Mediocre, Tailing 7Y Auction Sees Solid Foreign Demand

After an average 2Y, and a stellar (if slightly tailing) 5Y auction, moments ago the Treasury held its final coupon auction of the week when it sold $35BN in 7 Year paper in a sale that was solid if forgettable.

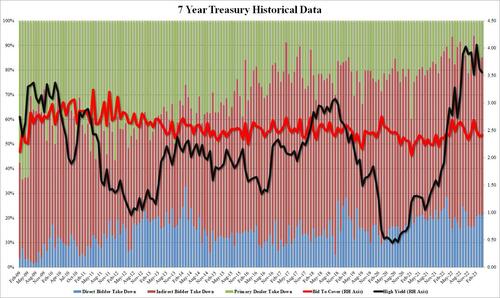

The auction stopped at a high yield of 3.563%, below the 3.626% last month and the lowest since January; extending the recent trend, the auction tailed the 3.550% When Issued by 1.3bps. This was the third consecutive tailing 7Y auction and 6 of the past 7.

The Bid to cover of 2.415 was a slight improvement to last month’s 2.394 if below the 2.465 six-auction average.

The internals were also average, with Indirects (foreign buyers) awarded 64.11%, above the 63.2% in March but below the recent average of 66.5%; and with Directs down to 21.1%, the lowest since February but above the 19.1% six-auction average, Dealers were left with 14.8% of the auction, virtually on top of the 14.4% average.

Overall, a solid auction which clearly benefited from the jump in yields throughout the day, which sent 10Y yields to 3.52%, or session highs, just in time for the auction.

Tyler Durden

Thu, 04/27/2023 – 13:19

via ZeroHedge News https://ift.tt/AcmzLO1 Tyler Durden