US equity futures slumped after earnings from tech giants GOOGL, MSFT and AMD fell short of Wall Street’s lofty expectations and as investors prepared for the first interest-rate decision of the year from the Fed (full preview here).

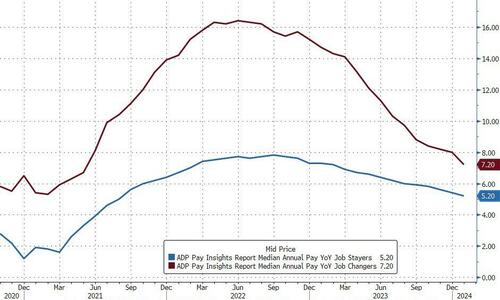

As of 7:45am ET, contracts on the Nasdaq 100 slid 1.1%, while those on the S&P 500 retreated 0.5% with Microsoft, Alphabet and Advanced Micro Devices all sliding in premarket after their updates failed to match the market hype around tech megacaps and artificial intelligence that has helped drive the recent record-setting rally in US stocks. The balance of MegaCaps are also lower as we await the Fed. Bond yields are modestly lower as part of a bull steepening; the US dollar is stronger despite consensus expecting more dovish signaling from Powell, and commodities are mixed. JPM asks if with Russell futs positive, will we see the pain trade (+Value/-Growth with MegaCap underperformance) come to fruition near-term? The macro data focus is on ADP, ECI (Fed’s preferred measure of wage inflation), Chicago PMIs, Trsy Refunding Announcement, and then Fed meeting later today.

As noted above, the biggest premarket movers were the tech giants as Microsoft, Alphabet and chipmaker Advanced Micro Devices all fell short of the bonanza required to satisfy. Microsoft’s revenue growth was the strongest since 2022 and AI products helped with that, but there were hopes for even more given the run in its shares in recent weeks that took its market value over $3 trillion. Alphabet, meanwhile, was hit by a miss in its core Google search advertising business, and AMD’s lackluster outlook overshadowed its AI chip prospects. All three are lower in premarket trading. In other individual stock moves, Paramount Global soared 21% after Bloomberg reported that media mogul Byron Allen made a $14.3 billion offer for the company. Tesla fell as much as 3.4% after Elon Musk’s $55 billion pay package at the electric automaker was struck down by a Delaware judge. Here are all the notable premarket movers:

- Advanced Micro Devices slips 5% after the chipmaker gave a revenue forecast that was weaker than expected.

- Alphabet falls 5.6% reporting fourth-quarter revenue from its core search advertising business that fell short of analysts’ estimates.

- Boston Scientific jumps 3% after the company reported adjusted earnings per share for the fourth quarter that beat the average analyst estimate.

- Mondelez falls 4% after the maker of Oreo cookies issued weaker-than-expected guidance for full-year organic net revenue growth.

- Paramount Global soars 17% after Bloomberg reported that media mogul Byron Allen has made a $14.3 billion offer to buy all of the outstanding shares of the company.

- Rockwell Automation slides 7.9% after reporting first-quarter sales and adjusted earnings per share that trailed the average analyst estimates.

- SoFi Technologies slips 3% as Morgan Stanley issued a downgrade, flagging near-term revenue headwinds.

- Starbucks gains 3% as management maintained confidence in the company’s 2024 profit goal, predicting that greater efficiency, new stores and a core of loyal customers will offset a dip in revenue growth.

- Stryker climbs 5% after the medical-device manufacturer forecast for 2024 that beat the average analyst estimate.

- Tesla shares fall 2.6% after top boss Elon Musk’s $55 billion pay package at the electric automaker was struck down by a Delaware judge.

Attention now turns later to the Fed, with the Federal Open Market Committee poised to keep rates unchanged but indicated no more tightening bias (see our preview here). The rate decision and accompanying statement will be released at 2 p.m. in Washington, with Chair Jerome Powell holding a press conference 30 minutes later. Traders see a roughly 40% chance the central bank will lower rates for the first time in March, but most Fed officials have said it’s too soon to speculate on such a pivot. While Powell may say that recent declines in inflation are encouraging, he may still show little urgency to ease, given resilience in the labor market and growth in the economy.

“Even if it’s not our scenario, we expect the Fed to keep the door open for a possible rate cut in March, without sending a firm and definitive signal,” said Alexandre Hezez, chief investment officer at Group Richelieu in Paris. A proposed redline statement from Barclays is shown below.

While we have more US megacap earnings after the close today and tomorrow, it’s a busy day of earnings in Europe too: Novo Nordisk A/S became only the second European company to reach a market value of $500 billion after it said sales and profit will surge again this year thanks to its blockbuster obesity shot Wegovy. Shares in Hennes & Mauritz AB plunged as much as 11% after the retailer missed profit estimates and its chief executive officer stepped down. Europe’s Stoxx 600 index edged higher with the insurance and real estate sectors rising most, while retailers fall after fast fashion giant H&M reported poor 4Q results. Here are the biggest European movers:

- Novo Nordisk climbs as much as 4.1%, taking the Danish drugmaker’s market value to $500 billion for the first time after announcing fresh guidance for 2024 and strong 4Q results

- Beijer Ref gains as much as 11% after the Swedish industrial ventilation firm reported 4Q earnings that Jefferies say were solid, with upbeat outlook commentary the key positive

- Wartsila rises as much as 7.2% to hit its highest level in four-and-a-half years after the company, which serves the marine and energy markets, said it expects demand to improve in 2024

- SEB shares jump as much as 7.9%, the most since October, after the French appliances maker forecast a full-year operating result of more than 15%, compared the previous 10% prediction

- Borregaard climbs as much as 9.4% to highest since June after Norwegian supplier of specialized biochemicals posted fourth-quarter Ebitda that Carnegie said showed strong results

- KPN climbs after raising FY free cash flow guidance and beating analyst estimates on the metric for 4Q. Service revenue growth was seen as steady, hinting at a healthy Dutch market

- Hennes & Mauritz drops as much as 10% after the clothing retailer reported 4Q operating profit that missed estimates; Bernstein says results showed weakness across the board

- Novartis shares fall as much as 5.3%, most since March 2022, after the Swiss pharma giant’s sales came in lower than analysts’ expectations, with key drugs missing estimates

- Raiffeisen Bank bank drops as much as 8.4% after fourth quarter net income missed expectations as the lender continued to reduce the volume of customer loans in Russia

- Vodafone shares drop as much as 4.1%, the most in two months, after its talks with Iliad to merge Italian operations fell through. Vodafone said it’s still in discussions with other bidders

Earlier in the session, in Asia, Japanese bond yields rose as a summary of the Bank of Japan’s meeting signaled it’s getting closer to raising its interest rate for the first time since 2007. Japanese stocks also gained, as signs that the BOJ may move to end negative rates boosted optimism over lenders’ profitability. Stocks in China and Hong Kong extended losses after data showed another month of contraction in China’s factory activity. Mainland shares wiped out all the gains spurred by hopes of stronger support measures by the authorities.

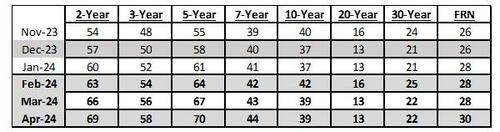

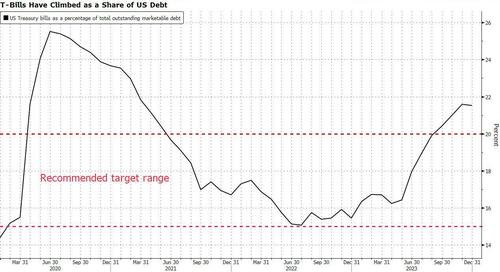

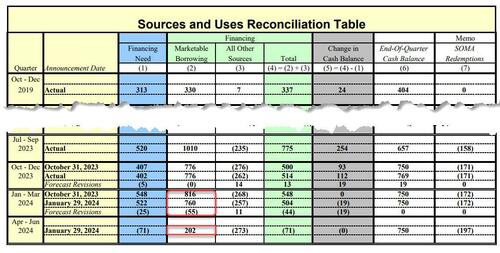

On the monetary policy front in Europe, data out Wednesday showed cooling price pressures in France, adding to optimism that the ECB may begin trimming rates as soon as April. The 10-year yield on German debt dropped as much as eight basis points, while the euro weakened. Meanwhile, the dollar strengthened against most of its Group-of-10 peers, while Treasury yields were slightly richer on the day, with futures off highs reached after steep gains for Australian bonds on domestic inflation data and gains for bunds during London morning on retail sales data. US session features ADP employment, quarterly refunding announcement and Fed rate decision. US yields remain within 1bp-2bp of Tuesday’s closing levels, off session lows; 10-year around 4.03% after briefly dropping below 4% during London morning; bunds outperform by 2.5bp in the 10-year sector, gilts by 1.5bp. Dollar issuance slate light so far; just one deal priced Tuesday, and muted activity is expected Wednesday ahead of Fed rate announcement; dealers are calling for around $150b of new supply in February. At 8:30am US Treasury is slated to announce sizes of note and bond auctions during the February-to-April quarter.

In FX, the Bloomberg Dollar Spot Index rose 0.1%, reversing three sessions of losses, as traders braced for the Federal Reserve to avoid signaling an imminent rate cut; Treasury yields fell 1-2bps across the curve.

- USD/JPY traded 0.1% higher at 147.78 after dropping 0.3% to 147.19; A summary of the BOJ’s meeting signaled the central bank is moving closer to raising rates.

- AUD/USD fell as much as 0.7% to 0.6559, the lowest level in a week, as Australian inflation eased more than expecting boosting bets on a pivot to rate cuts.

- EUR/USD dropped as much as 0.4% to 1.0806 before paring losses after French inflation dropped to its lowest level since before Russia invaded Ukraine; German unemployment unexpectedly decreased in January pointing to labor market resilience.

In commodities, oil headed for its first monthly gain since September as an escalation of attacks on ships in the Red Sea spurred a diversion of tanker traffic and raised fears about a wider conflict in the Middle East. On Wednesday, WTI fell 1.3% to trade near $76.80. Gold was flat, trading around $2,037.

To the day ahead now, and the main highlights will be the Federal Reserve’s policy decision and Chair Powell’s subsequent press conference, along with the quarterly refunding announcement from the US Treasury. On the data side, we’ll get the flash CPI releases for January from Germany and France, and in the US, there’s the ADP’s report of private payrolls for January and the Q4 Employment Cost Index. Finally, earnings releases include Boeing and Mastercard.

Market Snapshot

- S&P 500 futures down 0.5% to 4,925.25

- MXAP up 0.2% to 165.91

- MXAPJ down 0.4% to 502.98

- Nikkei up 0.6% to 36,286.71

- Topix up 1.0% to 2,551.10

- Hang Seng Index down 1.4% to 15,485.07

- Shanghai Composite down 1.5% to 2,788.55

- Sensex up 0.8% to 71,701.22

- Australia S&P/ASX 200 up 1.1% to 7,680.72

- Kospi little changed at 2,497.09

- STOXX Europe 600 little changed at 486.07

- German 10Y yield little changed at 2.21%

- Euro little changed at $1.0835

- Brent Futures down 1.0% to $82.04/bbl

- Gold spot up 0.1% to $2,039.51

- U.S. Dollar Index little changed at 103.47

Top Overnight News

- Australia’s CPI for Q4 undershoots the Street consensus at +4.1% Y/Y (vs. the Street’s +4.3% forecast). RTRS

- China’s NBS PMIs are mixed for Jan, with manufacturing coming in at 49.2 (up from 49 in Dec, but below the Street’s 49.3 forecast) and non-manufacturing at 50.7 (up from 50.4 in Dec and above the Street’s 50.6 forecast). WSJ

- A BOJ rate hike is getting closer, according to the summary of opinions from last week’s meeting. One member said there’s a “golden opportunity” to end negative rates before a Fed and ECB pivot. The yen rose and JGBs edged lower. BBG

- France’s CPI cools by more than anticipated in Jan, coming in +3.1% Y/Y (down from +3.7% in Dec and below the Street’s +3.3% forecast). BBG

- Iran signaled it’s prepared to hit back against any US strike on its soil or assets abroad, as the White House readies a response to a drone attack that killed three American soldiers over the weekend. BBG

- Paramount soared about 15% premarket after Byron Allen was said to have offered $14.3 billion for all of the outstanding shares. His plan is to sell the film studio, real estate and some intellectual property, while keeping the TV channels including the Paramount+ streaming service. He’s said to have banks and other investors lined up. BBG

- January FOMC Preview: Keeping a March Cut on the Table (Mericle): FOMC will likely aim to keep a March cut on the table without sending a decisive signal by removing the outdated hiking bias from its statement and noting that future policy changes will depend on upcoming inflation and other data. We continue to expect the FOMC to deliver a first cut in March and 5 cuts in total in 2024. The main reason is that progress on inflation has already surpassed the threshold the FOMC has given. GIR

- GOOGL -4% .. Solid topline, miss on headline OI (search OI beat though) ….Total Revs $86.31 (+13% y/ cc) vs cons $85.34bn .. Search $48.02bn (+13% y/y) vs cons $48.1bn … YouTube $9.2bn (+15.5% y/y) vs cons $9.2bn … Google Cloud $9.19bn vs cons $8.94bn. Total Op Income $23.68bn vs cons $23.8bn … Google Services OI $26.73bn vs cons $25.78bn … Google Cloud OI $864mn vs cons $357mn. EPS $1.64 vs cons $1.59. Employees up small q/q to 182,502(+121 q/q). GS GBM

- Heading into January month-end, the Goldman desk’s model estimates $10 billion of US equities to sell from US pensions given the moves in equities and bonds over the month. Note, we saw one trigger event on Jan 10th in which $12bn of US equities were sold, bringing aggregate selling in January to -$22bn by month-end. GS GBM

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly subdued amid a deluge of earnings releases and key data releases at month-end. ASX 200 shrugged off early weakness and printed record highs as yields fell after softer-than-expected inflation. Nikkei 225 initially retreated following disappointing Industrial Production and Retail Sales data, while hawkish-leaning comments from the BoJ Summary of Opinions also provided a headwind for stocks. However, the index then gradually recovered all of its losses. KOSPI was subdued after results from Samsung Electronics which topped estimates but its profits declined. Hang Seng and Shanghai Comp underperformed following the latest Chinese PMI data in which Manufacturing PMI matched estimates and remained in contraction territory for a 4th consecutive month.

Top Asian News

- BoJ Summary of Opinions from the January meeting stated a member said that the BoJ must patiently maintain monetary easing under YCC, while the positive wage-inflation spiral must strengthen further and wage growth must exceed 2% to reach the price target. A member said the prerequisite for policy change including ending negative rates, appears to be falling into place given improvements in the economy and prices, while a member said they are now likely at a phase where they need to confirm through specific data the likelihood of achieving 2% inflation. Furthermore, a member said there is a strong chance they can judge that policy normalisation is possible once they can confirm the impact of the quake on the economy in the coming 1-2 months, while a member stated they must deepen the exit debate as the likelihood of achieving the price target has heightened and it was also stated that BoJ could be forced to sharply tighten monetary policy if its decision to end the negative rate comes too late.

- Chinese President Xi promised US President Biden that China wouldn’t interfere in the 2024 US presidential election, when they met last November, which China’s Foreign Minister reiterated to the US National Security Adviser over the weekend, according to CNN.

- IMF senior official said Chinese authorities need to give a consistent and clear set of messages to address property sector woes and need to separate viable from non-viable while protecting homebuyers, while the official added that going forward, they would prefer if there were more policy rate cuts than bank reserve cuts in China.

- China’s major state-owned banks seen selling dollars in onshore foreign exchange market on Wednesday, according to Reuters sources

- Joint Saudi-Kuwaiti statement: Acknowledges the close cooperation between the two sides in the field of energy, and acknowledges the successful efforts of the OPEC+ countries in enhancing the stability of global oil markets, according to Asharq News.

- Saudi Arabia’s decision on capacity was reportedly at least six months in the making based on uncertainty around the need for additional spare capacity, according to industry sources cited by Reuters.

- United Microelectronics Corporation (2303 TT) Q4 (TWD): Consolidated revenue 54.96bln (prev. 67.84bln Y/Y). Gross margin 32.4% (prev. 42.9% Y/Y). “We anticipate overall wafer demand will increase mildly, however, customers maintain a cautious approach”

European bourses are generally lower, with clear underperformance in the SMI, post-Novartis earnings. European sectors hold a positive tilt; Retail lags hampered by losses in H&M (-8.8%) post-earnings; Insurance tops the pile. US equity futures (ES -0.5%, NQ -1.3%, RTY +0.4%) is on a mixed footing; with clear underperformance in the tech-heavy NQ following after-hours earnings from MSFT (-1.5%), GOOG (-5.5%) and AMD (-6.6%), detailed below. Click here and here for the sessions European pre-market equity newsflow, including earnings from Novartis, Novo Nordisk, GSK & more.

Top European News

- The Times shadow MPC voted 8-1 in favour of keeping the base rate unchanged at 5.25% with the lone dissenter voting for a 25bps hike, while it said the BoE should avoid signalling to investors where it intends to shift monetary policy over the coming months.

- UK Chancellor Hunt has reportedly warned his cabinet that tax cuts in the Spring budget could be smaller than expected amid “major structural weaknesses” in the UK economy, according to The Times. Hunt reportedly said there is likely to be less headroom for tax cuts than in the Autumn statement.

- Hapag-Lloyd (HLAG GY) CEO says freight rates are rising in Q1 2024 vs Q4 2023; better profit prospects for current quarter; “We do not believe the Red Sea crisis will be over soon, will probably take months”

Earnings

- Alphabet Inc (GOOGL) – Q4 2023 (USD): EPS 1.64 (exp. 1.59), Revenue 86.31bln (exp. 85.33bln). Google advertising revenue USD 65.52bln (exp. 65.8bln). YouTube ads revenue USD 9.20bln (exp. 9.16bln). Google Services revenue USD 76.31bln (exp. 75.97bln). Google Cloud revenue USD 9.19bln (exp. 8.95bln). Other Bets revenue USD 657mln (exp. 298.6mln). Co. is taking action to optimise global office space. Executive says Co. saw ad strength in retail, while CFO says search remained the biggest contributor to revenue growth and operating cost increase primarily reflected by growing R&D expenses. (Newswires) Shares -5.5% pre-market

- Advanced Micro Devices Inc (AMD) – Q4 2023 (USD): Adj. EPS 0.77 (exp. 0.77), Revenue 6.17bln (exp. 6.12bln). Data centre revenue USD 2.28bln (exp. 2.3bln).Gaming revenue USD 1.37bln (exp. 1.25bln). Client revenue USD 1.46bln (exp. 1.51bln). Embedded revenue USD 1.06bln (exp. 1.06bln). Sees Q1 rev. USD of approximately USD 5.4bln +/- USD 300mln (exp. 5.77bln). Sees Q1 adj. gross margin about 52% (exp. 51.8%). (Newswires) Shares -6.7% pre-market

- Microsoft Corp (MSFT) – Q2 2024 (USD): EPS 2.93 (exp. 2.78), Revenue 62.02bln (exp. 61.1bln). Cloud revenue 33.7bln (exp. 32.31bln). Revenue breakdown (USD): Intelligent Cloud revenue 25.88bln (exp. 25.29bln). Productivity and Business Processes revenue 19.25bln (exp. 19.03bln). More Personal Computing revenue 16.89bln (exp. 16.8bln). Other metrics: (USD) Capital expenditure 9.74bln. Operating income 27.03bln. Says 6 points of Azure revenue growth is attributable to AI, up from 3 points growth in the prior quarter, via co. exec in an interview. Office Commercial paid seats rose to 400mln from 382mln in Q3 23. CEO says now 53,000 Azure AI customers and one-third were new to Azure in the past 12 months, adds over half of Fortune 500 companies use Azure’s OpenAI AI services, seeing an increase in billion-dollar-plus Azure commitments. Q3 Guidance (via earnings call). Sees Q3 rev. USD 60bln-61bln (exp. 60.86bln) .Sees Productivity and Business Processes rev. 19.3bln-19.6bln (exp. 19.5bln).Sees Intelligent Cloud rev. 26.0bln-26.3bln (exp. 25.9bln). Sees More Personal Computing rev. 14.7bln-15.1bln (exp. 15.4bln). Sees Operating Expenses 15.8bln-15.9bln (exp. 16.5bln).Sees COGS 18.6bln-18.8bln (exp. 19.5bln)Shares -1.3% pre-market

- Novo Nordisk (NOVOB DC) – FY (DKK): Revenue 232.26bln (exp. 229.24bln), EPS 18.62 (exp. 18.32). New share buyback programme of up to DKK 20bln. The outlook reflects the gradual roll-out of Wegovy with capped volumes in international operations. Started increasing lower strength Wegovy within the US during January. Sees continued periodic supply constraints and related drug shortage notifications across a number of products and geographies. Q4: Wegovy Sales 9.62bln (prev. 2.45bln). Revenue 65.86bln (exp. 62.27bln). EBIT 26.7bln (exp. 24.9bln). FY24 Guidance: Sales: 18-26% (exp. 23.3%). Capex 45bln. adj. FCF 64-74bln. Co. has around a 2.8% weighting in the Stoxx Europe 600 (the largest in the index). Shares +1.1% in European trade

- Novartis (NOVN SW) – Q4 (USD): Revenue 11.4bln (exp. 11.7bln), Core EPS 1.53 (exp. 1.67), Core Net Income 3.12bln (exp. 3.34bln), Operating Income 3.8bln. FY23 dividend 3.30/shr, +3.1% (exp. 3.60). Net sales growth was driven primarily by strong performance for Entresto +31%, Kesimpta +99%, Kisqali +75%, Pluvicto +261% & Semblix +179%. Expect sales growth of 5% per annum until 2028, core operating margin at circa. 40% by 2027. (Newswires) Co. has around a 2% weighting in the Stoxx Europe 600 & and around a 16% weight in the SMI. Shares -3.5% in European trade

- GSK (GSK LN) – FY (GBP): Sales 30.33bln (exp. 29.81bln), adj. EPS 1.55 (exp. 1.52), adj. Operating Profit 8.78bln (exp. 8.77bln), Dividend 0.58/shr (exp. 0.57/shr). FY (continued): Shingrix sales 3.4bln, +17% (exp. increase mid-teen %) Arexvy sales 1.2bln (exp. 0.9-1.0bln). Vaccine sales +25% (exp. around 20%). adj. Speciality Medicine sales +15% (exp. increase low double-digit). Q4: adj. EPS 0.289 (exp. 0.299). Revenue 8.05bln (exp. 7.29bln). FY24 Guidance Dividend 0.60/shr (exp. 0.61/shr). Adverse impact of lower COVID-19 sales seen at 1pp of growth in sales. Commentary/CEO: 2031 sales outlook increased to over 38bln (upgraded). 2021-2026 outlook increased to sales more than +7% CAGR and Adjusted operating profit more than +11% CAGR. 2028-2030 is expected to see stable operating margins; given the likely loss of exclusivity for Dolutegravir during the period within the EU & US. Planning for at least 12 major launches from 2025. Strong pipeline progress, with 4 major product approvals: Arexvy RSV vaccine; Apretude for HIV prevention; Ojjaara for myelofibrosis and Jemperli in 1L endometrial cancer. (Newswires) Shares -0.9% in European trade

FX

- The Dollar Index is marginally firmer but once again finds itself pivoting around the 103.50 mark as has been the case in recent sessions. For now it is contained within yesterday’s 103.31-82 range with impetus expected from the FOMC.

- The EUR is a touch softer vs. the USD as the single-currency digests a soft French CPI and hawkishly-viewed German State CPI; EUR/USD is holding onto a 1.08 handle but a breach would see the YTD low at 1.0769 come into view.

- JPY is the marginal outperformer vs. the USD; still contained within yesterday’s 147.10-92 range with techs highlighting 10DMA at 147.86 and 100DMA at 147.47.

- AUD is the laggard within the antipodes as soft CPI metrics drag the currency lower. AUD ventured to a low of 0.6560 and further Downside sees 23rd Jan low at 0.6551. NZD steady on a 0.61 handle in what has been dull trade for the pair in recent sessions.

- PBoC set USD/CNY mid-point at 7.1039 vs exp. 7.1727 (prev. 7.1055).

Fied Income

- USTs are currently bid and the yield curve is marginally steeper, benchmark up to a 112-02 high. The docket is dominated by Quarterly Refunding (Monday’s estimates point to a smaller increase than forecast) and thereafter the FOMC/Powell.

- Bunds were initially bullish and shrugged off a hawkish handover from JGBs after the BoJ SOO; however, the deluge of German State CPIs were hotter Y/Y than consensus for the mainland implies and spurred a hawkish move down to 135.19.

- Gilt price action has largely taken impetus from EGBs awaiting the BoE on Thursday.

- Italy opens books to sell 15-year EUR benchmark; guidance seen +13bps to BTPs; pricing today

Commodities

- Softer trade across crude amid the overall downbeat risk tone in the market and the firmer Dollar. Sentiment for the complex is weighed on by Chinese Manufacturing PMI remaining in contraction whilst bullish Private Inventories, geopolitics, and energy commentary this morning are largely overlooked.

- Contained trade in spot gold ahead of the FOMC policy decision; XAU sees its 21 DMA (USD 2,030.10/oz) and 50 DMA (2,029.83/oz) converge.

- Chinese PMIs weighed on base metals overnight as Manufacturing PMI remained in contraction territory for a fourth consecutive month.

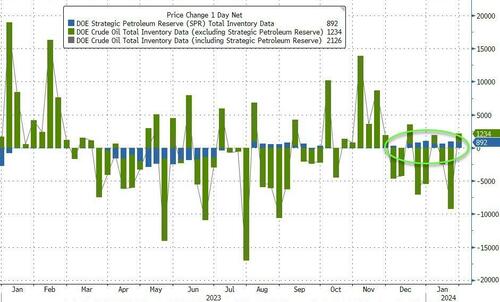

- US Energy Inventory Data (bbls): Crude -2.5mln (exp. -0.2mln), Gasoline +0.6mln (exp. +1.5mln), Distillate -2.1mln (exp. -0.4mln), Cushing -2.0mln.

- US seeks to buy about 3mln bbls of US-produced sour crude for the SPR for a June delivery.

Geopolitics

- Iran’s envoy to the UN said any attack on Iran, its interests or its nationals outside of its borders will be met with a definitive response, according to IRNA.

- US military said it shot down an anti-ship cruise missile fired by Yemen Houthis into the Red Sea, according to Reuters.

- Houthis say they fired missiles at US warship Greifley, and say they will target US, UK warships in ‘self-defence’, according to Al Arabiya

US Event Calendar

- 07:00: Jan. MBA Mortgage Applications -7.2%, prior 3.7%

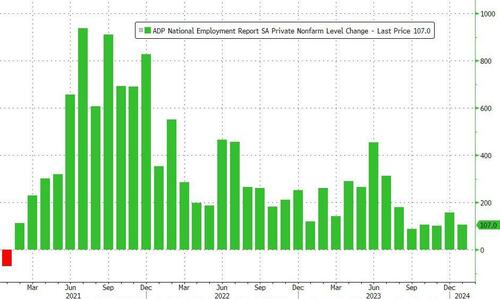

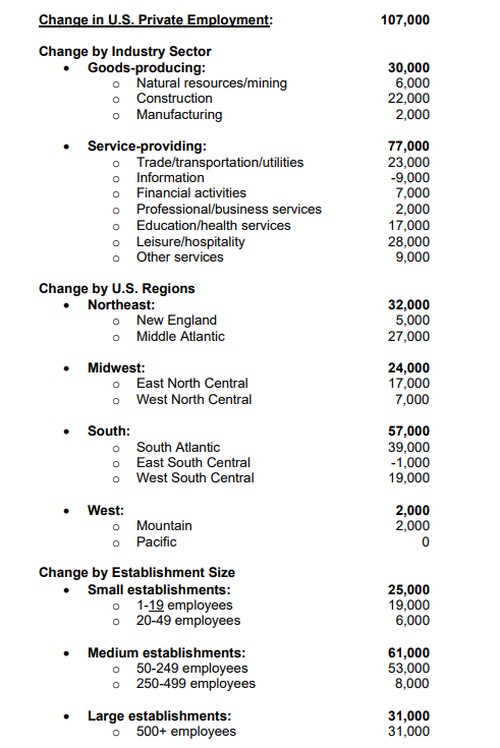

- 08:15: Jan. ADP Employment Change, est. 150,000, prior 164,000

- 08:30: 4Q Employment Cost Index, est. 1.0%, prior 1.1%

- 09:45: Jan. MNI Chicago PMI, est. 48.0, prior 46.9, revised 47.2

- 14:00: Jan. FOMC Rate Decision

DB’s Jim Reid concludes the overnight wrap

The main event over the last 24 hours occurred after the US closing bell as results from Microsoft and Alphabet last night soured risk sentiment. Both of the tech giants narrowly beat revenue and earnings estimates, but saw an underwhelming reaction in after-hours trading. Alphabet slid more than 5% amid lower-than-anticipated advertising revenues for Google. Microsoft declined by as much as 3% initially, arguably signalling some overextension of the recent strong rally, but largely reversed this decline after its outlook call later in the evening. Combined the two companies represent a near $5trn market cap, equating to 11.5% of the S&P 500 so very important for market direction alongside Apple, Amazon and Meta (a combined 13% of the S&P) who report tomorrow night. In addition last night, chipmaker AMD (market cap $278bn) fell as much as -6% after hours post a disappointing sales outlook.

Prior to these results, tech mega caps had underperformed yesterday, with the Magnificent Seven down -0.61% from Monday’s all-time high, led by Apple (-1.92%). Following last night’s results, NASDAQ futures are trading -0.80% lower this morning, following on from a -0.76% decline yesterday, while S&P 500 futures are down -0.37% (after -0.06% yesterday). The late risk-off tone also saw 10yr Treasury yields fall by 2-3bps near end of the session, closing -4.2bps lower on the day. There has been another -2bps fall overnight leaving 10yr yields at 4.01%.

Before the earnings, markets were subdued ahead of the after bell activity and the Fed’s decision today. The main theme was investors dialling back the likely speed of rate cuts after another round of positive data. For instance, the US Conference Board’s consumer confidence reading hit a two-year high, the JOLTS release saw job openings unexpectedly rise, and the Euro Area managed to avoid a technical recession in Q4. So a lot of good news all round. But with the data still surprising on the upside, it’s led to growing questions about whether the Fed will actually be wise to cut rates as soon as March. Indeed, futures lowered the probability to 44% yesterday from 48% the day before (and this was as low as 37% intra-day yesterday). And looking further out, at the close they were pricing 132bps of cuts by the December meeting, the joint lowest since the December FOMC.

When it comes to the Fed, it’s widely expected they’ll leave rates unchanged today, so the big question instead is what they signal about the timing and speed of rate cuts moving forward. That’s something they’ve explicitly acknowledged, since their dot plot at the last meeting in December pencilled in 75bps of cuts this year, which triggered a significant market rally in response. In their preview (link here), our US economists expect the FOMC to leave behind its tightening bias, and think the post-meeting statement will likely drop the reference to “the extent of additional policy firming”. In terms the next meeting in March, they think Powell will leave the door open for a potential cut, but will not express urgency around cutting rates, thus keeping open the timing of any move.

Diving into more detail on the strong data, the Conference Board’s consumer confidence reading rose to 114.8 in January, which was the highest since December 2021. Moreover, the present situation component was up to 161.3, which is the highest reading since March 2020, so there were lots of positive signs in the report. Likewise on the labour market, the difference between those saying jobs were “plentiful” and those saying they were “hard to get” rose to a 9-month high of 35.7%. And that in turn was backed up by the JOLTS report for December, where job openings unexpectedly rose to 9.026m in December (vs. 8.75m expected), which offered fresh signs that labour demand was still robust.

Those releases led to growing confidence that the Fed would be keeping rates on hold until at least the May meeting. But the optimism was clear in Europe too, since the Q4 GDP release showed zero growth, rather than the -0.1% contraction expected. Significantly, that means the Euro Area avoided a technical recession, as the Q3 number had a -0.1% contraction, so a Q4 contraction would have meant the economy had contracted for two consecutive quarters. As with the Fed, that led investors to dial back the amount of ECB cuts priced in, and the chance of a cut by April went from being fully priced on Tuesday, to 92% by the close yesterday.

The Fed will now help set the agenda from here, but if that wasn’t enough, today will also bring the US Treasury’s Quarterly Refunding Announcement, which will see them announce their plans for which notes and bonds they intend to issue. That follows the borrowing estimates on Monday, which triggered a rally in Treasuries after they expected to borrow $760bn over Q1, which was down from its Q4 levels. These didn’t use to attract as much notice, but the QRA was seen as one of the triggers for the major bond selloff from the start of August, as well as the recovery that took place from November onwards, shortly after the 10yr Treasury yield had hit 5% intraday. So these have been associated with important turning points in recent months, although it’s fair to say there’ve also been other factors as well, not least the Federal Reserve’s outlook as well as the inflation data.

When it came to markets over the last 24 hours, US Treasuries saw a noticeable flattening as investors became less confident about the prospect of near-term cuts. That meant the 2yr yield was up +1.5bps to 4.335%, whereas the 10yr yield ended the day down -4.2bps at 4.03%, its lowest in two weeks, despite a brief spike in yields after the Conference Board and JOLTS data came out.

Over in Europe however, there was a sizeable rise in yields across the curve, with those on 10yr bunds (+3.3bps), OATs (+3.9bps) and BTPs (+6.5bps) moving higher. In Europe, we also started to get some of the flash CPI releases for January, with Spanish CPI unexpectedly rising +3.5% on the EU-harmonised measure (vs. +3.0% expected). Today we’ll also get the French and German numbers, ahead of the Euro Area-wide release tomorrow.

For equities, there was a pretty subdued performance. The STOXX 600 (+0.16%) eked out a fresh two-year high, but the S&P 500 retreated marginally (-0.06%) led by the declines for tech stocks. The Russell 2000 (-0.76%) ended a run of three consecutive gains. At the other end, financials led the day’s outperformers, with the S&P 500 banks index up +2.13%.

Asian equity markets are mostly struggling this morning with the Hang Seng (-1.34%) leading losses with the CSI (-0.65%) and the Shanghai Composite (-1 0%) also trading in the red after another month of contraction in China’s manufacturing activity (more below). The KOSPI (-0.30%) is also down after the index heavyweight Samsung Electronics reported a -34% drop in fourth quarter operating profit as consumer demand remained sluggish in many businesses.

Elsewhere, the Nikkei (+0.3%) has progressively moved higher from opening losses led by financials as the BOJ’s summary of opinions signalled an increasing probability of ending negative rates in the near future without providing a timetable.

However the Japanese yen failed to build on its initial uptick against the dollar after the release of retail sales and industrial production figures for December. Retail sales unexpectedly contracted -2.9% m/m in December (v/s +0.2% expected) as against a revised +1.1% gain in the preceding month while the factory output rebounded +1.8% y/y in December (v/s +2.5% expected), compared to November’s -0.9% drop. So a confusing picture in Japan overnight.

Elsewhere we got our first look at China’s official 2024 PMI data which showed that manufacturing activity shrank for the fourth consecutive month in January albeit the reading slightly improved to 49.2 versus 49.0 in December, highlighting that the sector remains under pressure amid a weak economic recovery. Meanwhile, the official non-manufacturing managers’ index continued to outperform as it edged up to 50.7 in January from 50.4 in December.

Elsewhere, Australia’s inflation in the fourth quarter rose +4.1% y/y (v/s +4.3% expected) and down from a +5.4% gain in the third quarter thus encouraging thoughts that the RBA’s next move will be a rate cut. For the quarter alone, CPI rose +0.6%, or half the pace of the September quarter. Following the release, yields on the policy-sensitive 3yr Australian government bonds dropped -10.0bps to trade at 3.61%.

Looking at yesterday’s other data, UK mortgage approvals were up to a six-month high of 50.5k in December (vs. 53.0k expected). Separately, the I MF also published their latest growth forecasts, and they now see the global economy expanding by +3.1% in 2024, which is up two-tenths from their October projection.

To the day ahead now, and the main highlights will be the Federal Reserve’s policy decision and Chair Powell’s subsequent press conference, along with the quarterly refunding announcement from the US Treasury. On the data side, we’ll get the flash CPI releases for January from Germany and France, and in the US, there’s the ADP’s report of private payrolls for January and the Q4 Employment Cost Index. Finally, earnings releases include Boeing and Mastercard.