Solid Demand For Tailing 20Y Auction As Kink Persists

A week after several mediocre coupon auctions, today the Treasury tested market demand for 20Y paper with average results.

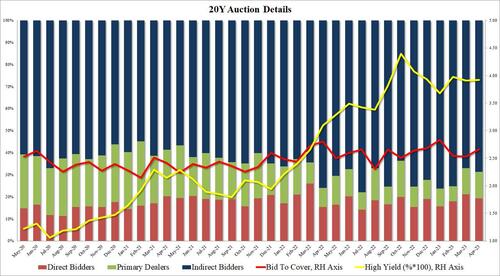

Today’s sale a 20Y reopening (technically 19-Y, 10-Monthy CUSIP TQ1), priced at a high yield of 3.920%, up from last month’s 3.906% and tailing the When Issued 3.918% by 0.2bps, the third consecutive tailing 20Y auction in a row (following 3 stop throughs).

The Bid to Cover of 2.66 was solid, above last month’s 2.53 and also above the six-month average of 2.62.

The internals were ok, with Indirects awarded 68.7%, and with Directs taking down 19.2% of the auction, slightly above the recent average of 18.2%, that meant that Dealers were left holding 12.0% of the auction, the most since last October, perhaps as the big banks start loading up on duration ahead of the next QE.

In summary, a medicore, modestly tailing sale of 20Y bonds, one which failed to benefit from today’s concession which pushed the 10Y yield over 3.63%; the reaction to the auction was clear: slight disappointment, with 10Y yields rising by 1basis point and last trading just south of 3.61%. Perhaps more notable, despite all the attempts of the Treasury Dept and the TBAC to normalize the curve :kink:, one look at the chart below shows that so far all attempts to “smooth” the 10Y to 30Y line have failed.

Tyler Durden

Wed, 04/19/2023 – 13:27

via ZeroHedge News https://ift.tt/ChBaESq Tyler Durden