Via Rabobank,

Hawks And Roves

“We’re an empire now, and when we act, we create our own reality. And while you’re studying that reality — judiciously, as you will — we’ll act again, creating other new realities, which you can study too, and that’s how things will sort out. We’re history’s actors… and you, all of you, will be left to just study what we do.”

– Karl Rove

Those around at the time were appalled by the sheer arrogance of Karl “The Architect” Rove under the ‘imperial’ presidency of George W. Bush. The quote above seemed so unseemly, even if there really was no global power at the time that could stop what the US was doing.

Ironically, Rove’s policies were a foundation stone for the world of 2023 now challenging US power left, right, and centre. Indeed, geopolitics is currently full of ‘new realities’ being created by ‘history’s actors’ for others to study impotently – including the White House. If you think only the US offers a Melian dialogue to others then you really don’t read much, or only from select sources.

On which, Rove’s architecture ironically also built the towering challenge to neoconservative, neoliberal power, and even to the centre, from the new Left and new Right. Sadly, the “reality-based community” did not win: rather both Left and Right created their own empires of reality, shrink-wrapped in social and mainstream media echo chambers, and ring-fenced with politically correct and incorrect landmines. Indeed, if you think about it, radical-conservative Rove was in many ways Woke before that was even a thing – see these quotes:

“All politicians operate within an Orwellian nimbus where words don’t mean what they normally mean, but Rovism posits that there is no objective, verifiable reality at all. Reality is what you say it is.”

“You may end up with a different math, but you’re entitled to your math. I’m entitled to the math.”

Back to markets, which are now Rovist in many respects too.

First, in yet another thick layer of irony, they therefore aren’t pricing for a world in which neocons and neolibs are out and a new geopolitical reality is in.

For example, calls of a “Shiny new China!” are seeing investors pile into Chinese assets again, even if the money going in so far is from hedge funds, who see it as a tactical play, rather than mutual funds, who don’t see it as a strategic play yet. They are cheered by formerly neocon but still neolib The Economist publishing an article saying China is trying “to ease tensions” but the US isn’t, quoting “Don Chuling of the China Institutes of Contemporary International Relations, a think-tank linked to China’s state security ministry”(!), and by Davos, Paris, and Berlin insisting Beijing must be ‘in’ not ‘out’ of world trade plans.

However, that narrative now has to adapt to Xi Jinping reportedly set to travel to Moscow to visit Putin just before the first anniversary of the invasion of Ukraine, which may even coincide with a marked escalation in Russian fighting (and possibly via Belarus, opening up West Ukraine as a new front, as Minsk signs a new military training agreement with Moscow). Suggestions are the trip will reaffirm the 2022 Sino-Russian partnership rather than a new ‘peace now’ Chinese stance on the war. The timing alone is hardly auspicious, even if the agenda is unclear; a more pointed focus on tactics and strategy than markets now grasp could certainly see the current mood shift.

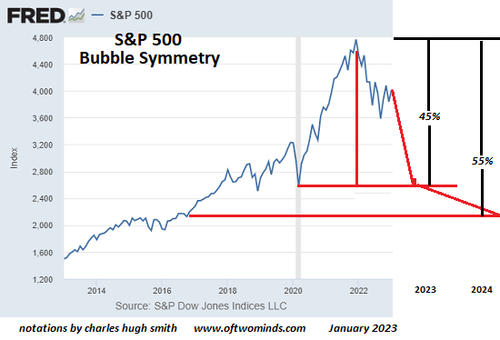

In macro terms, markets loved that the US employment cost index (ECI) was 1.0% q-o-q, not 1.1% as expected, and down from 1.2%. Despite the data still being high, they justified the S&P pushing up to +6% year-to-date, the Nasdaq +11%, and US 10-year yields down to 3.50% again. There were fewer mentions that Timiraos at the Wall Street Journal said the ECI data wouldn’t move the needle for the Fed, and that US consumer confidence 1-year ahead inflation expectations rose from 6.6% to 6.8% y-o-y.

In broader terms, markets think they are ‘history’s actors’ now too.

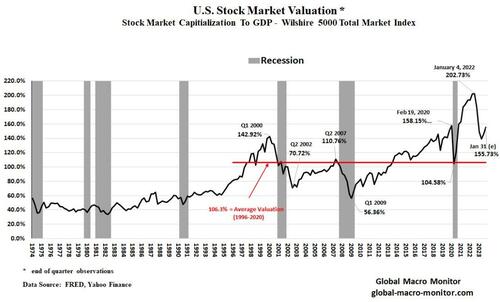

By pushing long bond yields lower in tandem with Fed hikes they are creating their own reality, because the lower long bond yields go, the more most assets levitate, despite the damage coming from rate hikes (or some would say because of it). The Fed may be hawks, but the market are Roves.

Arguably, they are trying to show the Fed has no real power to act, except in a destructive manner that will bring about a huge backlash against it. It’s markets saying:

“We’re an empire now, and when we act, we create our own reality. And while you’re studying that reality — judiciously, as you will — we’ll act again, creating other new realities, which you can study too, and that’s how things will sort out. We’re history’s actors… and you, all of you, will be left to just study what we do.”

Even so, the nickname George W. Bush gave to Rove, Turd-Blossom, seems appropriate as a response.

After all, it remains to be seen what the Fed will do today, and in March, and over 2023. Who really has the Mother of All Bombs? Markets or the Fed? If it’s still the Fed, does it get dropped today, or just taken for a warning fly past?

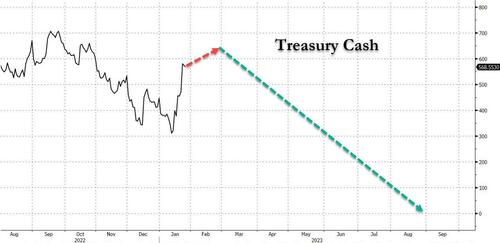

Naturally, as we wait to find out, few are paying attention to the architect of a very different kind of thinking, Taleb, who warns that ‘Disneyland is over’ for investors as cash-flows dry up.

“Disneyland is over, the children go back to school,” the author of “The Black Swan” said. “It’s not going to be as smooth as it was the last 15 years.”

That’s probably because some of the people taking Mickey Mouse positions have no vaunted skin in the game: all they have to do is meet the industry benchmark, and if those benchmarks are negative then so much the easier.

However, if you aren’t in that camp and think you are smarter than Taleb – you aren’t. Pinching an old joke from the TV Scot Rab C. Nesbitt –who looks like the 2023 Dorian Grey portrait of Karl Rove– Disneyland is not yet over for markets only in that they “dis’ nae listen, dis nae’ learn, an’ dis’ nae know what’s gonna hit ‘em!”

Day Ahead

Today sees final January PMIs globally and Eurozone January CPI, seen 0.1% m-o-m and 8.9% y-o-y, 5.1% core. Expect markets to swing on any tiny rounding-error under or overshoots.

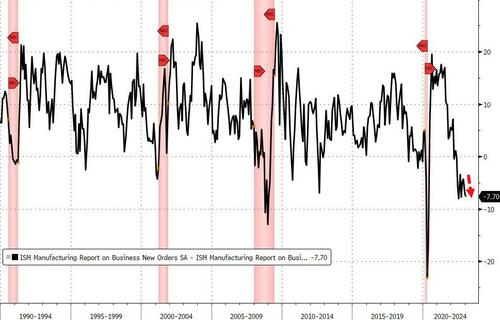

In the US we see ADP employment and the ISM manufacturing survey.

Then it’s the Fed, where we expect a 25bp hike to 4.75% and indications another hike is to follow, and no cuts are (at least in 2023).

Brazil also has a rate decision, where the Selic rate is seen on hold at 13.75%.