For years now, Miami Beach officials have talked and acted like the historic Clevelander hotel was the worst thing to ever happen to the city. That was until they saw the business’s plans for shutting down.

Over the past decade, the adults-only hotel, bar, and restaurant on Ocean Drive has been beefing with the city over whether it is an iconic pillar of South Beach’s world-famous nightlife or a bad actor whose late-night operations are bringing crime and out-of-control revelers to the area.

“It’s been a very contentious seven or eight years just to stay open,” says Alexander Tachmes, a lawyer and spokesperson for the Clevelander. He estimates that the business has spent $1 million challenging restrictions the city has slapped on its nighttime concerts and alcohol sales.

Tiring of fighting continuous, expensive court cases, the Clevelander’s owners decided to do something different.

In September 2023, they announced a plan to redevelop the five-story hotel into a 30-story residential tower. Most of the new homes would be luxury beachside condos. But 40 percent would be below–market rate, affordable units. The redevelopment would be a way to get out of the politically controversial bar business while cashing in on the growing demand for housing in ultra-expensive Miami Beach.

As a bonus, it really pisses off the city.

“I was hoping that it was simply a joke, but I don’t think it is,” says Miami Beach Mayor Dan Gelber. While he’d be happy to see the Clevelander replaced, he says the owners are scoring zero points with their “hideously out-of-scale” proposal.

“It’s absurd,” the mayor tells Reason. “It’s like the kids that kill their parents and say, ‘Have mercy on us, we’re orphans.'”

Under normal circumstances, that would be the end of it. The property’s low-density zoning and its location in a historic district would more or less require the owners to preserve the current building as is. Doing anything else would require the discretionary consent of Miami Beach’s elected city commission, which feels much the same way Gelber does.

But these are not normal circumstances.

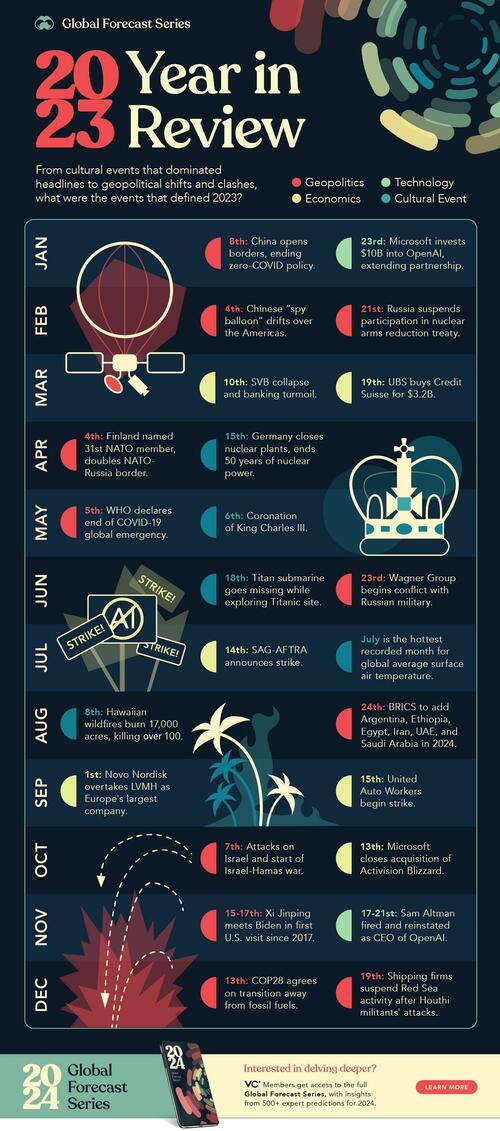

Beginning during the pandemic, the Sunshine State has experienced a surge of domestic immigration. More and more people have been trading blue America’s high taxes, high rents, and excessive COVID-19 restrictions for Florida’s sun-drenched livability. In 2022, it was America’s fastest-growing state in percentage terms. Only Texas added more people in absolute terms.

One consequence of having the country’s fastest-growing population is that Florida also has some of America’s fastest-growing home prices. Spiking demand has collided with a housing supply constrained by zoning codes, growth controls, and local politicians’ anti-development attitudes.

To remedy the situation, Florida lawmakers passed the sprawling Live Local Act in March 2023.

Tucked inside the legislation’s mess of cheap mortgages for schoolteachers and tax credits for low-income housing was a provision giving developers the right to build homes in areas and at heights not otherwise allowed by local zoning codes. As long as the builders include the requisite number of affordable units, local governments can’t say no to these denser housing projects.

The premise is that removing zoning constraints on new housing supply will help moderate increasing housing costs. It’s a simple idea, and it’s also a very controversial one, as the blowup over the Clevelander illustrates.

Builders are giddy at the prospects of getting once unthinkable projects built. Local governments are less pleased.

“If this were a good thing, the Florida Legislature would not have tried to take local government out of the equation,” says Gelber. “If this is a route that’s available to the Clevelander, it’s a route that’s available to other properties. The pressure to make enormous amounts of money will result in the loss of Ocean Drive as we know it.”

The brewing fight over the Clevelander is one battle in the larger war over zoning, growth, and Florida’s future generally.

The state has a decision to make. Will it embrace its status as a growth machine and strip away the regulations preventing it from being more dynamic, free, and affordable? Or will it further empower the anti-development institutions that are so prevalent in the high-cost states that Florida’s cost-of-living refugees fled in the first place?

Smart Degrowth

Florida’s pandemic-era growth surge is remarkable, but it’s not unprecedented.

The Sunshine State has undergone repeated population booms throughout its history, some even more dramatic than what it experienced during COVID-19.

The Florida of the 1970s was adding 1,000 residents a day and posting annual population growth rates of 5 percent or more. Today, the state is growing by a mere 1.9 percent annually.

The 1970s were a high point for anti-growth environmentalism. At the national and state levels, new laws were passed establishing long, complicated processes for approving new infrastructure and real estate developments. Locally, cities dramatically tightened their zoning codes.

Florida wasn’t immune to this slow-growth wave. It started passing laws intended to protect its natural and agricultural environments from development. This culminated with the Growth Management Act of 1985. For the first time, counties and cities were required to come up with comprehensive plans showing where additional growth could go and then to create detailed zoning regulations to enforce that plan.

These plans, and any subsequent changes to them, had to go through a lengthy process of public hearings and state sign-offs. Localities whose plans didn’t meet the state’s approval could be hit with financial sanctions and administrative appeals.

The state wasn’t afraid to use its oversight powers. In the first years of the Growth Management Act, over half of the 399 city plans submitted were deemed inconsistent with Florida’s growth management goals.

The result was a proliferation of rules and red tape across the state. Counties that had previously lacked zoning codes were forced to adopt them. Already-zoned municipalities were required to tighten regulations.

“Land use is one of the most regulated parts of the state,” says Sam Staley, director of the DeVoe L. Moore Center at Florida State University. “Any market-oriented framework was largely gone by the mid-1990s.” The new growth management system, he adds, was “one of the most restrictive and most top-down.”

In the years leading up to the Growth Management Act, Miami Beach had already been erecting a historic preservation system intended to prevent the redevelopment of much of the city. Even modest changes of historic properties now required additional city reviews. Properties could also be landmarked with the property owners’ consent.

A year after the Growth Management Act passed, Miami Beach created its first historic preservation district. It covered the Clevelander and other older hotels on Ocean Drive.

All these additional regulations constrained the housing supply and made homes less affordable. Since the state had to sign off on amendments to comprehensive plans, local governments couldn’t easily change regulations to accommodate growing demand for housing or changes in the kinds of housing demanded.

A 2001 study by Reason Foundation (which publishes this magazine) found that Florida’s planning system was responsible for a 15 percent increase in housing costs. The state’s housing price growth outpaced nationwide housing price growth, even as income growth lagged behind national increases.

Builders responded by concentrating construction at the upper end of the market, where prices and profit margins are higher. Housing production also shifted to the periphery of urban areas, where land was cheaper and regulation was lighter. That helped moderate price growth, but it also meant longer travel times and worsening traffic congestion.

This heavily centralized system of state planning and control eventually provoked a backlash. The Tea Party wave of 2010 swept into power a state Legislature determined to roll back regulation. In 2011, lawmakers largely repealed the Growth Management Act—and with it the state government’s heavy-handed controls on development.

This was a revolution half-complete. While Tallahassee’s role in land use regulation was much diminished, the system of local regulation it had helped create was firmly in place. The local anti-development politics that had grown up around these regulations didn’t go anywhere either.

“The issue we have now is the legacy of growth management laws, which has made it much more difficult for the building industry to respond in real time to growing demand,” says Staley.

Florida is less regulated than it used to be. It’s much easier to build a house there than in high-cost, high-regulation jurisdictions like California or Massachusetts. But the growth bombs now raining down on the state are making it clear how constrained new housing supply continues to be.

Posting Gainesville

A central part of Gov. Ron DeSantis’ pitch for his presidential candidacy is that Florida under his leadership has been better governed than its big blue peers. By resisting the worst COVID-19 restrictions and other big-government regulations, he says, he’s made the state a magnet for migrants from all over the country.

Missing from his pitch is much mention of what has enabled people to move there at all: Florida’s relative openness to new housing.

A quick glance at the raw numbers shows that, for all its land use regulations, Florida still builds far more housing for newcomers than its Democratic counterparts.

In 2022 alone, Florida issued 80 percent more building permits than California, despite having only about half its population. Florida’s 7 percent rental vacancy rate—a good proxy for the elasticity of housing supply—is almost twice California’s vacancy rate.

But with nearly half a million people moving to Florida this past year, there’s only so much new supply can do to suppress home price growth in the short term. It doesn’t help that in the years preceding the pandemic, the state was adding housing at a much slower clip than it was adding households.

The state’s legacy of slow-growth central planning means that much of this new housing is being built away from the highly desirable cities people want to live in—and at price points many families can’t afford.

Before the Live Local Act, state officials had mostly just tinkered around the edges to increase housing supply. They passed laws making it easier for localities to approve housing in new areas without first amending their comprehensive plans and allowing developers to build larger projects if they install greywater systems, for instance.

Florida’s Republican Legislature has also cracked down on localities’ ability to pursue housing affordability through the tempting but always counterproductive approaches of mandates and price controls.

In 2019, lawmakers passed a bill forbidding local governments from enforcing mandatory “inclusionary zoning” ordinances, whereby developers are required to give away a certain percentage of units they built at below-market rates without any offsetting compensation. After several county governments—including Orange County, which contains Orlando—tried to pass rent controls during the pandemic, the state banned that too.

Both “inclusionary zoning” and rent control have a clear track record of destroying new housing supply. Their elimination isn’t a small accomplishment.

Yet even as DeSantis pitches Florida as a refuge from progressive regulation, he has gone to war with locals trying to loosen regulations. Witness the dust-up over Gainesville’s zoning reforms.

In October 2022, Gainesville’s city commission approved by a tight 4–3 vote a slew of reforms that shrank minimum lot sizes, reduced setback requirements, and, most controversially, allowed up to four-unit developments in the city’s single-family-only neighborhoods.

“For so long the approach of local governments has been to say, ‘There’s nothing we can do, there’s only so much federal money coming in,'” says Lauren Poe, the former mayor of Gainesville. “I knew that, based on other jurisdictions and other models around the world, there are things local governments can do.”

Poe argued allowing more homes on less land was one thing the city could proactively do to make his city more affordable.

If a local government decides to do something more than shop around for subsidies, you might expect a governor who touts himself as pro-market to approve. But within a month of the Gainesville reforms being passed, DeSantis’ administration was suing the city to overturn the legalization of fourplexes.

The state Department of Economic Opportunity argued that Gainesville’s Democratic-controlled city commission was relying too much on the free market to bring housing costs down. “The ‘invisible hand’ of a free market operates simply in this situation—without inclusionary zoning tools, developers will not build affordable housing,” the lawsuit reads.

Partisan politics likely explains at least part of this: Fourplex legalization was deeply controversial in deeply progressive Gainesville, and DeSantis sensed a wedge issue.

Even without the lawsuit, the reform was doomed: In January 2023, the first act of business for Gainesville’s newly elected city commission was another narrow 4–3 vote—this one to start the process of repealing fourplex legalization.

This gives the city the dubious distinction of being the only American community in recent memory to vote to get rid of, and then reinstate, single-family-only zoning. The long arc of history doesn’t necessarily lean toward zoning reform.

And yet this faceplant for local reform was soon followed by a far more sweeping deregulation at the state level.

Crossroads and Cross-Purposes

Just a couple of months after DeSantis’ administration sued to overturn Gainesville’s modest fourplex legalization, he was signing the Live Local Act into law.

The governor’s press release about signing the bill didn’t mention zoning once; he focused instead on the legislation’s new housing subsidies. But the Live Local Act does more to pare back local zoning restrictions than basically any recent reform passed in the nation.

The law says localities must approve housing projects in commercial, industrial, and mixed-use areas at the highest residential density allowed in the jurisdiction. New housing can also be as tall as the highest building within a mile of the project site.

In exchange, developers making use of this density bonus must agree to make 40 percent of their new units affordable to people making 120 percent of the area median income—a threshold that allows for rents that are pretty close to market rates.

For Florida’s sprawling suburban communities, this doesn’t authorize anything too dramatic. Developers can now replace a low-slung strip mall or ill-used warehouse with a three-story apartment building.

But in urbanized areas like Miami Beach—where low-density zones and historic preservation districts exist alongside pockets of intense development—the law is revolutionary. Almost every commercial property owner can now theoretically throw up a skyscraper. The Clevelander can erect a middle finger to the officials it’s been fighting for years.

The law’s primary benefit for developers is that it lets them route around the anti-development locals whom DeSantis was eager to win over with his Gainesville lawsuit.

“From a land use perspective, the most amazing thing is the preemption [of local regulations and approval processes],” says Kevin Reali, a land use attorney with the firm Stearns Weaver Miller. “We just see so much opposition from local residents and local jurisdictions to approving multifamily.”

Jeff Brandes, a former Republican state senator who now heads the Florida Policy Project, says DeSantis’ contradictory approach to zoning reform is part of a larger failure of Florida officials to adopt a coherent approach to housing affordability.

“It seems like there’s no overall thought into what you’re trying to do,” he says.

This incoherence has long characterized Florida’s approach to growth generally. The state takes pride in its ability to attract newcomers, but their arrival has provoked a slow-growth backlash to the new homes the new residents require. When that approach proved too burdensome, the Legislature upended the state planning apparatus while leaving its legacy of heavy-handed local regulations in place. To make up for those regulations, Florida spends millions of dollars on affordable housing construction and rent subsidies—but much of that money ends up in the clutches of local governments that don’t plan for new housing and, in a few extreme cases, have adopted moratoriums on multifamily construction.

Housing policy has never been the state’s top political issue. Its back-burner status means policy gets pulled between thoughtful reform, partisan backlashes, and disjointed half-measures. But there are signs this is changing.

“This is the first time I can recall we’ve actually had housing become a top priority as a matter of general policy,” says Staley. “Here we’re talking about people that are really concerned in across-the-board reductions in housing affordability and how that’s related to the supply side.”

That newly acquired salience could also be for good or ill. The desire to do something about housing spawned the Live Local Act.

But the explosive density the law technically allows could also produce a backlash that undermines and weakens the law. Gelber, the Miami Beach mayor, promised the city would use whatever legal tools are available to stop the Clevelander’s redevelopment into a high-rise. That could just be one of many legal fights the new, untested Live Local Act produces.

Meanwhile, the state’s housing reformers argue the state should press forward with reform, backlash be damned.

Time is not on the state’s side, says Poe. “If you wait another decade, you’re talking about tens of thousands of people who might not be able to access housing.”

The post Red State, Red Tape appeared first on Reason.com.

from Latest https://ift.tt/TaIumdL

via IFTTT