CMBS Implosion: Unprecedented Surge In New Delinquencies Heralds Commercial Real Estate Disaster

Yesterday’s news that Saks Fifth Avenue parent Hudson’s Bay had missed its April payment on at least two commercial-mortgage backed securities prompted us to take a look at the current state of the CMBS market and, boy, was it ugly.

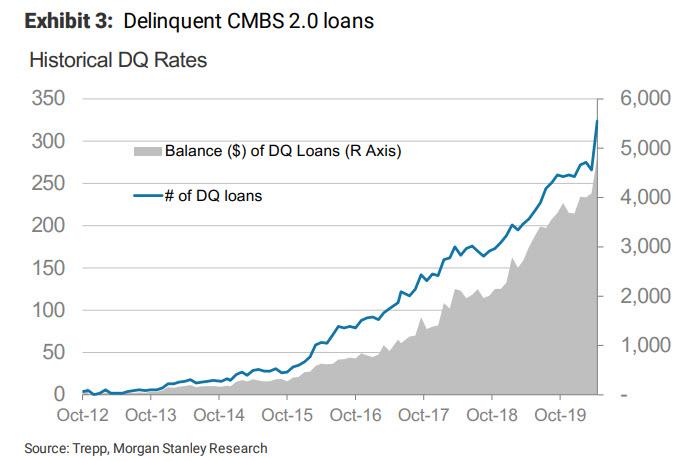

According to the latest remittance data compiled by Morgan Stanley, a record 66 loans totaling $1.0bn became newly delinquent in April, which is the greatest month-over-month change. In total, 324 loans with a total balance of $4.8bn are currently delinquent, which is also an all time high.

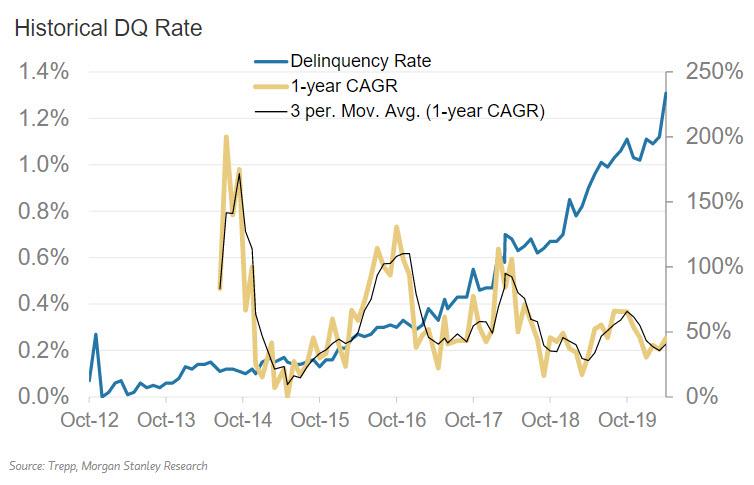

The resulting delinquency rate increased by 19bp month over month, to 1.31%, and the 1-year CAGR increased to 45.3%.

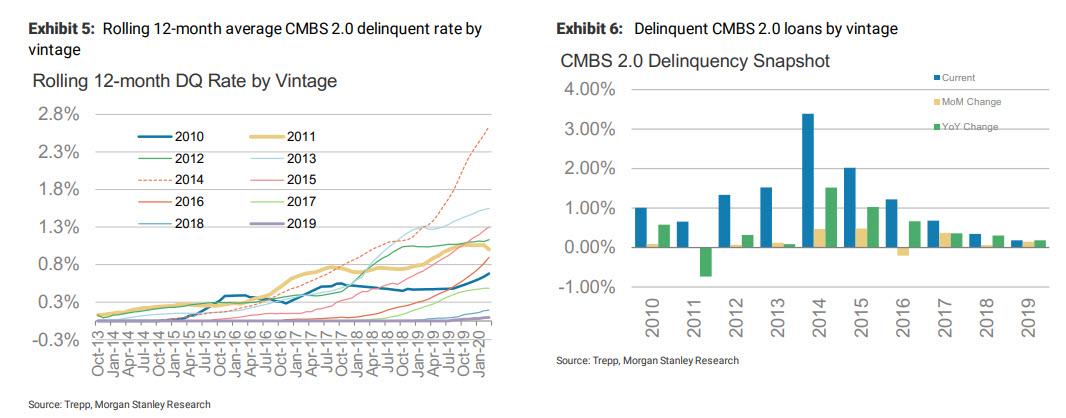

The 2015, 2014 and 2017 vintages increased the most by 48bp, 47bp and 37bp, respectively. The 2016 vintage was the only vintage that declined at -21bp MoM. At 3.39%, the 2014 vintage continues to have a meaningfully higher delinquency rate than the other vintages, with the 2015 vintage standing second-highest at 2.02%, followed by the 2013vintage at 1.52%. The 2016, 2012and 2010 vintages also stand above 1%,at 1.22%, 1.33% and 1.01%, respectively.

But what is far more troubling than the plain vanilla surge in delinquencies is the coming deluge of defaults. Recall that a CMBS loan becomes delinquent after it misses two consecutive payments. Loans that have missed just one month of interest are classified as “late but within grace period” or “late beyond grace period”. It is this measure that spiked 600bp MoM to ~8.5%, led by hotel, which rose 19% points to 21.6%, followed by retail, which increased 774bp,and multifamily, which was 308bp higher. Across vintages, ‘grace’ loans increased, ranging from a maximum 852bp for the 2012 vintage to a minimum of 416bp for the 2020 vintage.

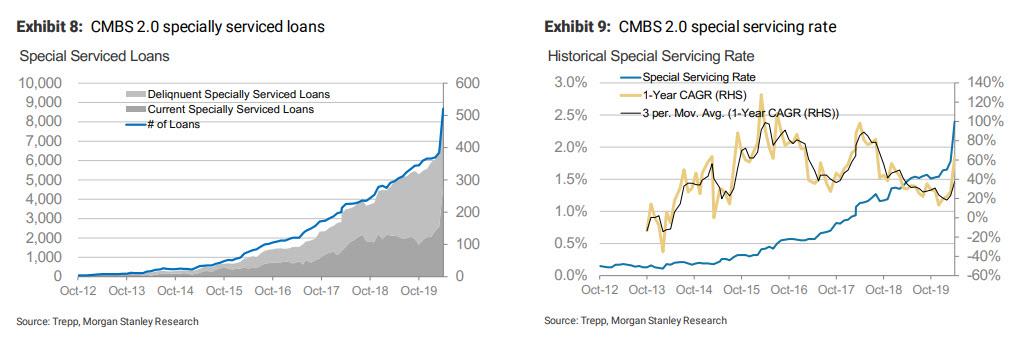

Looking further up the delinquent pipeline, 134 loans totaling $2.4bn were newly transferred to special servicing in April. In total, 521 loans with a balance of $8.9bn are specially serviced. The resulting specially serviced rate increased by 62bp month over month, to 2.40%,and the 1-year CAGR increased to 63.1%. Every vintage experienced an increase in the special servicing rate, led by the 2016 vintage, which rose by 117bp. The 2010 vintage has the highest special servicing rate,at 10.5% (driven by negative selection as loans pay off).

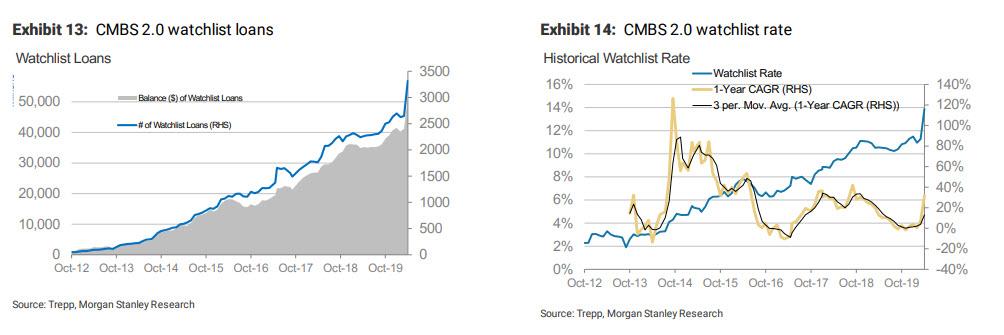

Meanwhile, 922 loans totaling $14.1bn were added to the watchlist in April. In total,a record 3,316 loans with a record balance of $51.4bn are currently on the watchlist. The resulting watchlist rate increased by 261bp, to 13.89%,and the 1-year CAGR also increased to 31.6%. Every vintage experienced MoM increases in the watchlist rate, ranging from a minimum of 0.81% to a maximum of 5.62%. The 2010 vintage has the highest watchlist rate,at 31.03%, followed by the 2011 vintage at 21.13%

Conclusion: while the retail sector is a disaster with a barrage of , hotels are just as bad, while multifamily CMBS (i.e., rentals) are close behind.

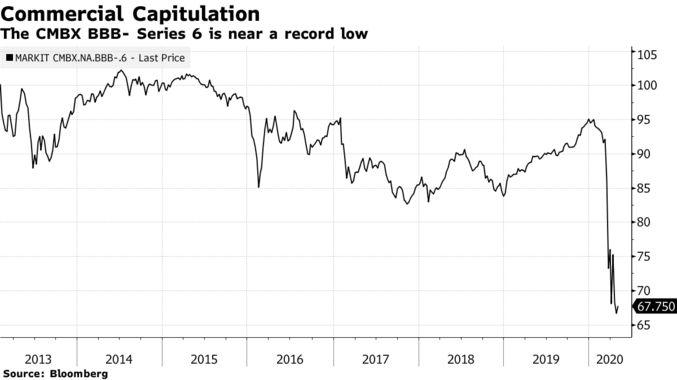

In other words, while Carl Icahn has made like a bandit on his CMBX “big short 2.0” bet, something we discussed last month in “Jackpot: The “Big Short 2” Trade Has Absolutely Crushed It” and which Bloomberg picked up with a one month delay yesterday profiling the collapse of the infamous CMBX Series 6 BBB- tranche…

… the real story is that the default tidal wave has now spread to most other commercial real estate sectors with a record 6% in loans about to be delinquent in May once they fail to make an interest payment for two months in a row. Said otherwise, the CRE bubble that the nervous Fed had been warning about for so long, has now burst and the full extent of the collapse will become evident over the next 30 days.

Tyler Durden

Thu, 04/30/2020 – 17:06

via ZeroHedge News https://ift.tt/2KTwB8p Tyler Durden