Stocks Surge In Massive Squeeze As Traders Frontrun End of Buyback Blackout Period

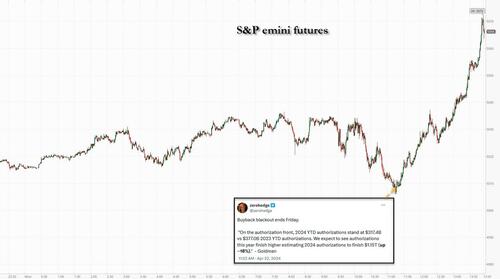

After the worst week for stocks since the March 2023 bank crisis, and after 6 consecutive weeks of Nasdaq declines, not to mention dealer gamma collapsing and CTAs still facing billions in forced selling, market sentiment was near-apocalyptic… at least until we reminded traders this morning that the cavalry was, indeed, coming when – just as spoos bottomed a little over 5,000 – we posted that the buyback blackout period that had snuffed bullish sentiment a month ago, was to end this Friday.

The rest, as they say, is history and stocks are now about 60 points higher at session highs…

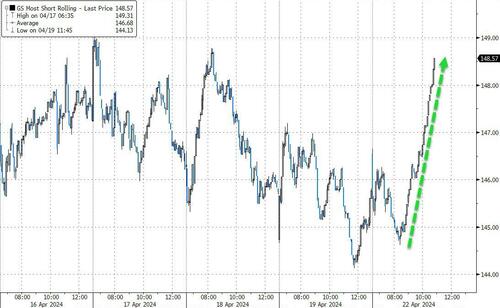

… driven by the biggest short squeeze in a month.

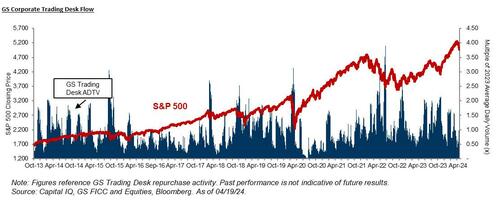

So now that the market is once again obsessing over the return of buybacks, here is what to expect courtesy of the Goldman buyback desk (full note available to pro subs).

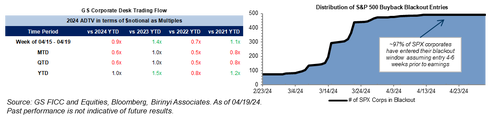

This past week in desk volumes has been more active as the broader market continued to fall. Though we are still in an estimated blackout window, with market trending lower, we noticed corporate 10b5-1 plans were more aggressive at lower price limits.

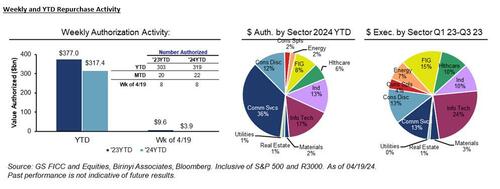

Last week’s desk volumes finished 1.4x vs 2023 YTD ADTV and 0.7x vs 2022YTD ADTV skewed toward Financials, Consumer Discretionary, and Industrials.

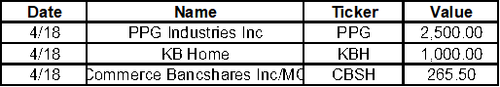

Last week was light for new repurchase authorizations. We saw 8 programs authorized this week for $3.9B. Largest programs launched last week include:

This upcoming week, out of the larger historical repurchasers, we expect to see GOOGL, RTX, GM, META, XOM, MSFT, V, CMCSA, CAT, TMUS report earnings.

On the authorization front, 2024 YTD authorizations stand at $317.4B vs $377.0B 2023 YTD authorizations.

Goldman expects to see authorizations this year finish higher estimating 2024 authorizations to finish $1.15T (up ~16%).

More in the full Goldman note available to pro subs.

Tyler Durden

Mon, 04/22/2024 – 14:11

via ZeroHedge News https://ift.tt/cAO4GZ8 Tyler Durden