from Bloomberg

- Three quarters of the 1,500 UK business leaders polled by BCG’s Centre for Growth believe the economy will shrink in 2023 but only 20% plan to shed staff, fewer than the 29% who plan to increase headcount: BBG

- Rishi Sunak and Ursula von der Leyen will meet in the UK in the early afternoon on Monday for final talks ahead of an expected announcement of a post-Brexit settlement for Northern Ireland: BBG

- The ECB is very likely to go ahead with its intention to raise interest rates by a half-point when it meets next month, President Christine Lagarde told India’s Economic Times: BBG

- Bloomberg’s aggregate index of eight early indicators suggests China’s economy rebounded in February after the long holiday, although it points to an uneven recovery with strong consumption following the scrapping of Covid rules but lagging industrial activity: BBG

- Macron announced he will visit China in April and hopes to encourage Beijing to pressure Moscow into reaching a settlement of the Ukraine war. SCMP

- New home sales by floor area in 16 selected Chinese cities rose 31.9% month-on-month in February, compared with a fall of 34.3% in January, according to China Index Academy, one of the country’s largest independent real estate research firms. RTRS

- American companies, including McDonald’s, Starbucks, Ralph Lauren, Tapestry, and others, are expanding in China in anticipation of a consumer-led rebound in the economy as the post-reopening recovery continues. WSJ

- China Renaissance confirmed Chairman Bao Fan has been assisting in a Chinese probe since he disappeared abruptly earlier this month. The investigation is being run by authorities, and Renaissance will “cooperate and assist with any lawful request.” It was reported last week that Cong Lin, the firm’s former president, has been involved in a probe since September. BBG

- BOJ policy – incoming governor Kazuo Ueda says it’s premature to discuss normalization as “big improvements” must be achieved in the country’s inflation trajectory before changes can happen (Ueda says the benefits of monetary easing exceed the costs). RTRS

- Russia has halted supplies of oil to Poland via the Druzhba pipeline, a move that comes one day after Poland sent its first Leopard tanks to Ukraine. RTRS

- US insurance regulators on Monday will meet to consider boosting capital charges on complex corporate loan instruments that some in the industry warn are creating excessive risk. The issue pits insurers backed by large private equity firms such as Blackstone, Apollo Global and KKR — who are increasingly investing in the loans — against traditional life insurers such as MetLife and Prudential Financial, who warn of growing risks. FT

- Pfizer is in early-stage talks to acquire biotech Seagen, valued at about $30 billion, and its pioneering targeted cancer therapies. WSJ

- Hedge fund Soroban Capital Partners is pushing Union Pacific Corp. to replace Chief Executive Lance Fritz, arguing the railroad has underperformed on his watch, according to people familiar with the matter. WSJ

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded cautiously heading into month-end and a slew of upcoming releases including Chinese PMI data, with headwinds also from the US where firmer-than-expected Core PCE data spurred hawkish terminal rate bets. ASX 200 was negative as participants digested a deluge of earnings and with the mining industry leading the retreat seen across nearly all sectors aside from energy which benefitted from a jump in Woodside Energy’s profits. Nikkei 225 price action was contained by a lack of pertinent macro drivers and with BoJ Governor nominee Ueda’s largely reiterated prior comments at the upper house confirmation hearing. Hang Seng and Shanghai Comp. were choppy with initial pressure amid geopolitical frictions after the G20 finance ministers meeting failed to agree on a communique due to opposition from Russia and China, while National Security Adviser Sullivan also warned there will be a real cost if China provides military assistance to Russia for the Ukraine war. However, Chinese stocks gradually recovered from the early weakness and briefly turned positive with sentiment helped by a continued liquidity injection and after China drafted guidelines to regulate financial support in the housing rental market, although the gains proved to be short-lived.

Top Asian News

- China drafted guidelines to regulate financial support in the housing rental market and began to solicit public opinion, according to China.org.cn.

- Macau dropped COVID-19 mask mandates for most locations aside from public transportation, hospitals and some other areas, according to Reuters.

- BoJ Governor Kuroda commented that he is resolved to keep ultra-loose policy and that the BoJ expects core consumer inflation to slow beyond 2% in both fiscal 2023 and 2024, according to Reuters.

- BoJ Governor nominee Ueda says CPI growth will slow below 2% in fiscal 2023 and that it takes time for CPI to meet the 2% target stably and sustainably, while he added that the BoJ’s current monetary easing is appropriate and that it is appropriate to continue monetary easing from now on as well. Adds, changing the 2% inflation target into a 1% target would strengthen the JPY in the short-term, weaken it long-term. Overshooting commitment is aimed at exerting powerful announcement effects on policy, need to be mindful of risk of inflation overshooting too much. Targeting shorter-dated JGBs than current 10yr yield is one idea if BoJ were to tweak YCC in the future, but there are many other options. Does not think Japan has reached the reversal rate, in which financial transmission channels are hurt so much that the demerits of easing exceed benefits.

European bourses are firmer across the board, Euro Stoxx 50 +1.8%, after a cautious APAC handover following Friday’s selling pressure. Sectors are all in the green with Energy names at the top of the pile, given benchmark pricing and Shell’s upgrade at GS. Stateside, futures are currently posting more modest upside of around 0.5% with Fed’s Jefferson (voter) the session’s main event. Tesla’s (TSLA) German plant has hit a production level of 4,000 per week, three weeks ahead of schedule, according to Reuters.

Top European News

- UK PM Sunak and European Commission President von der Leyen will meet at 12:00GMT/07:00EST in Windsor, according to BBC; if there is a deal, a press conference could be around 15:30GMT. Earlier, UK PM Sunak’s office said UK PM Sunak will meet with EU’s von der Leyen for talks on Northern Ireland Brexit deal late lunchtime on Monday and will hold a Cabinet meeting later on Monday. Furthermore, PM Sunak and von der Leyen will hold a news conference if a deal is reached, while Sunak will also address parliament if there is a deal.

- UK ministers are unlikely to quit re. the Brexit deal, with the likes of Steve Baker and others liking what they are hearing but waiting to see the full text, according to Times’ Swinford; ERG say they would love to back the deal but if the DUP does not back the deal it cannot and won’t support it.

- UK PM Sunak said they are giving it everything they’ve got regarding talks for a post-Brexit deal for Northern Ireland and he will try to resolve the concerns the DUP Party have regarding a new Brexit deal for Northern Ireland. It was later reported that PM Sunak said he won big concessions from the EU, according to The Sunday Times and The Times.

- UK Deputy PM Raab said there is real progress on a trade deal and he is hopeful for good news on the Brexit deal within days, not weeks, and also noted that Northern Ireland’s DUP does not have a de-facto veto over the Brexit deal. In other news, Raab said he will resign if an allegation of bullying against him is upheld, according to Reuters.

- ECB’s Lagarde said headline inflation is still unacceptably high and core CPI is at a record level, while she added that they want to bring inflation back to the 2% target and noted that rate decisions are to be data dependent.

- Magnitude 5.7 earthquake that struck the Eastern Turkey region has been revised to 5.2, according to the EMSC.

FX

- DXY retained a bid between Fib and psychological level within 105.360-070 range; though has erred towards the lower-end of these parameters going into the US session.

- Sterling ‘outperforms’ after a dip through 200 DMA vs Buck on UK-EU NI trade deal optimism, with EUR/GBP within 10 pips of 0.8800 at worst.

- Kiwi flags as NZ Q4 retail sales fall and Aussie feels more contagion from Yuan weakness; antipodeans near 0.6150 and 0.6710 respectively.

- Euro pivots 1.0550 vs the Dollar and Yen pares back from sub-136.50 amidst Fib support nearby.

- PBoC set USD/CNY mid-point at 6.9572 vs exp. 6.9586 (prev. 6.8942)

Commodities

- WTI and Brent are a touch softer though have lifted off overnight USD 75.58/bbl and USD 82.38/bbl lows given the improvement in risk sentiment throughout the European morning.

- Though, the benchmarks are shy of USD 76.82/bbl and USD 83.60/bbl peaks with numerous geopolitical updates factoring into the overall indecisive price action.

- Russia halted supplies of oil to Poland via the Druzhba pipeline, according to PKN Orlen’s CEO. Subsequently, Russia’s Transneft says payment orders for oil shipments to Poland were not issued in the second half of February, no oil flows to Poland currently, via Tass; paperwork for oil supplies to Poland has not been completed.

- Crude oil deliveries via the Druzhba pipeline to the Czech Republic are running as planned, according to Mero.

- Spot gold is little changed with the yellow metal in a tight sub-10/oz range above the USD 1800/oz handle, taking its cue from the similarly cagey USD.

- Base metals are, broadly speaking, firmer following overnight weakness but remain in proximity to the troughs from Friday’s session.

Fixed Income

- Bonds remain in bear clutches after another failed recovery rally.

- Bunds probe new cycle low at 133.61 (session high 134.36) have fallen just shy of key resistance area, associated 10yr at a YTD peak of 2.57%.

- Gilts wane just two ticks below 101.00 and test bids/support into 100.00 and T-note hugs base of 111-07/16 range ahead of US data, Central Bank speakers and crunch UK-EU Brexit talks.

Geopolitics

- Russia’s Kremlin, on China’s peace plan, says no conditions for peace ‘at the moment’ in Ukraine, according to AFP.

- G20 Finance Ministers meeting concluded without a joint communique as China and Russia opposed the draft with the two countries said to be upset by the use of a G20 platform to discuss political matters, according to sources cited by Reuters. India’s chair statement noted that there was a discussion about the war in Ukraine and it reiterated the G20 position on deploring in the strongest terms aggression by Russia, as well as reiterated the G20 position demanding Russia’s complete and unconditional withdrawal from Ukrainian territory.

- Russian President Putin said Russia has taken into account NATO’s nuclear potential and claimed that the west wants to liquidate Russia, according to TASS.

- Russian Wagner Group boss Prigozhin said his fighters captured the village of Yahinde which is north of Bakhmut, according to Reuters.

- US President Biden said on Friday that he is ruling out Ukraine’s request for F-16 aircraft for now but added they have to put Ukrainians in a position where they can make advances this spring and summer. Biden also said he doesn’t anticipate a major initiative on the part of China to provide weapons to Russia and that he hasn’t seen anything in the Chinese peace plan that would be beneficial for anyone but Russia, while he also suggested it is possible that Chinese President Xi did not know about the Chinese spy balloon, according to an ABC News interview.

- US National Security Adviser Sullivan said China has made the final decision regarding providing aid to Russia and has not taken the possibility of providing lethal aid to Russia off the table, while he noted the consequences have been made clear to China and warned there will be a real cost if China provides military assistance to Russia for the Ukraine war, according to an interview with ABC News. There were also comments from Republican lawmaker McCaul that China is thinking of sending drones and other lethal weapons.

- Belarus President Lukashenko will pay a state visit to China from February 28 to March 2. “The visit will serve as an opportunity for the two sides to further promote comprehensive cooperation”, according to Global Times.

- Germany, France, and the UK are considering making concrete security guarantees to Ukraine as an incentive for Ukrainian President Zelensky to engage in peace talks with Russia, according to the WSJ.

- German Defence Minister Pistorius commented regarding the Chinese peace plan and stated that they will judge China by its actions, not its words, according to Reuters.

US Event Calendar

- 08:30: Jan. Durable Goods Orders, est. -4.0%, prior 5.6%

- Jan. -Less Transportation, est. 0.1%, prior -0.2%

- Jan. Cap Goods Ship Nondef Ex Air, est. 0%, prior -0.6%

- Jan. Cap Goods Orders Nondef Ex Air, est. -0.1%, prior -0.1%

- 10:00: Jan. Pending Home Sales (MoM), est. 1.0%, prior 2.5%

- Jan. Pending Home Sales YoY, prior -34.3%

- 10:30: Feb. Dallas Fed Manf. Activity, est. -9.2, prior -8.4

Central Bank Speakers

- 10:30: Fed’s Jefferson Discusses Inflation and the Dual Mandate

DB’s Jim Reid concludes the overnight wrap

As we close out a tougher second month of the year than the first tomorrow night, Henry pointed out an interesting stat to me on Friday. January was the best January for the Global Bond Ag index this century whereas February so far is on course to be the worst February over the same period. The very strong financial market performance between mid-October and end-January was in our opinion based mostly around US terminal pricing being remarkably stable between 4.75-5.1%. In the previous 9-10 months it was constantly being repriced from around 1% to 5% causing chaos in the financial world.

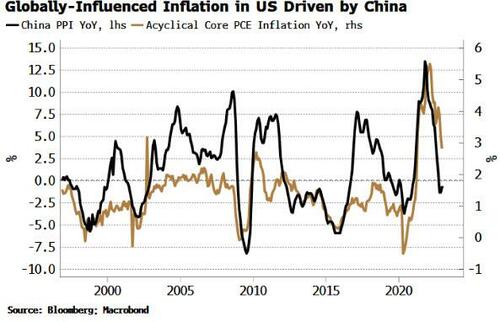

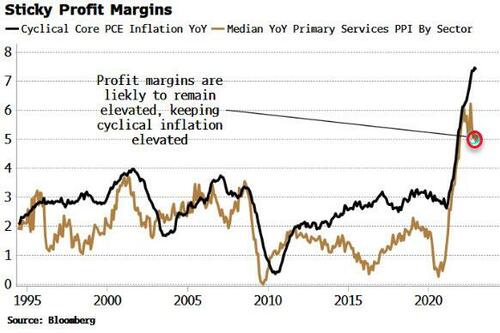

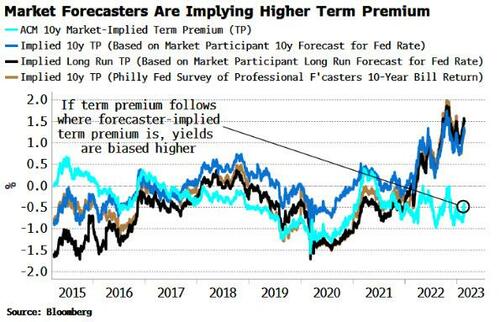

On Friday, US terminal closed at 5.4%, catching up to DB’s street leading 5.6% forecast. Clearly this has been bubbling up since payrolls (Feb 3), the CPI revisions (Feb 10), CPI beat (Feb 14), retail sales beat (Feb 15), and even things like Manheim used prices spiking higher again in January and February. Last Friday’s core PCE was another important piece of evidence with the 0.6% mom print above expectations of 0.4%. Even though the concern was that it would beat, this added fuel to the fire and markets still struggled to deal with the ramifications with 2yr, 10yr and terminal up +11.6bps, +6.8bps and +5.3bps to 4.814%, 3.943% and 5.40% respectively. 2yr yields are the highest since July 2007 and terminal the highest this cycle.

For core US PCE, the 3m, 6m and 12m annualised numbers are now 4.8%, 5.1% and 4.7% and thus strongly hint at inflation stickiness. With this data it’s tough to rule out a return to 50bps hikes even if that’s not yet the base case. While that uncertainty is there, markets will stay on edge.

In credit we downgraded our tactical bullishness in our “Credit: Rally ends soon” (Jan 30) note (link here) and suggested reducing exposure to dollar credit immediately. The biggest challenge though is when to officially run for the preverbal hills given we’ve had a long standing YE 23 target for HY of +860bps linked into our US recession call by year end. In the near-term we’re a little more relaxed on European credit. Indeed our credit team published a €HY update this morning looking at tight spreads in the face of growing fundamental vulnerabilities and the highest share of bonds rated B or worse in the last 10 years. However with supply unlikely to pick up materially, favourable technicals should keep spreads supported for now. Still, we think concerns about deteriorating credit metrics will eventually prevail and see €HY selling off in H2’23 alongside the US market when signs of a growth slowdown become even more tangible (see here for the full text).

Linked into this view, the recent US data probably makes us more confident of a hard landing given the boom-and-bust nature of this cycle that has been increasingly clear step-by-step over the last 2-3 years. This trend first emerged with the extraordinarily excessive covid stimulus, which in turn led to an enormous spike in the money supply, which brought structural inflation, and was always going to require an immense amount of tightening to control. An immaculate disinflation and soft landing from here would defy all historical precedent. Time will tell if we’re wrong and history needs to be rewritten but this feels a fairly straight forward US cycle to predict.

For this week, with the current sensitivities over prices, all eyes will be on the flash February European CPI releases (France Tues, Germany Weds, Italy and EA Thurs) and labour market data released throughout the week. The CPI numbers follow Friday’s upward revisions for the January report in the Euro Area, where core inflation was revised up a tenth to a new record of +5.3%. We also have the global PMIs (and US ISMs) with manufacturing on the first day of the month (Wednesday) and services (Friday).

ECB speakers will have plenty of opportunity to reflect on the data with at least 8 appearances already scheduled for next week. For a more backward-looking assessment, markets will also have the ECB’s account of the February meeting due Thursday to read through. Our own European economists upgraded their ECB call last week and now see two +50bps hikes in March/May followed by a final +25bps hike in June, which would imply a terminal of 3.75%, up from 3.25% previously (see full note here). Fed speakers are also prevalent as you’ll see in the day-by-day week ahead. There are six FOMC voters and there is a lot for them to chew over at the moment, especially after Friday’s PCE data.

Outside of the ISMs, US data will revolve around consumer and manufacturing activity. That will include the Conference Board’s consumer confidence index tomorrow, Chicago PMI (also tomorrow) and a host of regional central bank indices. Other notable indicators due include durable goods orders today and the advance goods trade balance tomorrow.

Asian equity markets are trading lower this morning with the KOSPI (-1.19%) leading losses across the region while the Hang Seng (-0.75%), the CSI, (-0.21%) the Shanghai Composite (-0.12%) and the Nikkei (-0.19%) all trading in the red. In overnight trading, US stock futures are fairly flat alongside US yields.

Earlier this morning, the government’s nominee for the Bank of Japan (BOJ) Governor, Kazuo Ueda in his speech to the parliament stressed the need to maintain the central bank’s ultra-loose policy to support the Japanese economy despite various market side-effects. Meanwhile, candidates for the BoJ deputy governor (Uchida and Himino) will appear for hearings in the Upper House tomorrow, following this week’s Lower House hearings.

Looking back on last week now, both equities and fixed income retreated as markets priced in further central bank hikes following mounting evidence that inflation was continuing to prove persistent. The selloff gathered pace on Friday, following the aforementioned US PCE inflation data surprising firmly to the upside, with headline PCE at +0.6% (vs +0.5% expected) month-on-month, and +4.7% (vs +4.3% expected) year-on-year. Further adding to the view that inflation is durable, core PCE inflation also came in above consensus, with the month-on-month print at +0.6% (vs +0.4% expected) whilst year-on-year came in at +4.7% (vs +4.3% expected).

This data led markets to swiftly priced in a more aggressive price of rate hikes from the Fed. In particular, there was growing speculation that the Fed might step up their hikes to 50bps again, with a +30.3bps move priced into the next meeting in March, up from +27.5bps at the start of the week. US terminal rate timing is starting to be evenly balanced between July (5.400%) and September (5.401%), rather than the July peak we’ve had for several weeks. It’s also at the highest level of the cycle. The pricing for the July meeting climbed up +11.8bps last week (+5.3bps on Friday), while the September meeting pricing rose +14.6bps last week (+6.9bps on Friday). Expectations also increased for rates remaining higher for longer, with the December meeting now implying a 5.28% rate. This was up +11.0bps on Friday and +21.6bps on the week – marking a fifth consecutive weekly increase.

Renewed expectations of additional hikes by central banks triggered a sell-off in both US and European equities on Friday. The S&P 500 fell back -1.05% on Friday, finishing off the week down -2.67% and marking its worst weekly performance so far this year. The Nasdaq similarly retreated, down -3.33% last week (-1.69% on Friday), its largest weekly down move since mid-December. European equities fell back too, with the STOXX 600 retreating -1.42% last week (-1.04% on Friday).

This sell-off was echoed across fixed income markets, with 10yr Treasury yields up +6.6bps on Friday and +12.8bps over the course of last week. 2yr Treasuries significantly underperformed, as yields rose +11.6bps on Friday and +19.7bps over the week, reaching their highest level since July 2007. It was a similar story in Europe, with the 2yr German yield up +11.7bps on Friday in their largest up move since December and hitting their highest level since October 2008. Over the course of the week, that left them up +15.3bps at 3.03%. In the meantime, 10yr bund yields rose +9.7bps last week (+5.9bps on Friday) to 2.54%, and the German 2s10s curve inverted to -50bps after it fell -5.6bps on Friday, which made up nearly the entirety of the -5.8bps flattening last week.

Finally, commodity markets fell back most of last week before a rally in oil on Friday (WTI +1.23% & Brent +1.16% Friday) left WTI crude down just -0.03% on the week at $76.32/bbl and Brent crude up +0.19% at $82.16/bbl. On the other hand, metals saw continued selling on Friday, with copper futures falling back -3.81% overall (-2.64% on Friday), and nickel down -4.93% last week (-3.33% on Friday). Looking at the market more broadly, the Bloomberg Industrial Metals Index fell back -3.17% over the course of last week (-2.44% on Friday). All this likely down to some concerns that the Chinese reopening isn’t quite as smooth and bouyant as hoped.