Missouri Files Injunction To Block Biden’s ‘Illegal Student Loan Plan’ While Lawsuit Plays Out

Missouri Attorney General Andrew Bailey announced on Wednesday that the state has filed for a temporary restraining order (TRO) to block the Biden administration’s “illegal student loan plan,” referred to by a coalition of states as “Plan B,” which was implemented shortly after a previous attempt (“Plan A”) was deemed illegal by the Supreme Court.

“Plan B” aims to forgive student loans under different statutory provisions, but faces similar legal challenges as plan A – primarily surrounding the authority to enact such broad debt cancellation without clear congressional authorization.

“From the moment the Supreme Court ruled in Biden v. Nebraska, President Biden made clear he would ‘stop at nothing’ to evade the decision,” reads the TRO request. “Although the challenged rule, by its own text, was not supposed to take effect until this July, Defendants decided to start implementing it early and have already illegally cancelled billions of dollars in loans.“

“Defendants make almost no attempt to meaningfully distinguish their Plan B from their patently unlawful Plan A,” the filing continues.

What led to this?

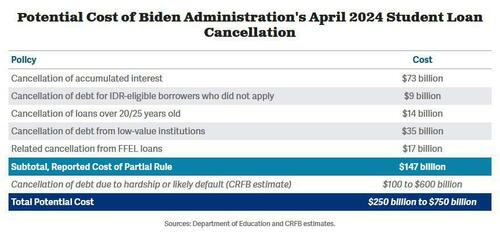

Shortly after Biden announced the SAVE plan earlier this month, 11 states sued, arguing that it’s yet another unlawful attempt to force Americans who incurred no college debt to shoulder the bill for those who did. According to the Committee for a Responsible Federal Budget, Plan B would add up to $750 billion to the US budget deficit.

The plan itself has five major components. It would:

-

Cancel accumulated interest for borrowers with balances higher than what they initially borrowed, capped at $20,000 for those in standard repayment and uncapped but restricted to individuals making less than $120,000 annually or couples making under $240,000 enrolled in an income-driven repayment (IDR) plan.

-

Automatically cancel loans for borrowers in standard repayment who would be eligible for cancellation had they applied for programs such as Public Service Loan Forgiveness (PSLF) or the new IDR program, Saving on a Valuable Education (SAVE).

-

Automatically cancel loans for borrowers who have been repaying undergraduate loans for over 20 years or graduate loans for over 25 years.

-

Cancel debt of those who attended low-financial-value programs, including those that failed accountability measures or were deemed ineligible for federal student aid programs.

-

Forgive debt of borrowers who are “facing hardships” or are likely to default on their loan payments.

According to AG Bailey, the plan is a “brazen attempt to curry favor with some citizens by forcing others to shoulder their debts.”

Now, Missouri wants a judge to block Plan B until the lawsuit plays out.

🚨NEW: We have filed a motion to BLOCK President Biden’s latest illegal student loan plan immediately.

Read more about it here: https://t.co/FMedyvEr7i https://t.co/QwZ4hLFjvA

— Attorney General Andrew Bailey (@AGAndrewBailey) April 17, 2024

The states argue that Plan B violates principles of separation of powers and exceeds the statutory authority granted by Congress. They also argue that it is arbitrary and capricious and fails to follow proper statutory procedures.

“Just ten days after the Supreme Court struck down Defendants’ first attempt at mass debt cancellation as patently illegal, Defendants rolled out their Plan B,” reads the new filing. “This newest plan relies on a different statute, but it clocks in at the same price tag and again seeks to shortchange the legislative process on a political topic that is highly salient.”

According to the TRO request, “Defendants’ Plan B suffers from all the same flaws that led the Supreme Court to strike down their Plan A,” and “Because Defendants’ Plan B carries the same price tag and covers the exact same topic as their first attempt at mass debt cancellation, it triggers the ‘major questions doctrine,’ just like the Supreme Court held their first plan did.“

The filing also discusses the significant economic implications of the plan – suggesting that it will have substantial effects on state revenues and the student loan market. Several states have already claimed that they are injured by the plan due to its impact on state-owned financial institutions and the alteration of competitive landscapes in the student loan market.

As such, the plaintiffs ask that the court issue a stay, or TRO, to halt the implication of Plan B.

The Constitution is clear: Congress has the power of the purse, not the President.

Joe Biden cannot unilaterally “cancel” hundreds of millions of dollars in student loan debt and force everyday Americans to pick up the tab.

— Attorney General Andrew Bailey (@AGAndrewBailey) April 9, 2024

Tyler Durden

Wed, 04/17/2024 – 14:20

via ZeroHedge News https://ift.tt/GRqL9xz Tyler Durden