IMF Slashes Global GDP Forecast For 6th Consecutive Time, Warns “Climate Change” Will Hit Economy

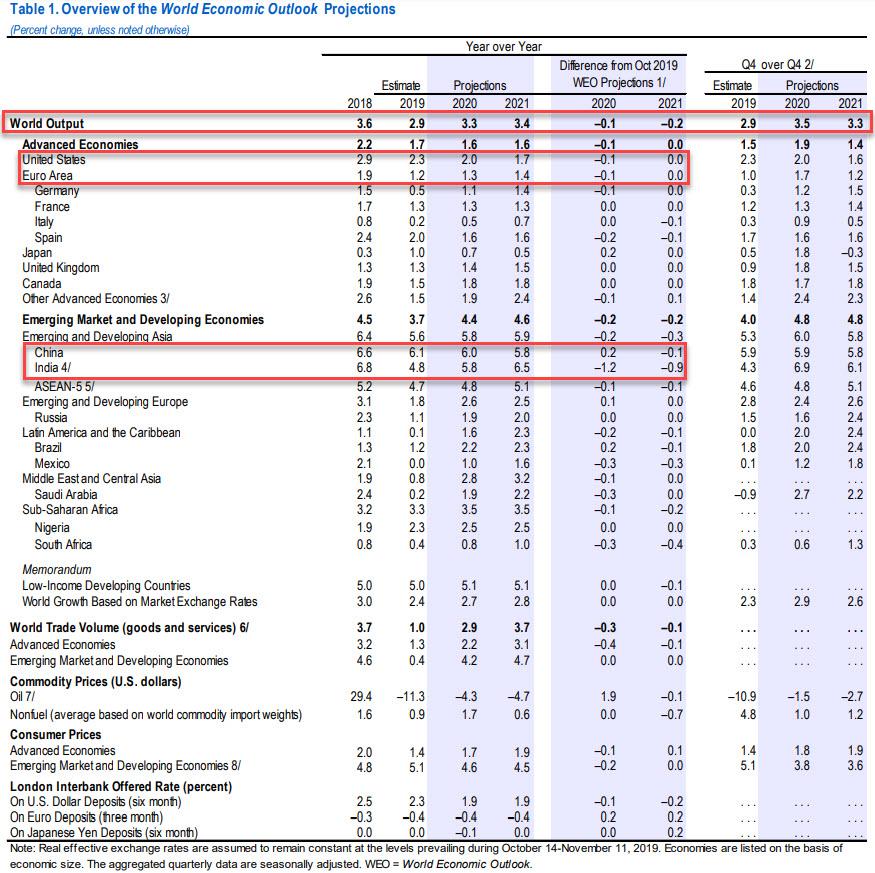

After the IMF cut its global economic outlook for 2019 to 2.9% in October, the lowest since the financial crisis, and warned that global trade growth would be “close to a standstill”, moments ago the IMF once again downgraded its forecast for global GDP for 2020 and 2021, its sixth straight reduction, although in a sliver of optimism, global GDP in 2020 is now expected to post a modest rebound from 2.9% to 3.3%, (down from 3.4% in October) and to 3.4% in 2021 (down from 3.6%) as the IMF says “there are now tentative signs that global growth may be stabilizing, though at subdued levels.”

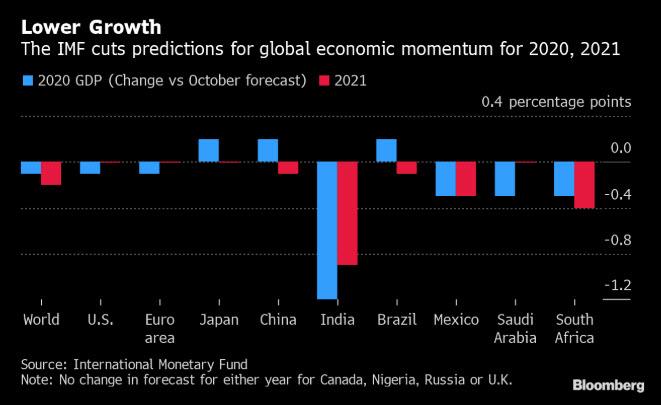

According to the IMF, the downward revision primarily reflects negative surprises to economic activity in a few emerging market economies, most notably India, where 2020 GDP is now expected to rise just 5.8% down from 7.0%, which means that in 2020 China will regain the title of the world’s fastest growing economy. In a few cases, this reassessment also reflects the impact of increased social unrest.

Emerging market debacle aside, the IMF said that on the positive side, market sentiment “has been boosted by tentative signs that manufacturing activity and global trade are bottoming out, a broad-based shift toward accommodative monetary policy, intermittent favorable news on US-China trade negotiations, and diminished fears of a no-deal Brexit, leading to some retreat from the risk-off environment that had set in at the time of the October WEO.”

However, and this will be of particular interest to traders, even the IMF admitted that “few signs of turning points are yet visible in global macroeconomic data.”

And so, in addition to the collapse in India, the IMF also sees continued slowdown in the US and Europe in 2020, both of which were cut by 0.1% to 2.0% and 1.3%, while China saw a modest increase by 0.2% to 6.0%, which however drops to 5.8% in 2021.

Commenting on its latest forecasts, the IMF said that “the balance of risks to the global outlook remains on the downside, but less skewed toward adverse outcomes than in the October WEO. The early signs of stabilization discussed above could persist, leading to favorable dynamics between still-resilient consumer spending and improved business spending. Additional support could come from fading idiosyncratic drags in key emerging markets coupled with the effects of monetary easing and improved sentiment following the “Phase One” US-China trade deal, with the associated partial rollback of previously implemented tariffs and a truce on new tariffs. A confluence of these factors could lead to a stronger recovery than currently projected.”

Nonetheless, the IMF admitted that downside risks remain prominent, and arise from:

- Rising geopolitical tensions, notably between the United States and Iran, could disrupt global oil supply, hurt sentiment,and weaken already tentative business investment.

- Higher tariff barriers between the United States and its trading partners, notably China, which have hurt business sentiment and compounded cyclical and structural slowdowns underway in many economies over the past year

- A materialization of any of these risks could trigger rapid shifts in financial sentiment, portfolio reallocations toward safe assets, and rising rollover risks for vulnerable corporate and sovereign borrowers. A widespread tightening of financial conditions would expose the financial vulnerabilities that have built up over years of low interest rates and further curtail spending on machinery, equipment, and household durables.

And the most amusing risk, one not seen before, climate change:

- Weather-related disasters such as tropical storms, floods, heatwaves, droughts, and wildfires have imposed severe humanitarian costs and livelihood loss across multiple regions in recent years. Climate change, the driver of the increased frequency and intensity of weather-related disasters, already endangers health and economic outcomes, and not only in the directly affected regions. It could pose challenges to other areas that may not yet feel the direct effects, including by contributing to cross-border migration or financial stress (for instance, in the insurance sector). A continuation of the trends could inflict even bigger losses across more countries.

But… but… whatever happened to the idiotic Keynesian “broken window” mantra: after all, what better reason to rebuild something over, and over, and over again than arson “global warming” causing all those Australian fires. Oh wait, it was arson. Nevermind, point still stands.

Perhaps the most ominous sign is that despite the “end” of the trade war, global trade volume forecasts were cut again, by 0.3% and 0.1% in 2020 and 2021 to 2.9% and 3.7%, respectively. The good news: both are an improvement to the dismal 1.0% recorded in 2019. Expect these numbers to be substantially cut in the coming quarters as the much anticipated global trade renaissance fails to emerge.

Tyler Durden

Mon, 01/20/2020 – 08:30

via ZeroHedge News https://ift.tt/2NJHprB Tyler Durden