AAPL Pumps’n’Dumps After Boosting Buyback But Pulls Guidance Despite “Seeing Pick-Up In April”

The big kahuna has printed and while at first glance it would appear everything is awesome – bigger dividend, boosted buybacks (by $50 billion), and optimism from CEO Cook – shares have given up the early spike gains.

Apple’s 2Q revenue was $58.3 billion, a gain of 1% from a year ago and better than the $54-billion average analyst prediction.

Net income was $11.2 billion, down from a year ago but still above estimates.

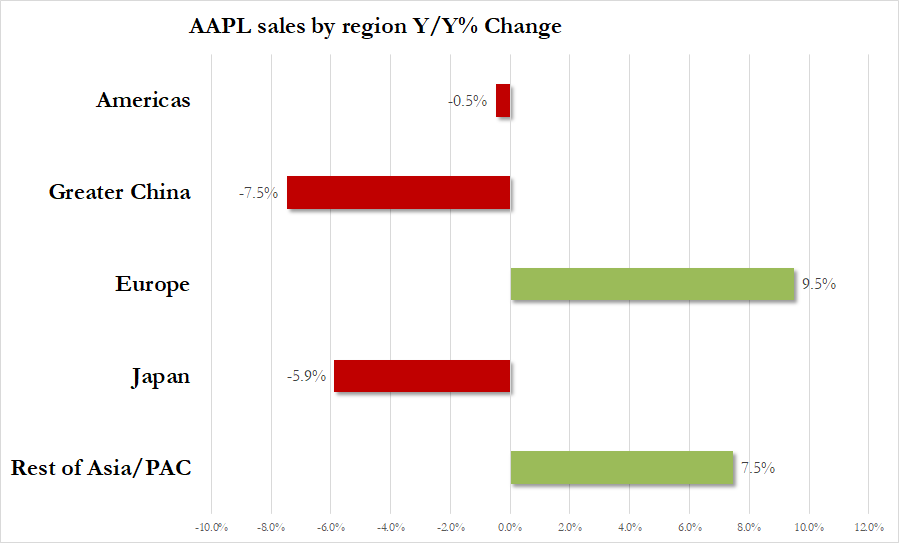

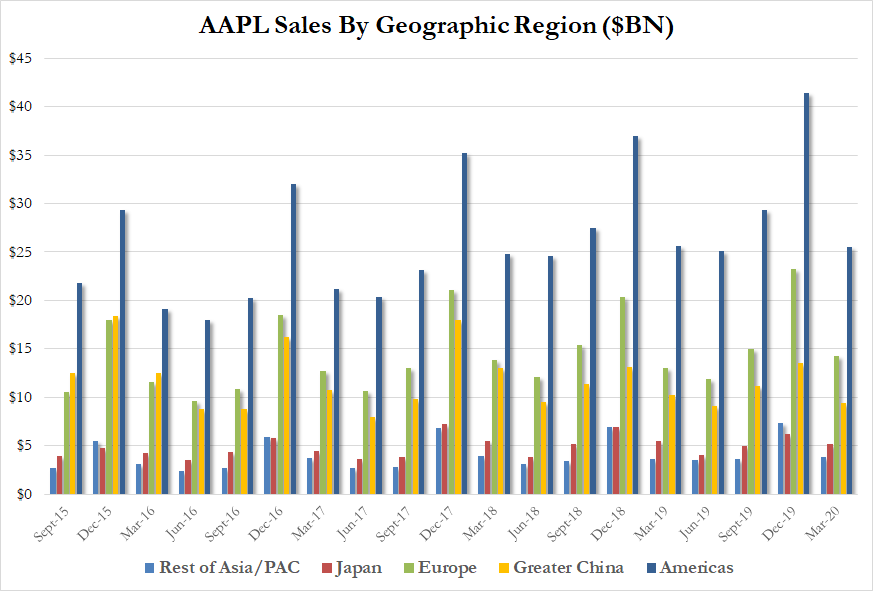

On a regional basis, not entirely surprisingly, China suffered the most:

-

America’s revenue was little changed at $25.47 billion.

-

Europe gained 9.5% to $14.29 billion.

-

Greater China fell 7.5% to $9.455 billion.

-

Japan and the rest of Asia Pacific also posted declines.

Cook on when stores will reopen:

“Soon, like within the next 1-2 weeks, we’ll open Austria Europe and Australia, and I would say by the first half of May, somewhere in that ballpark, I think the initial stores in the U.S. will open, just a few, not a large number, and we’re going to look at the data and make a decision city by city, county by county, depending on the circumstances in that particular place. We probably won’t be the first to reopen probably anywhere.

“In terms of the offices in Cupertino, it will be at least early June.”

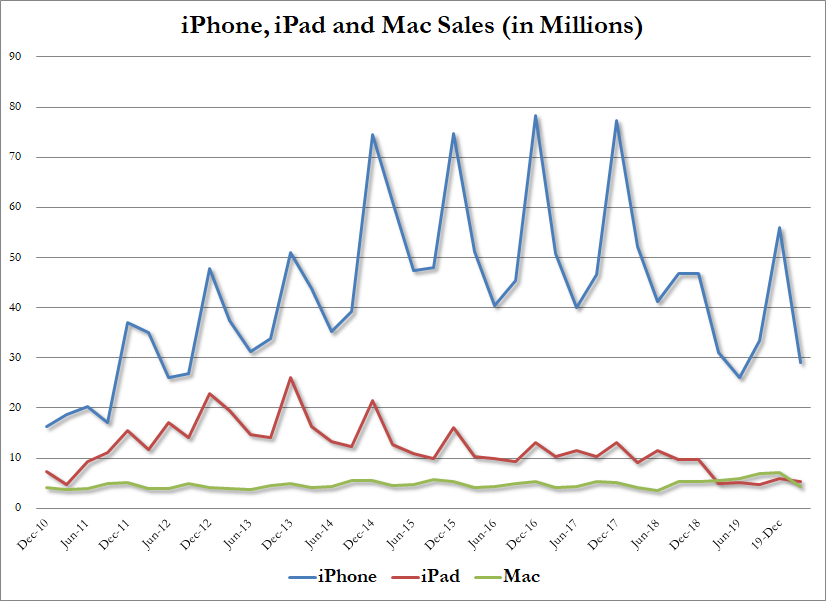

By product, there was some ugliness:

-

iPhone revenue dropped from 6.7% from a year ago to $28.96 billion (better than the $25.42 billion expected).

-

Mac sales were down 2.9% to $5.35 billion (well above expectations of $4.52 billion).

-

iPad revenue fell 10% to $4.37 billion (handily better than expected revenues of $3.88 billion)

On products:

“The reception has been very good” for the iPad Pro and Magic Keyboard, iPhone SE, and new MacBook Air.

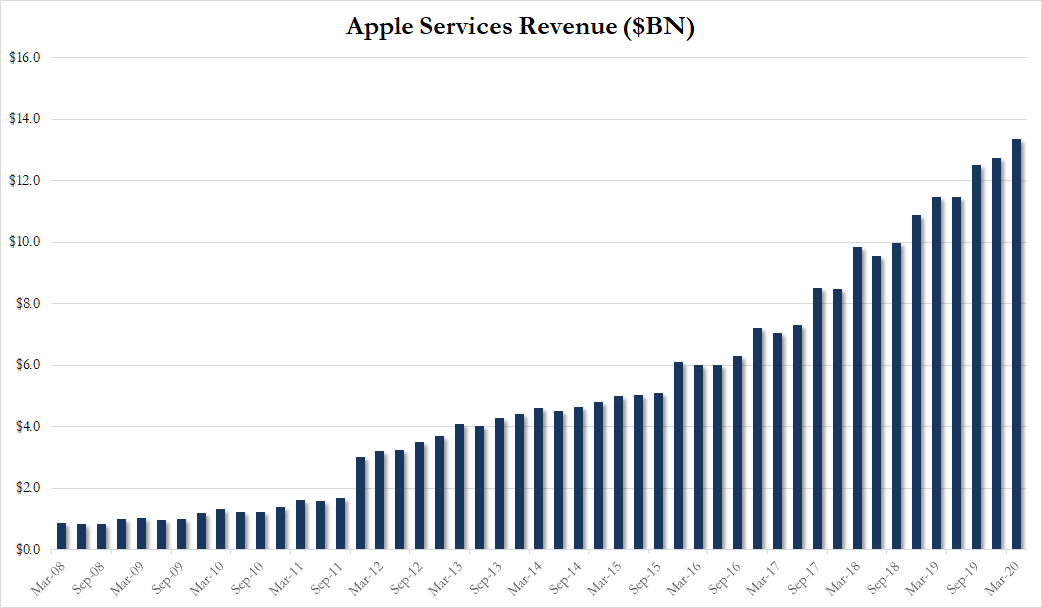

But on the bright side, AAPL was saved by Services and Wearables:

-

Services surged 17% to a record of $13.35 billion (very modestly worse than the expected $13.36 billion)

-

Wearables jumped 23% to $6.28 billion (worse than the expected $6.41 billion though)

Cook on services:

“The pandemic cut both ways. On things like App Store and TV+ and some other of the content businesses, it had a positive effect clearly. And then the negative effect it would have it would have was once the repair locations closed, AppleCare went down. And of course the component of advertising that we have was hit hard in month of march as well.”

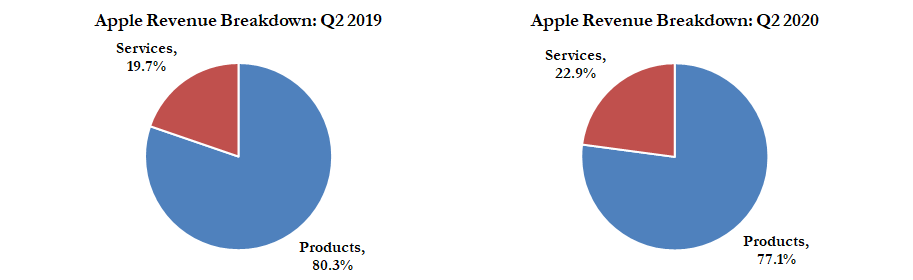

Services now a record 22.9% of total revenue:

So product revenues were lower but beat expectations and wearables and services saw revenues higher but missed expectations.

Of course, boosting the dividend and buyback is all that shareholders would normally care about, and CEO Tim Cook offered some more hope, telling Bloomberg in an interview:

“We’ve seen a further change in the last part of March and first part of April were very depressed and then we’ve seen a pick up relative to that period of time in the second half of April that I would attribute to partially the new products we were able to launch at end of March and early April, the economic stimulus and probably some level of people getting a bit more used to that this is going to last a little while, that’s it not a really short term thing.”

The initial euphoric jump in the stock is fading as despite the bullish uptick in April, Apple pulls it Q3 guidance…

“We’re not projecting what we’re going to do this quarter due to the lack of certainty and the lack of visibility that we got.”

That’s the first time in a long time and will be taken as a negative sign. While most companies have abandoned their outlook for 2020, many have continued to forecast three months out… and that has affected shareholder optimism.

So – what about that v-shaped recovery he told Trump about?

Tyler Durden

Thu, 04/30/2020 – 16:52

via ZeroHedge News https://ift.tt/2Yksbzu Tyler Durden