US Durables Goods Orders Unexpectedly Plunge In November As Boeing Backlash Hits

After a modest rebound in October (from September’s contraction), analysts expected a continued acceleration in durable goods orders in preliminary November data, but instead it collapsed!

Flash November Durable Goods Orders were expected to rise 1.5% MoM, but instead they tumbled 2.0% MoM, sending the year-over-year collapse to -5.7% – the worst since July 2016…

Source: Bloomberg

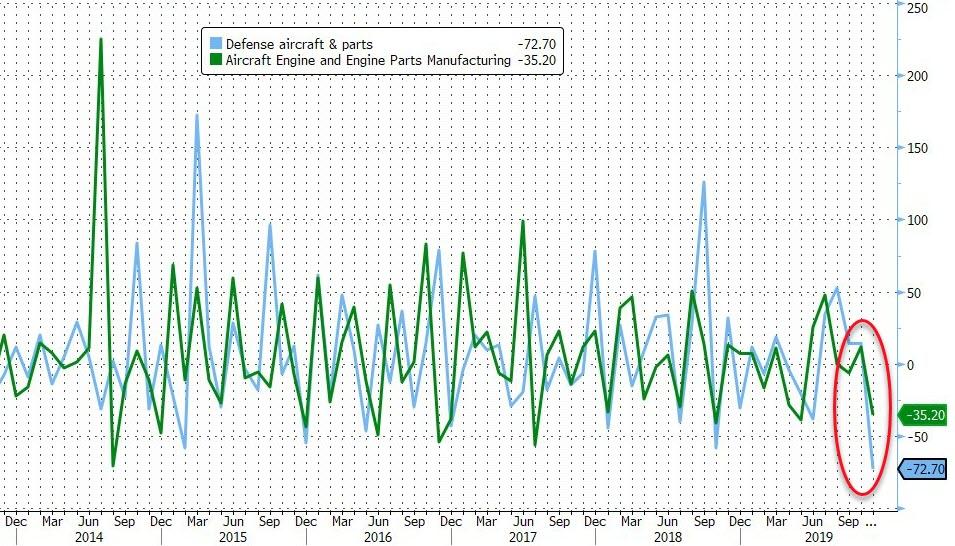

Core Durable goods orders (ex transports) were unchanged in November (worse than the 0.2% MoM expectation), indicating the headline drop was due to a slump in military aircraft and a drop in civilian planes.

The headline durable-goods figure was pressured by a decline in orders of commercial aircraft despite Boeing Co. reporting earlier this month that it received 63 orders in November compared with just 10 in October. Bookings for military hardware plunged 35.6%, the most since February 2017, while defense aircraft orders slid 72.7%.

Source: Bloomberg

The proxy for capex, Capital Goods orders ex-aircraft, spiked in October but slowed to just 0.1% MoM rise in early November data; and capital goods shipments ex-Air dropped 0.3% MoM (notably worse than the 0.0% expectation).

Combined with a decrease in core shipments, the figures highlight a lack of appetite for capital expenditures, with profit growth cooling and business sentiment still subdued amid global demand concerns.

Tyler Durden

Mon, 12/23/2019 – 08:39

via ZeroHedge News https://ift.tt/373wKiW Tyler Durden