MS Quants: 8 Reasons Why Stocks Are Going Lower

This morning we published a note looking at “How This (Asset) Cycle Finally Ends” in which we explained why the imminent tightening in credit conditions – beyond the near-record tightness already observed in the most recent SLOOS…

…. resulting from small banks retrenching and conserving cash into reserve and curtailing new lending, would finally end the asset cycle and lead the US economy into a recession, but not before hammering stocks and further collapsing the velocity of money.

A few hours later, Morgan Stanley’s QDS team of derivatives experts, reiterated the same view, writing that while authorities quickly cut off the “left tail” by providing coverage for uninsured deposits and instituting a new liquidity facility, squeezing shorts in the process, “equities should come under renewed pressure from a tightening of credit conditions and reduced velocity of money, plus the increase in volatility and shock to correlation that stresses positions.”

They then shared a few thoughts on the recent market moves:

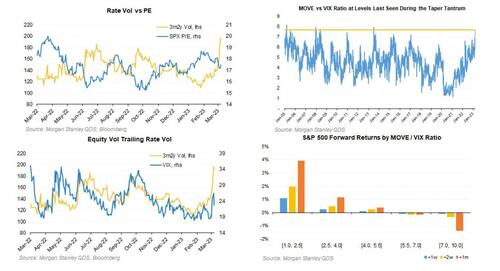

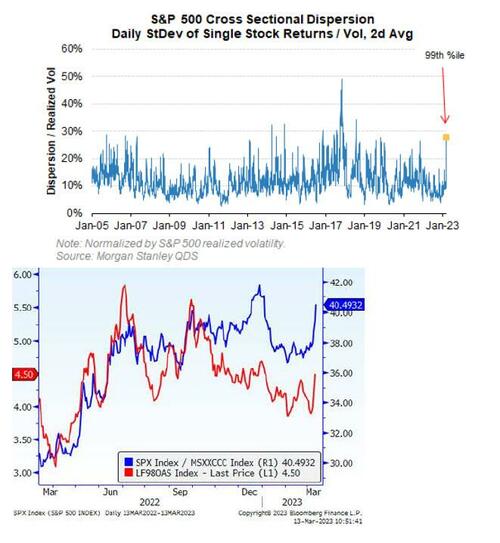

1. Cross market volatility suggests equities should be lower. Biggest move in the two year yield since 1987, biggest move in 2s30s since 9/11… plenty of cross market vol but equities aren’t reacting. Over the last year the SPX P/E multiple has had a -65% correlation to rates vol, which at current levels suggests P/E should be 15x – 2 turns lower or an SPX of ~3400. The last time rate vol was this high relative to equity vol (VIX) was the Taper Tantrum. Yes the Fed is further along in their hiking cycle – and rate vol will normalize after the shocks of the last few days. But QDS would also argue that economic/earnings growth and financial risks are higher now than they were two weeks ago.

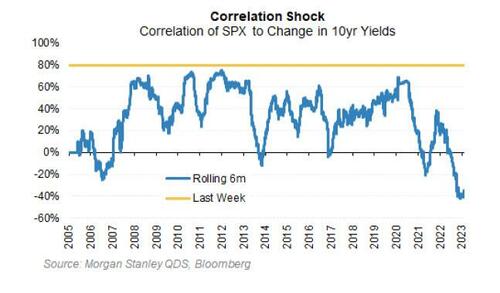

2. This wasn’t just a vol shock, it was a correlation shock. The change in focus from inflation and the Fed’s reaction function to concern about growth/recession and financial stability has flipped stock-bond correlation on its head, and correlation shocks are particularly hard to deal with as traders need to run from one side of the boat to the other.

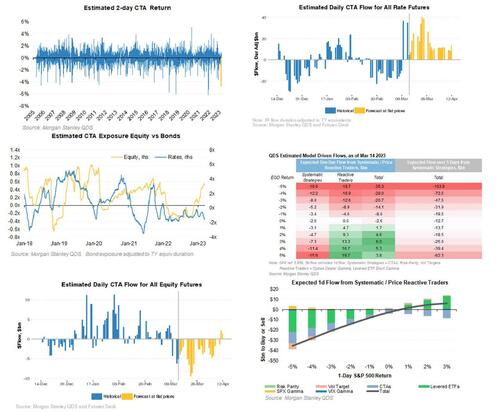

3. Change in trend + change in correlation + change in vol is bad for many investors, but CTAs in particular given current positioning. On QDS’s model, CTAs suffered the 7th worst two-day return since 2005 on Friday and Monday, as they were long stocks but short bonds. Wrong-way volatility typically leads to derisking – today’s reversal will be dampen the impact, but on net QDS is forecasting equity for sale bonds to buy over the coming days.

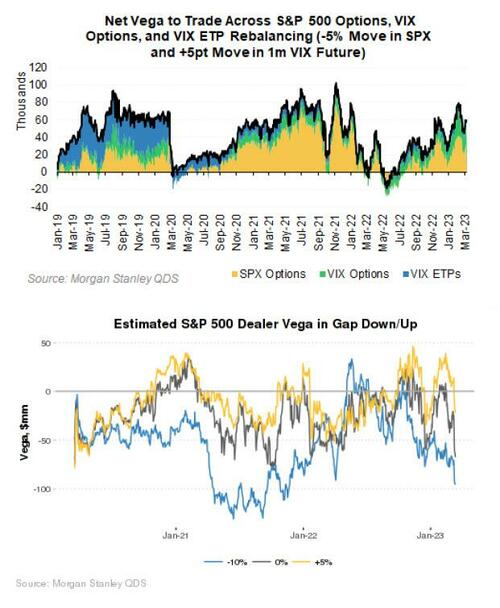

4. Equity volatility is off sharply today, but not out of the woods as the technicals that contributed to its squeeze are still there. QDS estimates that dealers have roughly $60mm of vol to buy in a down 5% move in SPX and +5 point increase in VIX futures – the 90th %ile versus the last year. That is still only the 65th %ile since 2019 – volatility is not going to go crazy – but investors should not look at a VIX level of ~23 as an ‘all clear’.

5. Within equities high dispersion = both risk and opportunities. Dispersion rose sharply over the last 2 days given the big moves in Financials. Those wrong way likely have to derisk on a broader basis, while opportunities also arise – companies with weak balance sheets (MSXXCCC from the MS Thematic Investment Strategy team) should now come under pressure.

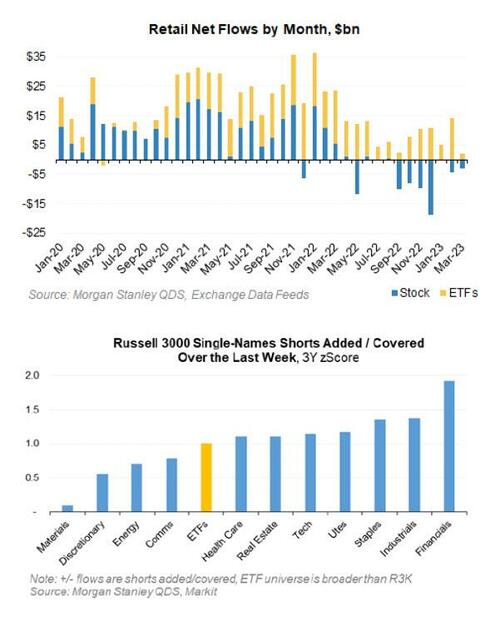

6. Selling pressure has come from both retail and institutions in the last week. The MS Futures Content team highlighted that Friday and Monday combined for the largest two-day increase in new shorts added in S&P 500 futures since March 2020 (rolls-adjusted), with an estimated $49bn of new shorts initiated. And on top of that, MarkIt data suggests 1 zScore short additions in ETFs and 2 zScore short additions in US single-names over the last week. On top of that, retail has been a small net seller of equities in the last week (<$2bn net sold), a -1.1 zScore event versus the last two years, based on QDS’s model based on public data. Some of these shorts are likely coming off today, and more could come off in the near-term – but those are short-term supports, not longer-term ones.

7. Conflicting policy goals. Up until a week ago, the Fed was balancing between growth and inflation. Now they also have to balance financial stability risks – and while they have plenty of tools to do that, at the end of the day these goals present a conflict. Inflation and growth argue for continued rate hikes and QT, while stress argues to slow or pause. Whatever is most acute usually wins… which may be good for stocks in the near-term, but longer-term the less tightening done now likely puts the economy and the Fed between a rock and a hard place.

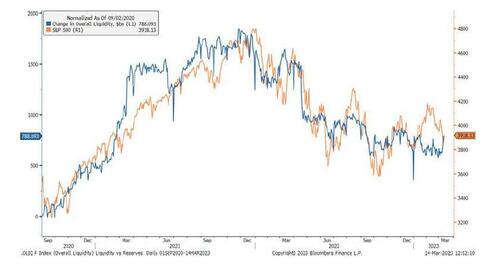

8. Reduced velocity of money. The potential for a higher cost of bank capital and more expensive funding after recent events has the potential to slow the velocity of money and compound monetary liquidity / QT risks. Equities have now caught back down to the level of reserves in the system after a record gap opened up in late January, and recent TGA spend down (tax refunds) and money coming out of RRP as the system demands more reserves has helped as well. In the near-term that could continue as RRP is drained. But even if monetary liquidity doesn’t contract going forward, if the velocity of money falls then credit extension will be limited and the economy and the market should suffer.

The above doesn’t mean the floor will fall out of equities – policymakers have limited the financial contagion channel. But the real economy channel is still a risk. QE and fiscal stimulus put excess savings in consumers pockets and funded many unprofitable businesses, which has delayed the economic reckoning. But increased cross market volatility, reduced velocity of money, and higher cost of funds should erode those buffers more quickly than before, and it seems hard to frame a bull case for stocks after the last week. Particularly after short covering and hedge monetization on today’s rally, QDS thinks the view that equities need to reprice lower as earnings deteriorate plays out from here.

Tyler Durden

Wed, 03/15/2023 – 22:40

via ZeroHedge News https://ift.tt/7kFmNsZ Tyler Durden