Authored by John Haughey via The Epoch Times,

A legal battle over the future of a website’s election prediction market is set to continue on Sept. 19, when an appeals court hears the case of Kalshi v. CFTC, a decision that could reshape how Americans engage in political discourse.

The three-judge U.S. Court of Appeals for the District of Columbia Circuit will be considering whether individuals should be permitted to purchase contracts to participate in predictive markets that trade on the outcome of elections. If so, should these markets be regulated like other financial exchanges and commodity markets or as a form of gambling?

New York-based KalshiEx LLC argues that the elections market section of its website is a derivatives trading platform where participants buy and sell contracts based on projected outcomes of events, such as elections, and should be regulated no differently than grain futures that investors purchase as hedges against price fluctuations.

These markets provide a “public benefit” by gauging public sentiment in real-time, Kalshi maintains, a valuable guide for policymakers, politicians, and pundits in charting the public pulse.

The Commodity Futures Trading Commission (CFTC), which regulates the U.S. derivatives markets, argues that Kalshi’s platform blurs the line between commodity trading and gambling, and should not be viewed the same as futures contracts.

The commission maintains that Kalshi’s market puts it in a position to be a de facto elections regulator, which it is not designed to be. Such contracts provide no “public interest” and, in fact, pose a risk to electoral integrity and could potentially incentivize manipulation and fraud, the CFTC argues.

Those conflicting contentions are the core of what the appellate panel will deliberate on before it decides to lift or sustain its stay on U.S. District Judge Jia Cobb’s Sept. 6 ruling in favor of the platform. Judge Cobbs found that the defendant, CFTC, exceeded its statutory authority as a Wall Street regulator when it issued a September 2023 order stopping Kalshi from going online with its market because it is a “prohibited gambling activity.”

Judge Cobbs on Sept. 12 also denied CFTC’s motion for a stay while it mounts an appeal.

After the initial stay request was rejected, Kalshi wasted little time getting its market online. Attorneys for the CFTC were also busy, and within hours secured a stay from the appeals court, setting the stage for the 2 p.m. Sept. 19 hearing.

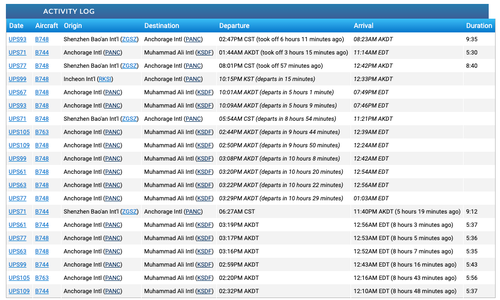

In the brief time before trading was paused “pending court process” late Sept. 12, more than 65,000 contracts had been sold on the questions, “Which party will control the House?” and “Which party will control the Senate?”

The appellate panel will essentially be engaged in a technical legal debate over the definition of “gaming” and “gambling,” and how they would apply, in this case, to any potential regulation.

In its Sept. 13 filing calling for the stay to be lifted, Kalshi rejected CFTC’s definition that trading on election prediction markets is “gaming.”

“An election is not a game. It is not staged for entertainment or for sport. And, unlike the outcome of a game, the outcome of an election carries vast extrinsic and economic consequences,” it maintains.

The CFTC said in its Sept. 14 filing that because “Kalshi’s contracts involve staking something of value on the outcome of elections, they fall within the ordinary definition of ‘gaming.’”

‘Horse Has Left the Barn’

Regardless of how the panel rules, “The horse has left the barn,” said data consultant Mick Bransfield, of Pittsburgh, Pennsylvania, who trades on Kalshi’s website and purchased a “Senate control” contract.

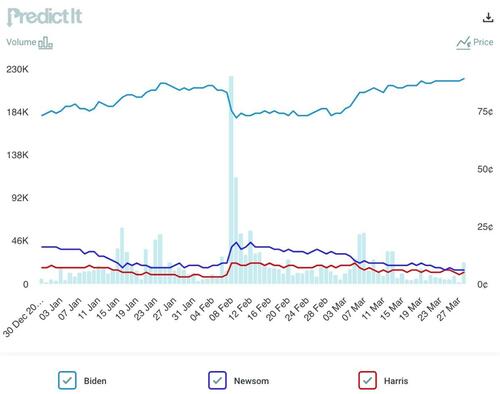

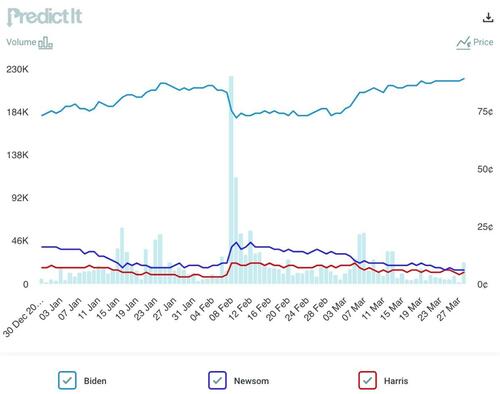

There are ample opportunities to place election wagers on offshore websites such as New Zealand-based PredictIt, which imposes strict spending limits; on websites such as Polymarket, a New York-based platform that cannot legally accept wagers from within the United States; or the American Civics Exchange, where businesses and high net worth individuals can purchase “binary derivative contracts” through proxies tied to policy and electoral outcomes as hedges against “unpredictable electoral, legislative, and regulatory events.”

Predictit.org/Screenshot via The Epoch Times

“Elections predictive markets have been around since 1988 in the United States,” Bransfield told The Epoch Times, adding that the issue is “more nuanced than people realize.”

That nuance, said Carl Allen, author of The Polls Weren’t Wrong, is that Kalshi’s platform would be the first federally regulated U.S.-based predictive elections market open to all individuals without spending limits.

“To me, the question is not should it be regulated, the question is how? I think that is where we are,” Allen, who writes about predictive markets on substack, told The Epoch Times.

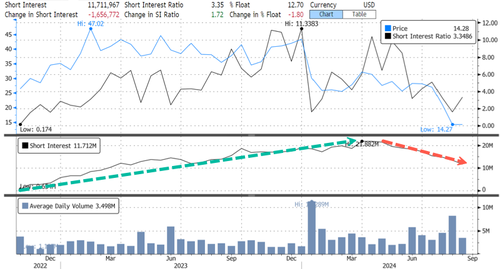

“It’s challenging to get your arms around this because there are so many organizations involved with it,” he said. “We’re reaching a really interesting point with sports betting going from totally disallowed, except for in Vegas and a few brick-and-mortar [stores], to being everywhere; crypto currency drastically growing; ETFs [Exchange-Traded Funds] getting big;” and Kashi attempting to open a predictive market on election outcomes.

Prediction market trader and Kalshi community manager Jonathan Zubkoff, who also writes about predictive markets and wagering, said the CFTC’s claim that elections markets are betting websites is mistaken.

“It’s not the same as sports betting” where there is “a line posted and billions of dollars are traded against it across different time zones,” prompting the odds to fluctuate, he told The Epoch Times.

“If you are looking at a line [to bet] on a Friday night for a Sunday game, there’s no hedge whatsoever.”

In elections markets, “there actually is a hedge” that gives people an opportunity to put money where “their bias is,” Zubkoff said.

Coalition For Political Forecasting Executive Director Pratik Chougule said another difference between sports betting and other types of gambling and predictive elections markets is that “unlike many other forms of speculation, the wagering here has a real public interest benefit. These markets inform in a way that is very beneficial.”

In October 2023, Chougule told The Epoch Times that elections markets reflect predictive science, citing numerous studies documenting that political betting websites are better indicators of public sentiment than any other measure except the election results themselves, including a study by Professor David Rothschild of the University of Pennsylvania’s Wharton School of Business.

“Polling is very unreliable,” he said. “And so we basically believe that, in order to promote good forecasting for the public interest, we believe that political betting is one solution to that because, at the end of the day when you have people wagering their own money on the line, that creates incentives that are very hard to replicate through other ways.”

Chougule, who hosts the podcast Star Spangled Gamblers, believes that, while not always accurate, election predictive markets are the best gauge of public sentiment in real-time.

“When they make a prediction, they are putting their money on the line,” he said. “It’s a pretty clear barometer of how an election is going.”

‘Gray Area’ Needs Rules

Chougule said he was “pessimistic” that Kalshi’s elections market would be online by Nov. 5.

“I think when you look at the landscape at the federal and state level, at Congress, at federal agencies, [there is] fear and skepticism and concern about what widespread elections betting could mean for our democratic institutions,” he said. “I don’t agree but it’s a fact.”

Bransfield said he was surprised by Cobb’s ruling against the regulators. “It did not seem the district court would side with Kalshi after the oral arguments in May,” he said. “The judge referred to elections contracts as ‘icky.’ That gave me the assumption that it would be unpalatable to her.”

But there is reason to be deliberative, Bransfield said.

“We should always be concerned about the integrity of our elections but these elections contracts have been around for so long,” he said, noting that more than $1 billion in 2024 U.S. elections contracts have already been purchased in the United Kingdom alone. “All those concerns already exist and have for a long time.”

Certainly, Allen said, “there are a lot of downstream effects that we are going to see from this,” but some fears are unfounded.

Unlike a sports contest where one player can affect the outcome, it would take a widespread concerted effort to “fix” an election, he said. Nevertheless, there is “potential for unscrupulous actors to release a hot tip” that could affect predictive markets.

Allen cited speculation about when former South Carolina Gov. Nikki Haley would end her presidential campaign during the Republican primaries, whether Robert F. Kennedy would pull the plug on his independent presidential campaign, and who both parties would pick as their vice presidential candidates as examples.

“A handful of people knew about [vice president picks] before it was public. It would be financially beneficial for someone to throw a couple [of] thousand dollars into that market,” he said.

Prime Minister Rishi Sunak (C) and his wife Akshata Murty (in yellow) at the launch of the Conservative Party general election manifesto at Silverstone race track in Northamptonshire, England, on June 11, 2024. James Manning/PA

The CFTC, in its challenge, noted that bets had been placed on the July 4 British general election date before Prime Minister Rishi Sunak officially announced it in May.

“It is very hard to see this gray area without some rules,” Allen said.

“Claiming that betting in elections is going to lead to issues with democracy and election integrity is one of the most ridiculous things I ever heard,” Zubkoff said, calling them “elections integrity dog whistles.”

Critics “are sort of lashing out,” he continued.

“It is a total misunderstanding. As someone who has traded in these markets, I haven’t seen anything that remotely constitutes a threat” to election integrity.

Zubkoff said Kalshi “very clearly has the better arguments” and cited the Supreme Court’s Chevron repeal as momentum that “bodes well for the future” of predictive elections markets.

He believes the appellate court will deny CFTC’s motion to extend the stay, and placed the odds of Kalshi getting a “yes” to go online before November’s elections at 60 percent.

Zubkoff noted that just like predictive elections markets, those odds could change in real-time during the hearing. “I could give you much better odds while listening to the hearing just based on the questions the judges ask,” he said.

Allen said the odds are “better than 60-40” that Kalshi will win its case, before qualifying that prediction with the ultimate hedge: “I don’t know how much money I would put on that.”