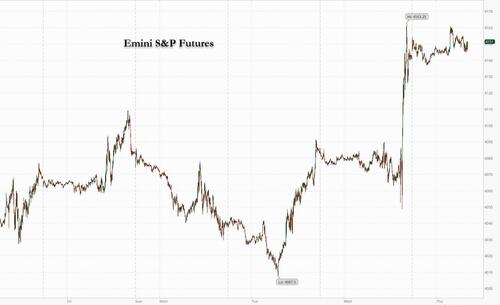

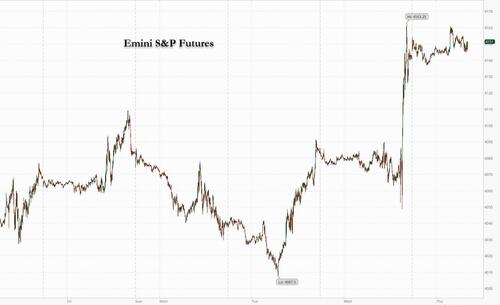

Global markets rose, with US futures solidly in the green as tech stocks were set to extend their rally on Thursday, lifted by Powell’s comments on inflation and Meta surging 20% in US premarket trading after the social-media giant’s earnings and buyback news. Summarizing yesterday’s market moving FOMC decision and presser, Goldman said that even though the “FOMC Statement was Hawkish: kept ‘ongoing’ and ‘appropriate’, however “more importantly presser was dovish: 1) Powell’s disinflation language (“we can say the disinflation process has started”, something that’s “welcome, encouraging, and gratifying”) and 2) the fact Powell didn’t warn markets RE easing financial conditions in the last few weeks.” In kneejerk reaction bears everywhere were steamrolled as Powell triggered a marketwide short squeeze.

Nasdaq futures were up 1.3% at 7:45 a.m. ET after the tech-heavy index jumped 2% during the previous session and closed at its highest level since September; the Nasdaq 100 is up 13% this year, having posted the best monthly gain since July in January. The recovery follows last year’s 33% slump, which was the worst since the 2008 global financial crisis. S&P futures added another 0.4% to yesterday’s surge, which pushed spoos to 4152, the highest since August as the consensus bearish trade (JPM, MS, GS, BofA are all bearish) gets steamrolled.

In premarket trading, it was all about Meta, whose gain of about 20% – the biggest one-day surge in the stock since 2013 – represents about 75 points in Nasdaq 100 futures’ advance, or about three quarters of the rise as the social media giant posted quarterly sales that topped estimates and boosted its stock-buyback authorization. If the gains hold, Meta will more than double its market value since a Nov. 3 low. The owner of Facebook is the best performer in the S&P 500 Index since the stock’s recent November 3 closing low of $88.91, and is poised to more than double in value since then. Shares of social-media companies such as Snap Inc. and other tech companies such as Alphabet Inc. gained in US premarket today. The Google parent, Apple and Amazon.com Inc. are among tech giants reporting results today. Here are some other premarket movers:

- Bank stocks are higher in premarket trading Thursday amid a broader rally by risk assets following the Federal Reserve’s interest-rate decision. In corporate news, Citigroup’s wealth arm has stopped accepting securities of Gautam Adani’s group of firms as collateral for margin loans. Meanwhile, Bank of America’s global mining head Omar Davis, one of the most senior bankers covering the sector, is retiring

- Carvana jumped as much as ~31%, putting the used car dealer on course for its sixth session of straight gains amid the rally in riskier assets.

- Shares in companies exposed to cryptocurrencies gained as Bitcoin held at its highest level since last August.

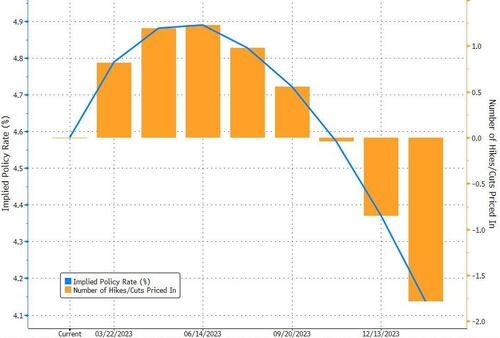

The euphoric mood was set by Powell’s comment Wednesday that the “disinflation process has started” suggesting that the aggressive tightening cycle is starting to reduce the pace of price growth, even as he warned of a “couple” more hikes to come. Positioning in US swaps markets assumes the Fed is getting closer to cutting rates as traders bet that economic conditions are likely to keep it from the additional rate increases that policy makers still anticipate.

“The more he talked, the more dovish he was,” Charles-Henry Monchau, chief investment officer at Banque Syz, said of Powell’s briefing. “It’s possible we’ll continue to see a series of volatility, but definitely the conditions seems to be more risk-on than last year,” he said on Bloomberg Television.

That said, some bears were stuck in denial: “Markets heard what they wanted to hear from the Fed,” said Veronique Riches-Flores, economist and founder of RichesFlores Research. “Markets will likely surf on this wave in the short term and it’s a good environment for risk assets.”

“Moving forward though there will likely be a lot of volatility around key indicators, such as the jobs data on Friday,” she said. “At one stage, if the data shows the economy is really resilient, investors will need to anticipate that Powell will need to take back control and that can lead to even more volatility.”

European stock also rose, tracking Wednesday’s gains on Wall Street after the Fed downshifted to a 25bps rate increase and noted inflation had eased somewhat. The Stoxx 600 was up 0.8% with tech, real estate and retail the best performing sectors. Here are some of the biggest European movers:

- Shell shares rise as much as 2.2% in London after the oil major launched a $4 billion share buyback, and posted full-year results that showed a record performance in 2022

- Banco Santander shares jump as much as 4.3% after the Spanish lender beat estimates, and offered positive guidance that analysts said could lead to further consensus upgrades

- Telecom Italia shares jump as much as 14%, the most intraday since November 2021, after KKR made a non-binding offer for a stake in the phone company’s multi-billion-euro network

- Dassault Systemes shares gain as much as 5.4%, the biggest intraday climb since November, after the software company’s FY constant-currency sales growth forecast topped estimates

- Siemens Healthineers gains as much as 6.8% as analysts flag solid order book momentum at the medtech group, offsetting a miss to first-quarter Ebit

- Telenor shares gain as much as 6.8%, the biggest intraday climb since March 2020, after the telecom operator’s guidance for Ebitda growth in Nordic markets beat analyst expectations

- Infineon shares jump as much as 8.8%, the most since March, after the chipmaker lifted its full-year margin forecast and kept its revenue outlook while factoring in a weaker dollar

- ING shares drop as much as 8.2% in early trading as analysts said the lack of a new buyback announcement and some areas of weakness in the Dutch lender’s results offset a profit beat

- Electrolux shares drop as much as 11% with analysts saying the appliances manufacturer’s update was much worse than anticipated

- Roche falls as much as 1.4% after a cautious outlook weighed on an overall weak quarterly report from the Swiss pharmaceutical giant

- Deutsche Bank shares drop 5.3%, most in four months, after the German lender’s earnings missed estimates. JPMorgan analysts say lack of buyback guidance also weighed

Asian stocks advanced as the Federal Reserve chair said efforts to quell inflation are making progress, supporting risk sentiment. The MSCI Asia Pacific Index climbed as much as 1% before paring more than half of the advance. Interest-rate sensitive tech stocks led gains, with TSMC, Samsung and Baidu giving among the biggest boost to the gauge. Tech-heavy benchmarks including Taiwan and South Korea led a rally in the region, while measures in Japan were mixed as the yen strengthened against the dollar. Key gauges in Hong Kong and Singapore fell, while Adani Group shares dragged on Indian benchmarks.

Investors cheered remarks by Jerome Powell that price pressures have started to ease, even as the Fed chair also said more interest-rate hikes are in store after delivering a quarter percentage-point rate increase. The dollar extended its fall following the Fed’s decision, helping boost foreign inflows to Asian equities. “Markets are really charting out their own path right now, looking at what inflation has been doing,” Charu Chanana, a senior markets strategist at SAXO Capital Markets, said in an interview with Bloomberg TV, adding that she would be more careful about risks ahead. “Even though Chair Powell highlighted dis-inflationary pressures that are there, we are potentially looking at inflation really being a monster,” she said. The key Asian stock index briefly touched its highest level since April after climbing some 27% from its October trough amid euphoria over China’s reopening and growing bullish calls on Asia. The gauge has outperformed the S&P 500 Index by about two percentage points so far this year.

Japanese equities ended mixed, bucking a broader rally in global stocks, as the Federal Reserve’s slower pace of rate hike strengthened the yen. The Topix Index fell 0.4% to 1,965.17 as of market close, while the Nikkei advanced 0.2% to 27,402.05. Toyota Motor Corp. contributed the most to the Topix Index decline, decreasing 1.2%. Out of 2,164 stocks in the index, 608 rose and 1,462 fell, while 94 were unchanged. “Powell’s acknowledgment of a slowdown in inflation while mentioning that the labor market is strong were well received,” said Takashi Ito, a senior strategist at Nomura Securities. Still, Japanese stocks are unlikely to rise as much as US peers as the yen strengthened.

Stocks in India were mostly higher on Thursday as investors looked beyond the rout in Adani Group shares, while companies continued to report strong earnings performance. All but one of the 10 companies related to the Adani Group declined as a week-long selloff in the diversified conglomerate’s shares stretched to $108 billion. On Wednesday, the group’s flagship firm Adani Enterprises, abruptly scrapped its fully-subscribed $2.4 billion follow-on stock sale plan amid carnage in its shares. It was the worst performer on Thursday, falling 27%, while three firms extended slide by 10% each. The S&P BSE Sensex rose 0.4% to 59,932.24 in Mumbai, while the NSE Nifty 50 Index was little changed. For the week, the Sensex is up 1% while the Nifty is steady, dragged by some of Adani companies and insurers, which have come under pressure following changes to India’s tax rules for the sector. Even as the carnage in Adani shares has dampened sentiment, investors are starting to focus on companies’ earnings performance and growth outlook. Tata Consumer was the latest to report higher-than-expected profit for the December quarter while mortgage lender HDFC and jewelry maker Titan’s earnings met the consensus view

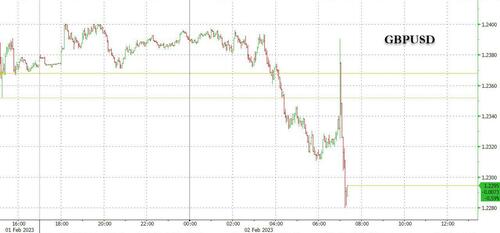

The Dollar Index fell 0.1% following the Fed rate decision and after Chairman Jerome Powell said the central bank has made progress in its battle against inflation, while the Norwegian krone and British pound are the weakest among the G-10 currencies. “The slowdown in the pace of Fed tightening to 25bps underlines the fact that the risk reward balance for central banks fighting the inflation threat is changing and after the aggressive action last year and the signs of easing inflation, greater caution in tightening policy is feasible,” MUFG analysts write in a note, adding that policy announcements from the ECB could highlight a policy divergence between the central banks. “The greater caution by the ECB last year means it has more work to do and that should be on show today with a 50bp hike coupled with still a hawkish message of more work to do to reach a level of policy consistent with price stability,” they add

- EUR/USD rose as much as 0.4% to 1.1033, extending gains for the third day before the ECB is expected to hike rates and warn that it will maintain its position that more aggressive rate rises are in store. A more hawkish policy stance by the ECB compared with the Fed suggest that investors are likely to focus on rate differentials, which could push EUR/USD towards 1.15 in the coming months

- USD/JPY slips 0.1%, after falling around after the Fed announcement

- EUR/SEK hovers near 11.4 hit earlier in the week, its strongest since March 2020. The Swedish krona has come under selling pressure over the past two weeks amid growing concerns about Sweden’s sluggish growth and a deteriorating housing market due to higher inflation.

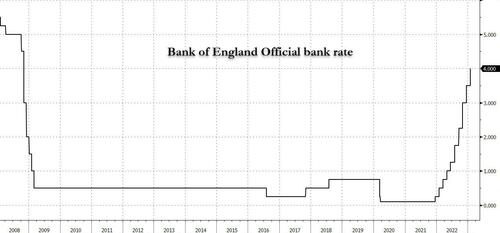

In rates, Treasuries were richer across belly of the curve, broadly holding Wednesday’s post-Fed move along with stocks. US yields richer on the day by up to 1.5bp across belly of the curve, the 10Y trading at 3.38% after closing around 3.42%; gilts had brief setback after Bank of England decision, followed by new yield lows for 10-year sector, richer by 16bp on the day (as reported earlier, Bank of England delivered a 50bp rate hike as expected with a vote split of 7-2 for a hike to 4%; statement said that inflation risks were skewed significantly to the upside). In Europe, focus now shifts to ECB rate decision at 8:15am New York time and President Christine Lagarde’s press conference. Three-month dollar Libor +0.99bp at 4.80614%. US economic data slate includes January Challenger job cuts (7:30am), 4Q nonfarm productivity, initial jobless claims (8:30am) and December factory orders (10am)

In commodities, WTI trades around session lows under USD 76.50/bbl (vs a USD 77.24/bbl high) while its Brent counterpart sits under USD 82.75/bbl (vs a USD 83.61/bbl high). Shell CEO sees continued appetite for gas in China, too early to say if the European energy crisis over. Adds, gas business can keep growing next year. Spot gold is holding onto gains above the $1950/oz mark with the 19th April peak at USD 1981/oz ahead while LME Copper reclaimed USD 9.1k/T after slipping below the mark on Wednesday.

Looking to the day ahead now, and the main highlights will be the ECB and BoE policy decisions, along with the subsequent press conferences from President Lagarde and Governor Bailey. Otherwise, US data releases include the weekly initial jobless claims, December’s factory orders, and the preliminary reading of nonfarm productivity in Q4. Lastly, earnings releases include Apple, Amazon and Alphabet.

Market Snapshot

- S&P 500 futures up 0.4% to 4,150.25

- STOXX Europe 600 up 0.6% to 456.03

- MXAP up 0.2% to 169.87

- MXAPJ up 0.3% to 557.20

- Nikkei up 0.2% to 27,402.05

- Topix down 0.4% to 1,965.17

- Hang Seng Index down 0.5% to 21,958.36

- Shanghai Composite little changed at 3,285.67

- Sensex up 0.4% to 59,945.83

- Australia S&P/ASX 200 up 0.1% to 7,511.65

- Kospi up 0.8% to 2,468.88

- German 10Y yield little changed at 2.26%

- Euro little changed at $1.0994

- Brent Futures little changed at $82.82/bbl

- Gold spot up 0.2% to $1,954.63

- U.S. Dollar Index little changed at 101.17

Top Overnight News from Bloomberg

- The dollar has had its worst start to the year since 2018, and chances are the losses may deepen with some help from the European Central Bank on Thursday.

- Currency option investors are looking for the Bank of England’s rate decision to have a bigger near-term impact on the pound than European Central Bank’s move later Thursday will have on the euro.

- Traders who’ve shrugged off Federal Reserve Chair Jerome Powell’s repeated warnings that interest rates will remain elevated this year will have their wagers tested again within weeks by key economic data.

- European stocks climbed with US equity futures, building on Wall Street’s advance after Federal Reserve Chair Jerome Powell said the central bank had made progress in its battle against inflation.

- Bank of Japan Deputy Governor Masazumi Wakatabe signaled there will be no policy change next month shortly before the end of his term and warned against further adjustments to the central bank’s yield curve control program.

- The Bank of Japan may be able to step toward normalizing policy this year by achieving its sustainable inflation target, according to Takatoshi Ito, an ally of Haruhiko Kuroda and a contender to replace him in April.

- Investors are readying for the final stretch in the race to replace Bank of Japan Governor Haruhiko Kuroda, a decision that could whipsaw markets from the yen to Treasuries.

- North Korea’s Foreign Ministry said the door remains shut for talks with the US on winding down its atomic arsenal, setting the stage for renewed provocations by pledging to respond to what it saw as threats from Washington.

More detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly higher in the aftermath of the FOMC meeting where the Fed slowed the pace of rate increases and Fed Chair Powell provided a slew of two-sided remarks in which he pointed to a couple more rate hikes to get to an appropriately restrictive stance but noted they are not very far from that level and acknowledged that the disinflationary process had begun. ASX 200 was led by outperformance in gold miners and tech but with gains limited by weakness in other commodity-related sectors and after mixed data. Nikkei 225 notched marginal gains with earnings releases driving the best and worst performing stocks and the 27,500 level continued to elude the index. Hang Seng and Shanghai Comp. initially gained although price action was then choppy after the HKMA raised rates in lockstep with the Fed and the PBoC continued its substantial post-holiday liquidity drain.

Top Asian News

- Hong Kong Monetary Authority raised its base rate by 25bps to 5.00%, which was as expected and in lockstep with the Fed.

- Australia-China trade discussions have the Australian PM Albanese “anticipating” a Beijing visit in 2023, via SCMP citing sources; adding, next steps amid the easing of tensions will see Trade Minister Farrell visiting Beijing prior to the PM. Subsequently, Chinese Commerce Minister Wentao and Australian Trade Minister Farrell will hold talks next week via video link, via Global Times.

- Maker of $555,000 Flying Motorbikes to Begin Trading on Nasdaq

- StanChart, HSBC Slip as Goldman Says Rates Boost Played Out

- Kuroda Ally Ito Sees Chance of BOJ Starting Unwinding in 2023

- Ex-BOJ Deputy Gov Nakaso Says to Serve on APEC Advisory Body

- Gold Rises to Nine-Month High as Fed Signals End to Rate Hikes

European bourses are benefitting from post-FOMC tailwinds with heavyweight earnings reports bolstering performance in the Tech, Telecoms and Energy sectors, Euro Stoxx 50 +1.1%. Stateside, futures are firmer across the board with action more contained vs European peers, ES +0.4%, with the exception of the NQ +1.3% which outperforms post-META. Meta Platforms Inc (META) – The social media bellwether surged over 20% afterhours after Q4 results, where although EPS missed expectations, revenue topped estimates, as did DAUs for the group, while advertising revenue was also above the consensus view, and it boosted its buyback by USD 40bln. +19% in pre-market trade

Top European News

- France’s Le Maire Expects Lawmaker Majority for Pension Reform

- Lagarde May Further Fuel Euro’s Bullish Run: ECB Cheat Sheet

- European Stocks Climb Before ECB as Fed Fuels Inflation Optimism

- Swedish Home Developer Bonava Slumps as Sales Drop Sparks Cuts

- European Gas Prices Mixed With Focus on Demand, LNG Shipments

- German VDMA: 2022 engineering orders -4% YY, Domestic -5% Foreign -4%.

FX

- The DXY has reclaimed and marginally extended above the 101.00 mark to a current 101.23 peak, after printing a fresh YTD trough at 100.81 post-Fed, to the modest detriment of peers ex-NZD.

- NZD has reclaimed some of yesterday’s lost ground against the AUD in wake of mixed data releases for Australia overnight.

- USD/CAD is contained near 1.32 pre-data while the EUR is essentially unchanged near 1.10 ahead of the ECB.

- In slight contrast, GBP has been erring lower and currently resides at the lower-end of 1.2319-1.24 parameters pre-BoE, with EUR/GBP firmly above 0.89 given the differing conviction levels on the magnitude and guidance between the BoE and ECB.

- PBoC set USD/CNY mid-point at 6.7130 vs exp. 6.7142 (prev. 6.7492)

- Brazil Central Bank maintained the Selic rate at 13.75%, as expected. BCB will remain vigilant and assess if the strategy of maintaining the Selic rate for a sufficiently long period will be enough to ensure the convergence of inflation, while it will not hesitate to resume the tightening cycle if the disinflationary process does not proceed as expected and noted that despite some recent moderation, consumer inflation and measures of underlying inflation are above the range compatible with meeting the inflation target.

Fixed Income

- USTs have seemingly paused for breath after Wednesday’s rally with upside in EGBs also exhausted for the time being pre-ECB and perhaps to digest hefty issuance from France and Spain.

- Currently, USTs are contained in 115.10-18 parameters while Bunds are at the lower end of a 137.00-62 band.

- In contrast, Gilts continue to climb and have been within 20 ticks or so of 106.00 with the associated yield at 3.20% ahead of the BoE and the potential for a lessening to tightening guidance.

Commodities

- Crude benchmarks are in close proximity to the unchanged mark after paring back modest overnight gains amid a slight bounce in the USD with newsflow elsewhere limited.

- WTI trades around session lows under USD 76.50/bbl (vs a USD 77.24/bbl high) while its Brent counterpart sits under USD 82.75/bbl (vs a USD 83.61/bbl high).

- Shell (SHEL LN) CEO sees continued appetite for gas in China, too early to say if the European energy crisis over. Adds, gas business can keep growing next year.

- Spot gold is holding onto gains above the USD 1950/oz mark with the 19th April peak at USD 1981/oz ahead while LME Copper reclaimed USD 9.1k/T after slipping below the mark on Wednesday.

Geopolitics

- North Korean state media said the US and allies’ military drills have pushed the situation to an extreme red line and that US drills threaten to turn the peninsula into a huge war arsenal, according to Reuters and SCMP. Furthermore, the White House said it rejects the notion that US joint military exercises in the region serve as a provocation for North Korea and said the US has no hostile intent towards North Korea, while it seeks serious diplomacy and will work with allies to fully enforce UN Security Council resolutions aimed at limiting North Korean weapons programs.

- Russian Foreign Minister Lavrov says will ensure that events organised by the West for the anniversary of the special operation in Ukraine will not be the only thing to attract world attention.

- Russian President Putin to speak on Thursday at a “celebratory concert” in Volgograd, via NY Times.

- Russian Foreign Minister Lavrov says that Moldova could become the new “anti-Russian” project after Ukraine. Adds, our relations with China are stronger than a military alliance, there is no limit.

US Event Calendar

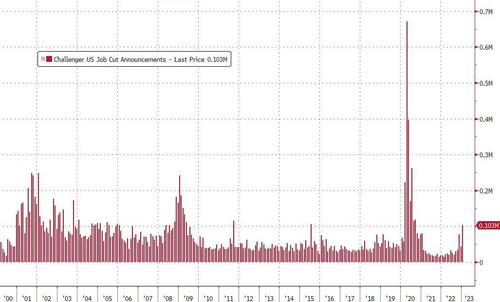

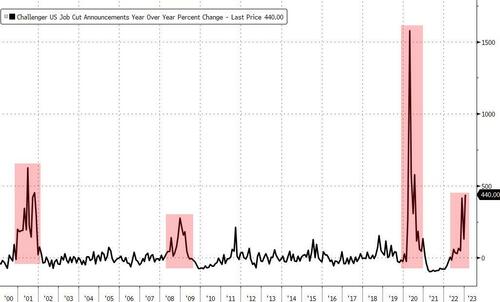

- 07:30: Jan. Challenger Job Cuts 440% YoY, prior 129.1%

- 08:30: Jan. Initial Jobless Claims, est. 195,000, prior 186,000

- 08:30: Jan. Continuing Claims, est. 1.68m, prior 1.68m

- 08:30: 4Q Nonfarm Productivity, est. 2.4%, prior 0.8%

- 08:30: 4Q Unit Labor Costs, est. 1.5%, prior 2.4%

- 10:00: Dec. Factory Orders, est. 2.3%, prior -1.8%

- 10:00: Dec. Factory Orders Ex Trans, est. 0.2%, prior -0.8%

- 10:00: Dec. Durable Goods Orders, est. 5.6%, prior 5.6%

- 10:00: Dec. -Less Transportation, est. -0.1%, prior -0.1%

- 10:00: Dec. Cap Goods Orders Nondef Ex Air, prior -0.2%

- 10:00: Dec. Cap Goods Ship Nondef Ex Air, prior -0.4%

DB’s Jim Reid concludes the overnight wrap

An FOMC meeting that was going as expected turned into a major positive event for both bonds and equities last night once Powell’s press conference developed. Next stop the ECB and the BoE today and then 12% of the S&P 500 reporting after the bell (Apple, Alphabet and Amazon) before payrolls tomorrow.

Reviewing the Fed now and the expected +25bps hike was accompanied by a statement where the FOMC said they anticipate, ”that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time.” In a shift from previous statements, the Fed said that inflation “has eased somewhat but remains elevated,” as well as saying that future increases of the policy rate will be dependent on a number of factors including the “cumulative tightening” of monetary policy rather than the “pace” of tightening as it had said before. Markets initially grabbed on to the idea that there would still be multiple more rate hikes, with the S&P 500 and US 10yr yields down -0.8% and -2.0bps, respectively, as Chair Powell’s press conference started.

During Chair Powell’s press conference, equities started turning higher when the Chair said that the, “disinflation process has started.” Chair Powell also did not actively talk down risk markets when asked if financial conditions were too easy, by saying that the focus is “not on short-term moves but on sustained changes.” Powell also did not push back on markets pricing in rate cuts this year, saying that it reflects views that inflation will ease faster than the Fed expects. So whether it was Powell’s intention or not, the market takeaway was biased towards the Fed being relaxed about loosening financial conditions and that cuts could happen if inflation behaved as the market expects it too. See our economists’ review of the FOMC here. They still expect two more 25bps hikes in March and May, with the latter being a little more debatable.

By the close, the S&P had rallied 2.0% off the day’s lows to finish up +1.05% after trading in a 2.7% intraday range. The gains were led by semiconductors (+5.3%), autos (+3.9%), transports (+2.1%) and software (+1.9%), meaning the Nasdaq outperformed, having rallied 2.75% off the lows to end up +2.00%. Those moves took the S&P 500 and Nasdaq to their highest levels since late September. US 10yr yields fell -9.0bps to 3.417% (with yields remaining fairly stable overnight) while the more policy-sensitive 2yr yields were down -9.5bps on the day after being up +5.4bps on the FOMC statement release before rallying as the press conference began. In terms of fed futures, the market is pricing in a terminal rate of 4.89% in June, which was down -2.4bps on the day, as well as 41.1bps of rate cuts by the January ‘24 meeting, down around 8bps from the previous day.

After the close, equities saw further good news with Meta seeing shares spiking +20.16% in after-hours trading on the back of news of a $40bn boost to the company’s share buyback plan as well as outperforming on revenues and higher user engagement. Against that backdrop, in overnight trading, US stock futures are adding gains with those on the S&P 500 (+0.28%) and NASDAQ 100 (+0.91%) marching higher. Meanwhile, the US dollar (-0.32%) is extending its decline this morning, trading at 100.90 – its lowest level since April 2022 amid risk appetite spurred by easing rate-hike expectations.

Moving on to Asia, those overnight gains in US equities are also reverberating across regional markets with the KOSPI (+0.85%), Hang Seng (+0.41%), the Nikkei (+0.18%), the Shanghai Composite (+0.29%) and the CSI (+0.06%) all trading moderately higher.

In early morning data, South Korea’s CPI rose to a 3-month high of +5.2% y/y in January (v/s +5.0% expected), compared to a +5.0% rate seen in December, thus keeping open the possibility of additional policy tightening despite the nation’s economy weakening.

It might seem like ancient history now, but before the Fed took centre-stage, we got a few challenging data prints earlier in the day. First was the ISM manufacturing, where the headline slightly underwhelmed at 47.4 (vs. 48.0 expected), but the prices paid indicator rose for the first time since March with an increase to 44.5 (vs. 40.4 expected). There was a notable warning from the new orders component however, which fell to just 42.5, and has normally meant that a recession had either begun or was just months away. Indeed, you’ve got to go all the way back to 1952 for the last time the new orders component was that low and a recession was still more than a year away.

Alongside that, the latest JOLTS report pointed to a significantly tighter labour market than expected, with job openings in December at a 5-month high of 11.012m (vs. 10.3m expected). That also takes the number of job vacancies per unemployed worker up to 1.92, which again is the highest since July. In the meantime, the quits rate (which is strongly correlated with wage growth) remained at 2.7%, which is the same as it’s been throughout most of H2 last year.

The Fed may be out of the way now, but attention will remain on central banks today with the ECB decision at 13:15 London time. It’s widely anticipated that they’ll deliver another 50bps hike, which would take the deposit rate up to a post-2008 high of 2.5%. But the bigger question is what the ECB will signal going forward, with officials debating whether they should maintain the 50bps pace or downshift to 25bps at the next meeting in March. In their preview (link here), our European economists are expecting President Lagarde to say that “interest rates will continue to rise significantly at a steady pace”, and reiterate the meting-by-meeting, data-dependent approach.

The other big thing to look out for from the ECB will be any details about quantitative tightening, particularly given the last meeting statement said we’d get “the detailed parameters for reducing the APP holdings” at today’s meeting. For those looking for more on QT, our economists and strategists have also released a primer (link here).

Ahead of all that, yesterday saw the release of the Euro Area flash CPI print for January. That showed headline inflation coming down by more than expected to 8.5% (vs. 8.9% expected), which is its third consecutive monthly decline. However, the more concerning detail was that core inflation held steady at its record 5.2%, rather than falling back a touch as the consensus had expected. One thing to note is that we don’t have actual data for Germany (the Euro Area’s biggest economy) because of the data processing issues, so estimates are being used there. So we might see some more attention than usual on the final number on February 23.

Against that backdrop, European markets put in a steady performance before the Fed’s decision, with the STOXX 600 down just -0.03%. Bank stocks continued to outperform as well, with the STOXX Banks up a further +1.12%, bringing their YTD gains to +17.22%. Sovereign bonds also held steady, with yields on 10yr bunds (-0.2bps), OATs (+0.1bps) and gilts (-2.5bps) seeing little movement as well. Italian BTPs were the one underperformer on the day, with yields up +14.2bps as inflation data was hotter than expected. Incidentally, the decline in Treasury yields meant that the spread of 10yr Treasuries over 10yr bunds fell to its tightest level since September 2020 at 112.7bps, which is in line with our rates strategists’ call for a tighter 10yr UST-Bund spread. They’ll likely be a bit of re-wideneing this morning as Bunds follow the US story but then the ECB will be pivotal.

Given all that’s happening at the moment, the Bank of England’s decision today is unlikely to get as much attention as usual, but the consensus and our own economists are similarly expecting a 50bp hike. That would take Bank Rate up to 4%, and we should also get the MPC’s updated forecasts, which our economists’ preview (link here) expects to show a dramatically improved economic outlook. In terms of the forward guidance, they think the MPC will signal that “some further modest tightening may be appropriate in the coming months depending on the economic outlook”. After today’s 50bp move, they’re expecting another couple of 25bp moves in March and May that would take the terminal rate to 4.5%.

To the day ahead now, and the main highlights will be the ECB and BoE policy decisions, along with the subsequent press conferences from President Lagarde and Governor Bailey. Otherwise, US data releases include the weekly initial jobless claims, December’s factory orders, and the preliminary reading of nonfarm productivity in Q4. Lastly, earnings releases include Apple, Amazon and Alphabet.