For all the hype around this meeting, Nomura’s Charlie McElligott has some less exuberant perspective on what happens next.

Via Nomura,

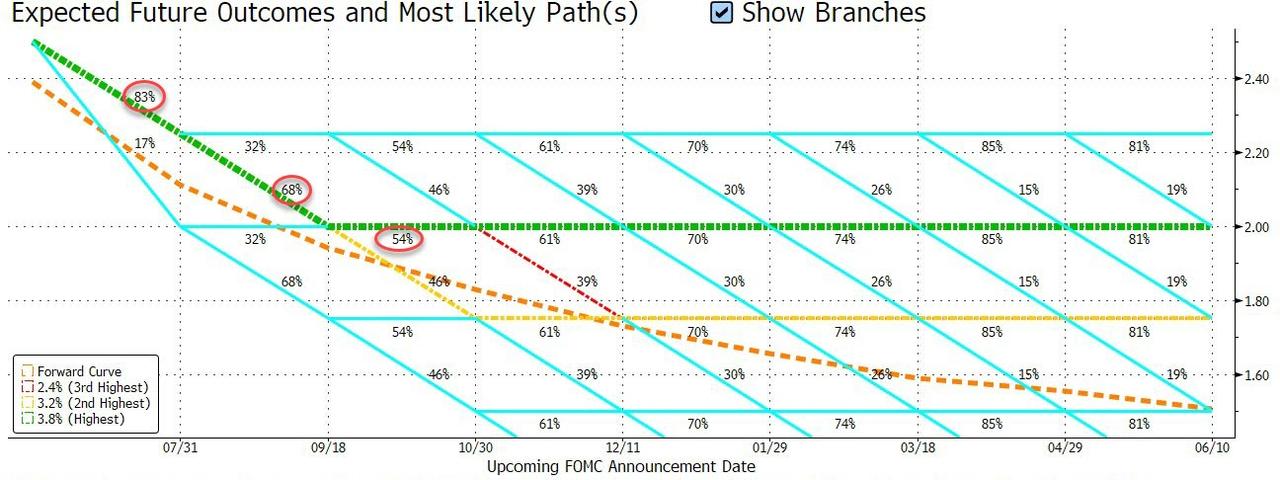

From the perspective of a “give ‘em an inch, they take a mile” rates market which continues to price-in the outright “commencement of an easing cycle” (~4 cuts / -100bps into the September 2020 ED$) as opposed to the Fed’s far more modest “just an insurance cut” talking-points…

This is where things get tricky for the Fed communication

It is increasingly a talking-point with clients that the “25bps cut + dovish” today may actually provoke a bit of “reckoning” ahead of / around the September meeting IF this current “okay” US economic backdrop holds, because the STIRs market continues to price ~70% probability of another cut for September and obviously additional easing behind.

Why?

Because a “25bps +dovish” set-up post-today’s meeting into a September environment where (critical to this scenario) the US economy maintains its current “still expansive” pace will likely force the Fed to finally have to begin guiding those Rates market expectations lower into accepting both a “no follow-up cut for September” and likely “just” one more cut in total thereafter, all over the course of August / September Fed-speak.

Relative to said “dovish” expectations already priced-in / crowding into front-end rates / curve steepeners, a messaging downshift then likely elicits an outsized “hawkish” market response and thus, incites Rate vol as that messaging is forced into becoming clearer as we proceed deeper into August.

At the same time, “just” a 25bps cut today into (critically) a “still fine” US economy out a few months will keep POTUS pounding on the Fed to “do more” under the guise of potential for further USD currency headwind

The issue is that late-August / September is where we could see a further escalation risk of a US Dollar upside breakout IF September then becomes a “hold” month because the economy holds steady, while the rest of the world (particularly the ECB) really “kicks-off” the easing and begins competitively devaluing their own currencies in a race to the bottom

Summarizing the risk then, there is potential for:

1) Aug / Sep Rate vol jump (on the repricing of September cut odds lower and the likely beginning of the ‘walk down’), potential for…

2) a USD breakout to fresh cycle highs (as rest of world accelerates their easing while the Fed seemingly then “stands pat”) which then sets the table for…

3) even greater escalation of political pressure from POTUS in light of this potential renewed Dollar strength (rest of world easing while Fed moderates message) and then…

4) pushes this pressure on Fed to “do more” even-deeper into the election-cycle—which is nowhere the Fed wants to be.

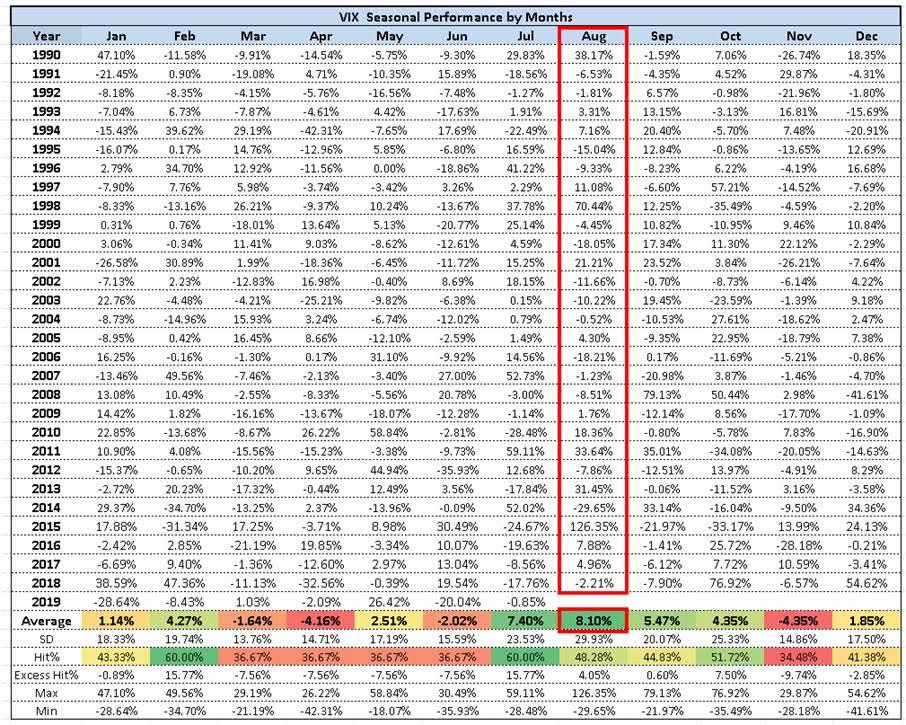

This scenario is dangerous because the month of August marks “peak illiquidity” after many funds effectively shut themselves with PMs in “gross-down” mode ahead- / into- their Summer holiday…

…and which is a large reason why over the past thirty years that we see August posts the highest average VIX return of any month.

An outlook where the data holds (or even improves) into the Fall would be a major shock to the consensus belief of “piece-meal & ongoing” Fed rate cut approach that the market currently is positioned-for, because the Fed won’t be able to deliver vs market expectations.

This ironically then is probably the largest justification for a Fed “50bps cut” today… because they have zero visibility on whether they will be able to cut later in 2019 (on data stabilization risk) and certainly into 2020 – especially as we hit the home-stretch of the US Presidential Election.

via ZeroHedge News https://ift.tt/2MqNtpf Tyler Durden