SEC Expected To Deny Spot Ether ETFs In May, Consensys Sues Over ‘Security’ Status

There are increasing doubts among industry insiders that the SEC will approved Spot Ether ETFs in May, according to a report from Reuters.

According to four people who participated, recent meetings between issuers and the SEC have been one-sided and agency staff have not discussed substantive details about the proposed products.

That is in contrast to the intensive and detailed discussions between issuers and the agency in the weeks before its landmark approval of spot bitcoin ETFs in January, said the people who declined to be identified because the talks are private.

As CoinTelegraph reports, before the historic approval, the SEC rejected spot BTC ETF filings for over a decade.

It only changed its stance after Grayscale Investments won a court victory against the securities regulator in August 2023.

Many analysts agree that the SEC is likely to further delay possible approval of Ether ETFs.

“It seems more likely that approval will be delayed until later in 2024, or longer,” VettaFi ETF data analyst Todd Rosenbluth reportedly said, adding that the regulatory landscape is still too “cloudy.”

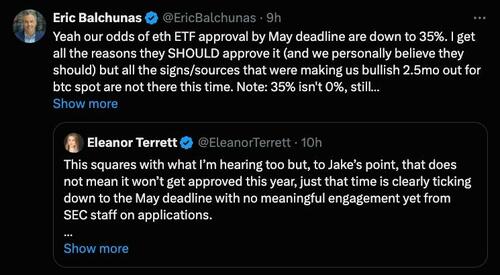

Bloomberg ETF analyst Eric Balchunas previously estimated chances of the SEC approving a spot Ether ETF in May at around 35% in March.

He also noted that he’d sourced “good intel” to suggest that the SEC may be giving the silent treatment to prospective fund issuers on purpose.

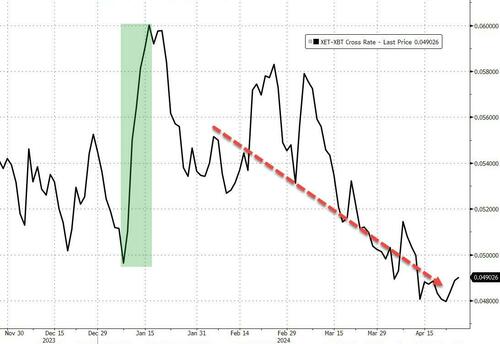

Price action has sown ETH relatively underperforming BTC from the initiation of the spot bitcoin ETFs as hope fades for ETH… for now…

Balchunas also mentioned that SEC Chair Gary Gensler’s stance on Ether could also impact the decision process as he has refused to give clarity on whether Ether was a security.

We have detailed the furore over the classification of Ether as a security (or not) a number of times (most recently here and here), but today saw the situation escalated as Consensys, a major backer of the Ethereum blockchain, filed a lawsuit against the agency in Texas federal court, asking the court, among other things, to resolve one of the biggest legal uncertainties hanging over the crypto industry by stating that Ethereum’s digital token, Ether, is not a security.

Fortune’s Jeff John Roberts reports that in its 34-page legal filing, Consensys uses dramatic language to argue that the SEC’s efforts to exert jurisdiction over Ethereum is both illegal and a threat to blockchain technology more broadly.

“The SEC’s unlawful seizure of authority over ETH would spell disaster for the Ethereum network, and for Consensys. Every holder of ETH, including Consensys, would fear violating the securities laws if he or she were to transfer ETH on the network,” the complaint states.

“This would bring use of the Ethereum blockchain in the United States to a halt, crippling one of the internet’s greatest innovations.”

Gensler’s tactics have angered many in the crypto industry who have complained the SEC has failed to provide clear rules or to create a regulatory model that accounts for the distinct features of blockchain technology.

The controversy over Ethereum has been especially heated since the SEC has signaled repeatedly in the past that the blockchain’s tokens, like Bitcoin, are not securities and therefore outside its jurisdiction.

This includes a landmark 2018 speech where a senior official stated that Ethereum had become “sufficiently decentralized” as well as the agency’s decision last year to allow Ethereum futures trading—an implicit acknowledgement that Ether is a commodity. Meanwhile, video has surfaced of Gensler himself, in his role as a private citizen, telling hedge funds in 2018 that Ethereum is not a security.

However, as we detailed here, these precedents (and his own words) have failed to dissuade Gensler, who appears to be using a recent feature of Ethereum, known as staking, as grounds for the recent legal campaign.

As a reminder, the release of so-called ‘Hinman documents’ last June had revealed the role of network decentralization in the SEC’s thinking on whether a digital token should be classified as security or not.

In particular, JPMorgan points out that SEC officials had acknowledged in the past that tokens on a sufficiently decentralized network are no longer securities because there is no “controlling group˙ in the Howey sense (the Howey Test relates to the U.S. Supreme Court case to determine whether a transaction qualifies as an investment contract).

“If there is no spot Ethereum ETF approval in May, then we assume there is going to be a litigation process after May,” Panigirtzoglou told The Block earlier in the month.

“We believe that the most likely scenario is that the SEC eventually loses this litigation (similar to what happened with the Grayscale and Ripple legal battles last year), which means that eventually, the SEC will approve spot Ethereum ETFs (but not as soon as this May).”

In an interview with Fortune, Consensys founder Joe Lubin described as “preposterous” the theory that staking transformed Ethereum from a commodity into a security.

“The act of staking is really just posting a security bond so you can get paid to contribute labor and resources to help operate the Ethereum protocol. Now they’re trying to turn that into some sort of investment contract,” Lubin said.

Lubin also stated that Gensler’s legal position appeared to be an attempt to halt the overall growth of crypto, and to justify the SEC blocking pending applications by companies to launch spot ETFs for Ethereum following the huge popularity of Bitcoin ETFs.

“They are trying to regulate a technology on its merits, which the SEC shouldn’t be doing. They’re trying to stifle certain kinds of innovation. And they’re trying to do that because probably they see Ether spot ETFs as a floodgate that’s going to bring a lot of capital into our ecosystem,” said Lubin.

As Fortune notes, the Consensys lawsuit was filed in Texas, which dovetails with a broader strategy of the crypto industry to tee up eventual legal appeals in the U.S. Court of Appeals for the Fifth Circuit.

The circuit has shown greater skepticism of agency actions than other courts and, if the industry can win a favorable judgment, it would likely tee up an appeal for the Supreme Court.

Meanwhile, against that clearly politically-motivated push by Gensler (anything to placate Warren after he was forced to acquiesce over spot bitcoin ETFs); on April 24, Hong Kong’s Securities and Futures Commission (SFC) officially approved the first batch of spot Bitcoin and Ether ETFs, including three BTC and three ETH ETFs by China Asset Management, Harvest Global Investments and Bosera.

HK spot bitcoin/ether ETFs officially approved to begin trading on April 30th. Fees are 30bps, 60bps and 99bps which is on avg lower than we thought, good sign. We doing an Analyst Q&A in an hour on this w/ local HK team. Register here, bring your qs: https://t.co/GzzCZailx3 https://t.co/AvJ6dv2Xha

— Eric Balchunas (@EricBalchunas) April 24, 2024

Following approval, Hong Kong’s crypto ETFs are expected to start trading on April 30.

Tyler Durden

Thu, 04/25/2024 – 20:45

via ZeroHedge News https://ift.tt/yu7FUO9 Tyler Durden