In what has become an annual tradition, Democrats and too many journalists are marking back-to-school season by trying to insist with a straight face that the COVID-era school closures from the autumn of 2020 all the way through 2022 were a bipartisan phenomenon, perhaps even mostly attributable to Republicans.

“Remember,” White House Press Secretary Karine Jean-Pierre said Monday, echoing an administration “fact sheet” released the same day, “when the president walked [into office], more than 50 percent of schools were shut down because of COVID, because the last administration didn’t have a plan—didn’t have a comprehensive plan—to deal with COVID and what it was doing to our economy and what it was doing to our kids. And because the president put…schools reopening and businesses reopening and making sure that people got shots in arms, made that a priority, we were able to open up the schools.”

There are several insufficiently factual assertions in that statement, beginning with the formulation that K-12 schools still shuttered as of January 20, 2021, remained so “because of COVID.” The pandemic was the stated reason, to be sure, but schoolhouse closure at that point was an active policy choice, one that had been rejected by a majority of European countries, American private schools, and the (Republican-run) states of Wyoming, Montana, Florida, Arkansas, South Dakota, Texas, and so on.

President Donald Trump may not have had what the Biden administration would characterize as a “comprehensive plan” to reopen schools (in part because K-12 education in the United States is still governed at the state and local level), but he did as of July 2020—when enough research and global experience had already demonstrated that children were overwhelmingly less likely to catch, transmit, and suffer from COVID-19—urge schools to “Get open in the fall.”

Republican governors such as Florida’s Ron DeSantis took Trump’s advice, as well as heaps of media/Democratic/teachers-union derision (some of which, defiantly, continues to this day). What did then-candidate Joe Biden say at the time?

“If we do this wrong, we will put lives at risk and set our economy and our country back,” the Democrat warned while unveiling a plan that conditioned reopening on $58 billion in additional federal aid. Also: “If you have the ability to have people wear masks and you have teachers able to be in a position where they can teach at a social distance—that, I think is one thing….But it costs a lot of money to do that. If you don’t have that capacity, I think it’s too dangerous to open the schools.”

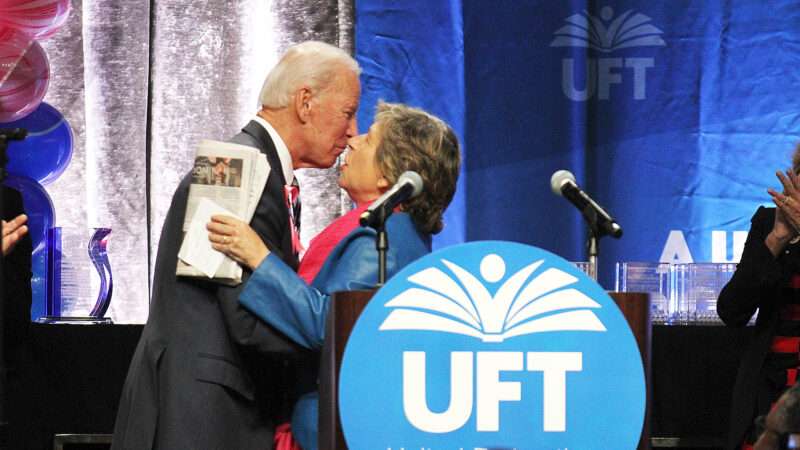

Such fearmongering was routine for the types of teachers unions that First Lady Jill Biden belongs to. Union demonstrations against reopening in the fall of 2020, usually in Democratic-dominated cities, featured such subtle props as coffins, body bags, and gravestones; an American Federation for Teachers (AFT) anti-Trump ad that August claimed that “our kids are being used as guinea pigs.” The states that closed their schools most—Hawaii, Maryland, Washington, California, Oregon, New Jersey, Massachusetts—did not have in common levels of infection, or hospital capacity, or mortality; but rather that they each voted for Biden over Trump by double-digit margins.

DeSantis was right, Biden was wrong, and by now even NPR education reporters admit that the remote learning favored by Democratically governed jurisdictions has been a generational catastrophe, triggering a parental stampede out of free-of-charge, government-run schools.

The latest numbers from the Centers for Disease Control and Prevention (CDC) show that since the onset of the pandemic, just 1,689 of the 1,141,899 deaths attributed to COVID, or one out of every 675, were kids under the age of 18, and nearly half of those were under the kindergarten age of 5. K-12 teachers in the pre-vaccine year of 2020 had a lower COVID mortality rate than the average worker. Post-vaccination, the least likely pathway of in-school transmission has been from student to teacher. The one country in Europe that didn’t close its schools even in the spring of 2020 is the one that has had the lowest rate of excess deaths.

President-elect Biden vowed in December 2020, if conditionally, that a majority of K-12 public schools would be open within his first 100 days of office. On his first day in office, he quietly downgraded that promise to just K-8 schools. By week three, “open” was reinterpreted to mean “at least one day per week.”

There was a practical reason for such expectation-lowering. The administration and its teachers-union allies still wanted one last huge federal payout, in the form of the $1.9 trillion American Rescue Plan, which (after being passed one month later) directed $122 billion to K-12 schools (on top of the $70 billion in emergency federal school funding those schools had already received), as well as an additional $350 billion to state and local governments, which typically spend about 20 percent of their budgets on pre-collegiate education.

“We need a Marshall Plan for our schools,” urged the school superintendents of New York, Los Angeles, and Chicago in a December 2020 Washington Post op-ed. (Only NYC of the three was even half-heartedly open.) The hostage-taking was not subtle; neither was the White House’s timing.

Just three days after redefining “open” as one day per week, and with the American Rescue Plan still hanging in the balance, the Biden administration unveiled its first major initiative affecting the pace of school reopening. And by “affecting,” I do mean “slowing down.” The CDC unveiled its long-awaited, allegedly science-based new guidance for how and when to fully reopen schools, and to the shock of epidemiologists, parents, and even some Democratic politicians—and in contradiction to the pre-CDC advice from new Director Rochelle Walensky—the ostensibly independent agency concluded schools should continue to enforce an average social distancing between students of 6 feet. For those many school districts, usually in heavily Democratic polities, that cut-and-pasted CDC guidelines as operational policy, that effectively meant hybrid and remote learning would extend into the indefinite future.

That was on February 12, 2021. On March 11, the American Rescue Plan was passed and signed into law, giving teachers their huge payday (very little of which, by the way, had anything to do with actual COVID-mitigation policies). Literally that same day came word that—ta-da!—the CDC was now considering revising the social-distance guideline to 3 feet after all, thus finally allowing the dwindling number of CDC-obedient districts to maybe fully reopen sometime.

“They are compromising the one enduring public health missive that we’ve gotten from the beginning of this pandemic in order to squeeze more kids into schools,” complained an ungrateful AFT President Randi Weingarten, whose paw-prints had been all over the original CDC guidance. “Even with the significant investment of American Rescue Plan money,” she wrote in a letter of protest to Walensky and Education Secretary Miguel Cardona, “districts lack the human resources and institutional planning ability to make changes like this quickly. Is this something that can be implemented in the fall, or perhaps the summer?”

You can understand why Joe Biden wants to falsely portray himself as a champion of reopening, just as you can see why—of all people—so does Randi Weingarten: Extended school closures, long after the survey data and global experience argued convincingly against them, constituted one of the most egregious public policy failures in modern American history, the aftereffects of which are still massively reshaping American kids, families, education systems, and cities. They are deservedly unpopular, with few people beyond opinion-journalism trolls still attempting to defend them.

What Biden delivered was not school reopening but a gargantuan transfer of federal tax money to local school districts right as their customer base was running away screaming, especially in cities and states that closed schools most. Occasionally, if grudgingly, reporters will note that spending several multiples of the Department of Education’s annual budget just on COVID relief to schools didn’t exactly make the schools much better ventilated. (“Among the reasons,” New York Times pandemic-beat writer Apoorva Mandavilli wrote on Sunday, include “a lack of clear federal guidance on cleaning indoor air, no senior administration official designated to oversee such a campaign, few experts to help the schools spend the funds wisely, supply chain delays for new equipment, and insufficient staff to maintain improvements that are made.”)

But sometimes the president himself will let slip what the school-relief bill was really all about: more jobs for an otherwise shrinking industry.

The American Rescue Plan, Biden said last week at a teacher-of-the-year celebration, provided “historic funding for schools to reopen safely so teachers could get back to the classroom, doing what they do best. Before the American Rescue Plan, only 46 percent of schools were open and in-person. Today, that’s now 100 percent. Plus, that law has delivered critical support for schools, including funding for after-school programs, summer programs; hiring more teachers, counselors, and school psychologists….Thanks to that law, the number of school social workers is up 48 percent. The number of school counselors is up 10 percent. The number of school nurses is up 42 percent. And since I took office, we’ve added nearly 80,000 additional public-school teachers—80,000.”

The post Democrats Try To Whitewash Their Starring Role in School Closures appeared first on Reason.com.

from Latest https://ift.tt/4u5Tq3t

via IFTTT