Authored by Sven Henrich via NorthmanTrader.com,

Markets are faced with another gap event, the G20 meeting this weekend, specifically any outcome from the renewed Xi/Trump trade talks on Saturday. To be, or not? Will they, won’t they? Progress, no progress, escalation, no escalation?

The outcome to these questions will likely see futures either gap up hard or gap down hard Sunday night.

Suffice to say markets in general are expecting some progress or at least no further escalation. How do we know? Well $SPX being less than 1.2% from all time human history highs is not exactly an expression of fear or concern.

So expectations are high that any positive signal on the trade war front will help propel markets to new highs and alleviate any growth concerns. After all central banks are dovish and stand at the ready to intervene, cut rates and/or relaunch QE. Draghi, Kuroda and Powell have send these messages clearly. TINA rules again and fundamentals have once again not mattered.

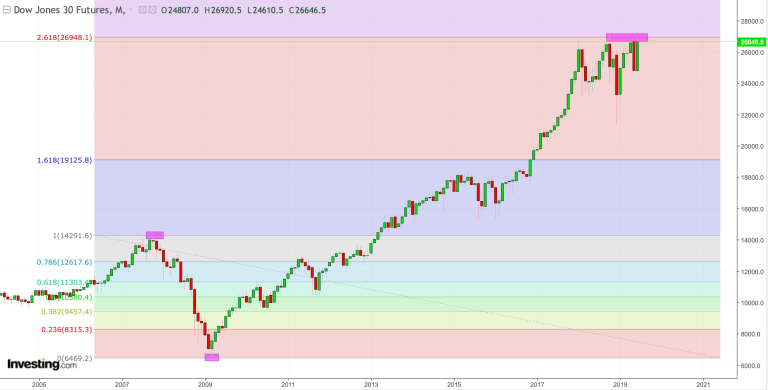

After all when free money drugs are offered stocks jump and the chart of the $DJIA offers an insightful illustrative lesson as to how jerky the action has been over the last year and a half:

This is your Dow, this is your Dow on drugs.$DJIA pic.twitter.com/vThdEj05jy

— Sven Henrich (@NorthmanTrader) June 26, 2019

Note the most vertical rallies have occurred when there were promises of free money, tax cuts, rate cuts, and the most steep corrections occurred when the fundamental picture reared its ugly head. The chart is one about control.

And be clear who’s in control here for now: Central banks. What was bad for stocks has been negated by their dovish tones, speeches and signals. Now throw a China deal on this smoldering fire and one can see the explosion coming.

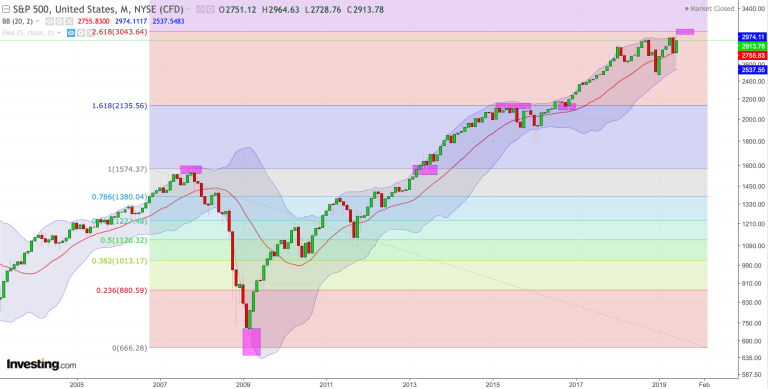

The natural technical risk target from my perch: 3043 on $SPX, the 2.618 fib or around 4% higher from here:

It’s the same technical pivot zone we’ve been talking about since January 2018. Nothing’s changed on that front. The potential alignment with the previous pivot zone of the 2015 highs and 2016 election lows remains impressive. Get good news on a China deal and one can easily envision such a ramp. Whether it’s sustainable is another debate entirely. If markets were to rally to there it’d view this price zone as massive technical resistance.

Are fibs relevant? Hell yea. We’ve seen it many times. Heck, we just saw it yesterday in Bitcoin rejecting hard from its visit to its .618fib:

If you’re looking for a technical explanation:$BTC hit its .618 fib today and is rejecting from there pic.twitter.com/aBADuzeUN3

— Sven Henrich (@NorthmanTrader) June 26, 2019

Is a 2.618 fib relevant, after all it’s a massive extension from the 2007 highs and the 2009 lows?

Why don’t you ask the $DJIA:

Oops. It’s hit the 2.618 fib are twice now and rejected each time.

Which leaves room for an entirely different interpretation altogether and that is that markets perhaps have already topped.

It may simply depend on this weekend’s G20 meeting outcome.

New highs to be or not.

Any escalation or lack of progress in trade talks may leave markets running out of patience. Q2 earnings are coming in July and are likely telling a story of companies not seeing the growth they need to meet lofty earnings estimates.

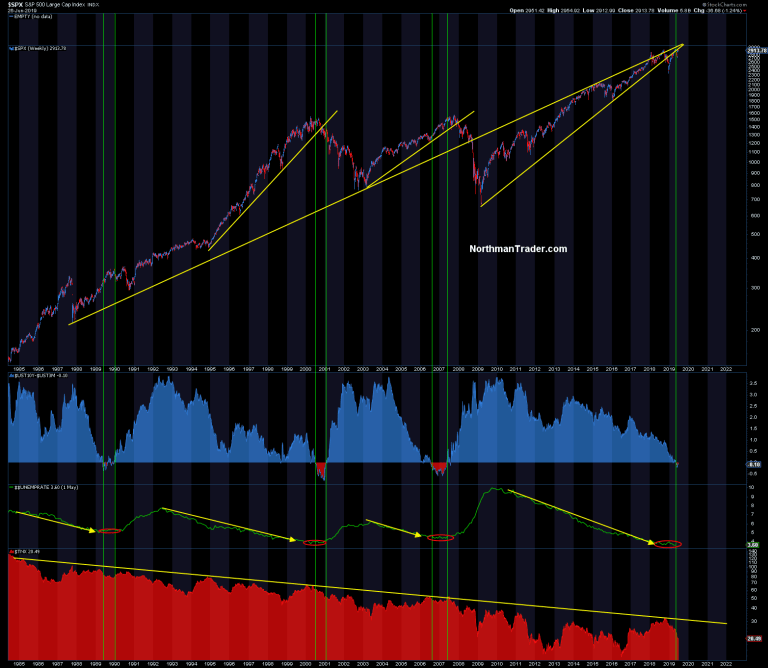

See here’s the thing, we are here:

Inverted yield curve, unemployment at a cycle low with $SPX still grappling with a broken bull trend line (despite new highs) and everything being dependent on the Fed not losing control.

Perhaps a China deal can delay the inevitable and even squeeze $SPX to that 3043 technical zone, but the confluence of the picture above suggest a business cycle whistling dixie.

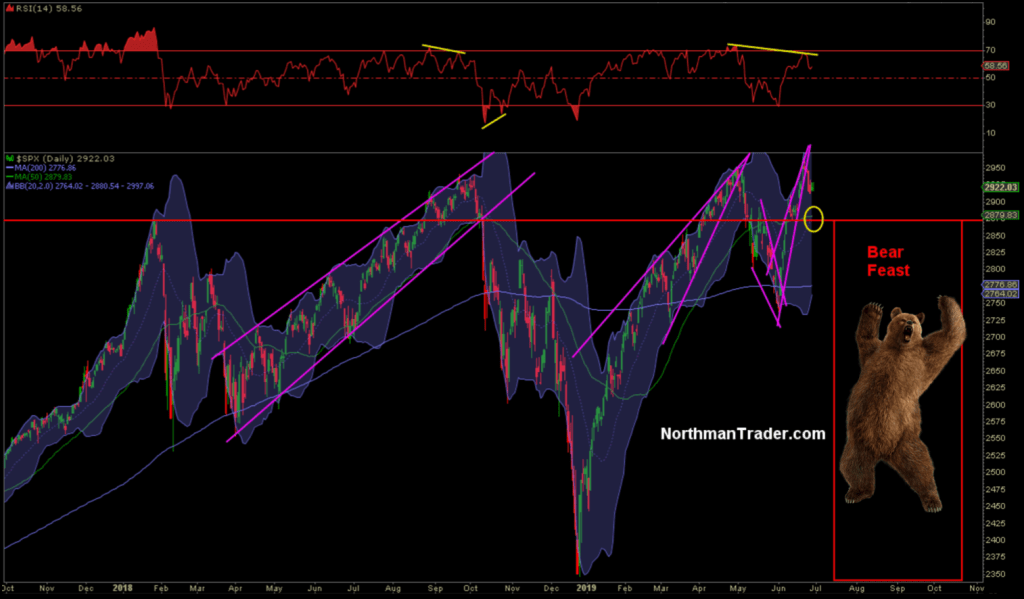

How do we know when fundamentals and bears wrestle control away from central banks? From my perch a renewed drop below the 2860-2870 zone. See $SPX see a sustain a drop below there and bears will raid and feast on these markets:

Why? Because topping patterns will kick in and the prophecy of the 4 horsemen will have come true. So best hope there’s positive news coming out of the G20 this weekend.

To be or not. We’ll know more this weekend.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News https://ift.tt/2ZN4VaI Tyler Durden