Yuan Weakens After ‘Unbalanced’ Chinese Economy Sees GDP Beat In Q1 But Domestic Consumption, Production Disappoint

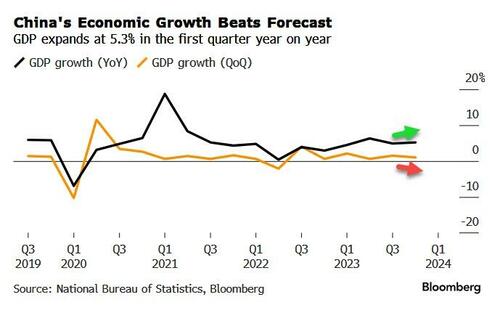

China’s economic growth beat expectations in Q1, rising +5.3% YoY – considerably stronger than the +4.8% consensus, and inching ahead of Q4’s +5.2% YoY growth.

Source: Bloomberg

Notably, that this is the first time the market compares two periods of economic growth without China’z Zero-COVID policy’s impact, and overall, as we detail below, economic activity data in March overall missed expectations.

-

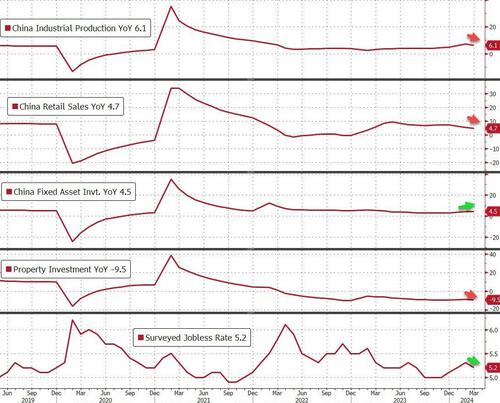

Industrial production rose 4.5% in March from a year earlier (below economists’ forecast of 6%).

-

Industrial output rose 6.1% for the first quarter (below the 7.0% in February).

-

Retail sales climbed 3.1%, also disappointing (versus an expected 4.8% gain) – domestic consumption is still weak amid deflation pressure and after imports shrank during the month.

-

Investment flows were mixed with Property investment continuing to slide (down 9.5%, worst since December, and considerably worse than the 9.2% expected)…

-

…but broad-based fixed-asset investment expanded 4.5% in the first three months (better than the 4% increase projected by economists).

-

Finally, the surveyed jobless rate in March declined to 5.2% from 5.3% in February.

Source: Bloomberg

Simply put, China’s economic recovery has been unbalanced.

As Bloomberg reports, manufacturing is holding up, thanks to resilient overseas demand and Beijing’s efforts to cushion the blow from US trade restrictions by developing advanced technologies at home.

But Chinese consumers have been slow to recover their appetite for spending, amid a prolonged real estate downturn that’s weighing on household and business confidence.

Factory prices have been in deflation for more than a year, reflecting anemic domestic demand.

The central bank on Monday kept the rate of its one-year medium-term lending facility unchanged, and drained cash on net from the banking system via the tool for a second straight month. The PBOC cut its reserve requirement ratio for banks by 50 basis points in February – a move that allows extra lending – and said there’s room for more cuts.

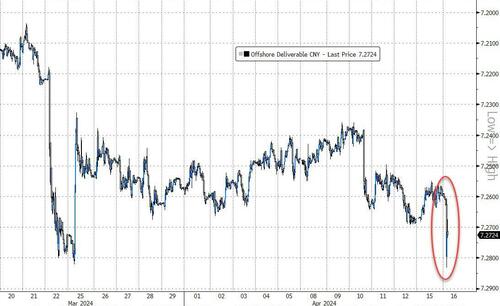

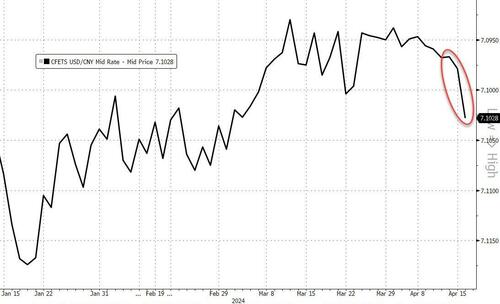

But China has reasons to be cautious in any monetary easing, since widening the yield gap with the US risks adding to downward pressure on the yuan, which is weakening after the data…

Source: Bloomberg

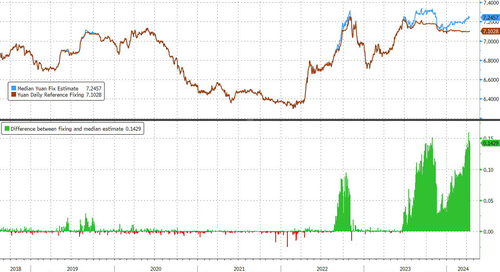

Notably, China unexpectedly weakened its yuan defense as pressure from a resurgent dollar and poor sentiment pressured it toward a policy red line. Specifically, the PBOC set a weaker daily reference rate for the managed currency, implying some flexibility for it to depreciate alongside regional peers amid broad strength in the dollar.

“The PBOC is bowing to reality, with dollar broadly higher and onshore dollar demand surging,” said Richard Franulovich, head of foreign-exchange strategy at Westpac Banking Corp.

“They obviously want to control and contain the move though, so they are guiding yuan lower in a moderate and steady fashion.”

Source: Bloomberg

Finally, investors are closely watching one major government effort to boost domestic demand this year: a trade-in program that will encourage businesses to upgrade their machinery and households to buy new cars, refrigerators or washing machines. Shares of Chinese home-appliance makers jumped last week after officials vowed “strong” fiscal support for the plan.

The degree of government support for households and businesses to spend at home will likely depend on how Chinese firms fare on international markets, Goldman Sachs economists led by Hui Shan wrote in a note last week.

“If external demand is strong, then less domestic stimulus is needed,” they wrote.

“If the property market continues to deteriorate, then more easing measures will be introduced.”

The Goldman team raised their growth forecast, predicting the 5% target will be met, and said the government doesn’t seem keen to significantly exceed it.

Tyler Durden

Mon, 04/15/2024 – 22:40

via ZeroHedge News https://ift.tt/FeYyfzm Tyler Durden