Tingo Group Annihilated After Hindenburg Calls It “Brazen Fraud” And “Humiliating Embarrassment For All Involved”

Perhaps shares of Tingo Group (TIO) should change their ticker symbol to “NGMI” because that seems to be the prevailing sentiment this morning after short seller Hindenburg Research released a report calling the company “a worthless and brazen fraud that should serve as a humiliating embarrassment for all involved.”

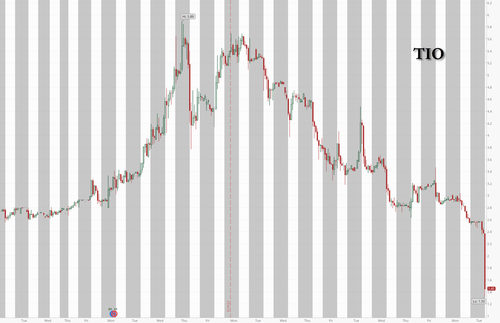

Shares were down nearly 50% heading into the cash open:

The claims in the report are astonishing, with Hindenburg taking shots at the company’s founder, “Dozy” Mmobuosi, and calling its financials fabricated.

“We’ve identified major red flags with Dozy’s background. For starters, he appears to have fabricated his biographical claim to have developed the first mobile payment app in Nigeria. We contacted the app’s actual creator, who called Dozy’s claims ‘a pure lie”,” Hindenburg writes.

“We strongly suspect Tingo’s cash balance, which it conveniently claims is held in Nigeria, is fake. The company collected only ~12% of the interest income one would expect from its claimed cash balances,” they continue.

The report takes exception with Tingo’s financials, indicating that it believes the numbers are fake:

- Tingo’s financial statements are riddled with errors and typos, including a note to itself that it apparently forgot to delete, saying “please update for the tingle (sic) transaction including the tingle (sic) foods transaction”.

- Its financials include other basic errors like incorrect math and leaving zeroes off key metrics.

- More troublingly, Tingo’s cash flow and balance sheet statements do not reconcile and show major errors indicating a complete lack of financial controls. Its cash flow statements regularly subtract items from cash that should be added and vice versa.

The company took shots at a recent “groundbreaking” the company supposedly held:

- In February 2023, the company held a groundbreaking ceremony for a planned $1.6 billion Nigerian food processing facility of its own, attended by the country’s agriculture minister and other political luminaries.

- We found that the rendering of the planned facility, featured in Tingo’s investor materials and on a billboard at the ceremony, is actually a rendering of an oil refinery from a stock photo website.

- Following its groundbreaking, Tingo reported in a May 2023 SEC filing that it made “significant progress” on the facility, including laying “the foundations of its numerous buildings”.

- We visited the site a week later and found zero signs of progress; it was empty except for the plaque and billboard commemorating the groundbreaking ceremony, surrounded by weeds.

Hindenburg also takes shots at each of Tingo’s business segments.

“Tingo claimed in its reverse merger press release that members of 2 unnamed farming cooperatives supply the majority of its then-9.3 million userbase, consisting of local Nigerian farmers. These farmers supposedly form the core of the company’s phone customers and provide the agricultural products used in Tingo’s food processing and trading businesses. A local media outlet identified and contacted the cooperatives. Both said they had never heard of Tingo and had fewer than 100 farmers in each cooperative. Our checks with the Nigerian Communications Commission showed it has no record of Tingo being a mobile licensee at all, despite company claims of having 12 million mobile customers,” the short seller writes.

They also took aim at the company’s “TingoPay” product:

- TingoPay (part of Tingo Mobile) claimed in 2021 to have launched a partnership with a major local bank.

- Two days after Tingo’s blockbuster announcement, the bank put out a statement calling Tingo’s claim false and that it had “NOT concluded any agreement with Tingo International in respect of any payment system whatsoever”.

- Tingo now claims its payment group has a point of sale (PoS) system and other merchant products. We found that pictures of Tingo’s claimed PoS system were taken from a different PoS operator’s website, with a Tingo logo photoshopped over them.

- Tingo claims its “seed to sale” online marketplace called NWASSA generated $125.3 million in revenue last quarter or ~15% of its total revenue, yet the website has been “under maintenance” and inoperable for months.

- Tingo claims it has launched its NWASSA platform in Ghana. The Ghana website also doesn’t work and just says “Updating…” without ever going anywhere.

Hindenburg concludes: “Overall, we think Tingo is a worthless and brazen fraud that should serve as a humiliating embarrassment for all involved. We do not expect the company will be long for this world.”

Tyler Durden

Tue, 06/06/2023 – 09:40

via ZeroHedge News https://ift.tt/7M425Ra Tyler Durden