Peter Schiff: Gold Price Breaks Record With More To Come

Gold set a new record on Friday and broke it again over the weekend. The spot price went as high as $2,125 in overseas trading Sunday night. In his podcast, Peter Schiff explained why he thinks this bull run is just getting started and gold will go much higher.

In fact, Peter said he thought these records would be broken “many many times over.”

Gold also closed the month of November at over $2,000 an ounce. It was the first time that gold finished any month above $2k.

Silver also rallied, but not as much.

I think silver is a particularly good buy right here because gold is at a record high and silver would have to double to hit its record high. That tells me that silver is very cheap.”

Gold stocks also rallied, but not to the same extent as the metal. Normally in a bull market, you would see an even bigger rally in mining stocks. But Peter said this is not a typical bull market.

Clearly, it is a bull market, by definition. Gold is at an all-time record high. So, it can’t not be in a bull market when you’re at an all-time record high. Yet gold stocks are not even anywhere close to their all-time record highs. In fact, gold stocks would have to go up another 12% just to hit a 52-week high let alone a record high.”

Peter said this market has been climbing a proverbial “wall of worry.”

It’s like the Rodney Dangerfield bull market. It gets no respect.”

Stock investors still expect gold to fall and they are factoring that into the price of gold stocks.

Nobody has confidence that the price of gold is going to rise. That’s what’s so atypical about this rally because normally gold stocks lead the metal.”

Peter said all of the bearishness reinforces his bullishness.

The question is when will investors realize that gold prices are going much higher? When will the bears throw in the towels and start buying gold and gold mining stocks?

Peter pointed out that $2,000 gold is still way underpriced when adjusted for inflation.

I don’t even know where the price of gold would have to be to hit a high adjusted for the CPI. Probably at least $3,000. … But we are going to get there. But the fact that we’re still so far below that inflation-adjusted high lets you know how cheap gold remains, despite the fact that it’s above $2,000.”

Peter pointed out that the big hedge funds, pension funds, and endowments aren’t invested in gold.

They’re not in this market at all. At some point, they’re going to wake up to this reality.”

Peter said he thinks it will be an “economic awakening.”

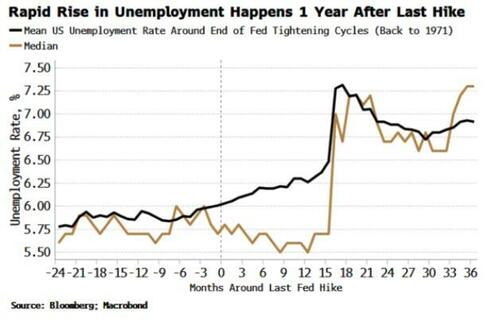

I think we’re going to see the economy become much weaker in a way that is easy to discern — when you’re going to see a big pickup in unemployment and a big deceleration in the GDP.”

This might seem unlikely given the 5.2% GDP growth in the third quarter. But Peter pointed out that this growth was primarily driven by government borrowing and spending and consumer borrowing and spending.

When people want to look at the economy and look at the GDP and say, ‘Oh, we had this GDP growth!’ Yeah, but we also had commensurate growth in the national debt. And so now, we have a much bigger debt as a result of this phony economic growth. Because it’s not real economic growth. We just spent borrowed money, and what grew is our debt.”

At some point, we will have to pay the piper for this fake economic growth.

It’s going to be paid with inflation. And that’s how you know the price of gold is going much, much higher the $2,000.”

A lot of people think the Fed has won the inflation fight. The markets are now pricing in a significant chance that the Fed will start cutting interest rates in March. But CPI isn’t anywhere near the 2% target. We’re looking at a more inflationary environment even while there is still significant inflation in the system.

Peter said he thinks gold is going to have an explosive move up before gold starts trading on a more steady but slower upward trajectory.

I think we have to move up quite a bit to shock investors into getting involved in this market. And they will, but at much higher prices, I think.”

Peter said we also need to keep an eye on the dollar. A weakening greenback has helped drive this gold bull rally. Peter said he thinks the drop in the dollar is just getting started.

The dollar is getting ready to go through the floor and that means gold is getting ready to go through the roof.”

In this podcast, Peter also talked about comments Jerome Powell made late last week.

Tyler Durden

Mon, 12/04/2023 – 10:20

via ZeroHedge News https://ift.tt/WdEk0MJ Tyler Durden