The BOJ “Has Made Up Its Mind To Hike Rates” After Union Wage Negotations Lead To Surge In Pay

After a decade of NIRP and unlimited bond buying to keep the Japanese bond market – and economy – from disintegrating, the BOJ may have no choice but to hike rates as soon as next week. The reason: inflation in “deflationary” Japan is now not only on par with the US, but wage growth is surging and threatening to spark a wage-price spiral even as the clueless, cartoonish central bank is keeping rates negative, buying bonds and stocks to prop up the market, and generally doing everything in its power to unleash hyperinflation and currency collapse.

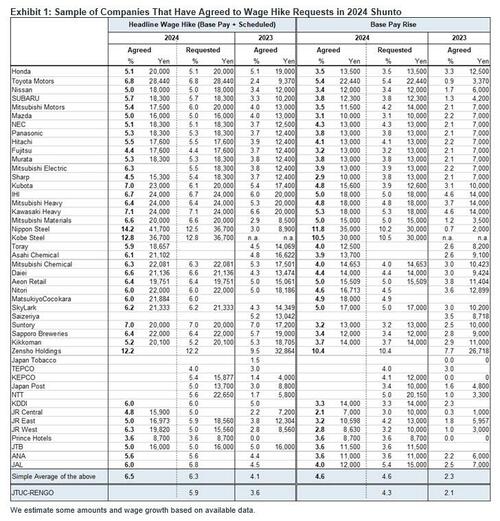

So with all attention on the Japanese labor union wage requests, overnight companies including Toyota, Honda, Nippon Steel and ANA Holdings all granted workers their biggest pay rise in more than three decades, underlining the inflationary trend and bolstering the case for the Bank of Japan to begin raising interest rates. Indeed, with the peak day arriving today for major companies to respond to union wage hike increases, media outlets have reported that most companies had already agreed to the full amount or more than labor unions wage hike requests without waiting for the March 13 deadline.

As the FT reports, galvanized by the sharp rise in living costs and a deepening labour shortage, the country’s trade unions have negotiated an increase in wages that is certain to exceed the rate of inflation, marking a milestone in a country where real wages have stagnated since the late 1990s.

With the shunto spring wage negotiations largely concluding on Wednesday, economists expect large companies to give their unionized workers an average wage increase of more than 4%, compared with 3.6% last year. That would be the biggest rise since 1992.

Perhaps the most iconic Japanese company of all, and the one which serves as an example for the rest of corporate Japan, Toyota said it had fully accepted its labor union’s request for a monthly pay increase of up to ¥28,440 ($193), the largest amount since comparable figures were first made available in 1999.

“We wanted to firmly cover for the impact from rising prices,” said Takanori Azuma, Toyota’s chief human resources officer, adding that the increases in monthly salary and bonus payments were at a record level.

Others went even further:

- Nippon Steel agreed to an 11.8% increase in base salary, exceeding its trade union’s request for the biggest jump in monthly pay since 1979.

- ANA gave its workers an average wage increase of 5.6% on Monday, the highest for the airline since 1991.

- Honda last month agreed to a 5.6% annual pay bump, the highest since 1989.

- NEC granted a 4.3% rise in base pay, the highest ever since the current wage negotiation system began in 1998.

- Mitsubishi Heavy Industries agreed to an 8.3% annual pay hike, its highest since 2005.

Combined with strong government pressure, the sharp rise in prices caused by the war in Ukraine and the global energy crisis had already led to large gains in wages during last year’s negotiations. But trade unions had failed to secure pay rises that would cover accelerating inflation while the gains did not spread evenly to small and medium-sized enterprises, which employ about 70 per cent of Japan’s workforce.

The wage negotiations had been closely followed by investors this year as solid wage growth is crucial for the Bank of Japan to muster enough confidence to begin unwinding its ultra-loose monetary policy measures. And despite recent weak economic data, which saw Japan’s economy enter a recession last month (only to be revised right back out yesterday) analysts believe the strong shunto results should allow the central bank to end its negative interest rate policy as soon as next week or April at the latest.

“It was extremely hard to demand higher wages when prices were not going up,” said Akihiko Matsuura, president of UA Zensen, one of the country’s largest trade unions with more than 1.8mn members in retail, food, chemicals and other sectors. “We need to bring 30 years of wage stagnation to an end.”

The union, which represents mostly workers at small and medium-sized businesses, has called for a 6% total wage increase, roughly double the rate of headline inflation, including 4% in base salary. Ahead of Wednesday, retailer Aeon agreed with the union to raise the hourly wage for roughly 400,000 of its part-time employees by an average of 7 per cent this spring in a sign that wage increases were trickling down to society at large.

“The big test is next year as to whether companies will fully respond to the demands of unions even when prices will not rise very much,” said Matsuura. Headline inflation averaged 3.2% last year but has slowed to 2.2% in January on the back of a decline in the imported cost of energy.

But even as inflation pressure declines, companies are still likely to face demands to raise wages as they struggle to find younger workers, further empowering the unions. Japanese workers rarely take to the streets to demand higher wages or better working conditions, but several strikes have occurred this year as companies have failed to meet the demands of unions.

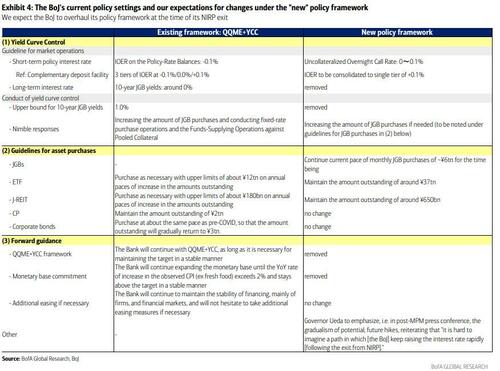

Commenting on the upcoming BOJ actions, Bank of America said that “despite hand-wringing over March vs April”, the BOJ has “effectively made up its mind to move by the end of the spring” and expects that “even if the BOJ ends up holding in March, it will send a much more explicit signal that it is thinking of moving at its next policy meeting” on April 25-26. The bank also expects:

- Hike in the current policy rate of -0.1% to a range of 0 to 0.1%, and a removal of the commitment to keep long-term rates at 0.1%.

- removal of yield curve control.

- removal of the commitment to keep expanding the monetary base.

- formal end to risk asset purchases (mostly equity ETFs, it is unlikely the BOJ can ever stop backstopping the bond market)

Going back to the coming wave of higher wages, the Goldman exhibit below shows a list of companies with relatively large labor union memberships and for which wage hikes can be calculated based on media reports up to 5pm JST on March 13 (list includes some companies that have not announced a wage agreement yet).

Since many companies agreed to the full requested amount, the weighted average of the list broadly comes in line with the collected request data by the Japanese Trade Union Confederation (JTUC-RENGO) announced on March 7, calling for base pay rise of 4.3%, and headline wage hike of 5.9% including scheduled wage growth (weighted average basis). As noted above, they far surpass the 2023 final agreed wage hike of 2.1% and 3.6% respectively.

JTUC-RENGO will collect today’s agreement and release the aggregate initial wage hike data on the evening of March 15. Last year, many companies agreed to the full base pay rise request (+2.8%) on the peak reply day, but the initial aggregate data released by JTUC-RENGO came in at +2.33%. It could be the case that companies who could not meet the unions’ request or smaller companies were not covered in media reports on the peak reply day.

That said, this year’s wage agreement is undoubtedly strong, and the first impression from responses on March 13 is that there could be considerable upside to Goldman’s shunto forecasts (base pay rise: 2.5%, headline shunto wage growth: 4.1%). The ultimate agreement on base pay rise could settle above 3%, and truly supercharge Japanese inflation.

Here Goldman joins BofA and notes that with the strong wage agreement, “we see even stronger likelihood of BOJ removing NIRP at the March or April meeting, although this does not necessarily point to higher probability for the March meeting” although Goldman warns that signals by the BOJ are not sufficiently strong to suggest a March hike, and will continue to closely monitor communications by the BOJ. Either way, a rate hike is now just a matter of time.

More in the full notes from BofA and Goldman.available to pro subs.

Tyler Durden

Wed, 03/13/2024 – 10:45

via ZeroHedge News https://ift.tt/N8EFZnb Tyler Durden