Via SchiffGold.com,

Most people believe the Federal Reserve stabilizes the economy and our money. In reality, the central bank incentivized debt and destroys wealth.

Is there a way to sidestep the destructive forces of central banking and fiat money?

T.W. Thiltgen believes there is a freedom train we can escape on – gold.

The following guest post was written by T.W. Thiltgen. The opinions expressed are his and don’t necessarily reflect those of Peter Schiff or SchiffGold.

I pose this question to you so that you can begin to consider that there is currently a macroeconomic problem that is more important than all other problems this country faces.

That macro condition is the relentless destruction of capital throughout the world and the US in particular.

Merriam-Webster Dictionary defines capital as “accumulated possessions to bring in income.”

For our purposes here, I will just call it SAVINGS.

In economics, one of the important identities is S=I or Savings = Investment.

You cannot invest if you have not saved, and you will be able to invest less if your savings fall. This may seem obvious but bear with me.

Your savings can be destroyed by other than your own bad investment decisions. Negative real interest rates (interest rates adjusted for inflation) are the central driver in the destruction of capital for at least the last 14 years from the start of the 2008-2009 collapse.

By keeping interest rates below the rate of inflation, the Federal Reserve has destroyed saving on an unimaginable scale. Even today, US Treasury interest rates are still 3% points below the rate of inflation. And that’s using the government’s numbers. The real inflation rate using the methodology of the 1980s would put today’s inflation rate near 15%. Either of these numbers is disastrous, but taking the average of the number between 7% and 15% or 11 ½ % means that the value (purchasing power) of your savings is being destroyed in a very short number of years. Even if inflation falls back to 3 – 4%, your real inflation-adjusted saving will decline at a rate that will ultimately lower your standard of living.

Forgetting savings for a moment, the reason is because real wages never keep up with inflation. This is why that real disposable income is less today than in the early 1970s. We are now living on capital generated by past generations. We are destroying the seed corn left to us by those previous generations. Unless going forward you as an individual can maintain your inflation-adjusted purchasing power, you are destined to suffer a serious decline in your standard of living, as is the rest of the country.

It will be very difficult to maintain purchasing power because you have to pay taxes on any interest income received even when the purchasing power of the principal and interest you receive back has lower purchasing power than when you bought the CD or Treasury Securities. You are actually paying taxes on phantom profits that you got in return. Are you starting to ask if the title of this article is possibly true?

As negative real interest rates continue, bank deposits and currency are becoming less valuable as a claim on goods and services. There are currently $18 trillion in bank deposits and $2 trillion in fiscal notes (cash). If negative rates continue, it is only a matter of time before holders of these deposits and currency begin to convert them to something else (anything else), rental property, land, gold, art, etc. Nobody will let those $20 trillion lose purchasing power at the rate that is occurring now.

As deposits are withdrawn, the foundation of bank lending will be reduced, causing loans to be called in. This will accelerate the collapse of the economy. If the Federal Reserve tries to stop this loss of deposits by continuing to raise interest rates and thereby giving depositors a real rate of return, then the high interest rates coupled with the massive debt load will make many debt obligations unpayable and a financial disaster much worse than 2008-2009 will occur. And if they give in and print more money when the economy turns down, inflation will explode again.

As you can see from the choices above, the possibilities of a soft landing in the economy, from this situation are VERY LOW.

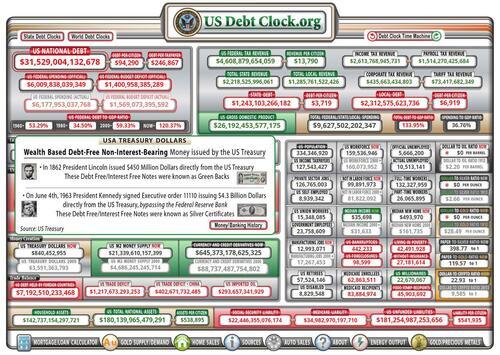

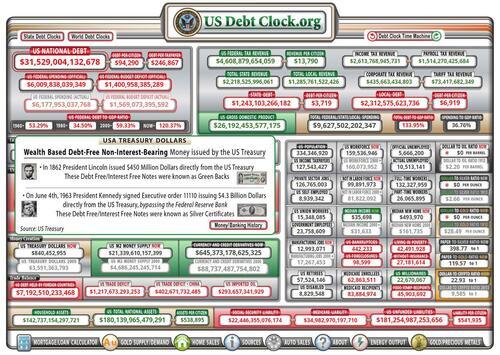

I would call your attention to a website called usdebtclock.org. I recommend that you go to the site and just stare at the debt clock as it clicks away the solvency of our government, as well as the solvency of corporations, municipalities, and individuals — in REAL TIME.

The entire fabric of our society is being ripped apart because of the rapid increase in debt of all types. In particular, the unfunded liabilities of the US government now total $181 TRILLION (bottom right). Now, look at the upper left at the US national debt of $31 TRILLION. If we were able to keep deficit spending to the same level as growth in GDP, the debt of $31 trillion would be manageable.

The problem for everyone is the unfunded liabilities.

The annual deficit is nearly $1.5 trillion each year now, but unfunded liabilities are rising by over $5 trillion each year. These unfunded liabilities consist of Medicare, Medicaid, prescription drug benefits, military and civilian retirement, and other programs. These unfunded liabilities used to show up in the annual deficit, but the law was changed to accrue them in a separate category so people would not see them.

Why? you may ask.

The justification was that they were not REAL LIABILITIES because they never actually have to be paid. Only interest on the national debt has to be paid. Because the total amount of the US debt plus US unfunded liabilities is so great that what can’t be paid, won’t be paid and the people writing the law KNEW IT.

After you have spent a few hours over a week’s time looking at each item in the debt clock and looking at the speed of increase, you decide what the end result will be. Then start to envision the value of our US fiat money, whether it be a currency, bank deposits or government bills, notes, or bonds.

If interest rates in the US continue to stay higher than those of other countries, as is the case now, the US dollar will continue to strengthen over time relative to other fiat currencies. (But all fiat currencies are falling versus gold.) What a wonderful opportunity this presents to holders of fiat US dollars. It allows them to convert them to “real money” — gold and also silver. This is an opportunity that citizens of other countries do not have as gold has already risen in terms of their currencies, as their values relative to the US dollar have fallen.

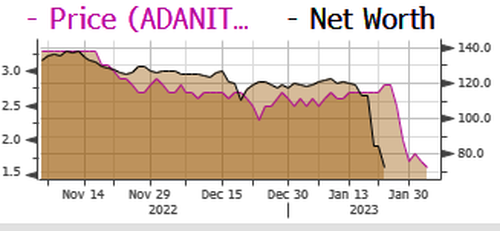

Gold is now one of the best-performing assets, as bonds, as well as stocks, are down substantially in 2022. When this conversion occurs, not if, not only will gold outperform other asset classes but the derivatives of gold such as gold mining shares will also.

Most investors and traders are moving in and out of stocks and bonds in order to garner a profit. Over time, most never realize a real return over inflation, brokerage fees, management fees, and taxes. Those who do not believe me simply have not looked at the data. Most investors look at nominal dollars and don’t factor in inflation and the opportunity costs of not considering other investments such as a business, farmland, or a host of others.

In my opinion, the goal of anyone who has “savings” is to have those savings retain purchasing power over time. You have earned it and paid income tax on it. Now you need to make sure those savings retain purchasing power.

I believe that everyone who has savings should convert some of those savings to real money — gold.

As J.P. Morgan said, “Gold is money, everything else is credit.”

What he was saying is that gold is money that is no one else’s liability. Gold is money par excellence. Gold is the best money because it has the highest stocks to flow of any commodity. Gold is not an investment, it is MONEY.

Once you have an allocation to REAL MONEY, you can now invest (i.e. speculate) in other areas, comfortable that in an inflationary or deflationary crash, you will survive financially. Gold is the only money that has retained its purchasing power over the last 5,000 years.

By converting part of your savings to gold at least you will have some portion of your savings that will not lose purchasing power. In addition, you will be able to survive a complete collapse in the monetary system.

If you have studied the debt clock at length and have come to the conclusion that, “everything is going to work out OK,” then you probably have the “Normalcy Bias”.

Normalcy bias is what keeps people from leaving their homes when a hurricane is coming or a fire is close to their property. What they are thinking is it has never hit here or burned near here, therefore it will be OK this time.

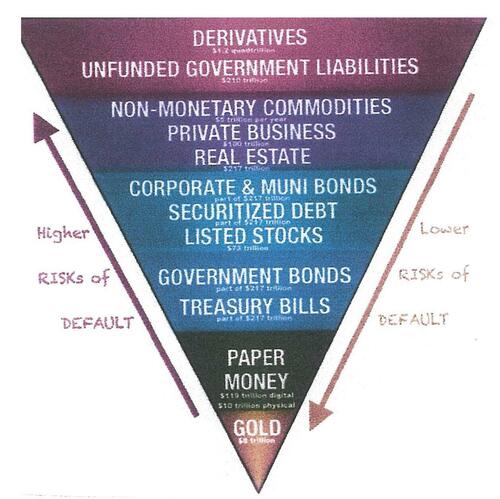

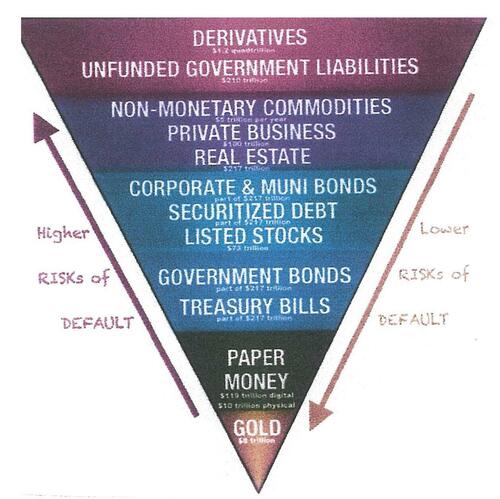

I will leave you with what Alan Greenspan the past Chairman of the Federal Reserve, said about deficit spending and gold. After reading you can see John Exter’s pyramid that shows what dies first as everything eventually flows to Real Money — gold.

In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. If there were, the government would have to make its holding illegal, as was done in the case of gold. If everyone decided, for example, to convert all his bank deposits to silver or copper or any other goods and thereafter declined to accept checks as payments for goods bank deposits would lose their purchasing power and government-created bank credit would be worthless as a claim on goods. The financial policy of the welfare state requires that there be no way for the owners of wealth to protect themselves. This is the shabby secret of the welfare statists’ tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists’ antagonism toward the gold standard.”