Forget Cocoa, Coffee. There’s A “Squeeze Risk” Building In The Tin Market

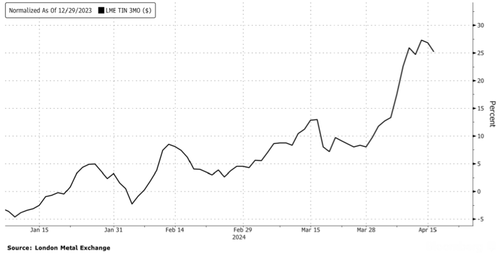

Tin prices on the London Metal Exchange have surged 27% this year, landing on the radars of some institutional desks. Other commodities closely monitored by hedge funds include cocoa, coffee, Brent crude, copper, and gold.

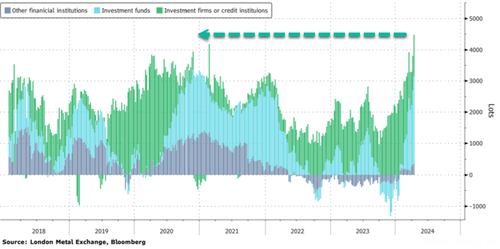

Bloomberg notes that LME data for the tin market shows the aggregate net-long position held by financial investors surged to the highest level ever, with data going back to 2018.

These bullish bets have pushed tin prices well into the $32,000 handle in recent trading sessions.

Bloomberg notes that the “big bull” positioning by institutional investors comes as major supply disruptions hit top producers across Indonesia, Myanmar, and the Democratic Republic of Congo. Also, the metal, a critical component of modern technology and used primarily as solder to connect electrical components and semiconductor chips, is the latest AI trade investors have been piling into.

“Every data byte and every electron travels through hundreds of solder joints that connect it all together,” Jeremy Pearce, head of market intelligence and communications at the International Tin Association, said in an email interview with the media outlet. He pointed out that tin’s trade thesis is that demand will rise in tandem with AI computing demand at data centers. Recall our note, “The Next AI Trade.”

Like Nickel and other commodities, tin is prone to mega short squeezes. Traders discovered this in 2022 after a once-in-a-generation squeeze broke the nickel trading on LME.

“Some market participants feel there could be a risk of a squeeze,” Ding Wenqiang, senior analyst at one of China’s largest metal researchers, Mysteel.com, told Bloomberg. He added, “They are paying close attention to the movements of the big bull in the May contract.”

Tightening supplies come as tin inventories plunged 47% so far this year to 4,045 tons. The metal’s spot price trades at a premium versus the three-month futures contract, producing a structure known as backwardation.

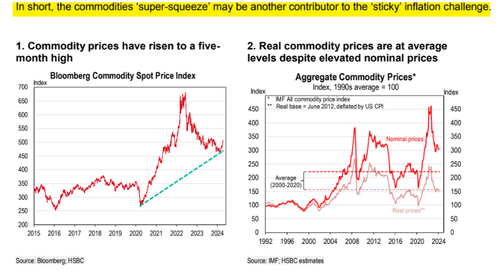

Nickel prices are rising as commodity prices have likely based and entered a ‘weak bull’ market, according to new research from HSBC Bank.

Rising commodity prices are more bad news for Fed chair Powell’s fight against the inflation monster.

Tyler Durden

Wed, 04/17/2024 – 22:40

via ZeroHedge News https://ift.tt/KLUwokl Tyler Durden