Futures Drop As Torrid November Rally Fizzles Ahead Of Jobs Data Deluge; China Stocks Hit Five Year Low

US equity futures, most European bourses and Asian markets as well as global bonds all retreated after five consecutive weeks of gains, as traders paused to digest November’s blockbuster rally and to consider the case for interest rate cuts, which they aggressively priced in after Powell’s “not as hawkish as feared” fireside chat on Friday. As of 8am ET, S&P futures were lower by 0.3%, dropping back below the 4,600 unwinding a portion of Friday session rally (which however left hedge fund bruised and battered as the most shorted stock soared much more than the HF VIP basket); USD is stronger and commodities are weaker: crude futures are lower by around 0.4%, adding to Friday losses; 10-year Treasury yields added five basis points to 4.25%. Despite the rise in the DXY, Bitcoin surged past $41,000, while gold briefly touched an all time high. With the Fed in its blackout window, the macro data releases will be the key focus; no treasury auctions this week. Today, that focus is on factory orders and durable/cap goods; this week we get a deluge of labor data starting with the latest reading on US job openings (or JOLTS) tomorrow, followed by ADP’s National Employment Report on Wednesday and non-farm payrolls on Friday.

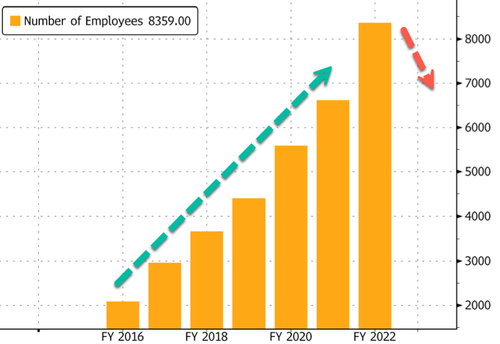

In premarket trading, Spotify shares rose 1.7% after the company said it will reduce headcount by about 17%, at least the third time this year the streaming service has cut jobs. Roche Holding AG gained after the Swiss drugmaker agreed to buy Carmot Therapeutics Inc. for as much as $3.1 billion in a deal that would give it access to experimental medicines in obesity and diabetes. Cryptocurrency-linked stocks rallied in premarket trading on Monday as Bitcoin extends gains to surpass the $42,000 mark, its highest level since April 2022. Shares of Hawaiian Airlines shares soared 181% after rival Alaska Air agreed to purchase the carrier for $1.9 billion. Here are some other notable premarket movers:

- Carvana rose 4.5% after JPMorgan upgraded the online used-car dealer to neutral from underweight. The broker said the upgrade reflects improvements in “productivity, costs, and culture.”

- Lululemon shares decline 2.0% after Wells Fargo downgraded the athletic-apparel brand to equal-weight from overweight, noting the valuation is “no longer cheap.” The broker also removes the stock from their Top Picks list, replacing it with Nike.

- Uber Technologies, Jabil and Builders FirstSource all rise in premarket trading as the companies are set to join the S&P 500 Index.

- Virgin Galactic fell 14% after Richard Branson told the Financial Times that he doesn’t plan further investments in the space tourism startup he founded.

A slew of economic reports this week culminating with Friday’s jobs report are expected to shed light on the state of the US labor market and whether markets are prematurely excited that softer economic conditions can open the door to Federal Reserve rate cuts. Soft-landing hopes built on an economy at “stall speed” look fragile, leaving the market open to risks of a deeper contraction, JPMorgan strategists led by Mislav Matejka warned in a note, although they have been saying the same thing for so long nobody cares any more.

Optimism around a peak in interest rates pushed the 10Y TSY yield down 60 basis points in November from a 16-year high of 5% the previous month, and brought a gauge of the securities into positive territory for the year. The S&P 500 advanced about 9%, one of its best November rallies in a century.

“While yield declines were warranted, the magnitude is too big given the recent data releases,” said Piet Christiansen, chief strategist at Danske Bank. “I think the market is too aggressive about rate cuts.”

As noted on Friday, bond traders doubled down on wagers that the Federal Reserve will cut interest rates as soon as next March even after Fed Chair Jerome Powell reiterated it’s premature to speculate on easing. Late last week, the swaps markets saw an 80% chance of a reduction in March and are fully pricing in a cut in May; March odds have since eased modestly. Those bets are set to be tested tomorrow, with the latest reading on US job openings (or JOLTS) for October. That report will be followed by ADP’s National Employment Report on Wednesday and non-farm payrolls on Friday.

“Still-robust demand and labor-market dynamics in the US” should keep traders wary that inflation can keep cooling, according to Barclays Plc strategists including Ben McLannahan. “Further falls in inflation will be more difficult from here,” they wrote in a report.

European stocks reversed earlier gains, trading about 0.1% lower as oil stocks underperformed most sub-sectors on Europe’s Stoxx 600 index. The Stoxx Europe 600 Energy index drops as much as 2% after Citi cited pressure on oil prices coming from more spare capacity and UBS flagged demand concerns. Citi analysts including Alastair Syme expect further oil price easing to low $70s by end-2024 in the face of growing spare capacity. The mining sector was the biggest underperformer amid falling iron ore prices. Here are Monday’s biggest movers:

- Rolls-Royce shares gain as much as 4.1% as JPMorgan upgrades the plane-engine maker to overweight and Goldman Sachs reinstates its buy rating, adding to a chorus of bullish views

- UCB rises as much as 7.8% after it announced that the EU has granted marketing authorization for Zilbrysq (zilucoplan) as an add-on to standard therapy for generalized Myasthenia Gravis

- Wolters Kluwer rises as much as 4% and hits new all-time high. The German software and services provider is set to join the Euro Stoxx 50, replacing UK gambling firm Flutter

- 888 shares gain as much as 18% after the Sunday Times reported Playtech made an unsuccessful £700 million ($890 million) bid in July for the William Hill owner

- DS Smith gains as much as 2.7% after Barclays upgraded its recommendation for the UK paper and packaging firm to overweight, calling it “one of the cheapest stocks in global packaging”

- ITM Power jumps as much as 13% after the clean-fuel company reiterated its FY guidance. Analysts welcomed its update, which contrasts with recent profit warnings from sector peers

- Nokia shares fall as much as 4.1% amid speculation that the telecom equipment maker could be removed from AT&T’s 5G equipment vendor list; rival Ericsson meanwhile gains as much as 2.7%

- European mining stocks fall as much as 2% as iron ore prices drop after inventories rose and the steel market moved into the typically slower winter season across northern China

- IMCD slips as much as 2% after JPMorgan cut its rating, noting that it doesn’t see earnings of chemical distributors’ in 2024 being “positively levered” to a possible macro recovery

Earlier in the session, Asia’s equity benchmark dropped, led by losses in Chinese and Hong Kong stocks as investors looked for fresh catalysts after a strong rally in November. Indian equities headed for a fresh record after Prime Minister Narendra Modi’s victories in three key state elections boosted expectations of policy continuity. The MSCI Asia Pacific Index declined 0.2%, after rising as much as 0.7% earlier. Stocks in Japan slid as the yen strengthened while Chinese shares extended declines. China Evergrande rallied 9% in Hong Kong after the distressed developer won breathing room to strike a restructuring agreement with creditors. That wasn’t enough to help boost Chinese stocks, however, and the CSI 300 Index closes down 0.7% at the lowest level of 2023 – which was also a fresh 5 year low – on Monday..

… as traders remain concerned about the health of the world’s second-largest economy despite Beijing’s recent push to shore up the market.

- Hang Seng and Shanghai Comp traded indecisively as PBoC Governor Pan’s repeated support pledges were offset by a substantial net liquidity drain and geopolitical frictions in the South China Sea, while attention was also on Evergrande’s windup hearing which the Hong Kong court adjourned to January 29th to give the Co. some breathing space to work on its restructuring proposal.

- Australia’s ASX 200 was higher with gains led by the yield-sensitive sectors such as tech and real estate, while gold miners were boosted after the precious metal initially surged above USD 2,100/oz and printed a fresh record high before fading the majority of the early spike.

- Japan’s Nikkei 225 lagged and briefly approached the 33,000 level to the downside with pressure from recent currency strength.

Putting today’s weakness on context, Asian stocks headed into December on the back of a 7.7% rally last month, their best monthly gain since January, as investors pile into bets that the Federal Reserve may cut interest rates by mid next year. Optimism also remains that China will continue its policy support for its struggling economy. Historically, regional equities tend to have a quiet December with average rise in the past 10 years seen at around 0.9%, according to data compiled by Bloomberg.

In FX, the Bloomberg Dollar Spot Index rose 0.2% reversing part of Friday’s steep losses. The Swiss franc is one of the worst performers, falling 0.5% versus the greenback after data showed inflation slowed more than expected in November.

In rates, Treasuries are cheaper with losses led by the front-end and belly across the curve, flattening 2s10s and 5s30s spreads. There is no strong catalyst for price action according to Bloomberg analysts, as Treasuries follow similar bear flattening across German curve, unwinding a portion of Friday’s sharp rally. US yields cheaper by up to 6bp across front and belly of the curve with 2s10s, 5s30s spreads flatter by 1.2bp and 4bp on the day; 10-year yields around 4.245%, cheaper by 5bp on the day and lagging bunds and gilts by 5bp and 2bp in the sector. Focus on the session includes factory orders, while Fed speakers are now in a self-imposed quiet period ahead of Dec. 13 policy announcement. The Dollar IG issuance slate is empty so far; this week’s issuance forecast is $15b to $20b, with bond sales expected to be front-loaded with Monday anticipated to be the busiest day of the week. No coupon issuance scheduled for this week with next Treasury auctions being next week’s 3-, 10- and 30-year sales.

In commodities, oil prices extended their recent CTA-driven decline, with WTI falling 0.5% to trade near $73.70. Meanwhile, European natural gas prices declined amid persistent low demand for the fuel kept supplies intact. Benchmark futures fell as much as 4.9%, breaking two consecutive days of gains for the contract. Gold surpassed $2,130 an ounce before giving up gains for the day.

Bitcoin climbed past the $41,000 level to the highest since April 2022.

US economic data includes October factory orders, durable goods orders at 10am. Fed members are now in self-imposed black-out period for speaking ahead of Dec. 13 policy announcement

Market Snapshot

- S&P 500 futures down 0.3% to 4,588.00

- STOXX Europe 600 down 0.3% to 465.03

- MXAP little changed at 161.80

- MXAPJ up 0.1% to 503.65

- Nikkei down 0.6% to 33,231.27

- Topix down 0.8% to 2,362.65

- Hang Seng Index down 1.1% to 16,646.05

- Shanghai Composite down 0.3% to 3,022.91

- Sensex up 2.1% to 68,881.89

- Australia S&P/ASX 200 up 0.7% to 7,124.65

- Kospi up 0.4% to 2,514.95

- German 10Y yield little changed at 2.37%

- Euro little changed at $1.0877

- Brent Futures down 1.3% to $77.88/bbl

- Gold spot up 0.2% to $2,075.57

- U.S. Dollar Index little changed at 103.29

Top Overnight News

- Defaults by Chinese borrowers have surged to a record high since the outbreak of the coronavirus pandemic, highlighting the depth of the country’s economic downturn and the obstacles to a full recovery. A total of 8.54mn people, most of them between the ages of 18 and 59, are officially blacklisted by authorities after missing payments on everything from home mortgages to business loans, according to local courts. FT

- ALK (Alaska Air) said it would buy HA (Hawaiian Holdings) for $18/shr. in cash in a deal worth $1.9B (including ~$900M of net debt), a significant premium to HA’s Fri close of $4.86/shr. BBG

- US goods deflation is in place and will likely continue for the foreseeable future (given that supply chains are back to normal while monetary tightening curbs demand), a trend that should help bring overall inflation back to the Fed’s 2% target as soon as the second half of 2024. WSJ

- Israel expanded its offensive, with a ground invasion of southern Gaza expected. A US Navy ship responded to a flurry of drone and missile attacks against commercial ships in the Red Sea. The US said it’s working to restart hostage release negotiations. BBG

- A Hong Kong judge has delayed a decision on Evergrande’s liquidation, an unexpected move that gives the Chinese property developer until next month to come up with a restructuring plan that satisfies its creditors. FT

- Indian refiners have resumed Venezuelan oil purchases through intermediaries, with Reliance (RELI.NS) set to meet executives from state firm PDVSA next week to discuss direct sales following the easing of U.S. sanctions on the South American country. RTRS

- Speaker Johnson has proven to be a surprisingly staunch supporter of Washington providing more financial aid to Ukraine. WSJ

- US corporate profits are beginning to rebound, a trend that could help prevent the US from experiencing a recession. WSJ

- Spotify is preparing to cut 17% of its workforce, or about 1500 people, as the company looks to bolster margins and profitability. WSJ

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded mixed with an initial positive bias after last Friday’s gains on Wall St owing to a decline in yields amid increased Fed rate cut bets for next year despite the pushback from Fed Chair Powell, although the upside was capped in the region after quiet macro newsflow from the weekend and ahead of this week’s key events including central bank rate decisions and a slew of data releases. was higher with gains led by the yield-sensitive sectors such as tech and real estate, while gold miners were boosted after the precious metal initially surged above USD 2,100/oz and printed a fresh record high before fading the majority of the early spike. lagged and briefly approached the 33,000 level to the downside with pressure from recent currency strength. Hang Seng and Shanghai Comp traded indecisively as PBoC Governor Pan’s repeated support pledges were offset by a substantial net liquidity drain and geopolitical frictions in the South China Sea, while attention was also on Evergrande’s windup hearing which the Hong Kong court adjourned to January 29th to give the Co. some breathing space to work on its restructuring proposal.

Top Asian News

- Chinese Center for Disease Control and Prevention requested that the elderly and patients with underlying diseases and children avoid public gatherings, while it advised the public to wear masks in crowded places such as public transportation. It also stated that some public cultural venues, museums and indoor attractions can implement measures to avoid high density of people.

- PBoC Governor Pan reiterated a pledge to defend the housing market’s healthy operation and said China’s financing structure needs to be improved, while he vowed to handle actions disrupting market order and vowed low-cost funding aid to affordable home projects.

- BoJ’s Noguchi said Japan has yet to achieve a wage-driven rise in inflation and said they must see price rises backed by sustained wage increases to achieve the 2% price target, according to Reuters.

- A bombing attack killed four people and wounded several others in the Philippines’ southern city of Marawi City in Mindanao, while it was later reported that Islamic State claimed responsibility for the bombing.

- China’s internet companies including Didi (DIDIY), Tencent (700 HK/ TCEHY) and Alibaba (9988 HK/ BABA) are reportedly drawing complaints amid growing system failures; industry experts call for strengthened oversight, according to Global Times

European equities are mixed, Eurostoxx50 -0.2%, with trade ultimately choppy throughout the session. The FTSE 100, -0.5%, underperforms, largely hampered by losses in Basic Resources and Energy. European sectors are mixed with Retail and Media to the upside, though the overall breadth of the market is narrow; Basic Resources and Energy are the main underperformers, largely a factor of losses in base metals and lower oil prices respectively. Stateside futures are trading on the backfoot, ES -0.3%, amid a mixed risk tone in European trade; with the RTY, +0.3%, outperforming.

Top European News

- ECB’s Nagel said it is way too early to declare victory over inflation and noted that inflation in the Eurozone will carry on declining in the months ahead but at a slower pace, according to Kathimerini.

- ECB’s de Guindos says recent inflation data is good news and it has been a “positive surprise”; too early to declare victory.

- Riksbank Minutes: monetary policy has reduced demand in the Swedish economy and contributed to an easing of inflationary pressures; monetary policy needs to remain contractionary, however, it is now appropriate to leave the policy rate unchanged. Bremen says In my overall monetary policy assessment, the prospects for inflation and economic activity weigh more heavily than the continued weak krona.

- German Economic Minister Habeck cancelled his COP28 trip to focus on budget talks.

- French Interior Minister said one person died and two were injured from an attack by a suspect on tourists, while the suspect was said to be motivated by the Gaza situation and was on the French security services watch list, as well as known for psychiatric disorders.

- S&P affirmed France at AA; Outlook Negative and affirmed Poland at A-; Outlook Stable, while Fitch affirmed the UK at AA-; Outlook Stable, affirmed Ireland at AA-: Outlook Positive and raised Greece from BB+ to investment grade status of BBB-; Outlook Stable.

FX

- The Dollar index has kicked off the week on a firmer footing as yields eased off Friday’s highs and risk gradually soured overnight and into early European hours.

- EUR/USD is slightly more cushioned vs G10 peers (ex-USD) following last week’s decline on dovish ECB commentary coupled with the softer-than-forecast regional CPI data across the bloc.

- Japanese Yen is now flat intraday following the notable rise on Friday on the back of narrowing rate differentials – dipping from a 148.34 high towards a 146.65 low against the Dollar.

- Swissy is the G10 laggard this morning following the region’s CPI metrics which printed sub-forecast across the board in the release before the SNB’s quarterly decision later this month.

- Aussie, Loonie and Kiwi are hit by the broader risk mood, with the AUD and CAD narrowly lagging amid their commodity links.

- PBoC set USD/CNY mid-point at 7.1011 vs exp. 7.1271 (prev. 7.1104).

Fixed Income

- Core benchmarks are essentially unchanged at the time of writing, and reside towards the mid-point of circa. 40 tick parameters in EGBs.

- Bunds were lifted to the 133.44 session peak in the wake of domestic Import/Export data, though the move proved fleeting.

- USTs are just over 10 ticks shy of Friday’s peak and a touch softer on the session as yields, particularly at the short-end, lift and pause for breath during the Fed blackout & pre-data.

Commodities

- Crude futures, WTI, -0.6%, lose further ground in a continuation of the price action seen since last week’s OPEC+ meeting which ultimately underwhelmed markets as voluntary supply cuts by OPEC+ members have raised doubts about their implementation; the complex has bounced off lows though very much within ranges.

- Spot gold surged at the open to record levels, surpassing USD 2,100/oz before waning back to levels under USD 2,075/oz, with the rally primarily driven by traders betting on the Federal Reserve cutting interest rates early next year.

- US Department of Energy said on Friday that oil companies will return 4mln barrels of oil to the US SPR by February from the previous exchange and the US seeks to buy up to 3mln more barrels of oil for SPR for February delivery.

- US, UK and EU are to tighten compliance and increase leverage for buyers to keep getting discounted oil, while they jointly reached out to Liberia, the Marshall Islands and Panama to warn of increased circumvention of the Russian oil price cap.

- Kuwait Oil Company said several were injured after a limited fire broke out at an oil line, although production was unaffected.

- Canada’s First Quantum notified buyers that the Co. will not be able to meet agreements due to a force majeure.

- UBS forecasts Gold at USD 2250/oz by end-2024

- Kazakhstan daily oil output recovered to 230.5k tons on Dec 3rd after falling amid CPC shipping disruptions, according to data cited by Reuters.

Geopolitics: Israel-Hamas

- Israel’s military chief said the operation in southern Gaza will match the operation in northern Gaza where they fought strongly and thoroughly, while an Israeli military spokesman said forces are operating on the ground against Hamas centres in all of Gaza, according to Reuters.

- Hamas deputy chief said Israeli hostages will not be freed unless there is a ceasefire, and all Palestinian detainees are released, while the Hamas armed wing said they bombarded Tel Aviv with a barrage of missiles.

- A Mossad team was in Doha on Saturday for discussions with Qatari mediators on restarting the Gaza truce in which talks focused on the potential release of new categories of Israeli hostages and new truce parameters. However, it was later reported that Israeli PM Netanyahu’s office said the Mossad team was recalled from Qatar due to deadlock in negotiations over Gaza and that Hamas did not meet its obligation to free all children and women hostages on the list it approved.

- Israeli military spokesperson said several humanitarian trucks entered Gaza after being security cleared on the Israeli side of the border, while the spokesperson added that this will be a long war and not bound by time, according to Reuters.

- Israel’s army said a launch was identified from Syria towards Israeli territory and the army responded by targeting the launch site, while it was also reported that Iran said two Revolutionary Guards were killed in an Israeli attack in Syria, according to Reuters.

- US Pentagon said it is aware of reports regarding an attack on USS Carney and several commercial vehicles in the Red Sea, while the US said that USS Carney engaged and shot down a drone launched from Houthi-controlled areas in Yemen. It was separately reported that the Yemeni Houthi group said its navy targeted two Israeli ships although Israel’s military said the ships targeted had no connection to the state of Israel, while AFP reported that a UK-owned ship passing through the Red Sea was hit by rocket fire.

- US carried out a self-defence strike in Iraq against an imminent threat at a drone staging site, according to a US military official.

- US Vice President Harris said international humanitarian law must be respected in the Gaza war and too many innocent Palestinians have been killed, while she added that Israel has a legitimate military objective against Hamas but must do more to protect civilians. There were also comments from Secretary of Defense Austin who said protecting civilians in Gaza is a strategic imperative for Israel, as well as noted that the US will remain Israel’s closest friend and won’t let Hamas win.

- UK Foreign Secretary Cameron will travel to Washington D.C. on Wednesday and will conduct bilateral meetings with US Secretary of State Blinken, as well as meet congressional figures, while the focus of discussions will be support for Ukraine and to work to de-escalate tensions in the Middle East, according to Reuters.

- Islamic Jihad said Britain announced the participation of its air force in intelligence missions in Gaza as an effective participation in the aggression, according to AJA Breaking via social media platform X.

- Turkish President Erdogan said the chance for peace in the conflict is lost for now due to Israel’s uncompromising approach, while he added that Hamas is not a terrorist organisation and nobody should expect him to define them otherwise. Furthermore, Erdogan said a contact group of Muslim countries is ready to prepare a roadmap for the resolution of conflict in Gaza after talks with Western powers.

- Israel General says ground forces have almost completed their mission in Northern Gaza strip

Other

- NATO Secretary General Stoltenberg said NATO should be ready for bad news from the Ukrainian front as Kyiv continues to defend against Russia’s invasion, while he added that they have to support Ukraine in both good and bad times, according to an ARD interview cited by Politico.

- China’s military said a US combat ship illegally entered waters adjacent to the Second Thomas Shoal and that the US deliberately disrupted the South China Sea, while it added the US seriously violated China’s sovereignty and undermined regional peace and stability.

- Philippines Coast Guard said it is to conduct patrols in the vicinity of the Whitsun Reef and it is monitoring the illegal presence of more than 135 Chinese maritime militia vessels at a reef in the South China Sea.

- North Korea said interference with its satellite operation would be considered a declaration of war and that North Korea would respond to any US interference in space by eliminating the viability of US spy satellites. North Korea also stated that its laws stipulate mobilisation of war deterrence if an attack against its strategic assets becomes imminent, according to KCNA.

- North Korea said US sanctions violate international law and that it will retaliate against the US, Japan and Australia for sanctions against its satellite launch, while it said it will take countermeasures against individuals and organisations that impose and enforce sanctions, according to KCNA. Furthermore, North Korea warned a “physical clash and war” have become a matter of time after the scrapping of a key military pact designed to reduce tensions with South Korea, according to The Telegraph.

- Venezuela on Sunday approved a referendum called by the government of President Maduro to claim sovereignty over an oil- and mineral-rich area of Guyana, according to AP News.

- Ukrainian drone attacked an oil depot within Russian-controlled Luhansk, via Ria

US Event Calendar

- 10:00: Oct. Cap Goods Orders Nondef Ex Air, prior -0.1%

- 10:00: Oct. Cap Goods Ship Nondef Ex Air, prior 0%

- 10:00: Oct. -Less Transportation, prior 0%

- 10:00: Oct. Factory Orders Ex Trans, prior 0.8%

- 10:00: Oct. Factory Orders, est. -3.0%, prior 2.8%

- 10:00: Oct. Durable Goods Orders, est. -5.4%, prior -5.4%

DB’s Jim Reid concludes the overnight wrap

All roads this week point to payrolls on Friday with the usual build up via JOLTS (tomorrow) and ADP (Wednesday). Elsewhere in the US the Services ISM is out tomorrow (we will also watch the employment sub component ahead of payrolls), and the initial read on inflation expectations in the University of Michigan confidence sentiment release (Friday) will be of note after 5-10yr expectations ticked up to a decade high of 3.2% last month. Remember the Fed are now on a blackout period ahead of next week’s FOMC so some of the big catalyst for moves of late, i.e. Fed speakers, won’t be there.

Around the globe, other highlights include a few important releases in Germany including the trade balance (today), factory orders (Wednesday) and industrial production (Thursday). Industrial production indicators are also due in France and Italy. Retail sales data is out for the Eurozone on Wednesday. In China, the Caixin services PMI (tomorrow) and trade balance figures (Thursday) are the highlights. Tokyo CPI is out just before midnight tonight

From central banks, Lagarde and Guindos speak today with the RBA (tomorrow) and Bank of Canada (Wednesday) expected to hold rates by the consensus although our economist is an outlier and predicts a hike in Australia . For the full week ahead the day-by-day calendar is at the end as usual.

Digging a bit deeper into the US employment picture, our US economists expect headline and private payrolls to come in at +130k with consensus at +180k and +160k respectively. The returning post-strike autoworkers will boost the data by around +30k. Unemployment is expected to hold steady at 3.9% by DB and the consensus, although our economists see the risks tilted to a 3.8% print. One thing our economists look carefully at is the diffusion index that shows the breadth of job gains. It’s currently at 52%, its lowest rate since the pandemic. They show that 70% of the private job gains in the last year come from only two sectors, namely leisure and hospitality and private education and healthcare. Outside of that job creation in the last 12 months is a very lowly 0.7% and just 0.2% over the last 6. Staying with US labour markets, the JOLTS data tomorrow is also important even if it’s October data. As our economists point out, while the hiring and quits rates were at or below their 2019 averages in September, the layoffs and discharges rate remained near historical lows. So that gap is keeping labour markets tight for now. Our base case is that the demand for labour eases in the next few months.

Asian equity markets are mostly trading lower as I type. The Nikkei (-0.72%), Hang Seng (-0.60%), CSI (-0.27%) and Shanghai Composite (-0.14%) are slipping while the KOSPI (+0.39%) is bucking the negative trend this morning. S&P 500 (-0.12%) and NASDAQ 100 (-0.28%) futures are also edging lower. 2 and 10yr Treasuries are back up +5-6bps this morning after a very strong rally last week as we’ll see below. Gold is up just under a percent and looking set for its highest close ever and Bitcoin is up over +3% and to the highest since April last year. In stock specific news, shares of Evergrande Group rose over +9.0% as a court hearing of the world’s most-indebted property developer over its possible liquidation was surprisingly postponed to January 29, 2024.

Recapping last week now, markets continued their strong performance as positive data added to growing investor confidence that the next move for central banks will be a dovish pivot. In fact, last week saw the close of the best month for a global 60:40 portfolio of equities and bonds since the positive vaccine news in November 2020. Supporting last week’s rally was encouraging inflation data on both sides of the Atlantic, an upward revision of US GDP for Q3 that showed annualised growth of +5.2% (previously +4.9%), and some dovish Fedspeak .

The rally was most pronounced in fixed income. After a brief stumble on Thursday, it continued on Friday as markets proved unphased by Fed Chairman Powell’s statement on Friday that the Fed was ready to tighten if needed. Instead, markets elected to focus on his comment that policy is “well into restrictive territory”. Fed funds futures moved to price in 134bps of cuts by December 2024, up from 90bps at the start of the week. This meant that 2yr Treasury yields fell -41.1bps (and -14.2bps on Friday) to their lowest level since June. 10yr yields were down -27.1bps (-13.0bps on Friday), their sharpest weekly decline since January and hitting their lowest level since the first week of September .

The stream of good news was also echoed in Europe, most notably with the November inflation numbers on Wednesday and Thursday, which saw Eurozone inflation slow to 2.4% (2.7% exp), its lowest since July 2021. With disinflation playing out faster than the ECB expected, markets raised their expectations of ECB rate cuts to price in 69bps of rate cuts by June 2024, up from 28bps at the start of last week. You can read our European economists’ take on the inflation numbers here. Off the back of this, 10yr bund yields fell -28.2bps last week (and -8.5bps on Friday) hitting their lowest level since June. The more interest-rate sensitive 2yr bund yields fell -39.0bps (and -13.4bps on Friday), to their lowest level since May.

The fixed income rally boosted risk appetite, though the +0.77% weekly rise for the S&P 500 (+0.59% on Friday) was remarkably its smallest gain in five weeks. The gains were broad-based, with the NASDAQ slightly underperforming (+0.38% on the week; +0.55% on Friday) and with the Magnificent Seven mega cap index down -1.19% (-0.24% Friday). Small cap stocks enjoyed the risk-on tone after rising +3.05% last week (and +2.96% on Friday). Over in Europe, the STOXX 600 posted a solid gain of +1.35% week-on-week (and +0.99% on Friday).

Finally, in commodities, gold enjoyed a strong week, soaring +3.57% (+1.73% on Friday) to a new all-time high of $2,072/oz. Meanwhile, the confirmation of OPEC+ cuts into 2024 did little to drive upward price momentum in oil, as markets remained doubtful over compliance to the new “voluntary cuts”. Brent crude fell -2.11% to $78.88/bbl, though its -4.77% fall on Friday was exaggerated by a shift in the benchmark month. WTI crude fell -2.49% to $74.07/bbl (and -1.95%% on Friday).

Tyler Durden

Mon, 12/04/2023 – 08:20

via ZeroHedge News https://ift.tt/CXkuy76 Tyler Durden