WTI Extends Losses After Bigger Than Expected Crude Build

Oil prices extended losses overnight (3rd day lower in a row) following API’s report showing an unexpected crude build. Rising stocks would add to bearish headwinds for prices driven by hopes that peace (or some such variant of it) may break out in the Middle East.

“The potential for a cease-fire agreement between Israel and Hamas has eased concerns of an escalation of the conflict and any possible disruptions to supply,” ANZ Banking Group Ltd. analysts Brian Martin and Daniel Hynes said in a note.

“Continued signs of inflation also raised concerns about demand for crude oil” ahead of the US driving season, when gasoline consumption rises.

Additionally, OPEC’s crude production stayed steady last month, leaving the group’s latest cutbacks incomplete.

The Organization of Petroleum Exporting Countries pumped 26.81 million barrels a day in April, about 50,000 a day less than the previous month, according to a Bloomberg survey. Minor increases by Libya and Iraq were offset by reductions in Iran and Nigeria.

As a result, supply curbs agreed by the group and its allies at the start of the year to avert a surplus are still unfinished

Will the official data confirm API’s unexpected build…

API

-

Crude +4.91mm (-1.5mm exp)

-

Cushing +1.48mm

-

Gasoline -1.48mm (-1.2mm exp)

-

Distillates -2.19mm (+400k exp)

DOE

-

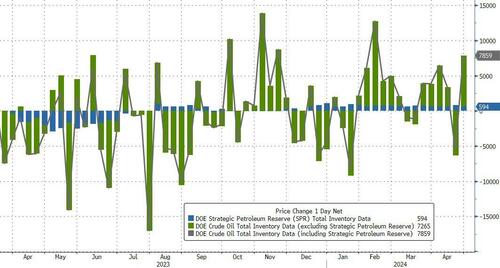

Crude +7.265mm (-1.5mm exp)

-

Cushing -1.089mm

-

Gasoline +344k (-1.2mm exp)

-

Distillates -732k (+400k exp)

The official data showed an even bigger crude build than API (and stocks at Cushing also rose significantly)…

Source: Bloomberg

The Biden admin added another 594k barrels to the SPR last week…

Source: Bloomberg

US Crude production was flat at 13.1mm b/d…

Source: Bloomberg

WTI was hovering around $81.25 (off the morning lows) ahead of the official data and extended losses after the big build…

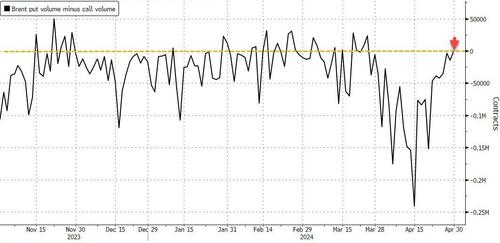

Finally, we note that oil options are signaling that traders are becoming less worried about conflict in the Middle East driving crude prices higher.

About 1,000 more Brent put options – which give the holder the right to sell at a pre-determined price and time – changed hands than bullish calls on Tuesday. That’s the first time put volumes have outnumbered calls since late March.

Puts are trading at their biggest premium to calls since the end of March.

Tyler Durden

Wed, 05/01/2024 – 10:36

via ZeroHedge News https://ift.tt/iYcXyzF Tyler Durden