Increasingly “Nothing In The Life Of Our Nation Is Real”

Authored by James Howard Kunstler via Kunstler.com,

Bidenomics In Action

“We are at an inflection point, a threshold, where weak, brittle, effete personality structures are a threat to human civilization.”

– JD Haltigan

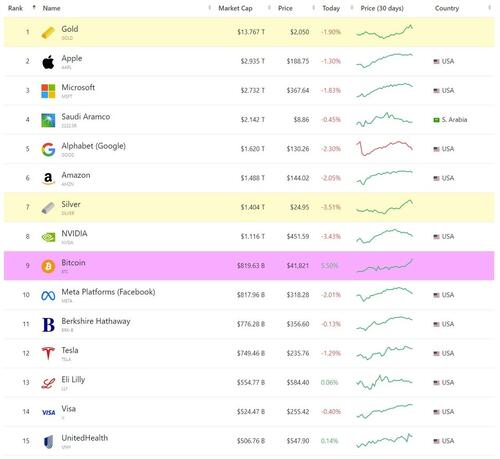

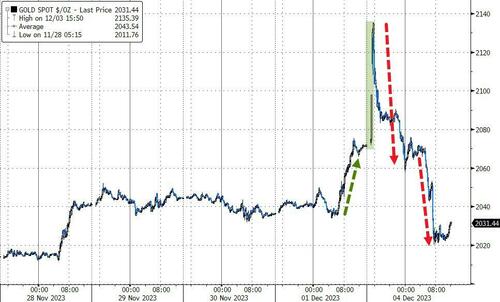

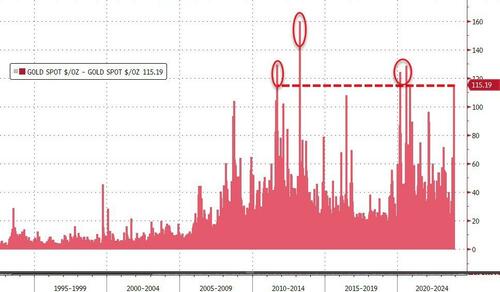

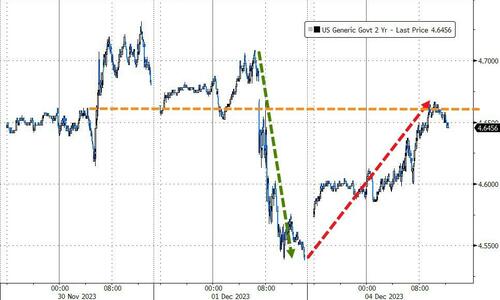

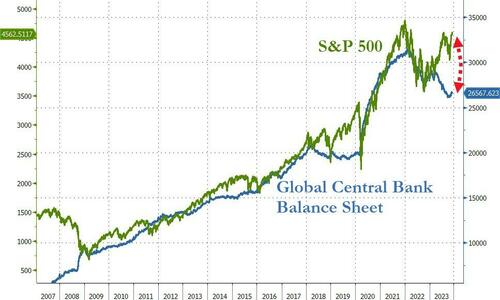

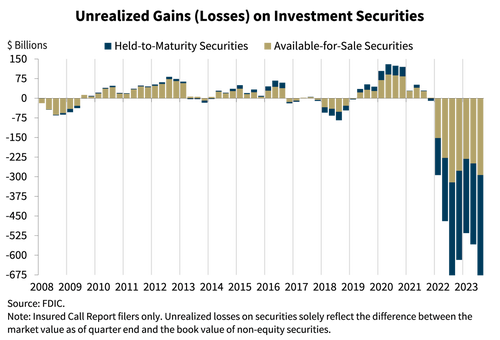

If you’re troubled at all about the state of our country, and even your own small role in it, you might be asking yourself whether the people running things have any idea what they’re doing. Some of these doings happen in the metaphysical realm of finance, for instance America’s national debt ($34-trillion and going up like mad), and the death of the US dollar, along with the bonds that underwrite it. Or the game of hide-the-salami with the repo and reverse repo markets played between the Federal Reserve and the US Treasury to give the broken banking system the appearance of stability when it is actually in deepening ruin.

Did you understand any of that? Probably not, but not because you’re dumb. It’s because all that action is meant to be incomprehensible even to people who went to grad school. The news media only amplify the mystification. The net effect is that increasingly nothing in the life of our nation is real. Every action taken is a swindle of one kind or another, a cavalcade of switcheroos aimed at zeroing out the consensus about reality.

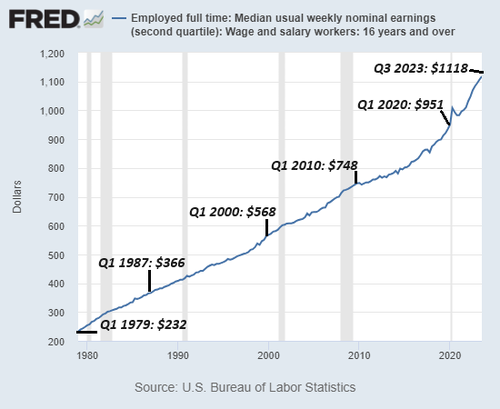

What trickles down from all this cosmic activity is the dwindling possibility of a fruitful life for most Americans. You cannot make a living. You can’t fix all the machines in your life or get new ones. You can’t get married because there’s no way you can fulfill your end of the contract. You search in vain for something purposeful to do. You are eventually faced with the choice: surrender to depression and hopelessness, or revolt against a ruling blob that is only good at one thing: depriving you of life, liberty, and the pursuit of happiness.

What also trickles down from on-high is the increasing dysfunction of all the systems that evolved to serve American life on-the-ground. For instance, the supply chains that stuff the gigantic merchandise marts from sea to shining sea. The trucking industry is falling apart. The industry can’t find enough workers to load the trucks. They call them “lumpers” in the trucking biz. United Parcel Service (UPS) is hurting so badly for lumpers that they now make the drivers load and unload the brown trucks and have to pay them double overtime for it. The fruit and vegetables that have to make a truck journey thousands of miles from the sunshine lands to the icy north sit rotting in the warehouses because there aren’t enough lumpers on the loading docks — in case you’ve noticed that the produce in your supermarket is looking wilty and gross.

All the systems that move stuff around this big country are wobbling. Many trucking and logistics companies went out of business in 2023, led by Convoy’s bankruptcy in October due to a “an unprecedented freight market collapse” and inability to get financing. UPS has not recovered from the big drop in shipping that followed the end of Covid lockdowns — 1.2-million packages per day in lost volume — nor adjusted to its new contract with the Teamsters Union, a 46 percent cost increase for drivers in the first year. UPS CEO Carol Tomé even took a pay cut: $19 million this year, down from $26 million (including stock packages) in 2021. Federal Express also saw a sharp drop in package deliveries and in September yanked its full-year profit guidance. The FedEx share price dropped 20 percent in one day. Consider, too, the California Air Resources Board (CARB) regulations aimed at a “zero carbon emissions” goal in 2035, legislation guaranteed to first paralyze and then kill trucking in that state, including trucks delivering into and out of California. Good luck with that.

Then there is the good US Postal Service, a crypto-public/private corporation cobbled together back in the 1970s supposedly because mail delivery was losing money. While our Constitution stipulates that the government “establish post offices and post roads” with the implied authority to carry and deliver the mail, the Constitution never said that the post office had to show a profit any more than the Army or the Navy does. These days it looks like our country is just about done with the mail business. Been to your local post office lately? Ours is looking like an old soviet DMV. . . a few part-timers on duty. . . mail delivered when they feel like it. . . an odor of rot in the building. . . . Consider that the post office is one of the few places where we citizens actually interface directly with the government’s workings. So, how does it look like it’s working to you.

Christmas, 2023, will be a test of how all these crumbling services and wobbling business models are affecting the people who live in the outfit known as the USA. Initial reports of empty Walmarts and maxed-out credit cards don’t paint a pretty picture. The Yuletide potlatch will not look like it used to.

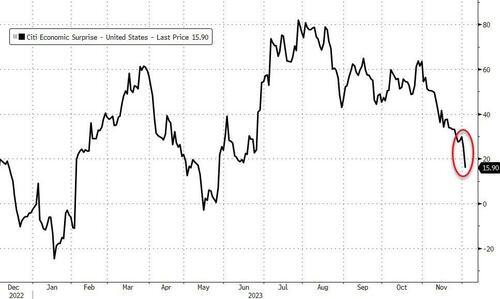

At some point, the activity on-the-ground — or eerie absence of activity — might ordinarily be expressed in the stock indexes — but these strange days the markets seem to be hostages of some algorithm cult that operates in a mystical vacuum where nothing matters.

When it gets to the point where famished Americans start eating each other to stay alive, will we see another S & P record high?

* * *

Support his blog by visiting Jim’s Patreon Page or Substack

Tyler Durden

Mon, 12/04/2023 – 17:00

via ZeroHedge News https://ift.tt/RJUZDOB Tyler Durden