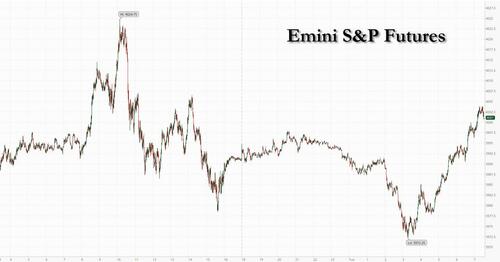

US stock futures rebounded on the last day of a turbulent month for stocks which saw much of the January gains wiped out, and even with S&P futures inching above 4000 the S&P 500 was on course to post a monthly decline as investor fears about a hawkish Fed response to sticky inflation prevailed. Contracts on the Nasdaq 100 and the S&P 500 rose 0.4% at 7:45 a.m. ET; the S&P 500 is set for a drop of more than 2% in February, trimming a sharp rally last month. Bonds sank in the wake of reports that showed accelerating inflation in France and Spain. The dollar reversed earlier gains and crypto rose.

Among notable movers in premarket trading, Zoom jumped after the video-conferencing software company issued an outlook for adjusted earnings that was much stronger than expected. Workday Inc. dropped after results, with analysts saying that the payroll software company’s outlook for subscription growth was cautious. Target rose after results beat expectations and Chevron expanded its stock buyback plans. Here are all the notable premarket movers:

- Chevron shares gain 1.3% as the company increased its annual rate of share buybacks in a show of confidence in its cash-generation goals.

- Dish Network Corp. shares are down 4.5% after BofA downgraded the satellite television company by two notches.

- Hims & Hers Health gains 9.1% after the health-care software solutions company posted 4Q results and 2023 guidance that beat estimates.

- Norwegian Cruise shares tumble about 6% after the company’s adjusted loss per share and adjusted Ebitda loss were worse than analysts expected in the fourth quarter. Peers Royal Caribbean (RCL) and Carnival (CCL) are trading about 1% lower.

- Olaplex falls 15% after the maker of hair-care products issued weaker-than-expected forecasts for net sales and adjusted Ebitda for the current year, projecting that 2023 will be a “reset year.”

- Progyny jumps 16% after forecasting 1Q revenue that beat the average of analysts’ estimates.

- Tesla shares gain 2.2% as the electric carmaker closes in on the market capitalization of Berkshire Hathaway Inc. — the fifth most-valuable company in the S&P 500.

- Target Corp. rises 1.3% after turning in a strong fourth-quarter performance, but the company offered a cautious financial forecast for this year as the retailer contends with shaky demand for discretionary goods.

- Workday shares decline 2.4%, with analysts noting the payroll software company’s cautious outlook for subscription growth, defying expectations for a stronger outlook.

- Zoom Video shares gain nearly 7% after the video-conferencing software company reported fourth-quarter results that beat expectations and gave an outlook for adjusted earnings that was much stronger than expected.

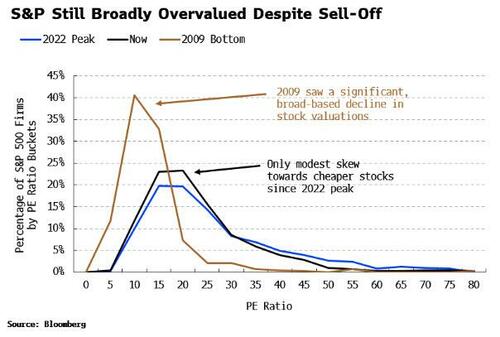

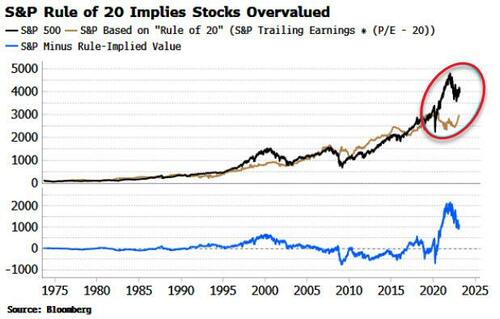

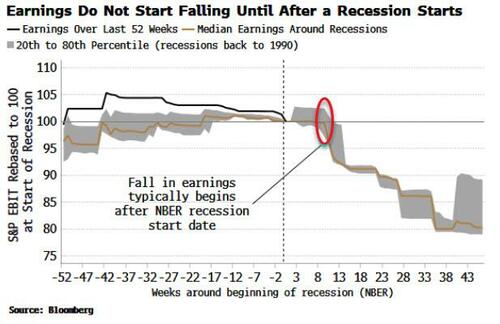

After a strong start to the year, demand for US stocks has tapered in February as data showed inflation remained elevated, raising fears that the Fed would keep interest rates higher for longer. The first quarterly decline in corporate earnings since 2020 has also hit risk sentiment. “The more upbeat sentiment that kicked off the week is ebbing away, with investors refocusing on risks ahead for the global economy,” said Susannah Streeter, head of markets at Hargreaves Lansdown.

Both US and European stocks ended last week with their biggest five-day drop this year on concern that central banks will ramp up their battle on inflation seemingly invulnerable to aggressive policy. Positioning data shows investors becoming more pessimistic as they amass short bets in both US and European equity futures, according to Citigroup strategist Chris Montagu who said investor sentiment toward stocks was starting to become pessimistic as they built short bets on S&P 500 futures last week. Other market strategists including Michael Wilson at Morgan Stanley have also warned that equities could see pressure in March from faltering earnings and higher valuations.

“Equity markets are not appreciating the macro challenges ahead,” said Wei Li, global chief investment strategist at BlackRock Inc. “That is not to say we cannot have shorter term bouts of rally, like what we saw in January, driven by technical factors, driven by FOMO.”

European stocks are in the red but off their worst levels with the Stoxx 600 down 0.1%. Healthcare and construction are the worst performing sectors while banks and insurance rise. European bond yields climbed as investors digested hotter-than-expected inflation prints in France and Spain, prompting traders to crank up wagers for the ECB deposit rate to hit 4% for the first time, sending the yield on two-year German debt to the highest since 2008. Here are the most notable European movers:

- Monte Paschi falls as much as 13% after French insurer Axa launched a private placing of about 100 million shares through an accelerated book-building process at a price of €2.33 per share

- Bayer shares slide 5.2% after the global agriculture and pharmaceutical company’s earnings outlook fell short of estimates due to declining prices for crop products

- Ocado shares drop as much as 10% after the online grocer reported a full-year pretax loss that was bigger than analysts expected

- Adecco shares drop as much as 3.6% following the staffing company’s fourth- quarter results, with analysts highlighting the impact of higher costs and potential for downgrades to consensus estimates

- Travis Perkins shares drop as much as 8.7%, the most intraday since August, after the UK builders’ merchant’s full-year results missed expectations

- Banco Santander shares gain as much as 3.2% after the Spanish lender unveiled a new 2023-2025 plan as it hosts an investor day in London on Tuesday

- Man Group Plc shares surge as much as 11%, their biggest jump since March 2020, after the world’s largest publicly traded hedge fund defied the gloom in the industry

- St James’s Place shares rise as much as 3.8% in early trading after the UK wealth manager’s underlying profit topped expectations

- Worldline shares rise as much as 3.4% as Morgan Stanley raises the French payments company to overweight from equal-weight, saying it offers an “attractive and defensive growth” outlook

- Saipem advances as much as 6.2% before paring some gains as the Italian oil-drilling specialist posted above- consensus guidance for 2023 after fourth-quarter Ebitda beat expectations

Asian stocks were headed for their worst month since September as a repricing of the Federal Reserve’s policy and an evaporating China rally weighed on the region. The MSCI Asia Pacific Index fell as much as 0.5% on Tuesday, driven by consumer discretionary and communication shares. Hong Kong stocks declined the most even as the city said it will end its mask mandate. A late afternoon surge helped Chinese shares close in the green. The regional stock measure has fallen more than 6% in February, erasing a bulk of January’s advance. Catalysts appear stretched amid concerns over global monetary policy, while China investors await a key meeting of the nation’s political leaders starting this weekend for further clues.

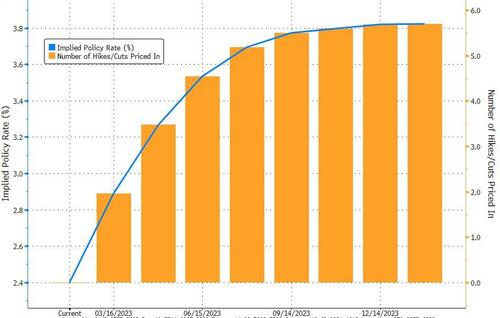

Investors have moved to price in a peak Federal Reserve rate of 5.4% amid elevated US inflation, pressuring riskier assets including those in Asian emerging markets. “It seems a lot of traders are not confident” as the economy still looks too strong for disinflation trends to resume, Edward Moya, a senior market analyst at Oanda, wrote in a note. “The Fed has a lot more work to do and that should be a difficult environment for stocks.”

Japanese equities trimmed earlier gains amid cautious sentiment as investors came to terms with further rate hikes by the Federal Reserve. The Topix was little changed as of market close Tokyo time, paring most of its 0.4% advance. The Nikkei rose less than 0.1% to 27,445.56. Services were the biggest boost to the Topix among industry groups. Oriental Land contributed the most to the advance, rising 3.5%. US Business Equipment Orders Increase by the Most in Five Months “While stocks in Japan rose following US peers, the market is still cautious about the outlook,” said Shogo Maekawa, a global market strategist at JP Morgan Asset Management. “If US economic indicators continue to exceed market expectations and interest rates rise, that will create headwinds for both US and Japanese stocks.”

Australian stocks advanced; the S&P/ASX 200 index rose 0.5% to close at 7,258.40, reclaiming some of Monday’s decline as miners and energy stocks climbed. Even with Tuesday’s advance, the benchmark notched a 2.9% monthly loss. Disappointing earnings results and worries over the Fed’s outlook weighed on the gauge in February. In New Zealand, the S&P/NZX 50 index rose 0.9% to 11,894.58

In FX, the Bloomberg Dollar Spot Index was little changed as the greenback traded mixed against its Group-of-10 peers, and Treasury yields inched up; the British pound is the best performer among the G-10’s, rising 0.1% versus the greenback. One-month risk reversals in the Bloomberg Dollar Spot Index remain under pressure in the past couple of weeks and point to a bearish correction, yet long-term bets suggest this will be short-lived. Here is the full FX scoreboard:

- The euro swung from a day low of 1.0582 to touch a high of $1.0625 following strong inflation readings from France and Spain. Euro-area bonds slid as traders bet the ECB will raise interest rates to a record high of 4%.

- The pound led G-10 gains, climbing against both the dollar and the euro for a second day as Prime Minister Rishi Sunak’s post-Brexit deal for Northern Ireland provided support. Gilts fell as traders raised tightening bets as much as 5bps, wagering on a 4.89% terminal rate by November.

- The Australian dollar erased Monday’s gain as broad greenback strength outweighed strong local economic data. Australian retail sales rebound, rising 7.5% from a year ago in sign of consumer resilience and keeping pressure on RBA. Bonds held opening gains.

- The yen was among the worst G-10 performers and most Japanese government bonds gained, flattening the yield curve, as concern eased that the BOJ will change its stimulus program any time soon.

In rates, treasuries are slightly cheaper across the curve, following wider losses across core European rates after French and Spanish inflation data surprised to the upside, causing a new wave of hawkish repricing for ECB policy rate. US 10-year yields around 3.95%, cheaper by ~3bp vs Monday’s close, with bunds and gilts underperforming by ~4.5bp and ~1.3bp in the sector; front-end slightly outperforms, steepening 2s10s spread by 1bp on the day. Following France, Spain inflation data, euro-zone front-end repriced for a peak ECB rate of 4% for the first time. Bund futures fell; German 10-year yields are up 6bps on the day while two-year yields climb 8bps. Focal points of US session include potential for month-end flows and a packed economic data slate.

In commodities, oil was set for a fourth straight monthly decline as concerns about tighter monetary policy and swelling stockpiles in the US eclipsed optimism about rising demand in China. Crude future advance with WTI rising 1.1% to trade near $76.50; Gold headed for its worst month since the middle of 2021, and on Tuesday fell roughly 0.4% to trade near $1,810.

Looking at today’s calendar, US economic data slate includes January advance goods trade balance and wholesale inventories (8:30am New York time), 4Q house price purchase index and December FHFA house price index and S&P Case- Shiller home prices (9am), February MNI Chicago PMI (9:45am), Richmond Fed manufacturing index, consumer confidence (10am) and Dallas Fed services activity (10:30am). From central banks, we’ll hear from the Fed’s Goolsbee, the ECB’s Vujcic, and the BoE’s Cunliffe, Pill and Mann. Finally, earnings releases include Target.

Market Snapshot

- S&P 500 futures down 0.2% to 3,978.75

- STOXX Europe 600 down 0.4% to 460.78

- MXAP down 0.4% to 157.58

- MXAPJ down 0.4% to 510.36

- Nikkei little changed at 27,445.56

- Topix little changed at 1,993.28

- Hang Seng Index down 0.8% to 19,785.94

- Shanghai Composite up 0.7% to 3,279.61

- Sensex down 0.6% to 58,944.15

- Australia S&P/ASX 200 up 0.5% to 7,258.40

- Kospi up 0.4% to 2,412.85

- German 10Y yield little changed at 2.65%

- Euro little changed at $1.0616

- Brent Futures up 0.7% to $83.02/bbl

- Gold spot down 0.3% to $1,811.43

- U.S. Dollar Index little changed at 104.66

Top Overnight News from Bloomberg

- Incoming Bank of Japan (BOJ) Deputy Governor Shinichi Uchida on Tuesday brushed aside the chance of an immediate overhaul of ultra-loose monetary policy, suggesting that any review of its policy framework could take about a year. RTRS

- Investors and traders continue to ramp up their bullish bets on the yen, with one eye firmly fixed on looming Bank of Japan management changes: BBG

- Ukraine’s head of military intelligence downplays talk of China supplying arms to Russia, saying he saw “no signs that such things are even being discussed”. SCMP

- Apple’s suppliers are likely to shift production capacity out of China far faster than many anticipate given deteriorating relations between Washington and Beijing. BBG

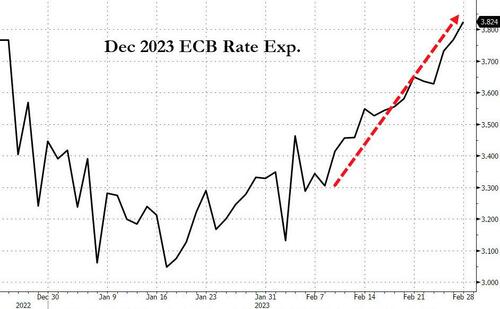

- Euro-area bonds slid and traders bet the ECB will raise interest rates to the highest level on record amid signs inflation in some of the region’s biggest economies is not coming under control. Data showed French and Spanish inflation unexpectedly accelerated to an all-time high in February, spurring money-markets traders to fully price a 4% ECB terminal rate, which would exceed a peak in borrowing costs seen more than two decades ago. That compares to 3.5% expected at the start of the year, with traders now betting the ECB will keep raising rates through February 2024. BBG

- Euro zone inflation pressures have begun to ease, including for all-important core prices, but the European Central Bank will not end rate hikes until it is confident price growth is heading back towards 2%, ECB Chief Economist Philip Lane said. RTRS

- The ECB might hold borrowing costs at a high level for some time once they reach their peak, according to Chief Economist Philip Lane: BBG

- Credit Suisse “seriously breached” risk management obligations in the Greensill affair, the Swiss banking regulator said as it opened enforcement proceedings against four unnamed former managers. Remedial measures include regular executive board-level reviews of key relationships for counterparty risks and recording the responsibilities of its 600 highest-ranking employees. BBG

- META’s new AI-driven Advantage+ tool, designed to overcome Apple’s privacy restrictions, is “significantly boosting the performance of advertising campaigns”. FT

- Chevron rose premarket after it raised its annual buyback rate to $17.5 billion beginning in the second quarter, up from a previously planned $15 billion. BBG

- The Swiss economy unexpectedly failed to grow in the final months of 2022 as manufacturing output contracted and exports weighed on momentum. Separately, Switzerland’s KOF Economic Leading Indicator rose more than economists expected in February, to 100 versus estimate 98.0: BBG

- The BOJ should take time over any future review if it undertakes one, according to deputy governor nominee Shinichi Uchida, a key engineer of the central bank’s easing program: BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks eventually traded mixed heading into month-end and despite the early momentum from the positive close on Wall St where risk sentiment benefitted as yields softened amid mixed data. ASX 200 was led by strength in the mining-related industries and after mostly encouraging data releases including a stronger-than-expected rebound in retail sales. Nikkei 225 initially gained amid the upper house confirmation hearings where the BoJ Deputy nominees reiterated the need to continue monetary easing, although the gains were gradually pared as participants also digested mixed data including the largest monthly decline in industrial production in 8 months. Hang Seng and Shanghai Comp. failed to sustain opening advances despite a substantial liquidity injection and reports the White House is scaling back plans to regulate US investments in China.

Top Asian News

- PBoC injected CNY 481bln via 7-day reverse repos at 2.00% for a CNY 331bln net injection.

- White House is scaling back plans to regulate US investments in China with US President Biden expected to forego expansive new restrictions on American investment in China, according to Politico.

- White House gave federal agencies 30 days to ensure they have TikTok bans on federal devices and systems, while it directed federal agencies to adjust contracts to ensure IT vendors keep US data safe by eliminating the use of TikTok on devices and systems, according to Reuters.

- BoJ Deputy Governor nominee Uchida reiterated that the BoJ needs to continue monetary easing for the time being to support the economy and shouldn’t review easy monetary policy just because there are side effects. Uchida added the BoJ will conduct policy flexibly and will firmly continue monetary easing to lay the ground for companies to raise wages, while he added that it is too early to seek an exit from monetary stimulus and that widening the yield target band itself would weaken effects of easing.

- BoJ Deputy Governor nominee Himino said NIRP has negative impacts on financial institutions’ profits and that they must be mindful of the impact to banks from negative rates but the focus now should be on keeping easy policy to support the economy. Himino stated that if conditions fall in place for BoJ to exit easy policy, that would be good for both the public and banks but added that the best approach is to support the economy with easy policy until inflation can achieve the BoJ’s price target excluding the impact of import price increases.

European bourses are mixed/flat, Euro Stoxx 50 +0.1%, as the initial pressure from hot French/Spanish inflation readings has eased through the morning. Sectors, are mixed with Banking/Financial names outperforming as yields lift alongside specific stock updates. Stateside, futures are little changed overall with the morning’s action moving in-tandem with European performance ahead of earnings/Fed speak, ES +0.1% Foxlink, an Apple (AAPL) supplier, will not be able to resume full operations at its India plant for two months following a fire, via Reuters citing sources. Apple could potentially face disruptions in supply chain for iPhones due to Foxlink incident. Chevron (CVX) reaffirms higher returns and lower carbon objectives, lifts share buyback guidance to USD 10-20bln/year; increases targeted annual share buyback rate to USD 17.5bln from Q2. Apple (AAPL) probe by Brussels into the Co.’s restriction of certain apps has been narrowed, according to FT sources. The US is to prevent businesses from using cash for buybacks in the CHIPS Act, according to the Commerce Department; Additionally, cannot make new, high-tech investments in China or other “countries of concern” for at least a decade. A release that is in-fitting with recent press reports.

Top European News

- ECB’s Lane says positive supply shocks since December and rate hikes have curbed inflationary pressures, forward looking indicators for food, energy and goods suggests inflation slowdown. Rate plateau should be held for some time, rates could be in restrictive territory for a number of quarters; hikes to end when it is clear inflation is heading to target.

- Northern Ireland DUP leader Donaldson says the Stormont Break in the Northern Ireland deal at first glance does give Stormont the ability to apply the break. Continue to have some concerns with the deal.

- EIB President proposes a new fund to see off US subsidies, via Der Spiegel; concerned that entire industries will migrate to the US given the subsidies on offer there.

FX

- The DXY is firmer on the session, though remains closer to its 104.57 trough then the 104.90 high, a low that printed in wake of shortlived EUR upside following February flash CPI metrics from France/Spain.

- Specifically, the price points lifted EUR/USD to a 1.0625 peak, though this has proved shortlived as the USD remains resilient and given unfavourable EUR/GBP action as the mood-music re. N. Ireland remains positive, on balance.

- As such, GBP is the G10 outperformer with Cable testing the 1.21 mark vs a 1.2028 base following a favourable face-value take from DUP’s Donaldson; though, sources indicate the parties’ review could potentially take weeks.

- JPY is the G10 laggard given unfavourable yield action and more dovish remarks from the BoJ deputy nominees; USD/JPY at the top-end of 136.12-84 parameters.

- PBoC set USD/CNY mid-point at 6.9519 vs exp. 6.9515 (prev. 6.9572)

Fixed Income

- Debt futures fade after the latest dead cat bounce and curves re-steepen.

- Bunds hit a fresh 132.51 cycle low, Gilts down to 99.38 and T-note retreats within 111-21+/10 range, solid 2025 German auction, albeit after heavy concession helps Schatz pare some losses between 115.52-114.95 parameters.

- JGBs outperform after more dovish testimony from BoJ nominees and decent 2 year sale.

Commodities

- WTI and Brent are firmer on the session and currently reside at the top-end of narrow circa. USD 1/bbl parameters which are just about within Monday’s range, with newsflow limited and the complex seemingly continuing to consolidate.

- Japan plans to emphasise the importance of investments into natgas, LNG, hydrogen and ammonia during its G7 presidency, according to a METI official.

- LME announces immediate suspension of warranting, applicable to LME-listed warehouses located in the US of any new primary aluminium, copper, lead, nickel or aluminium alloy (in form of NASAAC). Currently Russian NASAAC on warrant, 400/T, in LME-listed warehouses within the US. Suspending use of such warrants for use in settlement of LME NASAAC futures.

- Spot gold is a touch softer on the session as initial USD-induced upside has faded as the index moves back into positive territory, albeit only modestly so; more broadly, base metals are mixed given the USD’s resilience and inflation metrics weighing.

Geopolitics

- Kremlin spokesperson Peskov said Russia will not resume participation in START talks until Washington listens to Moscow’s position, while he added that NATO no longer acts as Russia’s conditional opponent but as an enemy.

- Russian Defence Ministry said the US is planning provocation in Ukraine using toxic chemicals, according to TASS.

- Russian domestic flights heading for St Petersburg are reportedly turning around, via Reuters citing a flight radar tracking site; Pulkovo airport has been closed to air traffic, due to an unidentified object with fighter jets responding, via BAZA. Airspace around the airport has subsequently reopened.

- Russian Defence Ministry says Ukraine attempted to attack two Russian regions with drones overnight, via Ria.

US Event Calendar

- 08:30: Jan. Wholesale Inventories MoM, est. 0.1%, prior 0.1%

- Jan. Retail Inventories MoM, est. 0.1%, prior 0.5%

- 08:30: Jan. Advance Goods Trade Balance, est. -$91b, prior -$90.3b, revised -$89.7b

- 09:00: Dec. S&P CS Composite-20 YoY, est. 4.75%, prior 6.77%

- Dec. S&P/CS 20 City MoM SA, est. -0.40%, prior -0.54%

- Dec. FHFA House Price Index MoM, est. -0.2%, prior -0.1%

- 09:45: Feb. MNI Chicago PMI, est. 45.5, prior 44.3

- 10:00: Feb. Richmond Fed Business Conditions, prior -10

- Feb. Richmond Fed Index, est. -5, prior -11

- 10:00: Feb. Conf. Board Consumer Confidence, est. 108.5, prior 107.1

- Feb. Conf. Board Present Situation, prior 150.9

- Feb. Conf. Board Expectations, prior 77.8

Central Bank Speakers

- 14:30: Fed’s Goolsbee Speaks at Community College

DB’s Jim Reid concludes the overnight wrap

Regular readers won’t be surprised to learn that I have a new injury. As soon as I was fit to resume normal activities after my recent back operation I went back to weights. I only do this to be better at golf. In my first couple of sessions back 2 weeks ago, I overdid the bench press and to cut a long story short I now have a rhomboid muscle strain or tear. I’ve stupidly tried to continue playing golf with it and have made it worse. I’m now in a lot of pain and probably out from golf for a few weeks. I come away from it wishing that my mid-life crisis was more skewed towards fast cars, tattoos, or a hair transplant rather than golfing ambitions.

After a rough three weeks for equities, bonds and my shoulder, markets have started this one off in a better mood so far as we hit the last day of the month today. That’s a sixth of the year nearly gone! They have edged higher thanks to a positive round of US data, whilst pricing for the Fed’s terminal rate remained stable after a sustained stretch higher over recent days. This in turn gave markets a clearer run to positively respond to the data across bonds and equities.

Things had looked quite different earlier in the day. In fact, at one point the 10yr Treasury yield reached its highest intraday level since November at 3.977%, before moving lower in the US morning, and ultimately closing -2.9bps lower at 3.914%. In the meantime, expectations of the terminal rate had likewise been on track to hit a new closing high and moved as high as 5.43% intraday, before ending the session little changed at 5.404%.

In risk markets, positive US data without a rates repricing helped, with core capital goods orders up by +0.8% in January (vs. unch expected). On top of that, there was further evidence that housing activity might have bottomed, since pending home sales were up +8.1% in January (vs. +1.0% expected), which leaves the index at its highest level since August. However note that mortgage rates have gone back up in February so we’ll see how strong the nascent housing recovery is.

For equities, the S&P 500 (+0.31%) posted a steady advance led by cyclical and growth sectors. The NASDAQ (+0.63%) outperformed, and the FANG+ index (+1.51%) saw an even larger advance thanks to a solid gain from Tesla (+5.46%) which ended the day as the 4th best performer in the entire S&P 500. Defensives lagged, as bond-proxies such as utilities (-0.77%) and food staples (-0.54%) were the worst performing industries. Meanwhile in Europe, the STOXX 600 (+1.07%) posted a decent broad-based recovery. Every sector of the index was higher, but like with the US, defensives lagged their more cyclical peers.

The exception to the pattern of positive data came from the Dallas Fed’s manufacturing index for February, which came in at -13.5 (vs. -9.3 expected). Notably, there were also increases in the prices paid and prices received components, with both hitting a 5-month high. That topic of inflationary pressures in February is likely to stay in the spotlight today, since this morning we’ve got the flash releases from France, Spain and Portugal, ahead of the Euro Area-wide release on Thursday. Remember that our European economists expect Euro Area core inflation to hit a new record of +5.5%, although they see headline inflation coming down a bit further to +8.4%, which would be a 4th decline since the +10.6% peak back in October.

This concern about inflation meant that European markets performed a bit differently to the US yesterday, with sovereign bond yields rising to fresh highs in several countries. For instance, the 10yr bund yield (+4.5bps) closed at its highest level since 2011, ending the day at 2.582%. And in the UK, the 10yr gilt yields was up +14.6bps to 3.805%, marking its highest level since Liz Truss was still PM back in October. Those moves came as investors continued to price in a more hawkish policy path for the ECB, building on the shift over recent weeks. Indeed, overnight index swaps are now pricing in no rate cuts at all in 2023, and by the December meeting they’re now pricing in +137bps of further hikes.

That repricing of the ECB’s rate path was seemingly endorsed by Croatia’s Vujcic yesterday, who said that the repricing reflected the ECB’s moves, and that markets were right to price in 50bps next time as they’d indicated. He also said that as long as core inflation persisted, then the ECB must persevere. Meanwhile at the Fed, the only major speaker was Governor Jefferson (who previously spoke on Friday), but he offered little new information on the policy side. One thing he did say was that raising the Fed’s inflation target could hurt their credibility, and pointed out that the outlook for core services ex housing inflation (which Chair Powell has said they are following) remained uncertain. Yet in spite of his reiteration of the 2% goal, short-term US inflation expectations continued to move higher yesterday, with the 2yr breakeven (+3.4bps) hitting a fresh 6-month high of 3.088%. In a WSJ interview published yesterday, Cleveland Fed President Mester seemed to imply that the threshold to go back to 50bps hikes would be high. She noted that “this is a different situation now. We’ve already reduced it to 25 (basis points). That’s going to be part of the consideration.” However, she noted that the more pertinent discussion for the FOMC in March will be just how much further the policy rate needs to go.

Overnight in Asia, major benchmarks are trying to catch up with yesterday’s price action in the US, with the Kospi (+0.64%) and the Hang Seng (+0.41%) outpacing the Nikkei (+0.13%) and the Shanghai Composite (+0.07%). US futures are also in the green, led by the Nasdaq 100 (+0.18%) while the S&P 500 is flat (+0.01%). The 10y yield is marginally higher (+1.2bps), mirroring the move in the 2y (+1.5bps).

Back here in the UK, sterling strengthened (+1.00%) after the government reached a deal with the EU over the Northern Ireland Protocol, which has been the most contentious part of the original Brexit deal. In essence, the Protocol was designed to avoid a hard border between Northern Ireland and the Republic of Ireland, but in doing so placed checks on goods moving into Northern Ireland from the rest of the UK, whilst Northern Ireland also remained aligned with the EU single market for goods. This has been opposed by unionists in Northern Ireland, who see the Protocol as placing an economic border with the UK, and the DUP (the largest unionist party there) have refused to enter a power-sharing agreement in Northern Ireland because of it.

When it comes to the new agreement, it removes checks on goods that move from Great Britain into Northern Ireland that remain within the UK. It also enables VAT and excise changes to apply on a UK-wide basis in future, including to Northern Ireland. And a new mechanism was introduced that will allow the devolved Northern Ireland Assembly to decide whether or not changes to EU goods rules affecting Northern Ireland should apply. If this brake is pulled, the UK government would have a veto over the application of a new EU rule. Leader of the DUP, Jeffery Donaldson said his party needed to go over the finer points of the agreement over the next few days, but that “in broad terms it is clear that significant progress has been secured across a number of areas.”

To the day ahead now, and data releases include French CPI for February, Canada’s Q4 GDP, and in the US there’s the FHFA house price index for December, the Conference Board’s consumer confidence index for February, the MNI Chicago PMI for February, and the Richmond Fed’s manufacturing index for February. From central banks, we’ll hear from the Fed’s Goolsbee, the ECB’s Vujcic, and the BoE’s Cunliffe, Pill and Mann. Finally, earnings releases include Target.